2021 Predictions #3 Top Mobile RPGs Will Go Cross Platform

Our 2021 predictions have been sponsored by Facebook Gaming.

Facebook Gaming helps developers and publishers to build, grow, and monetize their games. This is done through in-depth research, insights, and case studies as well as innovative marketing solutions and education materials.

Visit Facebook Gaming where you’ll find an incredible amount of insightful, actionable, and relevant information along with tips, tools, and solutions to help you grow your business.

Unless otherwise specified, all the data has been provided by the powerful Sensor Tower and analyzed by the author(s). All revenue numbers show net revenues. Data from China, Korea and Japan are excluded as this analysis focuses on Western markets only.

Finally, please take the numbers presented with a giant grain of salt. They are meant more for trend analysis based on estimations, rather than an exercise in accuracy.

Role-Playing Games on Mobile

The RPG market is a high risk, high reward genre walled by a robust entry barrier. Breaking into the top of the genre requires often massive development investments, an unrivaled content pipeline, and superb live operations - and often an appealing IP. A studio working on an RPG has to focus on depth over core gameplay, have incredibly robust live operation capabilities, and nearly impeccable production processes that keep the content fresh for the players. All of the above require serious investments, which increases the risk of building an RPG game for a studio.

Now of course these serious investments apply if you want to reach the top of the RPG mountain. A smaller studio can still build a very healthy and sustainable business with a very smart approach to content development. Small Giant did it with Puzzle and Empires. And a more modern example of this approach is Friends & Dragons from another Helsinki-based startup.

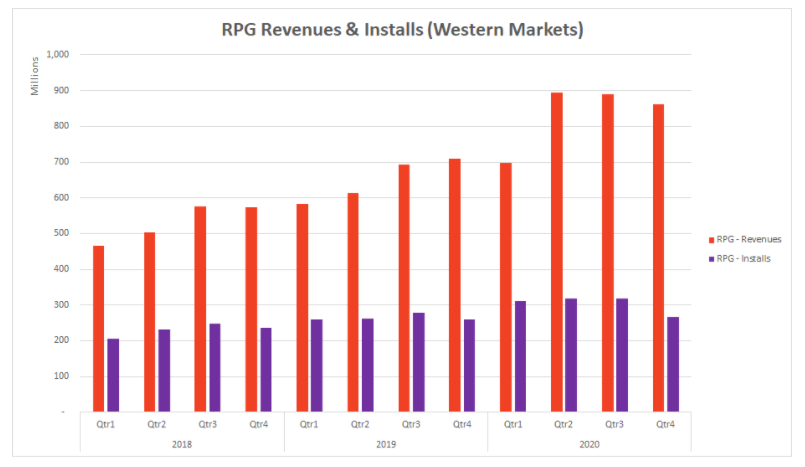

RPG games on mobile in the West reached new heights during the lockdowns. When comparing installs to the revenue, it is clear that the growth has been driven through existing titles monetizing better rather than new titles entering the market.

