What is Valve’s strategy?

In the past, fans debated which would be the winner gaming platform among many warring ones, with every new generation bringing in new contenders (Sony, Microsoft…) and removing some (like Sega or Atari). Some reminiscence of those conflicts still remains nowadays a PC, PlayStation and Xbox fans continue to clash over supremacy. But despite what may look like a pivotal battle, in reality, these players are a minority within a huge gaming population that is dominated by a single gaming platform - mobile.

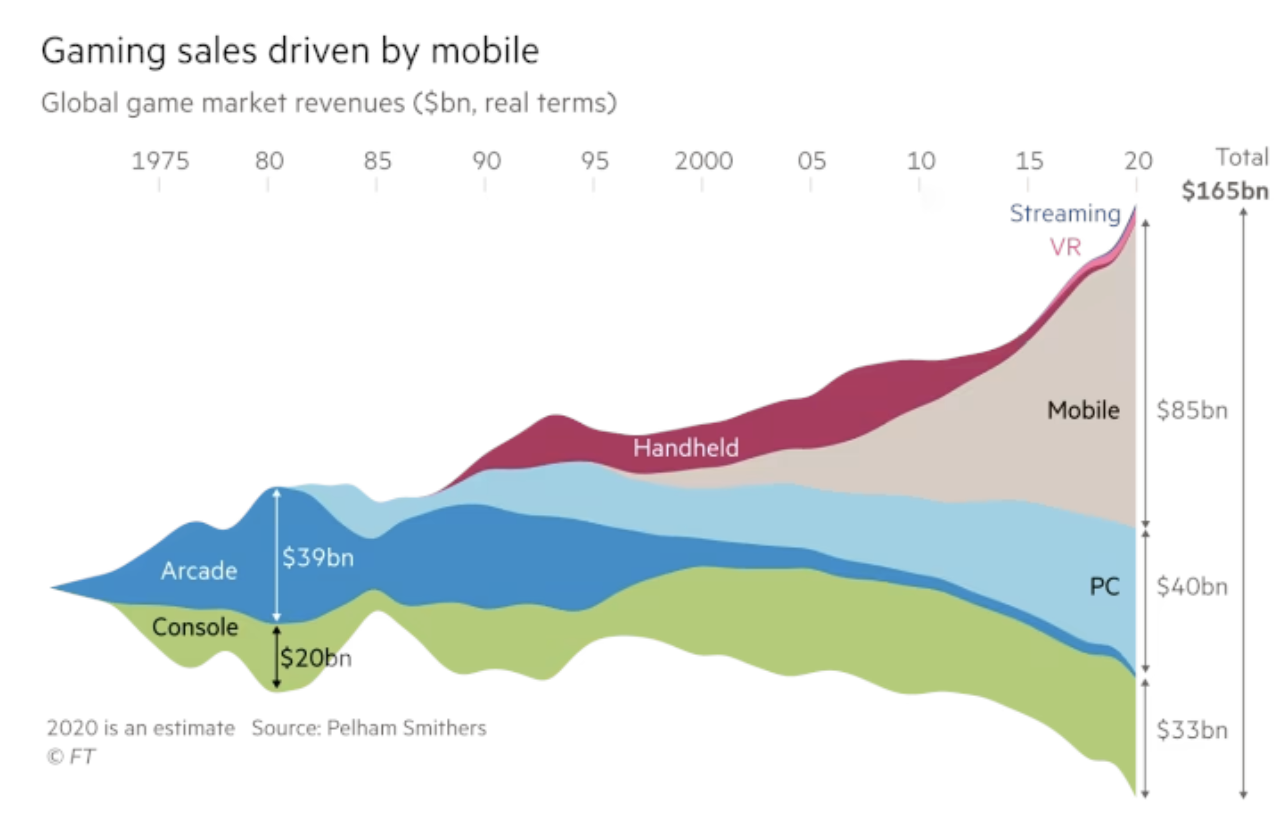

In 2022, it’s undebatable that the main gaming platform chosen by most people in the world is their smartphone. After all, every PC and console player has also a powerful gaming device in their pocket at all times. Newzoo estimates that more than 90% of 2021’s players played via mobile. The sheer volume of mobile players in the world and the volume of revenue hint that other gaming platforms are becoming a niche. And this already shows in revenue market size.

