No IDFA? No Problem! Apple Can’t Kill Gaming.

Written by Tiffany Keller, Director of Product for Subway Surfers by Sybo Games, the most downloaded Android game in the world. Want to chat with real industry veterans about our games’ ATT impact? Want to discuss brand integrations or joining our team? Drop me a message!

In “Apple IDFA Change has Triggered 15-20% Revenue drops in iOS advertisers”, Gamesbeat’s Dean Takahashi interviewed Brian Bowman, founder of marketing services firm Consumer Acquisition, on his heavily publicized anti-Apple stance. Here at Deconstructor of Fun, we’d like to offer a more optimistic perspective.

We quote Brian Bowman in this post and give our take on his statement. These views are Tiffany’s personal opinion and do not represent those of her employer. All information presented in this article is publicly available and typically links to those sources.

“Certain clients are down 30% to 40% percent in revenue. Others are feeling less of an impact. It’s a mess… There’s a collapse of VO bidding. The ability to specifically target people who are going to transact is diminished, and will continue to erode as ATT rolls out.”

With so many changes afoot in Apple’s ads delivery, it’s easy to feel fatalistic about what’s been dubbed the “Ragnarok of Gaming”. Now that over 60% of iOS users are on v14.6 with ATT in full effect, however, we see some of the smoke clearing. There is no widespread layoffs or game studios closing, and Android isn’t following Apple’s lead to dictate similarly austere privacy regulations. Many studios of all sizes have only been facing headwinds that, with some determination and adjustment to the way they do business, are completely surmountable.

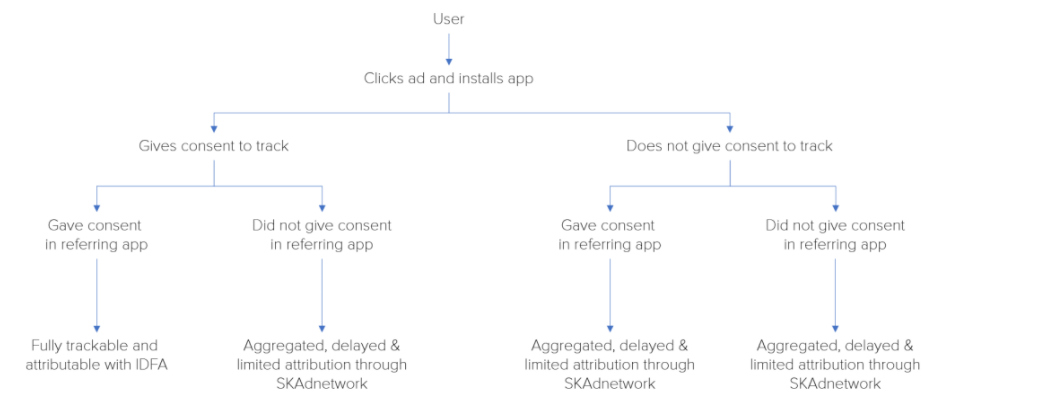

How in-game ATT acceptance is affected by the advertising app’s ATT acceptance rate by Business of Apps

While Gamesbeat cites 20% global ATT acceptance rates, gaming fares much better than other industries. Appsflyer reports a 47% average ATT acceptance out of a range from 39% (casino) to 51% (mid-core). While this sounds good, it's important to understand that ATT (App Tracking Transparency) acceptance is somewhat of a vanity metric due to the duality of the acceptance on the referring app as well.

And let’s not forget- there already were plenty of users not being tracked if games are adhering to privacy laws: GDPR refusers, Limited Ad Tracking users (15% of iOS users pre2020), (California Consumer Privacy Act) CCPA refusers, and if the studio is correctly avoiding a class action lawsuit for ads targeting children- also their COPPA users (Children Online Privacy Protection Act). So while there is both a CPI (cost per install) and CPM (revenue per 1k impressions) impact on ATT deniers, this typically only increases a game’s untrackable iOS players by 20-30% depending on audience mix.

