2020 Predictions #6: Three User Acquisition Trends Studios Will Have to Ace

These predictions are written by Eric Seufert. Apart from running the one and only MobileDevMemo, he also runs a strategy consulting firm for media and consumer technology companies - Heracles Media.

To make sure you don’t miss all the following prediction posts, please do subscribe to Deconstructor of Fun’s powerful newsletter. You can find the previous predictions here.

Unless otherwise specified, all the data has been provided by the wonderful services of App Annie. Please take the numbers with a giant grain of salt. They are meant more for trend analysis based on estimations, rather than an exercise in accuracy.

This analysis is also brought to you by ironSource. Here are the three things you need to know about ironSource:

#1: They’re developing the most robust, data-driven growth engine for mobile games.

#2: Their secret sauce is closing the monetization and marketing loop to help developers supercharge growth.

#3: They have an awesome Medium blog and podcast called LevelUp. You can find it on Medium by searching for “ironsource levelup”.

To my mind, the Zeitgeist of mobile gaming in 2019 wasn’t captured in the launch of a game, such as Call of Duty Mobile, or a platform, such as Apple Arcade or Google Stadia, but rather through the egregiously misleading mobile gaming ads that proliferated and saturated advertising channels over the course of the year. I take this view because those ads, to me, represents not a permanent trajectory of deceitful advertising tactics but a very specific, very revelatory, very fleeting moment in time: the full realization that success on mobile means leaning into the mechanics of the advertising platforms that almost exclusively sustain distribution for mobile games.

What these “fake” game ads showcase is the power of the unknown, because for every ridiculous ad a person sees that looks nothing like the game it is purporting to promote, there are potentially hundreds of variants the person didn’t see: those ads were routed to other people on the basis of click probabilities. Fake ads are really just digital Rorschach tests, built with so many variants and distributed so specifically via the sophisticated, highly-dimensionalized targeting algorithms of Facebook and Google that everyone sees exactly what they want to see.

I do believe that these misleading ads are a temporary phenomenon: platforms and consumers can be fooled, but only for so long. But what is exposed with these types of ads is just how fundamental the user acquisition function is for mobile games. If the advertising tail can wag the gameplay dog to such an extent that the content of an ad is more impactful to a game’s success than the content of the game, then it’s clear that user acquisition is an indispensable part of running a successful mobile game.

I have seen some commentators note that mass-volume creative production is a noteworthy trend going into 2020, but that feels like a lagged observation that would have been more prescient in 2018. We saw mass-volume, mass-variant ad creative reach critical mass in 2019; misleading ads are a symptom of that. What I think 2020 brings is a more consumer-friendly, data-driven approach to matching ad creative with audience tastes that is still fully aligned with the way the advertising platforms target potential users. The mass-volume, high-variety ad creative production strategy is a scattershot approach to audience targeting; I think a more contextual and informed approach dominates going forward.

This is partially because creative is just one aspect -- albeit an important one -- of the contemporary, event-driven, algorithm-regulated mobile advertising environment. The other is what happens in the game, and bridging in-game behaviour with advertising is an aspect of running a mobile gaming studio that still feels ripe for operational innovation.

In its State of Mobile 2020 report, App Annie estimated total mobile advertising spend for 2019 at $190BN; about one year ago, I estimated the size of the mobile gaming advertising market in 2019 to be $100BN. The mobile games market is massive, it is primarily driven by investment into marketing, and it benefits from secular tailwinds that are dramatically growing the total market for games and interactive entertainment. In this post, as part of the Deconstructor of Fun 2020 prediction posts series, I’ll identify three broad marketing trends that I think will influence the way mobile gaming studios operate in 2020.

If you enjoy this type of analysis, you might consider subscribing to Mobile Market Monthly, a new research product from Mobile Dev Memo and Deconstructor of Fun. We’re signing a handful of pilot customers this month.