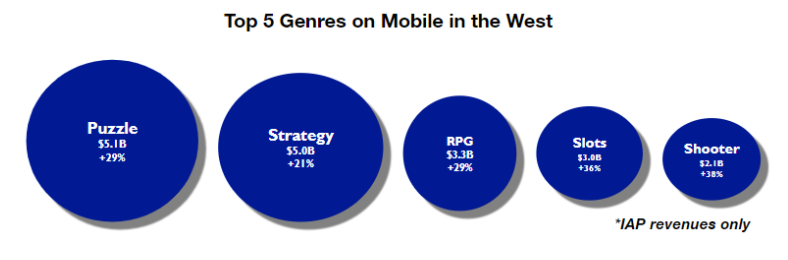

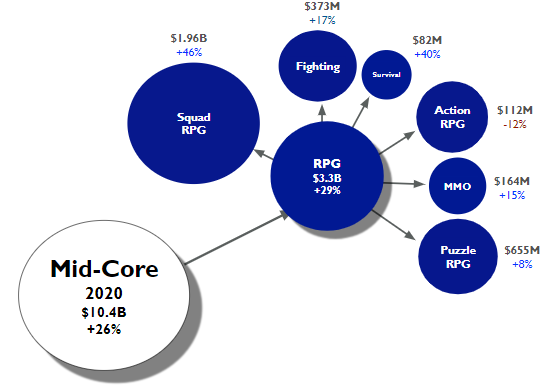

But the squeeze is worth the juice. The in-app purchase (IAP) revenues for Mid-Core games in the Western markets reached $10.4Bn growing formidably by 26% year-over-year. And the Role-Playing Games (RPGs) kept up with the growth generating $3.3Bn year-to-date with a growth of 29% YoY. This makes RPGs the third-largest genre on mobile after Strategy ($5.0Bn) and Puzzle ($5.1Bn) games.

RPGs in the West are the third largest genre based on IAPs.

What makes RPGs interesting genre is that it is the least concentrated among all mid-core genres. More fragmented sub-genre means usually more opportunities for newcomers.

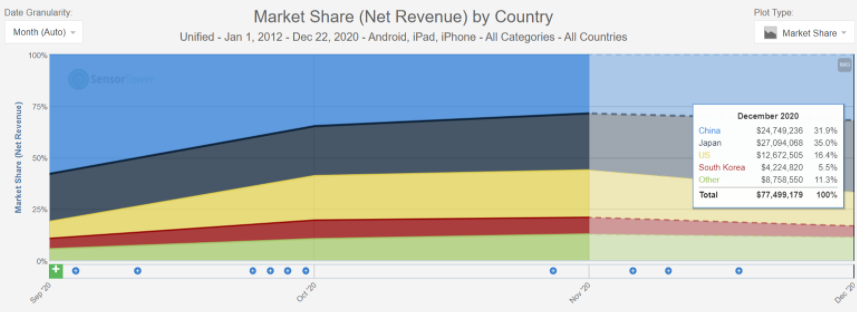

Another interesting point in RPGs is the vast potential. While the genre is third largest in terms of revenue in the Western markets, it still has leaps and bounds to go when looking at the success of RPGs in the key Asian markets. The general rule has been that top Asian RPGs can’t find success in the West, Lilith’s AFK Arena is one of the first games that have proved that rule wrong as the game launched and scaled to unbelievable heights in China after climbing to the top in the West. Though in this case, it’s an RPG game made by Chinese developers that launched first in the Western markets before entering the extremely competitive home market. (read: AFK Arena - Hail to the New King of RPGs)

What makes RPG a particularly interesting genre is not only the astounding revenues but the fact that it is the least concentrated genre in Mid-Core games. Nearly each of the sub-genres has a good handful of massively successful titles and throughout the years we’ve seen new games enter successfully and growing the pie as a whole. But don’t get it twisted, successful market entry into the RPG genre is nearly exclusively reserved to established developers with hefty war chests and seasoned developers - or studios backed by heavy hitters.

This year the genre didn’t see any significant new entrants in the West - apart from Genshin Impact and the Seven Deadly Sins. The bulk of the growth was driven by existing titles such as AFK Arena, RAID, MARVEL Strikeforce, and Hero Wars. At the same time, the old guard represented by Idle Heroes, Summoners War, and LEGENDARY saw a clear decline.

We break down RPGs into 6 sub-genres based on games’ features and core gameplay. Unlike last year, we’ve bundled all idle and turn-based RPGs into one sub-genre that we call Squad RPGs due to the fact that without exception all modern team based RPGs rely on auto-play and thus are in many ways ‘idle’.

Over the year the level of concentration has decreased mainly due to older titles (+3 year old) declining and slightly newer titles (3 or less years since launch) continuing to grow. In fact, in every subgenre except one the top title saw its revenue decreased. The only exception was Squad RPG, where AFK Arena continued to grow in all key markets.

The second point your attention is drawn upon is the growth of the genre as a whole that is driven by only a couple of the sub-genres while several others are trailing behind. This can be interpreted that the genre is ripe for something new - and as we’ve seen with Genshin, something new (and awesome) gets traction fast.