Explanation for ios14.5’s conversion postbacks on acquired users from Mobile Dev Memo

To the point on the collapse of VO bidding killing all the whales for mid and hardcore gaming- This is like saying that within 24-72hr of installing, only knowing someone made a $15 IAP, but not that they also bought a $2 starter pack can’t give us a good prediction of the install’s general LTV bucket.

Advertisers can still do Value Optimisation campaigns, but now they will need to codify up to 64 key conversion actions that could happen in the first few days of install. Instead of getting every relevant conversion action they do, you will now only get the highest value one. You definitely lose a richness of data, and that data would be aggregated for Limited Ad Tracking (LAT) users, but it doesn’t mean you can’t build campaigns based on conversion. It does mean that you need to include more curation on both the creative and the context in which the ad is shown, as targeting and following a user is more difficult. Or just use a network that does fingerprinting like everyone else is... until Apple starts enforcing that ban.

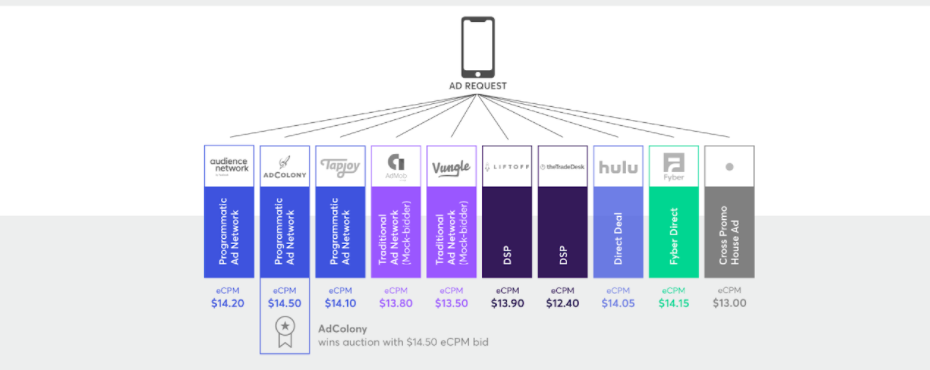

Explanation for how a header bidding unified auction serves impressions from Fyber

Contextual advertising, a form of header bidding, is the kosher way to serve an LAT user relevant ads without violating ATT- and is actually more prevalent than targeted advertising with 70% of North American advertisers relying on it. Header Bidding was originally designed to level the playing field and give advertisers the same depth of information available to Google AdX, but how does in-app header bidding actually work? A game launches a unified auction at the initialisation of the app (or whenever ads are cached to be served out of ad placements) that asks for each preferred network’s highest bid before declaring a winner.

Where does the context come in? When your game holds the auction, bidders can query a contextual cache that will give them relevant information about the ad placement and other signals like viewability metrics. Because all buyers in the auction can bid for the specific impression instead of just at the network level, it gives buyers more information on the context around that impression.

Depending on the tools the DSP (demand-side platform UA uses) integrated, contextual signals will show more information about the genre, ad placement, or how visible the ad is. This will make high-value ad placements more competitive, but can also make lower value placements often seen in hypercasual games less competitive. This does somewhat validate Brian’s point that Facebook finally moving to support header bidding could have a knock-on effect for hypercasual games- If advertisers can’t rely on targeting to try to sift out the few quality players in a hypercasual game, then the contextual signals hypercasuals send ad bidders is weak. The biggest drop in downloads across iOS has in fact come from hypercasual (and to a lesser extent casino), although almost all of the revenue impact was made up for in Android.

If you find your studio suddenly losing ad revenue or unable to profitably run UA, it might be that you are only running targeted campaigns or ad networks on the minority of IDFA users. Instead, lean into these privacy changes and also run separate contextual campaigns and publisher segments to properly acquire and ad monetise those LAT users.

