2020 Predictions #7: Why Auto-Chess Games can't Monetize - and How to Fix That

This prediction is written by Giovanni Ducati, who is a Director of Product Management at Scopely and who previously led strategy and finance for Hearthstone and as well as Esports at Activision Blizzard. The opinions expressed in this article are the author's own and do not reflect the opinions of the author's current or past employers."

To make sure you don’t miss all the following prediction posts, please do subscribe to Deconstructor of Fun’s powerful newsletter. You can find the previous predictions here.

Unless otherwise specified, all the data has been provided by the wonderful services of App Annie. Please take the numbers with a giant grain of salt. They are meant more for trend analysis based on estimations, rather than an exercise in accuracy.

Some of the best ideas in the gaming industry were inspired by other games and sometimes even created within other games. League of Legends, for example, was inspired by a mod for Warcraft 3 called DotA released in 2003. Then, it took 6 years and a different publisher from the original creators of DotA to take the MOBA concept into the behemoth that League of Legends is today.

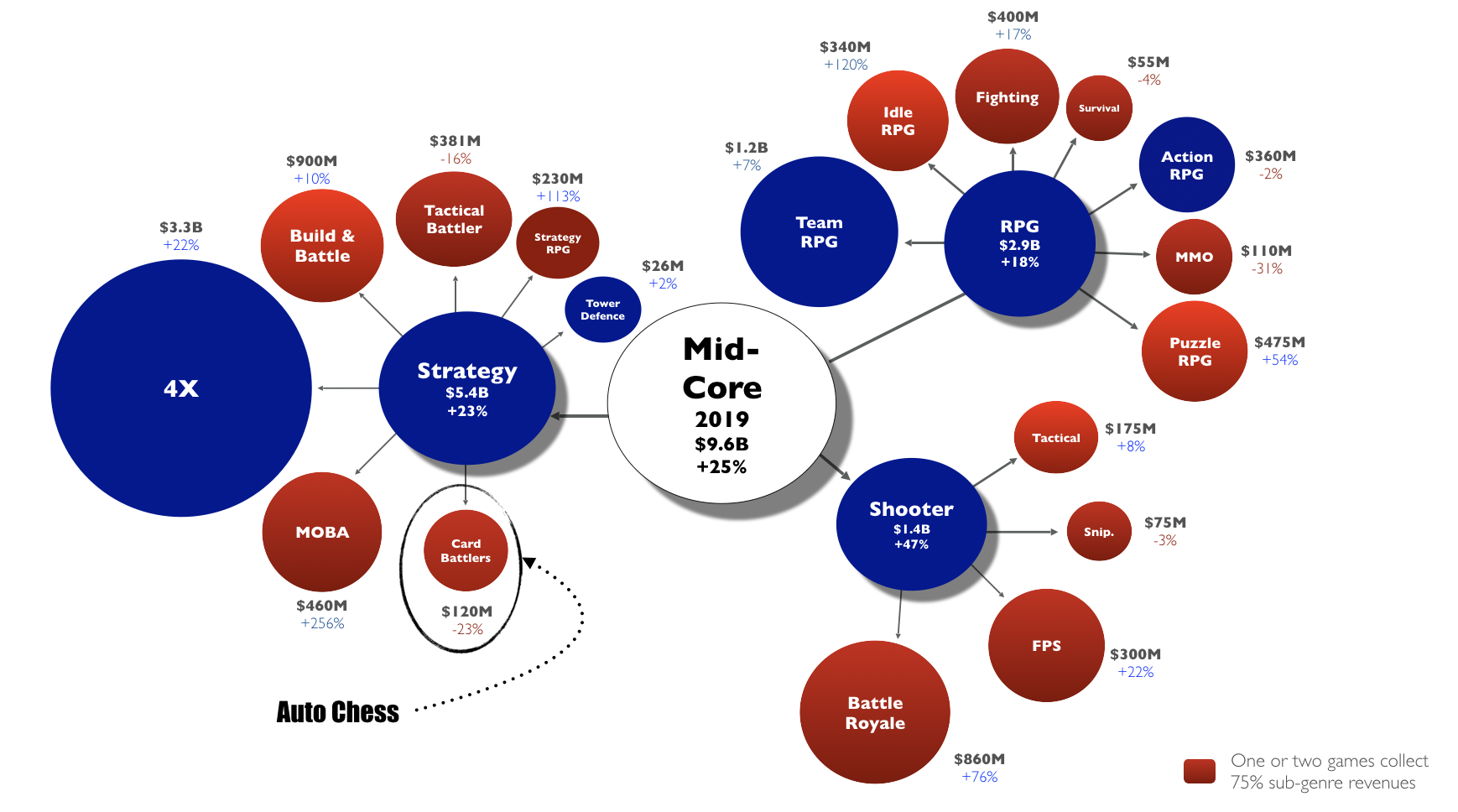

In 2019, it was DotA’s turn to incubate a new idea with a lot of potential: Auto Chess. In this analysis we will explore, if 2020 will be the year in which Auto Chess sees widespread commercial success. To save you from the suspense, the answer is NO. But we encourage you to read further to understand why.

In our taxanomy, Auto-Chess games don’t yet have their own bubble. They’re bundled under other Card Battlers, such as good ol’ Hearthstone, which has an Auto-Chess mode in it.

The Very Brief History of Auto Chess Games

Teamfight Tactics is Riot’s take on Auto Chess

Auto Chess is a relatively new phenomenon, as all the Auto Chess games were released in 2019 in the span of a few months. It all started with “Dota Auto Chess”, developed in January ’19 by Drodo Studio as a mod for Dota 2. Based on this initial success, in June/ July ’19 there was literally an explosion of new Auto Chess game releases: “Dota Underlords” from Valve, “Teamfight Tactics” from Riot, “Auto Chess: Origin” from Drodo (standalone version of the original game), and “Chess Rush”from Tencent. Later, in November ’19 Blizzard released “Battlegrounds” as a game mode within Hearthstone. And just like that, this new concept initially created for PC quickly became a new genre and expanded to mobile, as most of these games are also on mobile (or are going to be soon).