Squad RPGs

The Squad RPGs make up one of the biggest sub-genres on mobile in terms of revenues. And it’s no wonder these titles monetize so well. They are accessible through a compelling setting, automated gameplay, an endless stream of rewards the player receives during the first week of gameplay. Most importantly though, collecting teams of heroes add an incredible spending depth.

Top 10 Squad RPGs representing 75% of all sub-genre revenue. Revenues from Korea, Japan and China excluded.

During the last year, The Seven Deadly Sins and Marvel Strikeforce were the two top growers in the Western markets. AFK Arena declined in the West a bit but more than made up for the decline with its launch in the home market of China.

#1 High Production Values vs. Low Production Values

Hero Wars from a Playrix portfolio company and RAID from Plarium are on the surface radically different squad RPG titles. One has the lowest possible production values, while the other boasts assets built by a multi-hundred team.

What is worth analyzing is how similarly Hero Wars performs to RAID in terms of revenue. One is an extremely high production value game with top-notch creatives. The other looks like an RPG game from the Heroes Charge era. It just shows that success can be obtained in different ways, and in the case of Hero Wars, the success is likely due to how well the cheap art style works with misleading ads. And with higher IPM (install per 1000 impressions) Hero Wars is able to decrease the CPI and thus get 50% more installs and reach the same levels of revenue.

Nevertheless on the revenue side both of the titles we’re neck to neck up until the final quarter of the year.

The similarity in revenue can be explained by the difference in downloads. Up until Q1 Hero Wars growth was tied to how well the marketing was working. And as soon as the influx of new players drops, so drops the run-rate of Hero Wars.

This trend indicates that titles like Hero Wars will feel the IDFA depreciation immediately. While titles with strong long-tail, like RAID, will keep on keeping on.

Furthermore, the high production values allow RAID to capture an audience across platforms arguably better than a game that already looks poor on a small screen. With a PC launcher, Plarium has further extended the life-time of their hit title mitigating some of the impacts from IDFA depreciation.

Download the PC version of RAID and see for yourself.

#2 IP will set a Ceiling

Which one is better, Star Wars or Marvel? If it comes to RPG games, they are roughly the same. As you can see from the graph below, Marvel Strikeforce quickly rose to the same level as Star Wars Galaxy of Heroes and has only recently surpassed it fueled by the new ownership of Foxnext studios.

Up until Scopely took over, Strikeforce was largely the same size as Galaxy of Heroes. Which makes sense. Both games are very similar and both IPs are arguably of the similar value. The growth of Strikeforce in 2020 can be largely explained by either EA’s conservative UA strategy, Scopely’s bullish UA practices or both.

How about Disney versus Looney Tunes? Or Disney versus Disney? Again, when it comes to revenue, Scopely’s Looney Tunes matches Per Blue’s Disney Heroes. And even Glu’s newcomer, Sorcerer’s Arena is around at the same level where Disney Heroes was few months after lunch - despite Glu’s game having infinitely better production values.

Disney vs. Disney vs. Looney Toons.

Some interesting points to note. 1) both Looney Toons and Disney make pretty much the same amount of revenue when the UA investments are similar 2) new Disney title didn’t cannibalize previous nearly identical title despite massive initial push 3) the level of organic installs is shockingly low after the initial launch period. This can be seen by rapidly declining installs for Sorcerer’s Arena.

And perhaps an extra point: Disney seems very generous with lending their classic IP to identical titles inside the very short window. This may be one of the reasons for low organics as they are dispersed across two similar titles.

Based on the example above one could draw the following conclusion: you’ll reach a certain run-rate with an A-rated IP and you will reach a far lower level of run-rate with a B rated IP. But even if you make a game with a B rated IP with far superior production values and incremental product innovation, it’s B rated IP has set a glass ceiling you can’t seem to break.

