2019 Predictions #9: Say Hello to the New Breed of Battle Royale Games

This prediction is written by Michail Katkoff, Kalle Heikkinen, Abhimanyu Kumar and Alexandre Macmillan. .

The last prediction in this year’s extensive series focuses on the breakthrough category of 2018 - Battle Royale games. To make sure you don’t miss on all of the 🔥content coming out in the future, please do subscribe to the Deconstructor of Fun infrequent but powerful newsletter. Also, the other 2019 Predictions can be found here.

Before you jump in, let us sum up how we arrived to the predictions.

First we created a taxonomy together with Game Refinery dividing the games market into four different genres: Casual, Mid-Core, Casino and Sports. Then we further broke down the genres into categories based on games and then we further divided each category into a sub-category based. As as example, Candy Crush Saga is in a) Casual Games genre > Puzzle Games category > Match & Blast sub-category

Then we pulled the data of top 500 games (excluding China, Japan and Korea) from Sensor Tower and aligned the data with the genres, categories and sub-categories. Once we had a clear view of what happened, we got together and wrote our predictions.

Please, take the numbers presented with a giant grain of salt. They are there more to show trends and to give rough estimates.

First: A Sneak Peak of the Whole Mid-core Market

As you’ve noticed from the previous prediction post, we actively refer to categories, genres and subgenres. In this post, we discuss Action Games, which we see as a category in the Mid-core genre. More specifically, we will deep dive into Battle Royale, which is a subcategory of the Action Games genre. To understand our taxonomy in details, please read this. To understand it at a glance, please look at the image below.

The Mid-core market on mobile grew 7% in net revenues during 2018.

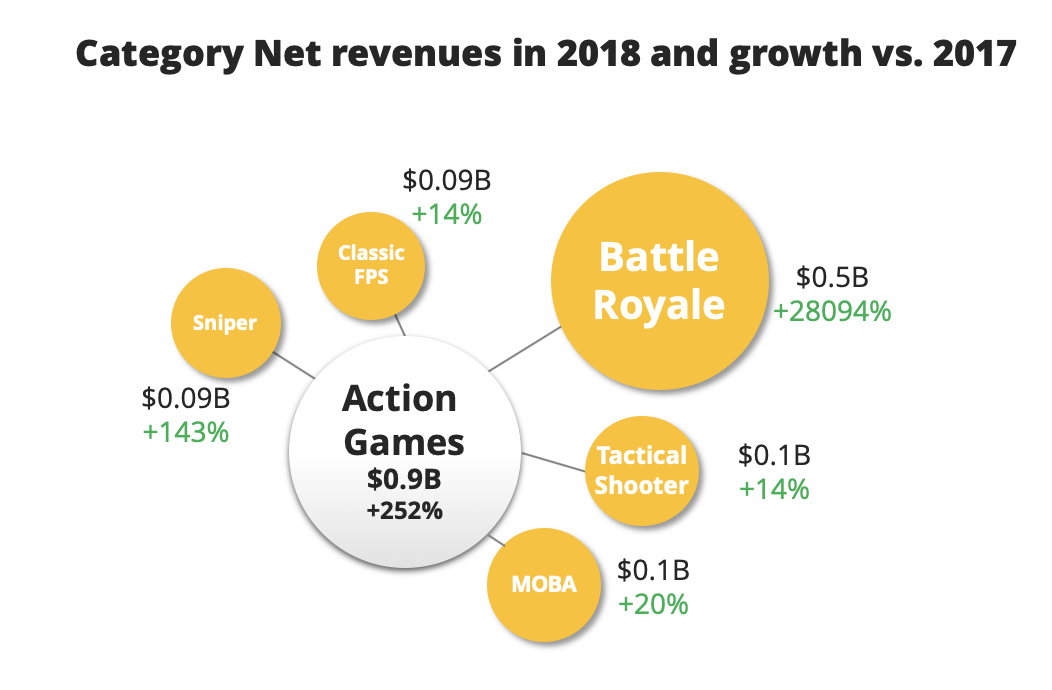

The Action Games category was by far the fastest growing category on mobile. This was due to rise of Battle Royale and due to the simple fact that the category size in terms of revenue was among the smallest on mobile.