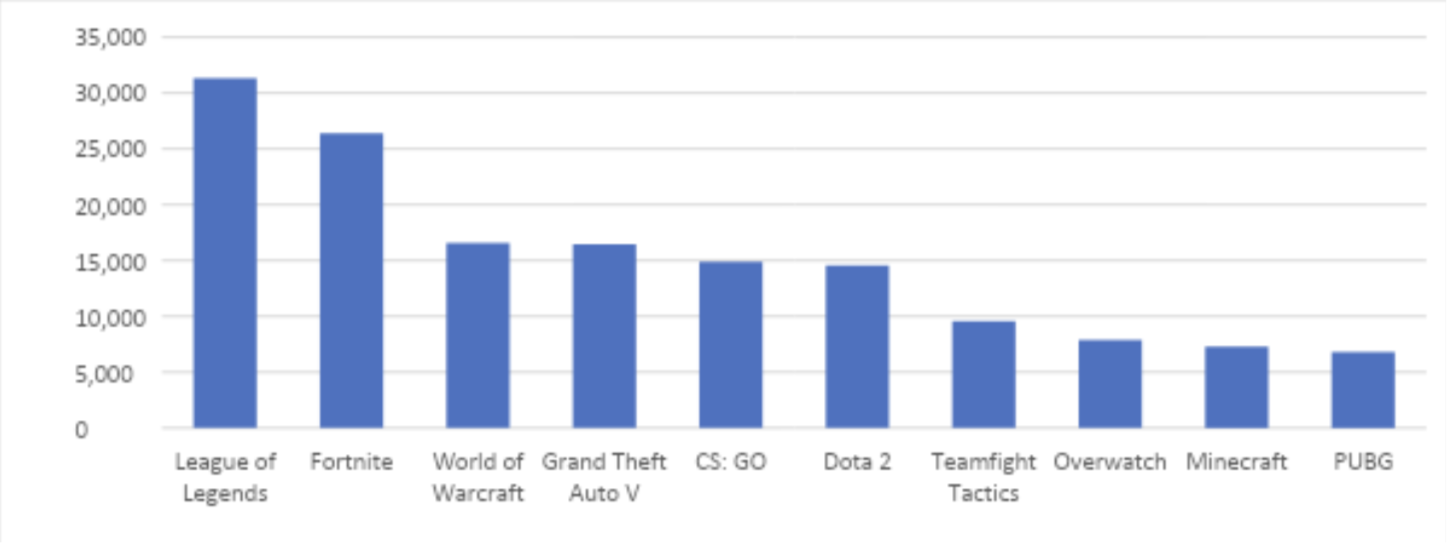

Given the rush to release their own version of Auto Chess, these developers must have seen something special in this new genre… and so did the audience, given the very positive initial response. Looking at Twitch data, Riot’s Teamfight Tactics (perhaps the strongest of these games) broke into the top 10 of most viewed games in the last 6 months.

Top 10 Games by Total Hours Watched on Twitch – last 180 days (source: www.sullygnome.com)

If you haven’t tried any of the Auto Chess games, please stop reading and try them out right now: they are tremendously fun (or at least do check out the video we linked above)! Now that you’re back, here is a quick overview of the Auto Chess core loop.