Trend #1: Audiences are the New Oil

The importance of numerous and varied ad creatives in the algorithmic campaign management environment that Google and Facebook have ushered onto mobile is widely acknowledged, but less understood is the purpose of that experimentation: to allow the platforms to explore and define relevant audiences and reach them with semi-bespoke messaging (more on this topic here).

Creative experimentation effectively helps Facebook create its own proprietary lookalike audiences at the ad set level -- but those audiences aren’t made visible to the advertiser (the “walled garden” sequesters data off not just from other advertising platforms but from the advertiser itself). Experimenting with creative to allow Facebook to create targeted audiences that are hidden from the advertiser is expensive: by definition, it requires spending money to discover which creative-to-audience pairings don’t work.

Facebook audience construction and management will become a much more meaningful part of the mobile marketing workflow in 2020. Advertisers will need to come up with sophisticated models for identifying monetize-able users early in their tenure in a game so as to push those users into lookalike lists that can be used for targeting more users like them. This is similar to what Facebook does with AEO campaigns, but it’s even more flexible: Facebook only allows a few different event types to be targeted in AEO campaigns (lest the advertiser create custom Facebook events), whereas a developer can use literally any event in the game as its own predictor for long-term value.

What’s more, audiences will be seen as assets that increase the value of a developer in M&A and partnership opportunities. It’s not impossible to envision a company being acquired for its player data: since marketability tends to be a function of a game’s potential for monetization, it’s wholly sensible for developers that effectively monetize users to acquire studios solely for the purpose of acquiring their audiences.

Trend #2: Bridging Marketing and Live-Ops

As the engine of monetization for most successful games, live ops will become much more synchronized with marketing. Marketing teams will align their acquisition strategies around weekly events, tournaments, etc. and craft their creative to accommodate the user journey that best positions new users to participate in social and competitive gameplay.

This means that managing marketing spend will become much more specific to time: week-parting and day-parting to optimize for users being on-boarded into event cycles can be more profitable than simply running campaigns at a stable level of spend across the week. These fluctuations in spend across the week will need to be carefully constructed so as to not conflict with the way that Facebook and Google’s algorithms work (sudden stops / starts cause problems for these backward-looking channels), but since Facebook’s CBO tool allows for weekly and daily budget allocation, this type of analysis is entirely possible.

And as marketing teams devise models for efficiently allocating spend across the week, they’ll begin to look toward other opportunities for reaching users at the right time to coincide with their in-game experience: three-day weekends, long holidays, time of day, etc. This focus on live ops and marketing alignment will circle back to the game team: if a game is more marketable on some day of the week, perhaps it’s best to plan events around that? These types of product and marketing feedback loops will become more important and more common going forward.

Trend #3: Data Scientist as the New CMO

An uncomfortable tension has always existed between brand-oriented and direct response marketers in mobile gaming, but it does feel like 2020 will see the argument tilt in the favor of direct response. How do you make the case for omni-channel brand-based marketing when Playrix is worth billions of dollars and its ads look like fever dreams?

