2020 Predictions #4: Who Will Reap the Rewards as Fortnite Declines?

This analysis is written by Adam Telfer, Michail Katkoff and Abhimanyu Kumar.

To make sure you don’t miss all the following prediction posts, please do subscribe to the Deconstructor of Fun infrequent, but powerful newsletter.

Unless otherwise specified, all the data has been provided by the wonderful services of App Annie and analysed by the author(s). Please take the numbers presented with a giant grain of salt. They are meant more for trend analysis based on estimations, rather than an exercise in accuracy.

you can find the previous predictions here.

Not even a year has passed since we did our predictions on Action games in 2019. At that time, we talked about the wave of Battle Royale, the launch of Brawl Stars, and the limitations of the new trend of cosmetic-only economies.

In 2018, Fortnite and PUBG were tearing up the charts making all us mobile designers look bad. How were they getting away with terrible control schemes? How was a cosmetic-only economy the #1 revenue generator on mobile? 2019 continued this trend, with PUBG Mobile still being the #1 game on mobile.

For 2020 we decided to break out shooters as its own category within Mid-Core. This sector is so unique versus action games, and one that has been growing quickly.

But is shooters a segment that you should be competing in? Let’s dive in.

An Overview of Shooters

While Shooters in the Western markets generate only 18% of all Mid-core revenues, they also boast a very healthy 22% year-over-year growth rate at a very conservative growth of downloads.

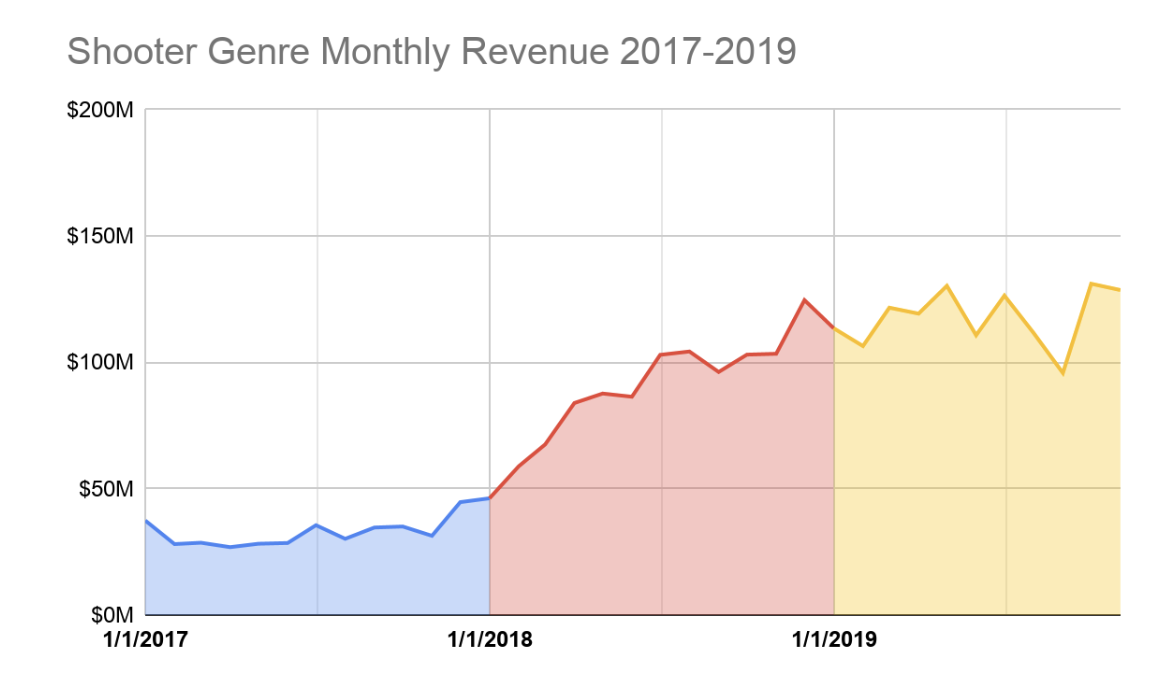

Taking the highest level view, the Shooter space is a smaller category but growing. Comparing to Strategy and RPG, it’s had much higher year over year growth in downloads and revenue than the other categories, mostly backed by major releases (Call of Duty) as well as improving monetization (PUBG Mobile). However, year over year metrics don’t tell the full picture:

2019 has actually been a year of stabilization for the shooting genre, where revenue has remained roughly the same on a month to month basis. Downloads mostly stabilized, but spiked in the fall due to the launch of Call of Duty.