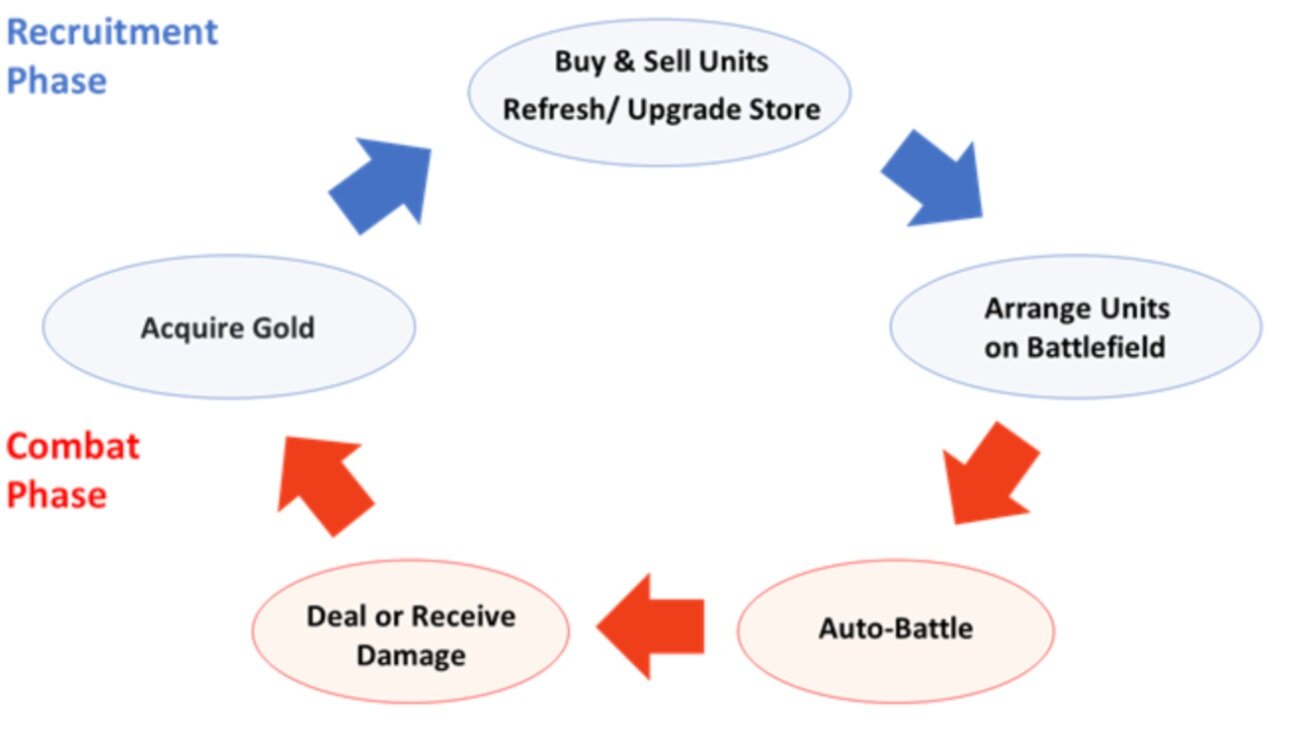

Auto Chess Core Loop: Recruitment Phase and Combat Phase

Here’s how you play Auto Chess:

The objective of the game is to defeat 7 opponents through a series of 1v1 fights. Before each battle, players can strengthen their team by buying and selling characters from a shared pool, using a finite amount of resources (“recruitment phase”). Then, players place their characters on the battlefield and their team fights the opponents’ team (“combat phase”) on their own -- hence the name “Auto” Chess. Winning typically requires building a team with strong synergies and positioning the characters on the battlefield in a way that plays to their strengths. To spice things up, every turn is limited by timer, forcing players to make quick decisions.

Hearthstone Battlegrounds: the “Recruitment Phase” (left) and the “Combat Phase” (right)

The appeal of Auto Chess stems from:

a highly strategic gameplay forcing players to make hard choices, given the limited number of characters to choose from in each round. The fun factor here is not just winning, but includes also the dream of creating the perfect team and the thrill of chasing it

an even playing field, as players are not required to spend anything to compete (e.g., purchasing card packs, like in Hearthstone)

a replayable experience, as each run provides players different sets of characters to choose from, and winning requires working with what you have vs. building the same team over and over

a nostalgia element, as the shared pool of characters may remind of Magic: The Gathering’s “draft mode”, the different feel of each run may remind of D&D, and the sheer difficulty of the gameplay (and the process of learning by losing time and again..) may remind of old school games from the 90’s.

