2020 Predictions #5: The Clash of Ice and Phasers

This analysis is written by Buğrahan Göker and Michail Katkoff

To make sure you don’t miss all the following prediction posts, please do subscribe to the Deconstructor of Fun infrequent, but powerful newsletter.

Unless otherwise specified, all the data has been provided by the wonderful services of App Annie and analysed by the author(s). Please take the numbers presented with a giant grain of salt. They are meant more for trend analysis based on estimations, rather than an exercise in accuracy.

you can find the previous predictions here.

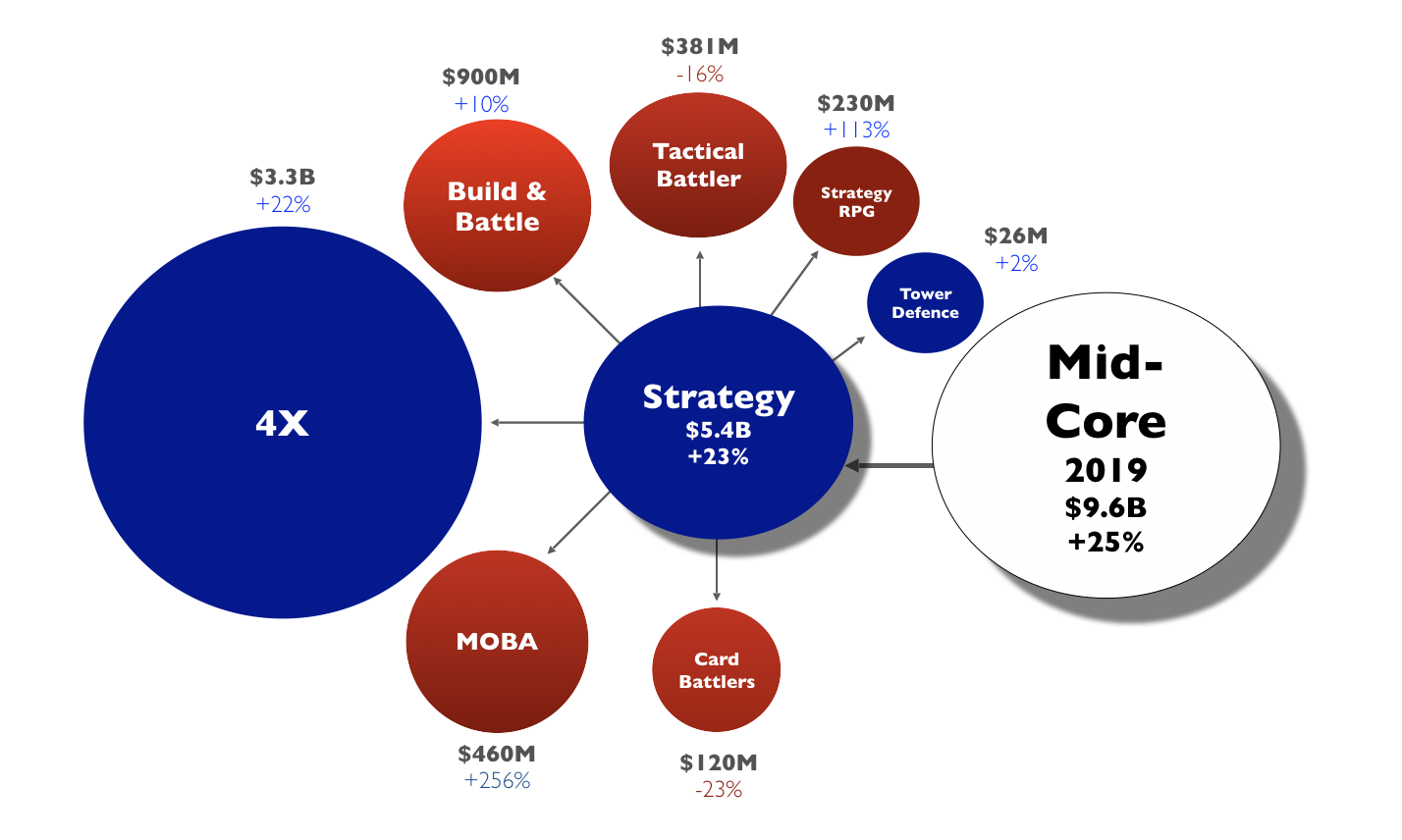

Before talking about Game of War, Star Trek Fleet Command and Mobile Strike, let’s talk about this magnificent genre known as Strategy. In fact, Strategy games is the biggest genre on mobile in terms of revenue in the Western markets. Year to date strategy games generated nearly five and a half Billion Dollars in in-app purchases. That’s over a Billion more than puzzle games, which is the second largest genre in terms of revenue. What’s even more impressive is the growth of the genre, which escalated to 25% YoY.

Strategy games are by far the most top grossing genre on mobile beating the second largest genre, Puzzle Games, by nearly $1Bn. In this analysis we will focus on 4X and Strategy RPG

In our taxonomy we breakdown Strategy genre into 7 sub-genres based on games’ features and core gameplay. At a glance the breakdown shows two things.

Firstly, while the revenue pie is substantial and rapidly growing, it is also heavily concentrated making it difficult for new games to enter and grow. Pretty much every sub-genre in strategy games is marked as red, which indicates that the sub-genre has one or two games reaping over 75% of all sub-genre revenues.

Secondly, one can quickly spot two sub-genres that show triple digit growth. This usually means that the genre is either new (Strategy RPG) or has been boosted by the launch of a Billion Dollar franchise (Brawl Stars in MOBA)

Before diving deep into the predictions let us scratch the surface a bit and look at the last couple of years in strategy genre:

On the revenues side 4X games (example: Game of War, Star Trek Fleet Command) reached a new stable level at the beginning of the year but have since stabilised. This goes hand-in-hand with the install trends. We can see several bumps in sub-genre installs after which the install volume has been pretty much in decline for the whole 2019. This indicates few games scaling up after which they have been retaining and monetizing their player base.