Shooter Sub-Genres

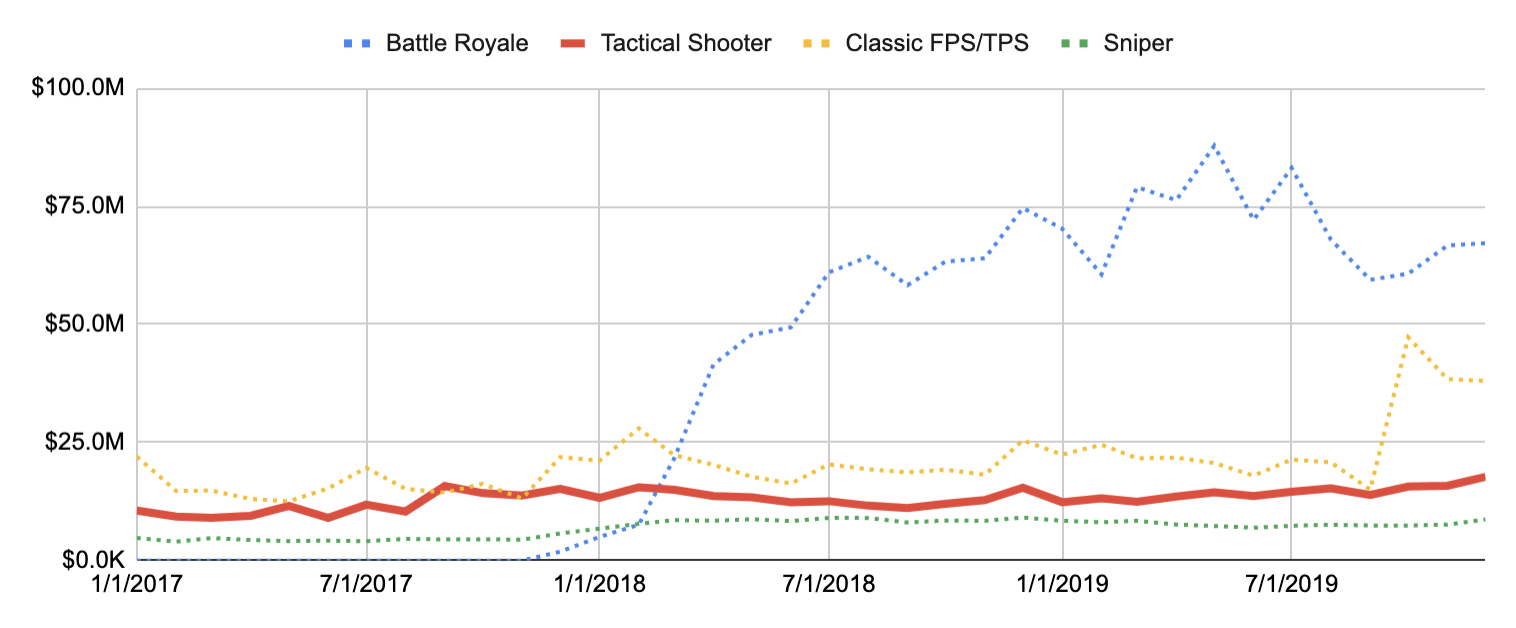

We’ve broken Shooters into 4 sub-categories: Battle Royale (example: PUBG, Fortnite), Classic PvP Shooter (example: Call of Duty), Tactical Shooter (example: World of Tanks), and Sniper (example: Sniper 3D). Let’s go through each in order.

Battle Royale

Battle Royale continued to be dominated by one game: PUBG Mobile, and 2019 was a massive year for it. Only looking in the west, it brought in nearly 30-40% of overall sub-genre revenues over the year. Including the game’s chinese version (“Game for Peace”) it is actually twice as large!

What’s interesting is how locked up Battle Royale is geographically and demographically. Each top game carves out a niche and owns it: PUBG Mobile owns China, Knives Out in Japan, Garena Free Fire in second tier markets, Fortnite with young players in the west, and Call of Duty (technically a PvP Shooter) owns the more mature players in the west. Each have leveraged their core competitive advantage to own their audience. For example, NetEase developed Knives Out with a japanese local developer, Garena Free Fire have optimized their game for lower tier devices and have years of experience growing games in south east asia. PUBG Mobile/Game for Peace dominates in China partially because of the recent regulation changes -- making it near impossible for Fortnite to launch there.