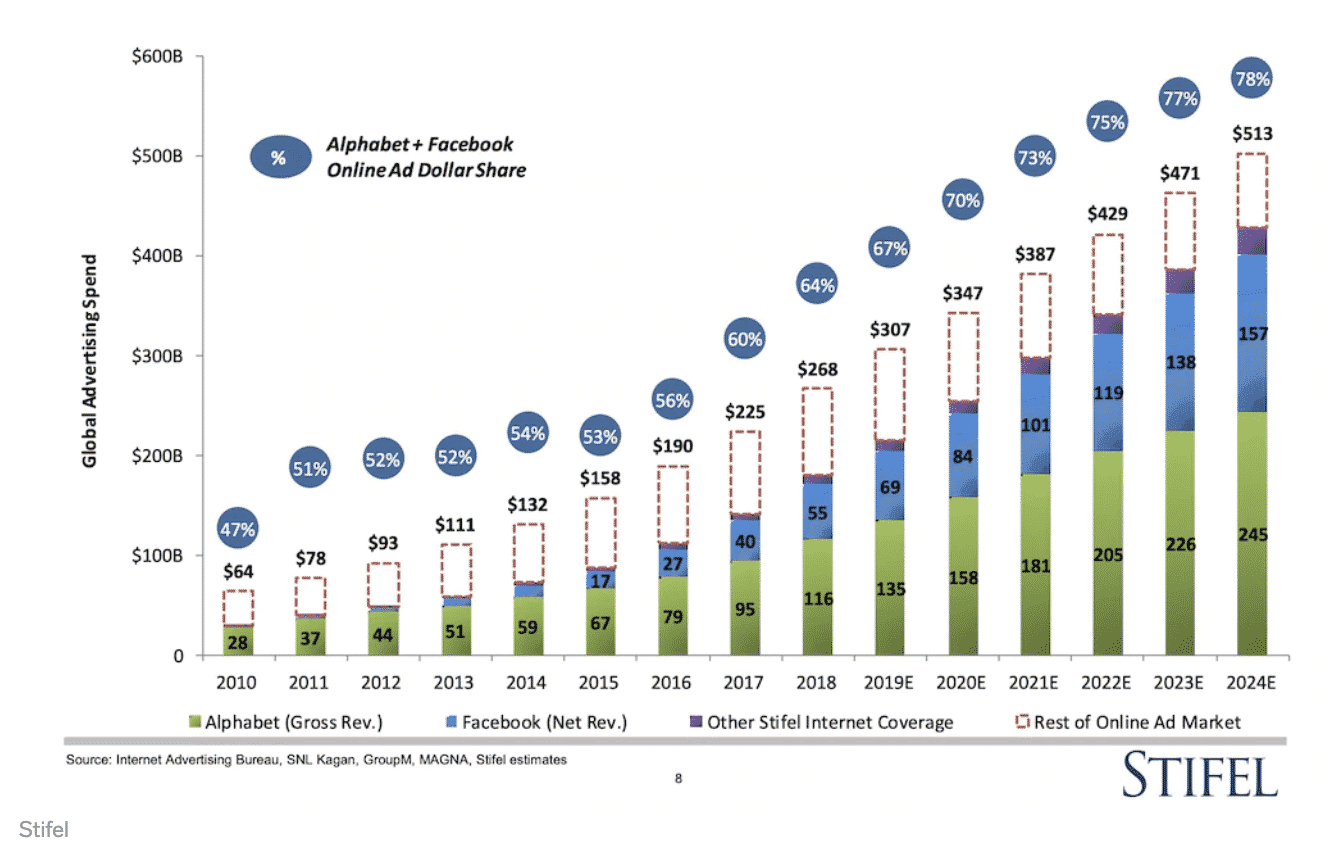

When I published the 2020 predictions for mobile marketing on Mobile Dev Memo last year, in which I anticipated the death of the CMO role for mobile-first companies, many noted that the “death of the CMO” is a decades old premonition that has never materialised. I hate to ever say that “time time is different,” but this time genuinely is different: not only have Facebook and Google completely abstracted away the mechanics of digital campaign management, but they are also capturing an increasing proportion of digital marketing growth as a result of momentum, insurmountable leads in advertising technology and data, and incumbent-preserving regulation in the form of GDPR and CCPA. These are substantive changes.

What mobile games marketing teams need now are

The creative throughput to generate very many advertising concepts,

The analytics throughput to convert in-game behaviour into targeting lists, and

The data science throughout to combine #1 and #2 into insight that predicts overall monetization. One could argue that brand-mindedness is important in the game concepting stage, but I’ve never seen focus groups outperform theme testing: with mobile, marketers and product managers have the ability to receive direct, objective feedback from very many real players, quickly. Why would that ever underperform assumptions-based concepting?

And in general, I have found that the people best positioned within a game studio to construct compelling combinations of theme, tone, and game mechanics -- what I call the Power Triad of Resonance -- are game producers who deeply understand gamer motivations and impulses, not traditional marketers, and especially not game marketers that come from outside of mobile gaming.