#3 Not Every IP is a Fit for RPG

Tom Clancy Elite Squad is a stunning looking game. And sadly also the poster-boy for poor product-market-fit

And of course, then there’s an IP gameplay miss-match. Ubisoft’s Tom Clancy Elite Squad, which launched in 2020, is a solid RPG game with great graphics and an IP that fits the demographics of the target audience. Yet the meta focused RPG gameplay was a clear miss for an audience that was looking for action.

Despite absolutely fantastic execution, Tom Clancy Elite Squad is a big miss for Ubisoft. Lack of organic installs post launch is also bit of an alarming sign for the appeal of the franchise on mobile.

Puzzle RPG

Within the Puzzle RPG Dragon Ball Z Dokkan Battle continues to reign supreme powered by its strong home market of Japan, which brings over half of its +$600M a year revenues. Meanwhile, we saw Zynga’s Empires & Puzzles plateau despite the COVID headwinds implicating that the game is pretty much as big as it can get (and that’s very big!). At the same time, Best Fiends, one of the oldest titles in the sub-genre continued its modest growth reaching new heights under Playtika’s ownership.

Playrix’ entry into Puzzle RPG is all but natural after seeing the success in both Squad RPG (Hero Wars) and Puzzle (Fishdom, Homescapes, Gardenscapes).

Combat Puzzle, Small Giant’s (Zynga) follow up title for Empires & Puzzles looks to have failed to exit soft launch in 2020. Looking at the RPIs (revenue per install) the game is trailing too far from its predecessor. Meanwhile Playrix’ Puzzle & Conquest seems to be on the track scaling very nicely. Question is, whether the IDFA deprecation will hurt the growth of Puzzle & Conquest given how reliant Playrix has been on misleading ads to grow their games (read: Can Playrix' Puzzle Breakers Crack Zynga's Empires & Puzzles?)

Nevertheless, while both Zynga and Playrix are trying to break the code, Puzzles & Conquest from 37Games has already done that and is rapidly gaining ground in the top grossing charts. This game is a direct competitor to Zynga’s Empires and Puzzles from the looks point of view but it has seemingly added some 4X elements to improve monetization. And while at it, they are scaling a zombie version of the game called Puzzles & Survival.

While the RPI for Playrix’ title looks very promising (Android only), the RPI for Small Giant's (Zynga) Combat Puzzle is anything but. Nevertheless, the fact that Playrix still hasn’t exited soft-launch and the zig-zagging installs speak of challenges in scaling up.

The question remains if they can solve it before IDFA depreciation and if these same challenges are keeping Combat Puzzle out of the global launch.

The biggest disappointment in the Puzzle RPG sub-genre is LEGENDARY for the second year in a row. Despite being the poster child of live services (read: LEGENDARY - a Master Class in Live Operations), the game continued to decline losing nearly half of its revenue compared to 2019. This was largely due to a very poor release that upset their high-value players. The effect of the release highlights the importance of balancing between releasing things quickly and testing. The game brings 99% of N3TWORK’s IAP revenue signaling dire times for a publisher that was at its top only a couple of years ago.

Fighting Games

Kabam’s Contest of Champions continues to go unrivaled in the sub-genre since 2015 (!).

Read: How Kabam's Contest of Champions Made $100 Million in Seven Months

All are the same within the Fighting games. Marvel Contest of Champions (read: How Kabam's Contest of Champions Made $100 Million in Seven Months) continues to take half of the sub-genre revenues while Dragon Ball Legends takes 30%. The rest is divided among smaller high-quality titles like Mortal Kombat, Injustice, and The King of Fighters. Apart from Ubisoft’s Brawlhalla, which seemed to receive a KO right after launch (just like Tom Clancy Elite Squad), there were pretty much no other new games.

While the genre is mature, there’s definitely space for massive fighting games - assuming that it would have sufficient RPG depth and a first-class IP. We bet that a Star Wars fighting game with a hero collection and progression that rivals the Contest of Champions could be a massive hit.

The fact that Disney and Kabam haven’t done a fighting game with Star Wars IP is mind-boggling. The product-market fit is perfect. And as we’ve seen with Strikeforce and Galaxy of Heroes, we can pretty much guess the revenue based on Contest of Champions.