This category has a lot of limitations in terms of monetization. Because of the way Battle Royale is structured, players starting off with any strategic advantage would be seen as unfair. While some developers (ex. Wildlife’s Zooba) have been experimenting with “Brawl Stars” like stat progression inside of a Battle Royale, these games have failed to reach the same scale or hit the same retention numbers as PUBG and Fortnite. The audience prefers fair competition, so the leaders have focused on making cosmetics as impactful as possible.

The genre’s key revenue driver are Battle Passes. These can be lucrative but requires a massive pipeline of quality cosmetics in order to be effective. Fortnite developer Epic has been creating over 200 new unique items for each season -- with more than 80 of these items being a full geometry change outfit. This is what it takes to make a cosmetic economy effective, and why small developers have very little chance in this genre. Cosmetic focused economies are incredibly expensive to run effectively, and only pay off at scale.

For PUBG Mobile in the west, a key turning point for their monetization was their July Season 8 launch. This season, in particular, created a higher baseline for revenue for PUBG, as well as hitting its highest revenue peak in the couple of million $s range in a single day. This was a likely sign of them reaching a critical mass of players, and then launching a high quality battle pass with differentiated cosmetics.

PUBG’s Season 8 was a true step up in monetisation.

Pair the locked up geography and demographics with a light monetization scheme requiring scale and this segment is near impossible for new entrants. The likely scenario is that new entrants will need to find radically different audiences in order to grow to the scale needed to be effective as cosmetic economies.

Thus, this sub-category is hyper-competitive with a very high initial investment cliff. As a new developer entering this space you’d be competing with massive brands (PUBG, Fortnite) alongside some of the strongest publishers (Tencent, Epic, NetEase). In 2020 we should see more publishers join the fray, with EA launching Apex Legends for Mobile. This will lock up this genre further, making it difficult for any other publisher of smaller size to compete.

Classic PvP Shooters (FPS/TPS)

Separate from Battle Royale, we’ve carved out “Classic PvP Shooters”. This sub-category is for games focused on modes like team deathmatch. Within this group, Crossfire (originally a 2007 PC game) has been dominant in this category up to fall 2019, when Call of Duty Mobile was launched.

Call of Duty had an amazing launch download volume, racking up a massive volume of downloads in Q4 2019 and beating out PUBG’s launch peak by an order of magnitude. Built by Tencent’s Timi studio with decades of creating cosmetic economies (QQ Speed, Legend of the Dragon, Honor of Kings). The game’s overall quality is amazing, recreating the gameplay of Call of Duty’s multiplayer on console nearly to perfection.

However, COD’s launch was the highest downloaded game of all time, its revenue generated per player was weak in comparison to other cosmetic-only economies. Check out our full COD deconstruction. 2020 will be the year that Tencent and Activision ramp up the monetization in COD Mobile.

Load-out view is the key monetization driver and enabler in both Battle Royale and PvP Shooter sub-genres

Like Battle Royale, this category is limited in terms of its monetization options: any competitive advantage is seen as unfair and would limit the audience you can reach. However, PvP Shooters typically have an RPG progression track to unlock loadout options. Instead of Battle Royale where all weapons and attachments must be found in the map, classic PvP shooters are free from that restraint. This light progression helps give longer term goals as well as opens up monetization opportunities for players wanting to speed up their progression to unlock all strategic options.

Tactical Shooters

Tactical shooters are considerably smaller than Battle Royale and Classic PvP. Games in the sub-genre typically have the same 5vs5 game modes and loops as classic PvP, but add significantly more depth to their loadout system. But what really makes tactical shooters different is the speed of gameplay and power progression.

Successful tactical shooters feature a vehicle or a machine to focus on slower gameplay. This makes the game more accessible for mature male players who like to take their time to make their shot. Slower core gameplay also increases the tactical aspects and creates more demand for teamplay. Both elements are highly appreciated by the target audience.

There’s always a very steep class-based power progression curve where a better tier vehicle has more armor, more health and more firepower than a lower tier one. This is again done with the target audience in mind who appreciate skill elements but tend to appreciate winning even more. Power progression also unlocks tremendous retention and monetization potential compared to Battle Pass.

