The Imminent Ragnarok of M&A in Mobile Gaming Space

This post is written by Eric Seufert, a strategy consultant and the owner of Mobile Dev Memo

In Norse mythology, Ragnarök is a series of events, including a great battle, foretold to lead to the death of a number of great figures and gods, natural disasters and the submersion of the world in water. After these events, the world will resurface anew and fertile, the surviving and returning gods will meet and the world will be repopulated.

I believe that the deprecation of the IDFA will catalyze a period of accelerated consolidation in the mobile gaming space via M&A. Smaller, single-game mobile gaming studios will see their growth trajectory obstructed completely and suddenly. The valuations of these companies will drop rapidly. Portfolio accumulation will become a predominant user acquisition driver as large players gobble up smaller developers on a discount .This will lead to Ragnarok in the mobile games space.

In order to understand IDFA, this podcast episode is a must-listen: Everything You Ought to Know about IDFA with Eric Seufert & Yevgeny Peres

History of Mobile Gaming Evolutions, Revolutions and Permutations

Gaming, and especially mobile gaming, is peculiar as an investment category: the audience for games numbers in the billions, more games per decade become billion dollar businesses than products from any other consumer category, and gaming tends to lead other categories with respect to mass-market consumer adoption of new hardware form factors. Yet despite these traits, many private equity and venture capital investors avoid gaming, believing it too esoteric and hits-driven.

This phenomenon leads to a set of three cycles within mobile gaming that I refer to as market evolutions, market revolutions, and market permutations.

Market evolution in the mobile gaming market are the foundational uber-cycles precipitated by innovations and platform changes that create whole new product categories -- these developments are so large and mass-market that they create opportunities that attract mainstream investors to the gaming category. In the last decade, I believe that mobile gaming has experienced just three evolution:

The growth of the free-to-play model in the West, which brought games onto almost every single smartphone on the planet;

An orientation towards in-game events (or “live ops”), which created real games-as-a-service dynamics, with social and competitive gameplay funneled through weekly content releases that accommodate long-term retention;

The recent deprecation by Apple of the device-level advertising identifier, which is used by a whole swath of the mobile advertising ecosystem to deliver highly-targeted advertisements to potential players on behalf of mobile gaming advertisers. For background on the deprecation of the IDFA and why the IDFA is so integral to the growth of most mobile games, see this post and this post.

These market evolution catalyze large waves of investment into mobile gaming from sources of capital that don’t typically make equity investments into gaming companies. As new companies with core commercial theses related to these innovations come to market, the mobile gaming category as a whole is invigorated, attracting new entrepreneurs and talent.

Market revolutions are sub-cycles within evolution that don’t create new categories but may spawn new gaming genres. New companies are often built to bring these incremental innovations to market, but these innovations are so narrowly applied so as to be imperceptible to investors that aren’t specifically focused on gaming. These market revolutions are numerous but some examples are:

Video ads-driven monetization, which created the hypercasual and idle categories and was largely made possible by improved smartphone hardware and more accessible mobile data prices globally;

Gacha rewards, which award unpredictable, random prizes to players over the course of gameplay and encourage engagement;

Subscription pricing, which has appreciably impacted many games’ underlying business models by making revenue more predictable;

Battle pass, which in some ways replaced Gacha rewards while similarly encouraging long-term retention and more consistent revenues.

And permutations are even more specific and subtle: they are changes within existing genres that increase the appeal of those games or improve their core monetization profiles. These changes are perceptible to players and game developers but largely go unnoticed by the broader public; a market permutation might create one or two new hit games within a genre but likely wouldn’t dramatically change that genre’s overall revenue composition. Examples of market permutations are:

The chest collection system introduced by Supercell in Clash Royale;

Free-form base arrangement (vs. fixed in-place base placement) in 4X strategy games;

The narrative driven decoration progression in casual puzzle games

The idle RPG core gameplay, which has driven the growth of squad RPG sub-genre with games such as AFK Arena and Idle Heroes

While specialist games investors are aware of the innovations brought to gameplay mechanics and business models in revolutions and permutations, investors without the specific purview to mobile games might miss them or see them as too supplemental or minor to warrant investment. Thus companies with commercial theses built around revolutions -- and, to a lesser extent, permutations -- are largely either self-funded or funded from gaming insiders: sector-specific gaming VCs and executives from within the gaming industry.