What needs to be noted in the 4X sub-genre is the dominance of Chinese developers in the Western markets. When Machine Zone was at its pinnacle with Game of War and Mobile Strike, Western publishers were driving the bulk of revenue in 4X games. But starting from 2018, Chinese publishers took over the market. In 2019 Chinese publishers take 76% of all the 4X revenues. At the same time, China accounts for only about 7% of all 4X sub-genre revenues. In other words, Chinese 4X publishers are having more success in the Western markets than they have at home.

Build and Battle games’ (example: Clash of Clans, War Dragons) installs have been declining over the past two years, which indicates that there hasn’t been any new games that were scaling up. There is however a big one time spike in early 2018, which had only a mild impact on revenues. That bump was the launch of Talking Tom Camp that unsurprisingly was an incredibly poor IP for a strategy game. On the revenue side things look more interesting. First half of the year showed growth of revenues, which then turned into decline for the second half of the year. That’s all due to Clash of Clans’ and the infamous battle pass.

MOBAs saw an incredible increase in the West following the launch of Brawl Stars. Sub-genre revenues have also increased though they have mostly been in slow decline. This is largely due to the fact that Brawl Stars hasn’t really grown, in terms of revenues, since launch and no other similar titles have had any meaningful success in the Western markets.

Finally, worth a mention is the emergence and growth of Strategy RPG (example: Game of Sultans, King’s Throne) sub-genre, which new to the Western markets. We see the initial bump in installs driven by Game of Sultans as it entered into the competition with Be The King and was later followed by King’s Throne.

Explore, Expand, Exploit and Exterminate

4X games (4X = explore, expand, exploit, exterminate) make up the largest sub-genre on mobile in terms of IAP revenues. These mid-core strategy games are characterised by a heavy focus on meta systems and progression with almost zero skill-based gameplay - though the upcoming Avatar game published by Scopely is coming with a Clash Royale style battles (fast forward to 1M 55s to view the battle in the YouTube video above) and can change what success looks like. Just like Scopely’s first 4X smash hit Star Trek Fleet Command, which focuses more on exploration (as it fits with the brand) rather than extermination.