While technically players can buy better tanks and robots, this genre keeps things competitive by having very critical strengths and weaknesses for each class. So while there is a progression economy where you can have a gameplay impact in the core game, there is a significantly high skill ceiling in the core gameplay where any team can win if they leverage these clear strengths and weaknesses of each playable class.

Despite this additional depth of loadouts and deep chase for playable classes, this genre has not retained players at the same level as PvP Shooters and Battle Royale, which is the likely reason for the low RPI.

Pixonic’s War Robots has been the Kings of this genre for awhile, despite going up against Wargaming’s World of Tanks. Based on their RPI and theme, it's likely their success is due to a lot of organic growth and history being on the charts. Similar to trying to topple Subway Surfers or going after Hay Day/Township, this category is likely locked up from an organic perspective, making growth by UA the only possibility.

Snipers

The last and smallest sub-category for shooters is Snipers. This genre has been a staple on mobile since 2010, and arguably is the most “mobile-friendly” sub-genre here. It requires the least amount of control complexity, and typically has opportunities for light RPG mechanics and progression alongside it.

Snipers is the smallest of all Shooter sub-genres on an IAP revenue basis.

* Ad revenues not included

Without a doubt, the Sniper market has stabilised the past year with Downloads and Revenue trends pretty much flatlining. Year-on-year, 2019 Downloads were flat (+1% YoY) while Revenue was slightly down (-8% YoY).

* Ad revenues not included

The flatlining is majorly driven by the two key products in the sub-genre that make up for ~85% of the market. These are “Sniper 3D” and “Sniper Arena”. Both titles have been long-standing market leaders and are effectively locking down and executing on live ops within this sub-genre.

Sniper 3D and Sniper Arena have been long time dominators of this market.

* Ad revenues not included

At the same time, Sniper 3D in particular has low production values and dated F2P designs. Further, its linear progression systems and weak long term monetisation makes its survival highly dependent on a constant influx of new users. Naturally, downloads and revenues for the sub-genre move in lock step. An opportunity does exist in the market to leapfrog these aging games through improving production values, leveraging stronger F2P design systems and also superior live ops techniques.

This is where “Sniper Strike” by Eight Pixels shines. Apart from massively improved visuals, the game has also hugely updated its F2P mechanics compared to its older counterparts - Clash Royale’s systems being a huge inspiration for them. Live ops through content releases and merchandising is also highly active for the title. All this has played a significant role in allowing Sniper Strike to stabilise at an 8% market share over 2019. The impact of these can be seen in how Sniper Strike has been able to grow revenues on dropping downloads, resulting in a healthier RPI trend. Their next hurdle lies in scaling revenues through scaling user acquisition.

Sniper Strike’s upgraded visuals, F2P systems and live op strategies contributing to a much healthier RPI curve compared to the dated Sniper 3D.

* Ad revenues not included

A screenshot from Sniper Strike’s gameplay.

Finally, there are two other titles that are not captured in the data, but significant to the Snipers discussion. Square Enix’s premium game “Hitman Sniper” and Glu’s very popular “Deer Hunter”. Hitman has a clear opportunity to leverage its widely known IP and launch a pure F2P title. Glu on the other hand has not released a new Deer Hunter title for the past 4-5 years. “Deer Hunter 2016” was released during the later half of 2015, before which Glu released “Deer Hunter Classic” during the later half of 2013 and “Deer Hunter Reloaded” during the first half of 2012. Without a doubt, the revenue generated from the Deer Hunter product portfolio is looking pretty weak at the moment and Glu is currently soft-launching “Deer Hunter 2020” -- so likely it launches this year!

Various Deer Hunter releases in the past 5 years with some amount of release cyclicality.

New Releases

Looking at this category’s newest entrants, we can see that actually the number of releases has been going down since 2017. While Battle Royale has been an exciting area, for the most part 2019 hasn’t seen a surge of Battle-Royale shooter style games.

In addition to Call of Duty Mobile, some of the most prominent releases last year were these four games.

To highlight one of the games, lets take a look at Zooba Battle Arena, developed by Wildlife studios (who recently raised a massive late-stage investment). The game is built closer to the audience of Brawl Stars than PUBG Mobile, but is going all in on aiming for the “casual” mobile shooter audience while focusing on battle royale. Instead of going for a cosmetic-only they’ve opted for a Brawl Stars style progression system.