In this post we will only provide predictions for Battle Royale subcategory. This is due to two reasons. Firstly, all subcategories of Action Games are tiny. Secondly, they are not growing, unless they implement Battle Royale mechanics (case example: Pixel Gun). And for all of you MOBA lovers. This subcategory is just not big in the West on mobile and it’s not due to lack of effort. In fact, we predicted this back in 2014 (read: If Vainglory Doesn't Make it, No One Will)

Battle Royale is the New Norm

No matter how you measure it, 2018 was the year when Battle Royale took us by storm. What got started in the modding scene of PC survival games such as Arma, H1Z1 and DayZ, eventually developed into a global phenomenon including the likes of PUBG and Fortnite.

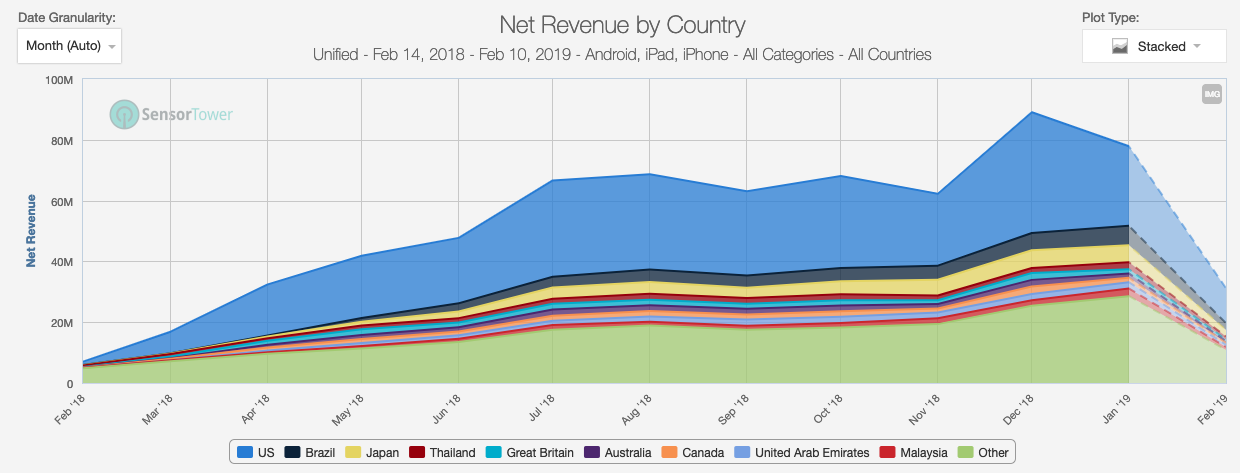

Battle Royale games have grown rapidly on mobile over 2018. And this graph doesn’t have Fortnite’s Android revenues.

US still accounts for over 40% of all revenues in Battle Royale games. Apart from that, the distribution is quite even apart from one surprise - Brazil is the second most grossing country for Battle Royale games largely due to Garena Free Fire.

Of course, Fortnite accounted for most of the Battle Royale revenues. Since the day it released in March on iOS, Fortnite has held tight to the the #1 top grossing spot. The game generated $350M in net revenue on iOS alone in 2018. Across all platforms Fortnite is estimated to have generated $2.4bn in 2018 and it was the most watched game on Twitch in 2018. In addition, the game skipped Play Store when launching on Android arguably saving well over $100M it would have had to pay Google as platform fee.

Fortnite has redefined the way financial analysts looked at the industry, and it has colored all the expectations concerning the financial stability of game publishers and the health of their future release calendar. One of the main reasons for the drop in share price of the big names in the console business is Fortnite, and the way it set all expectations. On the other hand, there’s a strong argument that financial analysts should stop talking about Fortnite’s effect on video games’ stock.