Growth of gaming has been driven by mobile devices every since Apple introduced in-app purchases.

What’s even more relevant for our topic here, there are strong arguments to support the idea that mobile dominance as a gaming platform will actually increase in the following years:

The huge casual player segment of the market is an audience almost exclusive to mobile and is unlikely to buy more specialized and expensive gaming platforms. Wii’s achievement of becoming a hit among the non-gamer audience will become harder to pull off as TVs offer natively many of the side features that made the Wii worth as a TV companion device.

Players in emerging markets are already choosing mobile as their main gaming platform since the smartphone fills the role of the console, the TV, and the PC. Nowadays, people have to have a phone, but they don’t necessarily have to own any of the other devices. So it’s cheaper to over-invest into a single mandatory platform than split the investment among multiple devices, particularly when the difference in quality is becoming blurrier.

In many areas of Asia, especially China, gamer audiences have also chosen mobile devices as their main gaming platform. This may be the reason why hardcore games like MOBAs or autochess don’t work well on mobile in the West, but outperform in China.

Young audiences are growing used to their gaming experiences being agnostic to the platform. They close Genshin Impact on their PC and open it on their mobile as they leave home. Can we expect them to have specialized gaming platforms when they have similar experiences in another?

Gamer audiences in the West that are the main pillar of traditional gaming platforms will eventually decline, as they grow older and become less relevant economically. They also will find fewer incentives to get a console or gaming PC as the difference in quality compared to mobile platforms become smaller.

Console platform providers have noticed this shift. After all, it’s one of the main reasons their revenues have stagnated in the last twenty years. And potentially an existential threat to the concept of a standalone console in the next decade.

That is why on the hardware front, several ongoing innovation trends aim to turn consoles more mobile-like: For example, the shift towards cloud gaming aims to remove the high entry price and provide a gaming experience agnostic to any hardware. The last step of that path is enabling players to access their console-like experience on anything with a screen and an internet connection, thus becoming as versatile and portable as a mobile.

On the software front, the movements are even more noticeable and have been going on for several years now, with many developers aiming to get positioned on mobile by engaging in acquisition (TTWO buying Zynga, ATVI buying King…) or simply by launching mobile adaptations of their products (CoDM, Apex Legends Mobile, PUBG…).

That said, Valve has been almost completely absent from mobile game headlines. This is less surprising than it may seem at a first glance.

Valve's status as a private company means that they’re less pressured to explore the hot trends of the stock market. This gives them more freedom to bet on different opportunities, often overlooked by their competitors, and even sometimes directly generated by the competitor’s need to satisfy the whims of the shareholders.

The key example happened in the 2000s: Many similar game development companies focused primarily on developing games for consoles, which at the time dominated the market in terms of revenue. On the contrary, Valve bet on something that shareholders might have opposed: They doubled down on PC, which at the time seemed a dying platform, by launching Steam (2001).

The results speak for themselves: The vacuum on PC allowed Steam to become the dominant store, and nowadays it’s the company’s main business.

A decade later, PC started to grow motivated due to the technological stagnation of consoles and the advent of DLCs and games-as-a-service. Then many competitors tried to build their own stores (Ubisoft’s Uplay launched in 2012, EA’s Origin in 2011…), but it was too late: PC was Valve’s walled garden.

If we take a look at Valve’s current strategy, it becomes obvious that it’s following the same exact playbook of avoiding walled gardens and creating its own. While everybody is focused on mobile, a space that’s so crowded that it would be impossible for anyone to achieve a dominant position (particularly since it’s a walled garden already owned by Apple and Google), they’re doubling down on VR and portable devices.

Each of these bets requires separate analysis:

#1 Valve is one of the leaders in VR gaming. They’ve achieved that by leveraging their already massive Steam audience and the huge power of its gaming IPs (Half Life Alyx being a mandatory purchase for any hardcore VR gamer).

They’ve also become independent in terms of hardware by releasing the Valve Index, which arguably it’s the best VR headset for gaming. This would allow them to escape any attempt by Meta to build a walled garden around their hardware.