From product perspective there are two main elements that define 4X games:

4X games are extremely difficult to build and operate. Nevertheless a successful execution leads to an incredible return on investment and an opportunity to build a truly scalable business.

There’s room for new games at the top of the 4X genre. This is due to a simple fact: DAU of a solid 4X game is surprisingly small while the LTV of the players is surprisingly high. This leads to a fragmented market where marketability and product innovations are extremely important.

The recent trend over the past year or so in 4X games has been towards accessibility. The role of accessibility in form of art style and UX has arguably broaden the player base of these games and thus expanded the market share for 4X games. Yet accessibility is the icing on the cake. What makes a 4X game successful in the sub-genre is still the depth of the meta combined with highly social gameplay.

4X in 2019

Last year we predicted, that there’s a massive opportunity to be seized in the 4X sub-genre.

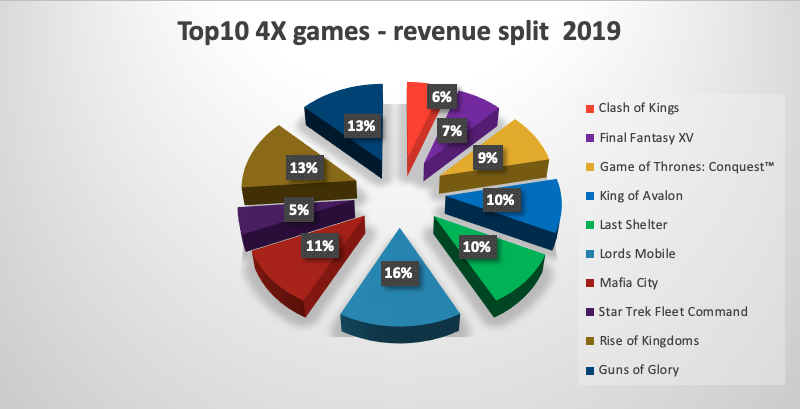

Before we get into 2020 predictions, let us review our prediction from last year’s prediction post “There Is a Billion to be Made in the Wake of Machine Zone“. Our forecast was that the sub-genre will continue to rise in 2019 and it turned out we got it right. 4X games have grown by 23% in 2019 reaching $3.2Bn in revenues for the past 12 months. That is a year-on-year increase of $600M in sub-genre revenues marking it the highest growth in terms of monetary value in 2019.

What makes the growth spur of 4X games so intriguing is that:

it occurred in a well established sub-genre

it was driven by the launch and scaling up of new games

the new games didn’t largely cannibalise existing ones

The graphs above paint a very interesting picture. New 4X games scale up to the top of the sub-genre reaching multi-hundred million run-rate without heavily cannibalising existing top games. All top five games are also diversified for different audiences, ranging from realistic mafia themes to stylised fantasy themes. But there’s still one common element for all top five games - Made in China.

Last year, we also predicted that 4X games will continue to see product innovation, improvements in UX and implementation of more accessible art styles. This was another prediction that we got right. The main innovation came from the introduction of different core gameplay systems and features adopted from other mid-core genres.

Fun Plus’ State of Survival is a great example of a 4X game that has added an RPG-like core gameplay. In the game player engages with hero progression that is tied to a custom made PvE campaign mode. As seen from gameplay above, a player can control his team of heroes with an auto-play option similar to turn-based RPGs.

While 4X games pushed for accessibility and depth, in 2019 we saw them take also live services a step further. The number of in-game events and their varieties went up every month and many titles implemented special in-game calendars to help players keep track of the current and upcoming events. In addition to that regular events, several 4X games began experimenting on running separate events for various player cohorts based on engagement and/or monetisation profile.

Rise of Kingdoms is one of the first mobile games to implement an in-game Event Calendar, helping players keep track of ongoing and upcoming game events.