As a result, the potential audience for Auto Chess is large and may even reach beyond the Card Battlers’ player base (which is large, considering also physical card games). Also, the fact that these games were created within the universe of Dota, League of Legends, and Hearthstone may bring in players from their respective eco-systems.

OK, but where’s the loot??

However, the path to becoming a commercial success is all but certain, as Auto Chess faces two massive challenges: monetization and long-term retention.

Monetization is by far the most serious challenge. Currently, AutoChess games offer little to nothing for players to spend on, e.g.:

Riot’s Teamfight Tactics players can buy select vanity items (e.g., skins for the arena and the “little legends”)

Blizzard’s Battlegrounds gives players (limited) benefits if they buy Hearthstone card packs, such as access to gameplay stats, visual emotes, and a third hero to choose from initially)

The crux of the issue is that the gameplay doesn’t lend itself well to monetize, mainly because of the “even playing field” mentioned above. More specifically, the current gameplay doesn’t offer any power progression, and therefore players cannot spend prior to playing; also, there are no opportunities to monetize during the gameplay to improve the odds of winning. As a result, the main remaining lever to drive monetization is vanity, but it is not clear that a vanity-based economy could make Auto Chess a commercial success -- more on this later.

The monetization issues are evident in the chart below with the net daily revenues on mobile of two games from the group discussed above (note that TFT is not available on mobile yet, and Battlegrounds is embedded within Hearthstone).

Looking ahead, the weak monetization is particularly dangerous for Riot, Valve, and Blizzard: if Auto Chess “steals” high-spend players from League, Dota, or Hearthstone, the damage for the publishers would be significant.