It is safe to say that releasing a Battle Royale mode has become a top priority for “traditional” publishers. EA pointed to the absence of a Battle Royale mode in Battlefield as a factor contributing to lower than expected performance and plans to add a Battle Royale mode to Battlefield in March 2019. This notion is further supported by the release of Apex, which set EA’s stock on another roller coaster within a few days of release - and just a few days after a disappointing earnings call.

How to Grab a Piece of the Battle Royale Pie?

Islands of Nyne, Realm Royale, Fear of the Wolves, Call of Duty: Black Ops, Ring of Elyseum, Dying Light, The Cullin, Rust, Counter-Strike Battle Royale and so many others have tried to take market share from Fortnite and PUBG. All of the follow ups have been executed well and offered something new. Yet they failed to become anything more than a niche at best or curiosity at worst.

The way we see it, you have to get at least these four elements right to succeed in Battle Royale:

#1 Launch BIG on Multiple Platforms

When it comes to launching a Battle Royale game, doodling between LTVs and CPIs is a lost cause. The only way to come out is to come out with all guns blazing. And preferably on multiple platforms at the same time to maximise the coverage.

Apex Legends is the most recent entrant to the red hot ocean of Battle Royale games. The surprise attack launch across both PC and consoles earned the game a million concurrent players in 8 hours and a 10 million mark only three days in!

While the massive launches have their clear benefits, they also out a major pressure on the product itself. The game has to be ready not only from feature and performance perspective but also ready to scale rapidly and ready to offer enough content for the masses of early adopters.

Just a few really well made and somewhat different Battle Royale games. Even a true fan of Battle Royale games hasn’t played more than one of these.

Skipping on a big launch is the reason why you likely have never heard about games like Battle Lands Royale, Islands of Nyne, Realm Royale, Fear of the Wolves, Ring of Elyseum, Dying Light, The Cullin or Rust.

#2 Make Meaningful Product Differentiation

Finally, you can’t expect beating the best with pretty much exactly the same product. Don’t be like Creative Destruction, which is a weaker version of Fortnite. And the only reason Rules of Survival had any success was that it launched a couple of months earlier thank PUBG. And once PUBG came out, the duller version faded away. If you want to stand out of the pack, you need add meaningful differentiation to your game.

There’s barely any difference between Rules of Survival and PUBG, nor between Fortnite and Creative Destruction - all resulting in lowering the chances of copycat titles to capture significant market share.

There’s barely any difference between Rules of Survival and PUBG. Nor there is much difference between Fortnite and Creative Destruction. Due to lack of meaningful differentiation, the copycat titles are struggling to find any meaningful market share.

Take Apex Legends for example. The key product differences in the game are classes and squads. These two factors create a meaningful teamplay, which leads to players insisting to play together with other good players and/or their friends. This meaningful social element fuels retention and monetization because you can’t leave your friends hanging and because it’s fun to show off your new skins among buddies. The squad play is a meaningful product differentiation as it completely changes the gameplay dynamic while varying play motivations compared to Fortnite and PUBG. In addition to that, the game stands on its own as a true FPS compared to the rival 3rd person shooters. This could lead to a market where there is a 30-40% audience overlap between Fortnite, PUBG and Apex, due to different playing motivations and different experience needs at various times, such as playing alone versus playing with friends and teammates.

The classes in APEX Legends offer a meaningful product differentiation that is more than just visual or a gameplay tweak.

At the same time, meaningful differentiations can also result in lack of meaningful success. A good example of this is Battlelands Royale by Futureplay Games. Based on the look and feel of the game, it clearly enjoyed very short period of time-to-market. The product differentiation focused on accessibility and the game definitely delivers arguably the most casual battle royale game on the market. Yet accessibility is not something the players wanted. Just look at Fortnite’s young audience. Clearly it’s not a hard game to get into. So as a result, Battleland Royal’s product positioning was off and the game remains little more than a curiosity and reference point for follow-up titles. (nevertheless, do download the game and have yourself a good old time!)