Screenshot from Zooba.

Going casual, similar to Futureplay’s “Battlelands Royale” before it, will avoid the big players like Tencent and Activision -- but thus far the game has failed to retain and monetize at the same level -- the same issue that Futureplay has faced. It’s likely this game is able to carve out its own niche away from Tencent - by focusing casual and focusing on Wildlife’s growth expertise in lower tier markets, but will operate at the low end of the CPI:LTV spectrum.

So How Did We Do With Our 2019 Predictions?

Fortnite will hold on to its spot at the top -> CORRECT

Fortnite, despite dropping 25% in 2019, is still the #1 game globally, raking in $1.8B according to Superdata (although this does not include the revenue from Star Wars and Avengers crossovers…)

Apex Legends on PC/Console will secure its spot on the top as soon as they implement battle pass -> INCORRECT

Respawn (Apex Legends’ developer) has had an amazing year. The team has done a phenomenal job of shifting its culture from a product-focused development studio to one that can execute live services.

In March 2019 they launched the season one battle pass, but it fell flat due to weak content. In season two they focused on quality cosmetics, ranked mode, and mid-season events which helped regain their player base. By season three in October they had a strong player base and tied together with a strong battle pass, they had a revenue surge.

Regardless, they’ve been able to retain a core base of players and are still a strong new franchise for EA. Unfortunately, there is no public data on Apex Legends overall revenue. What we do have is EA’s FY targets: a range $300M to $400M for Apex’s April 2019 to March 2020 revenue. Assuming Apex will fall in this range, Apex is lower than Fortnite ($1.8B), COD Modern Warfare ($1B in < 2 months), and PUBG (>$1B on mobile). So Apex did not manage to crack the top 3.

Battlefield V and Star Wars Battlefront 2 will enter the Battle Royale category -> PARTIALLY CORRECT

Battlefield V on console added a Battle Royale mode, but failed to perform. Very likely to the competing attention going to Apex Legends, Fortnite, PUBG and Call of Duty BLOPS3.

Star Wars Battlefront 2 never added Battle Royale, although rumours have spread this year that it was prototyped at DICE. Likely due to the team being much smaller while live, and focusing more on fixing the core issues in the game and launching new content.

Revenue in the Battle Royale sub genre will continue to grow at a slower pace -> PARTIALLY CORRECT

This depends on how you cut the data, but Battle Royale as a genre has stayed relatively flat since January 2019. However, If you include COD Mobile (which has a game mode within it for Battle Royale), then the overall trend for 2019 looks like a slow increase.

Battle Royale modes will get widely adopted in all kinds of games. -> INCORRECT

Battle Royale has fizzled out in 2019, especially since the post in February.

While Battle Royale was added to many genres by the time of the previous post (A mode in Brawl Stars, Action RPG like Spellbreak, MOBAs like DOTA2, Tetris 99) Battle Royale has not picked up momentum.

Instead 2019 ended up focusing much more on “Drafting” style mechanics. Autochess (Teamfight Tactics), Roguelikes (Slay the Spire) all gained traction this year as “it” games, where battle royale has no longer picked up momentum.

Brawl stars will face challenges in the West -> CORRECT

Brawl Stars started from a very high position in the beginning of 2019 but since has been steadily declining. What has slowed down the decline are introductions of new brawlers. All other updates, such as skins and new levels, seem to have had only minor impact on the monthly revenues.

Fresh from their global launch December 12th, 2018 -- after nearly 2 years of grinding to get the game in shape, their launch year has not been a typical Supercell-level hockey stick of growth. Both their revenue and downloads declined throughout 2019.

7 Predictions for Shooters in 2020

#1 Apex Legends on Mobile will not break into the Top 3 within the Battle Royale Category

EA deciding to port Apex Legends to mobile was likely an easy strategy meeting. After the success of PUBG Mobile, Fortnite, and Call of Duty Mobile why can’t Apex work?

While I believe that there will be a spillover effect of Apex fans coming over to mobile, the likely result is that Apex on mobile will do fine, but won’t crack into the top battle royale charts. The game will get a ton of organic downloads, and may even pull some PUBG Mobile western players over to it. However I do not believe the game will beat out PUBG, Fortnite, or Knives Out. Why? 3 indicators.