The reason why the vast majority of Fighting games fail to scale is that they break the three rules of a successful RPG:

Rule #1: Depth over gameplay. Traditional fighting games attempt to perfect gameplay with the goal of creating a console-like competitive experience. And as they focus on gameplay, they tend to ditch the depth. Character progression and collection becomes secondary to mastering the core. This is against the rule of successful RPGs that have gone as far as ditching the gameplay altogether and focusing purely on the meta.

While a fighting game should have a fighting game core that lures the players in, they need to also have a deep RPG meta, to retain and monetize the players above and beyond a pure skill-based progression.

Rule #2: Live operations are your livelihood. This goes with all the RPGs. New characters introduced through events that end in sales. New dungeons, multiplayer raids, guild wars all leading to players leveling up and ascending heroes in their roster. A well oiled production team that hits dates with quality while drawing data from analytics, community, and good ol’ gut feeling is a must!

For a fighting game, this means constant growth of the rosters. Choosing the right theme and/or an IP is crucial to enable successful live operations throughout the years.

Rule #3: Straightforward content production. Fighting games pride themselves on high-quality heroes that are expensive to model, rig, animate, and integrate. The only way to go is to perfect both internal art production and art outsourcing.

While lots of RPGs look to decrease production cost by simplifying the art style, fighting games don’t really have these options. Studios reuse hero rigs, limit the number of bones, simplify animation and optimize the VFX but there’s no way a fighting game can go full Small Giant and treat art merely as a functional piece of game design. Thus fighting games are inherently at a disadvantage when it comes to production costs making the sub-genre expensive to enter.

To summarise it, there is more than one way to succeed in the RPG genre - as long as the depth, the appeal is there and the live operations are perfected. On the other hand, failure to succeed in the RPG genre looks nearly always the same. It usually starts with the poorly resonating art style or an IP bundled with unnecessary innovation to moment-to-moment gameplay. As a result, you have a game with a more shallow metagame - which often is the result of the innovations done into the core moment-to-moment gameplay.

Action RPG

For the longest time, the Action RPG sub-genre in the West has been led by a single game: Marvel Future Fight. There have been several entrants with and without IP (Dragalia Lost, DC Unchained, Legacy of Discord, Darkness Rises, Taichi Panda to name a few) which have all failed to get any long-lasting traction in the Western markets despite being made by extremely successful Asian based action RPG studios.

On the surface, it seems like Action RPGs continued to be the most unappealing sub-genre with a decline of over 12% while the rest of the market grew 29%. The decline was first and foremost due to MARVEL Future Fight, which saw its impressive revenues of over $100M melt to around $60M. Apart from Guardian Tales by Kakao, the bright spots in the sub-genre were few.

But let's be honest, despite Genshin Impact making most of its revenue outside the Western markets, it grossed twice more in the US in two months than MARVEL Future Fight did during the whole year. So in reality, the Action RPG genre grew driven by some of the Asian action RPGs that make only a fraction of their incredible revenues outside their core markets.

Genshin’s success is monumental. But it also makes sense to break down and understand how much of that success is driven by the three key Asian markets. Could a Western developer take the same leap of faith knowing that their title is likely not to get the same level of success in the Asian markets - not to even mention that launching in China without brutal revenue share is out of the question.

In early 2019 we predicted that the sub-genre would grow significantly in the West driven by the success of the new Diablo on mobile - or more accurately - the Diablo reskin of Legacy of Discord. We saw this game as a hit in the West and the East alike. Even though the original unveiling of the game was extremely underwhelming for the core audience.

It’s 2021 and Diablo Immortal has just entered closed Alpha. The game looks stunning. Yet again, the production costs have to be in tens of millions by now with a large multi-continent team working on the title that is so significantly late. Being so deep in the hole puts tremendous pressure on Blizzard's first mobile game.

While the fan-boy in us continues to root for the game, the objective analyst inside of us is very skeptical.