#3 Go All-In on Influencers

We’d assume that by now we don’t have to make case for influencers’ importance for the success of your battle royale game. No they are not be all end all by no means. Call of Duty Black Ops had Post Malone and Neymar Jr as well as Ninja playing the game. Yet few months afterwards the game is known as “the last Call of Duty” instead of The Call of Duty.

The importance of influencers is not only something that Twitch and YouTube are banking on. As of late, Epic has set up a program that pays content creators for sending their audience to install a game on Epic Games Store.

Nevertheless, together with the right pricing strategy (discussed next) and a big launch, influencers play an important component when it comes to elevating your product from a cool game into a worldwide phenomena.

Check out a message below from our sponsor Matchmade, the award winning influencer marketing platform. A service to keep in mind when you want easily and effectively run influencer campaigns.

#4 Pick the Perfect Pricing Strategy

It’s important to talk about pricing strategies because all three of the current Battle Royale hits are employing them. In theory, there are three different pricing strategies.

First is to focus on maximizing the profits. A good example of this is World of Tanks, where players are upsold on prower progression of ever better and more expensive tanks that become obsolete as player progresses in the game (read: World of Tanks Blitz Liberates Players from Mid-Core).

The second pricing strategy focuses on defending a market. A good example of this is League of Legends, which through underpricing its content defends its giant playerbase from new entrants (read: Comparison between League of Legends and Heroes of the Storm).

The third pricing strategy focuses on entering a market. An example of this is DOTA2, which was able to compete against League of Legends by offering an even lower price point (all the champions are unlocked for free). Market entry pricing requires the company to usually have some significant distribution channel advantage such as Tencent’s WeChat, Valve’s Steam and EA’s Origin.

When it comes to market entry both Fortnite and Apex are free-to-install on all platforms. PUBG is free on mobile but still paid on PC. Being free decreases the entry barrier and increases the reach allowing the game, at least in theory, to transform into a global phenomena. Having a paywall is something that kept Call of Duty Black Ops from reaching its full potential.

Most importantly though, Fortnite has taken major steps to defend its market via distribution advantage by distributing its game via Epic store, not only on PC but also on Android. Controlling the distribution channel has allowed Epic to gain a whopping 30% revenue advantage to its competitors. APEX Legends, which is distributed via EA’s Origins, which allows it to gain a competitive parity in pricing terms.

Finally, Fortnite is ahead of the curve by also maximizing its profits in addition to defending its position via distribution advantage and underpricing. The game perfects a holistic battle pass system, which fits perfectly with the free-to-win monetization model of battle royale games. To get more granular, Fortnite is underpricing at the download level while maximizing profit at the IAP level. The lowest price point in the game is $9.99. There are limited-time offers in the store at $4.99 - but they don't include any currency. There is no conversion price points of $0.99 or $1.99. The lack of profit maximization and a battle pass mechanic is something that will hold APEX Legends back a bit.

To sum it up, Fortnite holds it’s spot at the top by maximizing its profits via holistic battle pass system and high IAP prices. The game has gained an entry to the market via its own distribution channels (apart on iOS) and it defends the market by underpricing the product with an overwhelming amount of content behind a single battle pass (and of course all those micro transactions…).

PUBG follows Fortnite in all but market entry as the game is distributed via Play and iOS stores on mobile. On PC and Console the game costs $30. The combination of loot boxes, battle passes and paid product is designed to maximize the profit.

Apex Legends has followed in Fortnite's footsteps with a full fledged and regularly refreshing item shop, while selling premium currency at very comparable prices. Entry price is $12, goes up to $120, but bonus currency given out with incremental price points are lower compared to Fortnite. So there is a bit of a profit maximisation perspective here, but since a lot of the consumers will be coming into the game jaded by Fortnite, the even higher starting price point and lower bonus currency with incremental purchases could potentially backfire.