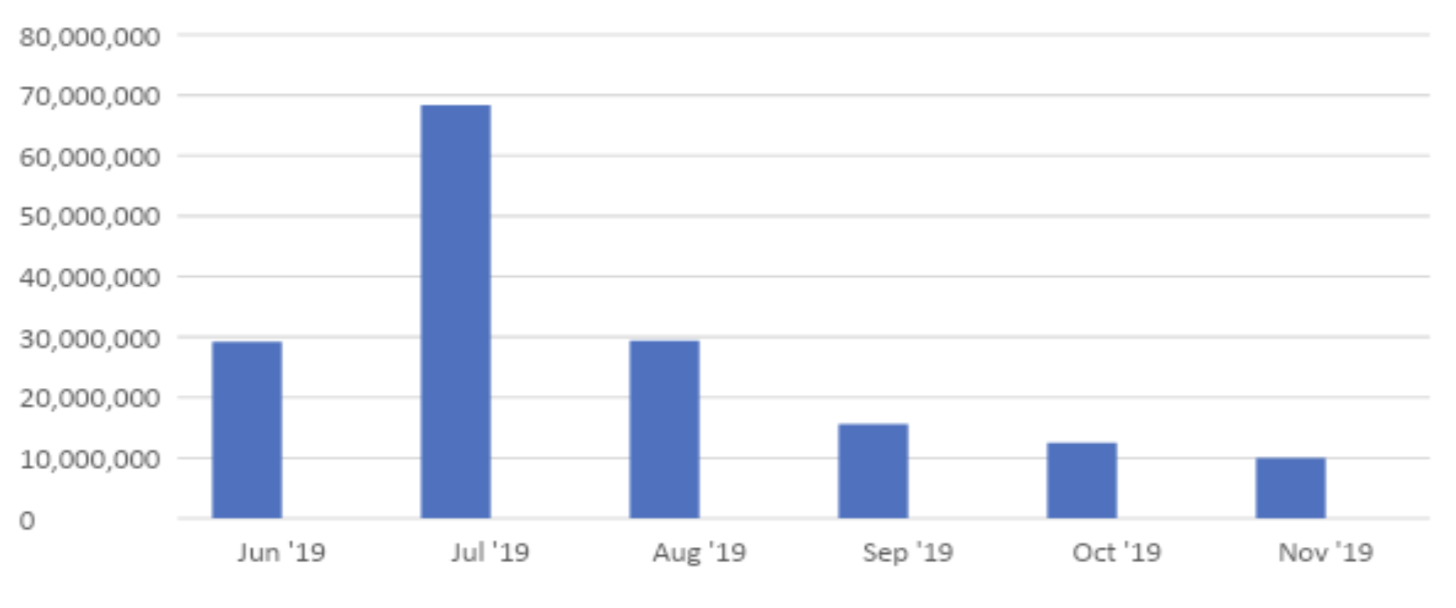

Long-term retention may also be a problem. The chart below suggests that the excitement for TFT has been fading since launch, despite a whole new set of characters was released in Nov ’19.

Teamfight Tactics Total Hours Watched on Twitch (source: www.sullygnome.com)

Then there’s the retention issue. The reasons for the decline in interest after launch is likely due to at least one of these reasons:

While the gameplay feels complex at first, its depth is actually shallower than Hearthstone or League (e.g., fewer characters). So, after players familiarize themselves with the characters and their synergies, the gameplay could feel stale (and there’s currently no LiveOps in sight to refresh the experience, besides from new sets of characters -- which, as shown above, didn’t drive viewership)

The social layer is currently limited only to queueing up with you friends, instead of having meaningful benefits from being in an alliance, accomplishing objectives with your friends, or fighting alongside your friends against other alliances;

Apart from achieving mastery and increasing your rank on the ladder, there are no long-term objectives, such as progression or collection (apart from vanity, if it ever becomes meaningful)

Lastly, all three games are or will be available also on mobile, which poses additional challenges, such as: mobile typically requires a faster core loop vs. the typical PC experience (the platform that these games seem to be designed for); on mobile, the real estate available to make vanity relevant is even smaller.