I believe that the deprecation of the IDFA will catalyze a period of accelerated consolidation in the mobile gaming space via M&A. Many smaller, single-game mobile gaming studios have seen their growth trajectory obstructed completely and suddenly. The valuations of these companies will drop precipitously, and they will become attractive acquisition targets by larger companies that can use their aggregated DAU to cross-promote users into those games. I believe that portfolio accumulation will become a predominant user acquisition strategy in the post-IDFA world: rather than amass an audience slowly and systematically through profitable user acquisition and retention-led compounding DAU, large studios will simply buy DAU by acquiring live games.

This change, coupled with the proliferation of sector-specific investment funds and the emergence of a large cadre of gaming industry angel investors (mostly based in Europe), fueled a surge in financing in companies building mobile games rooted in market revolutions. This cohort of companies, which came to market in the 2015-2017 time frame, is beginning to explore exit opportunities, and a number of cash-rich super-acquirers with incredible appetites for M&A are ready to buy them.

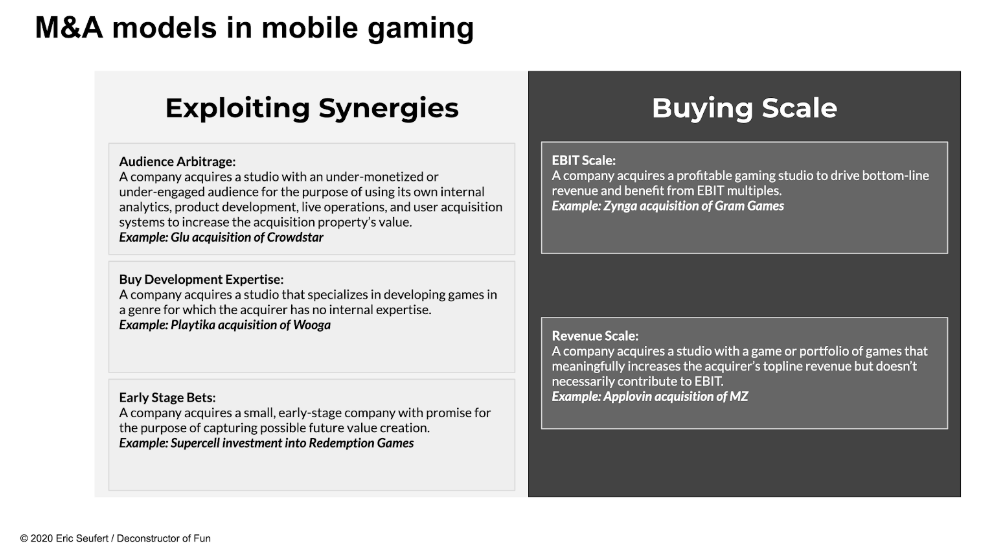

As this consolidation period plays out, 5 distinct models of M&A in mobile gaming have emerged that capture different motivations from an acquirer’s perspective. I survey each of them here, with examples and considerations for post-acquisition integration. These models can be grouped into two different strategic imperatives: Exploiting Synergies and Buying Scale.

Exploiting Synergies

Model 1: Audience Arbitrage

Motivation: A company acquires a studio with an under-monetized or under-engaged audience for the purpose of using its own internal analytics, product development, live operations, and user acquisition systems to increase the acquisition property’s value.

Examples

Scopely acquisition of DIGIT Game Studios

Glu acquisition of Crowdstar

Applovin investment into Firecraft Studios

MiniClip acquisition of Ilyon

Due Diligence Considerations

Organic and paid growth rate: is the company able to acquire users profitably at any level of scale?

Is the game growing mostly organically?

Audience Composition

How large is the audience and what is the average age of DAU?

What percentage of revenue is driven by live operations-related product mechanics?

How quickly is the studio able to ship updates? Are they reactive and capable of making substantive changes to the product?

Acquisition Success Factors

Integration: Can the game be easily integrated into the acquiring company’s infrastructure?

Culture: How amenable to modern product and user acquisition practices is the acquired company? (eg. will they tolerate ML-driven product mechanics such as level difficulty optimization, dynamic starter pack design, etc.)

Model 2: Buying Development Expertise

Sean Gallup/Getty Images

Motivation: A company acquires a studio that specializes in developing games in a genre for which the acquirer has no internal expertise.

Examples

Scopely acquistion of DIGIT and PierPlay

Playtika acquisition of Wooga and Seriosly

AppLovin acquisition of Belka and PeopleFun

Ubisoft acquisition of Green Panda and Ketchapp

Due Diligence Considerations

How widely distributed is the company’s institutional knowledge around the genre for which the studio specializes? Is the company’s success dependent on just a handful of key employees?