Second, Apex additionally monetises by selling cosmetic based loot boxes. This could be one of the reasons why they can afford to start at a higher price point and give out lower bonus currency with incremental price points, since loot boxes give you more cosmetics for less. Given the proven monetisation depth of loot boxes and the high need of vanity items in battle royale games, this could prove to be a smart move from Apex to push monetisation. A byproduct definitely is EA getting back into the good books of consumers after their previous loot box scandal - nothing better than selling cosmetics in loot boxes.

Third, since Apex is built on Titanfall lore, there is an existence of characters with different abilities and therefore a monetisation opportunity opens up to sell characters, which Apex is also doing in the store. If they are able to balance characters well, a new character release cadence with the current character pricing might just be able to create the same revenue peaks Fortnite possibly sees every time a new season battle pass comes out.

Fourth, all news items point to an Apex battle pass in the works. But since Apex already sells cosmetics through loot boxes, we can see Apex's battle pass going one of three ways - selling additional gameplay, or selling additional cosmetics, or selling additional of both.

There is one downside to Apex though - it is a FPS in a cosmetic economy. We’re not sure how big of a problem it'll be for sales when the player cannot view the cosmetics he has bought while in gameplay action, but feels like a bit of a downer.

All-and-all, it feels like Apex has all bases covered when it comes to monetisation strategies while staying market relevant. That combined with the massive following they've gotten is an indication that this game is not going anywhere over 2019.

One last point, which may be contradictory to what we just said. Pricing strategies become more relevant when looking at highly comparable goods, like aftershave. But, it would be prudent to be sensitive to the nuanced difference between how people consume goods vs entertainment. The likeliness to simultaneously consume more than one entertainment source of a similar type is way higher than that for a good. For Battle Royale games that have low switching costs compared to MOBAs, sizeable audience chunks play more than one product at a time. And if the product gameplay and monetizable offerings are significantly different (as is the case between Apex and Fortnite), then pricing strategy takes a second seat (though still important), as players play different products to satisfy different needs.

Battle Royale Beyond Shooters

While these titles are fully-fledged classic examples of battle royale games, it has since then become apparent that with a pinch of creativity, it is possible to include a battle royale mode in a surprisingly wide array of different game genres.

Brawl Stars (Supercell)

Supercell’s newest title was finally greenlit for global launch last December, and so far it has performed just as expected taking its place in the top-10 charts. It seems like the Finnish developer is well aware of market trends because Brawl Stars too supports a battle royale mode called Showdown. Players enter the mode as solo or duo and strive to be the last brawler alive while scouting the map for chests that contain buffs to players’ health and attacks. In Showdown it is gas clouds that push players to move into a safe zone.

Honor of Kings (Arena of Valor in the West, Tencent)

Tencent’s MOBA behemoth Honor of Kings hasn’t been standing idly despite its dominance in the Chinese top grossing charts. Instead, the game is continuously updated with new content and ways to play the game. Last summer, Tencent added a new 100 player Breakout mode to the game to quench its battle royale-thirsty player-base.

Just like in a regular MOBA match, Breakout starts with players selecting a character. While adjustments to characters’ attributes have been made to maintain balance, all characters still keep their unique skills from MOBA gameplay. Players can then choose their starting position in the map, and after that, it’s the usual battle royale-drill with loot to be scavenged and sandstorms serving as the explanation for the shrinking game area. In addition to the character selection process, other MOBA elements in the mix include the possibility to purchase and upgrade gear on the fly and NPC-monsters that players can slay for loot.

Clash of Kings (ELEX)

Who said 4X games couldn’t go battle royale? ELEX’s Clash of Kings gave us their interpretation of battle royale last summer with the Slaughter Battlefield mode. In each round, 20 players with balanced stats are thrown into the fray, where they’ll start by safely scanning the battlefield and planning their moves. After that, it’s an all-out war where lords get points for attacking other players and killing NPC-monsters, with the goal of being the last lord standing. Obviously, Slaughter Battlefield also has a shrinking safe zone, so players need to plan their positioning.