Blizzard has stacked up with mobile talent as of late, the IP is strong and the game design is very solid with strong MMO elements. Yet again, MMORPGs on mobile have failed in the West over and over again. Our assessment is that Diablo Immoral will be a successful title, but very likely not as successful as Activision hoped it would be.

The Action RPG sub-genre doesn’t lend to high monetization as well as other RPGs due to the fact that the player is focusing on a single character instead of building several squads of characters.

Secondly, Blizzard has likely done everything to not be seen as an aggressive monetizer.

Thirdly, is the IP truly as broad outside us, the core audience? Will Diablo be able to attract nearly as many players as Call of Duty?

Our prediction is that the game will fall way off from that $100M in the launch year and will likely lead to more pressure from Activision to speed up development times within the meticulous (but slow) Blizzard.

Survival Games

While the survival genre is still small, compared to other genres in RPG, it is growing rapidly. To breakthrough, it needs a title with a renown IP. An IP like Mandalorian can significantly improve the early retention of a survival game, which traditionally have a very steep learning curve.

Survival games grew throughout the year as several titles that we’re launched a year prior, such as Raft Survival, Westland Survival, and Dawn of Zombies, managed to scale. At the same time, the king of the survival games, Kefir’s Last Day on Earth actually started to decline. When a dominating title declines and several other titles grow, it makes the subgenre much more attractive

As it stands, the survival games are still very difficult to get into for new players. Even though the setting of the game is clear (rebuild and survive), the extremely complicated crafting trees together with the extensive narrative that the player faces from the get-go can be a major turn-off.

With all other RPG genres, entry from a top IP can grow the genre significantly. Just think how complicated RPGs were until Star Wars came along? Same with card collecting games before that. Rage of Bahamut was inaccessible for most but once the game got reskinned with Marvel characters, fusing and evolving became clear as day.

Thus there’s an argument to be made, that say a Mandalorian survival game would be a massive hit benefiting the whole survival game sub-genre as a whole.

MMORPGs

Lineage 2 has amassed over $1.5B in net-revenues. The US accounts for only 3% of all the revenues, which speaks of how Asia centric the game is.

MMOs are mainly popular in the East and continue struggling in the West. The reason for the decline seems to be a lack of key titles to draw player’s interest in these games. And it’s not the lack of trying. Lineage and Runescapes have entered the market but failed to gain meaningful traction in the West. Black Desert had a fantastic launch and did 25% of its revenue in the US, which is leaps and bounds more than Lineage. Though as the year progressed, Black Desert continued to decline quite rapidly month after month. Now of course there’s only one MMO that could reverse this trend bigly - and that’s of course World of Warcraft - or perhaps the new MMO from Riot..?