New Kings Arise

For a couple of years IGG’s Lords Mobile was at the top of the 4X genre beating the competition with a combination of highly accessible art style and an incredibly deep set of features. In fact, Lords Mobile is by far the most downloaded 4X game till date, beating the likes of Game of War and Mobile Strike. And it’s also only the third game, behind the two Machine Zone titles, that has crossed the 1 Billion Dollar life-time revenue mark.

Rise of Kingdoms is the top grossing 4X games in the market just little over a year from launch. Lords Mobile lost its leading position, but the fall from grace had it simply drop from #1 to #2. This speaks volumes of how healthy the sub-genre is.

And while Lords Mobile was the number one 4X game in 2019 both in terms of revenue and installs, it got surpassed by Lilith’s Rise of Kingdoms towards the end of the year.

There are several factors that make Rise of Kingdoms stand out among other games in the sub-genre:

the most enjoyable map systems among all 4X titles as players are allowed to fully control their armies on the map instead of relying on point-to-point interactions (to our knowledge, Star Trek Fleet Command is the only other game to have this system)

customisable base building that reminds you of Dominations

first successful implementation of the Battle Pass in a 4X game

a hero system with item progression, just like in an RPG game

features that support massive kingdom versus kingdom battles

off-the charts marketability that relies heavily on classic PC game strategy game series Age of Empires, Civilizations and Rise of Nations.

Rise of Kingdoms puts national heroes at the forefront taking a page from classic PC real-time strategy games. This allows the game to increase its marketability. And any reduction in CPI is a big win in the 4X market, where the user acquisition costs per player are counted in tens of dollars.

Another striking game of the year is Star Trek: Fleet Command, which was released in late 2018. The game managed to maintain its position in Top 10 and crossed the $100M revenue mark well before turning a year.

Unlike most of the sub-genres on mobile, 4X is one of the least concentrated.

Star Trek (+1509%), Rise of Kingdoms (+582%) and Last Shelter (+309%) have grown the most during 2019 largely also because they were launched in 2018. The only three games that saw their YoY revenue decline in top 10 are Final Fantasy (-49%), Clash of Kings (-33%) and Lords Mobile (-10%). All three also saw decline in new users as did Guns of Glory.

Scopely’s Star Trek has now passed Machine Zone’s Final Fantasy XV making it the most successful 4X game from a Western publisher. The success of the game resulted in the publisher Scopely acquiring the game’s Irish developer DIGIT.

*edit: Star Trek is still trailing behind Game of Thrones published by Warner. This makes Star Trek the second most successful Western 4X game just inches away from Machine Zone’s Final Fantasy.

Machine Zone remains still the best Western 4X publisher. Game of War and Mobile Strike may be but shadows of what they were in 2016 but these two games still contribute around $100M every year. And that’s $100M with less than 1M in installs, which speaks of longevity of a 4X game.

Nevertheless, when we talk about individual mega hits we risk losing sight of the true leader in the 4X games. As a matter of fact FunPlus is the number one 4X publisher second year in a row beating its rivals with a healthy portfolio of several 4X titles instead of focusing on only growing one. The company is known to introduce at least one new title every year since the launch of their flagship title King of Avalon in 2016.

FunPlus is clearly the biggest 4X publisher that beats the competition with a portfolio approach instead of focusing on a single hit title. Even though they do have two titles in the top 5.

After hitting a homerun with King of Avalon, Fun Plus has focused on marketability as a driver for growth. Each of the following title seems to have only visual changes that aim to increase the IPM (Cost Per Install = Cost Per Mille / Installs Per Mille) while at the same time finding a new niche audience.

What about an IP?

We mentioned in our last year’s prediction that the 4X market may attract IPs with 30+ male audiences. And this occured, but with very varied success. While both Scopely’s Star Trek Fleet Command and Warner Bros’ Game of Thrones Conquest seared to new heights Battle Strike Force by Beyond Games and Breaking Bad Crime Elements by FTX Games both flopped. As did the Terminator game by Plarium and the Godfather game by Feelingtouch before them.