Contra: The Return (Tencent)

Still in soft-launch in the West, Contra’s Chinese version has already been wreaking havoc in the Chinese top-grossing charts for a good year and a half. The feature-rich side-scroller just recently added yet another playing mode to its already impressive set of game modes. Yep, it’s a battle royale mode but not just any battle royale mode, but one in collaboration with Star Wars!

I strongly recommend watching the video above to get a better idea of how the mode works, but here’s a brief summary anyway. The mode takes place in a virtual training ground inside the first Death Star, where players as stormtroopers battle it out until there is only one trooper left standing. Just as in any classic battle royale game, in Contra you also get to have a say on where in the training complex you start the game. Weapons and equipment are also procured on-site, and there’s obviously a shrinking safe zone ensuring that the fights stay intense.

Battle Royale in 2019

So more than any other sub-genre, there is a lot of volatility in the mobile market around Battle Royale games and predictions are about a yet uncharted territory. At this point, a prediction about Battle Royale is much more than a prediction about a sub-genre: it feels much more like a prediction concerning the direction in which the gaming market is going – and maybe even about the increased convergence between gaming platforms.

So, there are 2 ways to approach this prediction, play it safe, be as non-committal as possible and look back on this a year from now happy the predictions were not too off. Or embrace the uncertainty, extrapolate on some emerging trends, and take a leap of faith (and maybe go into hiding after this). Be warned in this prediction we’re going all-in, taking no prisoners and not looking back. If it doesn’t turn out to be accurate a year from now, at least it will be entertaining today.

Fortnite will hold on to its spot at the top

Apex Legends will secure its spot on the top as soon as they implement battle pass and create a cadence of new character releases, potentially across old and new classes

Battlefield will enter the Battle Royale category. Especially the Star Wars version will get a ton of hype but the upfront price will limit the audience size causing the game to get overshadowed and outperformed by the free-to-play Battle Royale games. Games that are services rather than products..

Revenue in the Battle Royale sub genre will continue to grow at a slower pace pushed by smaller hits such as Garena Free Fire (Big in Brazil) and Knives Out (Big in Japan) as well as by Battle Royale games with more standout themes.

Battle Royale modes will get widely adapted in all kinds of games. Even Tetris jumped on the Battle Royale train!

Fair competition – as in, pay-to-win instead of pay-to-progress - will be an aspect of any real-time PvP game that is free-to-play. This trend will affect LTVs and it will be widely adopted on console in the coming years.

More focus on monetization will result in new ways to increase LTV in cosmetics driven Battle Royale games. Expect a page to be taken out of Counter Strike’s playbook (How Counter Strike Can Sell a Single Skin for $61,000)

Brawl stars will face challenges in the West. If you are interested in hearing more on how Brawl Stars has faired, check out Deconstructor of Fun’s presentation at the upcoming GDC.

One final call out - Focusing on Battle Royale as the next big thing misses the key dynamic at play here. It’s not that the mobile market is now all about last-man standing shooters. It’s that the gaming market as a whole is looking for a convergence of experience across multiple platforms - just ask Super Evil Megacorp (Vainglory's vision of a cross-platform future).

If there is one prediction to walk away from here, it’s not that more people will be playing Battle Royale games. It’s that developers and publishers will strive to create cross-platform and trans-media gaming experiences. And yes, this is where streaming comes to play as it is a key part in the success and appeal of Battle Royale games.

Creating cross-platform experiences doesn’t mean porting a PC or console game to mobile with shard servers. It’s safe to say that, Fortnite’s implementation on mobile is rudimentary. By simply porting the same game to mobile, Epic has created 1.0 a cross-platform free-to-play experience. The next big step will be modulating the experience of a game in different ways to match the characteristics of each medium: allowing users to engage with a same game in different ways depending on the platform they’re playing.

Relevant previous posts from Deconstructor of Fun:

Battle Royale Games - Everything You Ought To Know

Battlelands Royale: Contender Or Pretender?

$126 Million and Counting: Fortnite, How Do They Do It?