(A) Comparing Fortnite to Apex: Apex’s audience is more PC than Console. The audience is far less likely to accept the touch controls. They won’t get the same crossover as Fortnite enjoyed with its younger audience who are comfortable playing on console and mobile. Fortnite’s audience is actually closer to Minecraft and Terraria, where that audience has been playing with virtual joypads for years.

(B) Comparing PUBG Mobile to Apex: Apex isn’t going to get approved in China where PUBG mobile gets more than half of its revenue from. Tencent has an impossible to beat cosmetic pipeline, event release schedule that is tailor made for mobile. Reaching the same numbers as PUBG Mobile will be impossible.

(C) To crack the top 3, Apex needs to make nearly double its console revenue ($400M). Fortnite makes a majority of its revenue from PC/Console ($1.8B to the $320M on iOS). Assuming Fortnite is the right comp, it’s more likely to hit ~20% of its console revenue on the year, so $80M putting it in 5th place.

#2 Fortnite will no longer be the #1 across mobile, PC and console by the end of 2020

Fortnite has had an amazing run. It is the game of a generation. However 2019 was the year it came back down to earth.

Epic has been throwing all the resources it can at Fortnite to slow its decline. The launch of Season 2 was amazing and their launch of creative mode will likely create a tail of engagement. Despite all that, players have been moving on to other games.

Our prediction is that 2020 continues to be a year of decline for Fortnite, although slow. The game will no longer be the juggernaut it has been. Other games are right on the heels of Fortnite (Dungeon Fighter Online $1.6B) and will pass them in 2020.

#3 Without better Cosmetics and launching in China, COD Mobile will make less than $230M in its launch year

COD Mobile has had an amazing first launch, but based on how quickly the downloads are slowing down, according to our estimates, the likely scenario is that it will only grow from its 180M downloads now to 200M-230M by the end of the year.

To figure out its overall revenue, we then have to project out its RPI, which is currently estimated at ~$0.50. Fitting a trendline to its daily progress, they will likely hit $0.80-$0.90 RPI. This is likely their baseline which would mean between ~$160M and ~$210M for its launch year.

The caveat here is that Tencent is known for their “Come, Stay and then Pay” model. They are taking their time before launching monetization features in COD Mobile. This was the same approach for PUBG Mobile, same as Honour of Kings. Looking at PUBG Mobile’s RPI curve (after the launches of their battle passes) they managed to grow to over $1 globally within its first year. This is the upside, which is completely dependent on whether Tencent and Activision will start focusing on radically differentiating weapon skins with interesting gameplay benefits. If they manage to execute the Tencent playbook, the upside here is upto $230M in its launch year.

However estimates of COD Mobile reaching higher than this is not likely going to happen. The only case would be if it was approved in China and they reach an even larger playerbase.

#4 The Top 5 Shooters in 2020 Mobile will be the same as 2019

(Although they may change order!)

While COD Mobile may have opened the door for more console-like experiences coming from mobile, this should not be a greenlight for mobile developers believing that console-style PvP Shooters are now an open market on mobile. Each of the top shooter games have locked down their audiences, making new players nearly impossible to penetrate.

2020 is not a year to launch a PvP Shooter for core fans.

#5 Brawl Stars will continue to decline in revenue, but still be the #1 Casual Shooter

Brawl Stars remains the best casual shooter in the market. While they’ve been on a decline in 2019, I believe they will be the top revenue earner for “casual” mobile shooters for 2020.

New entrants will have to go up against Supercell, Tencent, EA, NetEase, and Activision. This is the land of giants.

#6 Tactical Shooter and Snipers will remain the smallest shooter markets with little growth in revenue

Tactical Shooters and Snipers have no signs that it will change since 2015. As much as I love a shake-up, a new entrant in this space will be unlikely. The only shakeup will be Deer Hunter 2020, which isn’t enough to grow these segments.

#7 Snipers will see a small download and revenue bump from the “Deer Hunter 2020” launch, but the rest of the market conditions will remain the same.

While Snipers will continue to remain the smallest sub-genre in the Shooters genre, it will see a small downloads and revenue bump with the release of Deer Hunter 2020. Sniper 3D and Sniper Arena will continue to remain the market leaders, while Sniper Strike will try to scale users and cross the 10% market share mark especially given how Eight Pixel’s parent company Outplay performed over 2019.