Quality of execution as well as the pull that the IP has for target audience matters a lot. But the depth of the war chest also play a significant role as scaling a 4X game is very expensive due to extremely high CPIs.

We could argue that the execution or the IP is the reason for the demise of these games. But most likely the biggest factor is money. You see, the CPIs for Strategy games are incredibly high. And while a great IP like Game of Thrones and Star Trek can help to bring down the CPIs, the fact is that a smaller publisher simply doesn’t have the funds to invest into user acquisition and wait for over a year to get the money back with interest.

So, what will happen to the upcoming IP based 4X games such as Avatar Pandora Rising by FoxNext (now Scopely) and Star Wars, which will be done either by EA or Natural Motion based on the job ads? Let us predict, right after introducing this new sub-genre you should know about…

Strategy RPGs - a new genre from China, with love

Strategy RPGs are full of difficult dilemmas and difficult choices.

Strategy RPG is a new sub-genre in strategy category with a strong focus on the role playing and narrative parts of the empire-building games. These games offer lighter competitive features compared to other strategy sub-genres while emphasising more on the collection of heroes and maidens combined with idle progression. These games are created as alternatives for 4X players who are exhausted with intense social and competitive gameplay.

Strategy RPG genre has doubled in a year. We expect the growth to continue at a double digit pace driven by theme innovations first, followed by improvements in accessibility in 2021.

Although Strategy RPGs have existed in China for several years, they’ve gained popularity in Western markets only in early 2019 with titles such as Game of Sultans and Be the King. Considering the nature and gameplay of these games, the audience in male. In many of these games, there is no option to select a female character. In fact, players can only play as a king, a sultan or an emperor with no option to choose a queen or an empress.

Usually, the plots in Strategy RPGs are identical. The player takes over the crown after the tragic death of his father and as the new ruler the player must develop their country while at the same time plan and execute the revenge on behalf of their father.

Making babies is important. Also in Strategy RPG games.

Harems (or maiden towers) have an important place in these games and they play a pivotal role in player progression. And it’s not only progress, where harems get to shine. You’ve likely encountered enough creatives for these games to know that Strategy RPGs leverage appealing maidens extremely well in their UA campaigns.

In 2020, we predict that:

4X sub-genre will continue to grow at double digit pace and the Chinese publishers will continue their domination. We will see more attempts from big Western publishers due to the mouth-watering market size and high acceptance of new games.

Avatar and Star Wars are the most anticipated games from Western publishers for 2020. We expect both to succeed.

We also expect Scopley to double down on Star Trek’s success with another title from their Digit Studio in addition to the Avatar game they just copped with the FoxNext acquisition.

Top publishers will continue to ship new re-skin titles with the goal of finding a more marketable theme but unlike in previous years, these re-skins will not be strong enough to compete in the modern 4X market.

This will lead to focus on product improvements in form of better UI/UX, and adoption of elements from other genres - RPGs, Tactical Battlers and Build & Battle games in particular.

We will also see more games with an IP entering the market launched by companies with existing 4X portfolio.

Lilith’s Rise of Kingdoms will be the top grossing 4X game of 2020 but as the competition heats up, it will start declining before Summer the latest.

Avatar and Star Wars strategy games will successfully launch towards the end of 2020. We believe in the success of these titles because

a) the developers of these games have the experience of working with first tier IPs

b) they have a proven record of building and operating complex games and

c) they have the resources to scale these games in a market with notoriously high CPIs

Wild card: Supercell releases a 4X game with a Clash of Clans IP taking the genre by storm with a massive influx of new to the sub-genre audience

Strategy RPGs in 2020

The subcategory will continue to be dominated by Chinese publishers

We’ll see new themes. King’s and Sultans are taken. Maybe you’ll take the role of a president or a commander?

We’ll see the genre opening up to female audiences. Love Nikki is a great example of a game that added tremendous amounts of depth around a relatively simple dress-up game.

Do you dis/agree with our predictions? Let us know!