What should be the path?

Through 2020, we expect that Riot, Blizzard, and Valve will focus primarily on the monetization challenge (leaving the gameplay mostly as is) and that they will bet their chips on vanity to do so. This means introducing high-quality vanity skins for characters and avatars while providing various options for players to express themselves (e.g., emojis, victory dances a la Fortnite). In parallel, to source these vanity items, the three publishers will likely introduce a premium Battle Pass (in addition to the free one already available for TFT and Underlords) and/or loot boxes.

However, it is unlikely that a vanity-based economy with the current gameplay and business model will bring Auto Chess to commercial success. One could argue that vanity works well for League of Legends, and therefore could work for Auto Chess, since TFT uses the same characters. However:

League has a massive player base and therefore, even if only a fraction of players spends on vanity, it’s enough to drive a tremendous topline. Instead, Auto Chess is not likely to have a large player base in the medium term, given the retention challenges mentioned above

Vanity works well when it can be shown clearly to other players, and it’s not obvious that the real estate dedicated to vanity in Auto Chess is sufficient/ exciting like in League. Also, since the characters acquired across runs vary, Auto Chess players may not be compelled to spend to acquire custom skins.

Instead, hitting a home run with Auto Chess will require addressing both the retention and the monetization challenge with transformational changes to the business model and to the gameplay. This could include a combination of the below:

Introducing monetization opportunities without spoiling the fun factor. This is going to be risky and likely require gameplay changes. Other games (and even other genre) could provide inspiration here, e.g.: paying/ grinding to unlock heroes and avatars (similarly to how League monetizes characters); buying an additional life when the player dies (similarly to match 3 games); buying consumables providing perks or power during the gameplay (e.g., having more time to complete each turn); etc.

Long-term player goals: Introducing an overarching vector of progression that feels meaningful for players in the long term, beyond the ladder (e.g., PVE/ story based? social focused?)

Strong community: Introducing a social layer with meaningful benefits for players to help drive retention

Expand the audience: Making the gameplay more accessible to appeal to a larger audience (e.g., simplifying and shortening the core loop, making it a better fit for mobile as a byproduct)

Gamify the competition: Creating a persistent economy with a soft currency and introducing game modes that generate sinks (e.g., a tournament system with entry fees that pays out to the winners only; this could also be done with a series of higher stakes/ higher rewards arenas a la Golf Clash)

Our prediction for 2020:

It took 6 years after Dota 2’s release for an unknown company called Riot to launch League of Legends and begin building a giant phenomenon. We believe that 2020 will not be the year of Auto Chess and that it may actually take Auto Chess a long time to reach commercial success (if it ever happens), given how far the business model seems to be.

In 2020, Riot is best positioned to take the lead among the three publishers (Riot, Blizzard, Valve), given their head start in terms of audience.

In the coming years, however, it’s possible that it will be a newcomer with “nothing to lose” (i.e. no existing portfolio of games nor a big brand to protect) to challenge the existing gameplay and to introduce the transformational changes that will make the business model work. Think of a game that combines power progression with drafting and auto-battle. Clash Royale meets Auto Chess, to be more specific.

Today Auto Chess represents an ancillary game mode for League, Hearthstone, and Dota 2, and their publishers may not dedicate the attention needed to make it successful if they have bigger fish to fry. Their publishers for sure see the same cannibalization risks explained in this analysis. Though this issue doesn’t seem to stop other big publishers entering the space (Ubisoft launching their auto-chess game)

Lastly, while the current Auto Chess games suffer from several challenges, they have shown (along with other games, like Archero) that players are excited about the drafting and auto-battling mechanics. In 2020, we expect to see several more games across different genres that will leverage these systems.

If you enjoy the depth of the analysis we present, please sign up for Mobile Market Monthly - a product by the folks behind Deconstructor of Fun & MobileDevMemo.

We’re signing a handful of pilot customers now.