And while currently, the total market size of VR is almost negligible, it’s not guaranteed that it will remain like that. If VR becomes a more relevant platform in the future, Valve will be in a dominant position, second only to Meta, and at a fraction of the investment. This would be an incredible win even if the actual VR market size in the next decade ends up significantly smaller than in Mark Zuckerberg’s metaverse dreams.

#2 Valve’s handheld device strategy seemingly aims to capture the console audience in an upcoming shift towards more portable formats. In my opinion, it pursues the same opportunity as their experiments allowing streaming from a PC to other devices: To offer an alternative to cloud computing, which has technological challenges (subpar latency, demand for ultra-fast brandwith…) that may not be possible to overcome.

Valve’s Stead Deck is a portable PC that gives players access to their Valve library on the go. Yet the sales haven’t proved the product market fit. At least, not yet.

If the future brings an exodus from classic console devices into alternative platforms, it’s possible that players choose a portable device that synergizes with their libraries of already owned games and provides a better gaming experience, over a cloud gaming subscription that offers a suboptimal gaming experience due to the technical limitations of cloud gaming.

In fact, Valve may not be alone in anticipating an opportunity: Earlier this month, Logitech G and Tencent just announced a product that kind of resembles the description of SteamDeck.

The main problem with this plan is that it doesn’t seem that there’s any kind of future for pieces of portable hardware alternative to a mobile phone: Portable consoles are getting obliterated by mobile, in what seems an ultimately unavoidable existential threat that so far has been delayed exclusively by the power of Nintendo’s key IPs.

Even more, despite surprisingly good results, the SteamDeck sales have not even come close to Nintendo's numbers on portable consoles. Although we can assume that it has been a profitable endeavor, it may be below the opportunity cost for a company like Valve.

But I’d suggest caution before claiming shortsightedness on Valve’s actions: After all, it’s a company that has proved several times in the past to be able to detect opportunities that its competitors don’t.

While SteamDeck becoming the gamer’s choice for a portable console would be a mere minor success, it would take a completely different scope if this has been the first step to release the gamer’s choice for a smartphone instead.

Both their VR and handheld device strategies have something in common: Valve pivoting toward becoming a hardware company.

Suppose Valve was able to release a SteamPhone that provided access to the same features and apps of a mobile device (TikTok, WhatsApp…), while also providing access to the Steam library. In that case, they might be able to override mobile walled gardens and tap into the audience of the future.

Doing it right away would require expertise that they don’t have (managing manufacturing, logistics, and go-to-market an order of magnitude higher than what they’ve done…). But they’re closer after the release of these products.

What about Valve releasing mobile games (software)?

In the short to mid-term, it seems unlikely that Valve plans to release any mobile games. As sad as it can be for fans, Valve’s business is not developing games, but rather building and operating platforms (walled gardens). Their in-house games are attraction mechanisms for their platforms (akin to console exclusives), but the numbers moved by a single product simply don’t justify the effort for a company of Valve’s scale.

So far, the only attempt by Valve to enter into the space was DOTA Underlords mobile version, which at first followed a strategy very close to Riot Games’ TeamFight Tactics: They first launched on PC and quickly got a mobile version.

Riot didn’t stop supporting TFT despite its moderate success in the West and the growing evidence that the autochess genre would not become as big as MOBAs or Battle Royale. And eventually, they were rewarded when they achieved big success in China. (Riot had suffered on their own flesh what can happen if you underestimate mobile when Honor of Kings became China’s League of Legends. They had past trauma to keep them focused on the opportunity).

On the contrary, Valve’s interest in Underlords seems to have vanished fast: Despite DOTA Underlords being a beautifully crafted and very polished game, in many aspects superior to similar titles, not being a breakthrough title ended up with diminishing support from the devs.

Again, the profits that releasing in-house games generate are not big enough for a company of Valve’s scale. The Underlords move would’ve only made sense if the autochess genre would’ve become a global sensation. So it’s not surprising that Valve quickly lost interest in it.

Valve’s strategy to move against the stream has allowed them to achieve immense victories in the past. Only time will tell if ignoring mobile to pursue different bets leads to similar success… or ends up being revealed as a big strategic mistake.

(Special thanks to the GameMakers community for their early feedback on this topic!)