How large is the market for the genre in which the studio specializes?

How old are the studio’s successful games? Can the success of those games be replicated in the current market?

Acquisition Success Factors:

Culture: Can the company continue to operate on its own without intervention from the acquirer? Can the acquirer allow the company to operate on its own?

Attrition: Will key members of the acquired company’s team leave?

Overlap: Are there synergies between the acquired and acquiring company’s games that can yield value? Can the audiences be cross-targeted or cross-promoted? Can the content or art pipeline be streamlined?

Model 3: Early Stage Bets

Motivation

A company acquires a small, early-stage company with promise for the purpose of capturing possible future value creation.

Examples:

Nearly all of Supercell’s M&A activity

Voodoo acquisition of GumBug

Rovio buying Darkfire Games

Playrix acquisition of Plexonic, Eipix

Niantic acquisition of Seismic Games

Due Diligence Considerations:

Does the team have experience launching and running games?

Is the team focused on a large total addressable market? Are they equipped to win the vertical?

Are the co-founders all aligned around the types of games they want to build?

Do all of the co-founders want to join a larger company? Or do some of them want to work at a small start-up?

Acquisition Success Factors:

Retention: Can the acquirer manage to retain all of the key employees as they transition into a larger company?

Execution: Can the acquirer keep the acquired company focused on their work for the medium to long term?

Buying Scale

Model 4: EBIT Scale

Motivation

A company acquires a profitable gaming studio to drive bottom-line revenue and benefit from EBIT multiples.

Examples:

Zynga acquisition of Peak Games, Small Giant and Gram Games

Stillfront acquisition of Candywriter and Goodgame Studios

Due Diligence Considerations:

DAU scaling: how is DAU growing as the studio acquires new cohorts of users? Are cohorts retaining and compounding over time, driving increased revenue?

What are the gross margins on marketing spend?

What is the user acquisition payback timeline and how has it changed over time?

Acquisition Success Factors:

Operations: Can the game continue to scale over time without needing to increase user acquisition payback windows?

Integration: Can the company’s profitable games be improved via access to more sophisticated infrastructure?

Model 5: Revenue Scale

Motivation

A company acquires a studio with a game or portfolio of games that meaningfully increases the acquirer’s top-line revenue but doesn’t necessarily contribute to EBIT.

Examples:

Scopely acquisition of FoxNext

NetMarble acquisition of Kabam

Stillfront acquisition of Kixeye, Storm8

Applovin acquisition of MZ

Due Diligence Considerations:

Have user acquisition payback windows or CAC prices meaningfully increased over time?

Is late-stage retention consistent? Have there been any changes in late-stage retention over the previous 3-6 months?

If the game runs a regular event cadence, how meaningfully do events contribute to overall monetization? Is the live ops content expensive to produce?

Acquisition Success Factors:

Attrition: Can the acquirer prevent key people on the game team from wanting to the leave the team / the company?

Operations: Can the acquirer manage to keep user acquisition costs flat as the game ages?

Understanding the Models as an Acquisition Target

Deprecation of the IDFA will catalyze accelerated consolidation in the mobile gaming space. Smaller, single-game mobile gaming studios will see their growth trajectory obstructed completely and suddenly. The valuations of these companies will drop rapidly. Smaller developers will become desirable targets for large players in the market as portfolio accumulation becomes a predominant user acquisition strategy in the post-IDFA world.

It is instructive to consider how these models, and their attendant integration success factors, can impact a sales process -- for many mobile gaming companies, post-acquisition performance can contribute significantly to the overall proceeds from the sale. A great example of this can be found in Zynga’s acquisitions of Small Giant Games and Gram Games: buried deep in Zynga’s Q1 earning letter was a disclosure that Zynga had taken a charge of $120MM for earn-out payments to the employees of Small Giant and Gram versus guidance of $25MM. Those companies earned nearly a combined additional $100MM over their expected total exits as a result of the strong performance of their games post-acquisition!

Any acquisition target or company entering into a sales process should be cognizant of a potential buyer’s motivations in conducting M&A broadly but especially in their specific transaction. Every deal is different; company management should seek to understand how their acquisition brings value to the acquirer’s shareholders and how the acquirer will quantify that value. These M&A models provide a good framework for thinking about not only how a deal can be successful, but how that success contributes to the overall transaction price.

Our partner ironSource builds technologies that help game developers take their games to the next level. They boast industry’s largest in-app video ad network, a robust mobile ad mediation platform, and a data-driven user acquisition platform. In other words, everything you need for game growth.