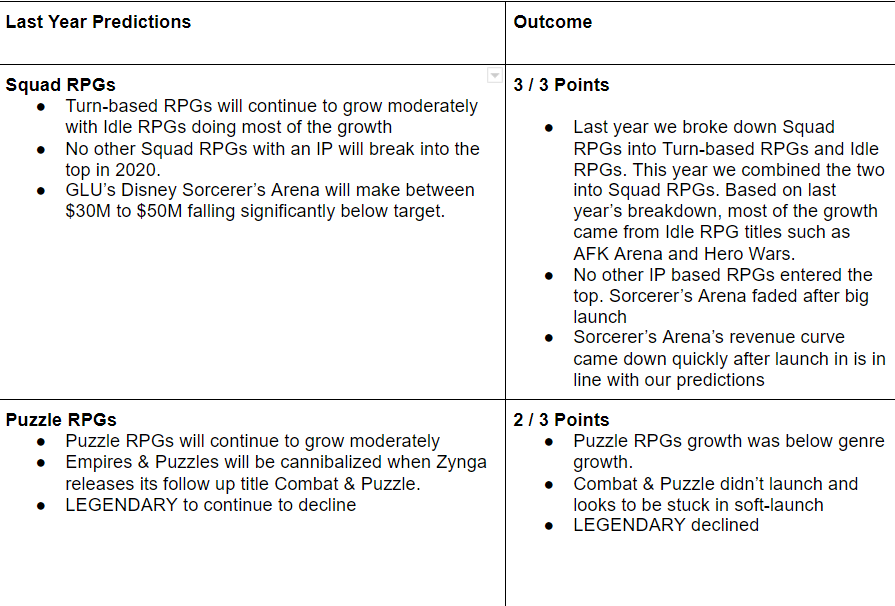

Last Year’s Predictions

Prediction #1 - Launching and scaling an RPG game will become even harder

Character collection and evolution through extensive gacha systems and constant events drive whale monetization in RPGs. This monetization system has been supported by optimized user acquisition and segmentation that has allowed publishers to pay incredibly high CPIs. In the post-IDFA era ability to acquire ‘whale users’ and the ability to early identify high-value players becomes incredibly difficult.

As a result of IDFA depreciation, we won’t see new RPG titles from small-to-midsize developers climb the top-grossing. We don’t predict a collapse of current top games either, due to incredibly sustainable long-tails of the existing player base. It’s just unlikely that they will grow.

Anyone entering RPG, and planning to make their mark, will have to have deep pockets so IDFA depreciation wouldn't be as impactful since they're going to be spending heavily taking sizable share-of-voice through a healthy media mix.

Prediction #2 - Monetization will go broad instead of deep

On the product side, IDFA depreciation will affect A/B testing, which remains the basic tool for game optimization. With the inability to track where the players are coming from, grouping them into A/B segments will be more challenging. And as the segmentation suffers so does the identifying and catering to high-value players with specific offers early on in the player journey.

IDFA depreciation will hurt optimization based on segmentation in the long-run. This will lead to RPGs adopting more broader monetization systems. Expect battle passes and piggy banks to be in every single RPG.

Prediction #3 - Collaboration with IPs

A good IP allows a game to reach lower CPIs due to the familiarity and relevance of the ads. You’re more likely to download a John Wick game than a shooter without the well-dressed assassin. Especially if the game is launched close to the movie premiere.

But low CPI wasn’t as important as high monetization in RPGs. In fact, pre-IDFA the focus has been purely on value optimization. The price of the acquisition is secondary to the ARPU-curve, which in RPGs is nearly infinite.

IDFA will put the focus back on lowering CPIs, and that’s where IPs help. We’ll see more IPs being integrated into existing titles through events. This will also help with remarketing, as the top titles look to reconnect with lapsed players.

Prediction #4 - RPGs Will Go Cross-Platform

We’re not predicting more Genshins to launch in 2021. Though for sure the success of the game has most likely encouraged the behemoth publishers of China to invest in similar titles. But what we are predicting that in the near future is that the current top RPGs start offering PC clients.

RAID from Plarium is showing the way and it is only a matter of time before companies like Scopely follow suit. Why not? IDFA is not an issue and there’s no Apple or Google taking their 30% cut. In the long-run, be prepared for cloud-native RPG Games from companies like Mainframe Industries.

And a few extra predictions:

Zynga’s Puzzle Combat will launch globally. As it stands, all of the metrics are trailing far away from the ones at the top of the genre. Nevertheless, haven’t seen Zynga give up. On the contrary, the publisher seems to show incredible resilience to forge a hit no matter what it takes.

N3TWORK, LEGENDARY’s publisher is going to be acquired for talent. Perhaps if the price is right, Stillfront will take the legacy title as it clearly fits with the existing portfolio. Mots likely acquirer will be a large publisher looking for publishing talent. EA with their new focus on mobile and their price-conscious acquisition strategy on the mobile side.

Diablo will finally launch on mobile. Despite the expectations, the revenues are not likely to pass $100M a year. This is well below expectations that are likely astronomical due to years of delay and the brutal revenue share with Net Ease. The consequence is increased control of Activision.

Finally, kudos to Brett Nowak, CEO of Liquid and Grit, and Sashank Vandrangi, Design Insights Lead at King, for providing comments.