For UA, using contextual advertising in your DSP will help your campaigns convert better for LAT users, and on the publisher, side optimizing a separate SSP (supply-side platform ad ops uses) network stack strong in contextual bidders for LAT users will increase your CPMs. It’s important to also consider your marketing mix- what about your native mobile strategy or organic ASO (App Store Optimisation)? Project Makeover has become the #1 downloaded casual game since iOS14.5 came out because during this period of uncertainty they went all-in on native Facebook ads that can still benefit from the rich 1st party targeting system Facebook has built. There is also a heavier emphasis on organic traffic, with IP-based games or games featuring benefitting more than before. Although you can’t track users as easily, you can still do ASO AB testing on icons or marketing assets through Storemaven, Splitmetrics, or Geeklab- and Apple is coming out with their own native version!

“As CPMs become more expensive, both on Android and iOS, they (small to medium studios) will be negatively impacted. Again, I don’t know, but I’m guessing — it’s illogical to me that Android would be impacted. It should be normal. It hasn’t lost anything.”

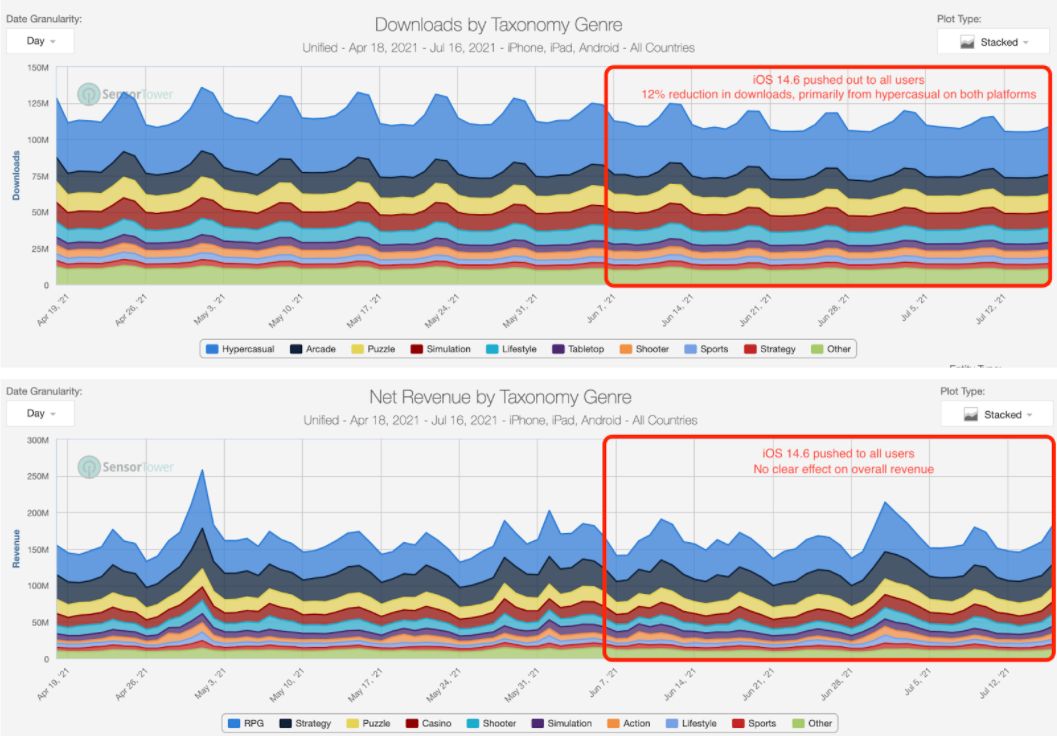

Downloads and Revenue by genre from Sensor Tower

There is a lot to unpack here, but while studios are facing headwinds any losses are in the single-digit percentiles. Most smaller games that rely on ad revenue have only a 20% mix of iOS players, unless they’re games that trend particularly well in North America such as IP driven, Word games, Interactive Stories, Golf, Football, or Basketball games.

If you’re a small ad revenue-dependent studio outside of those genres, ATT is typically impacting only 5-10% of your overall user base in terms of literally moving users from IDFA to LAT status. Those new LAT users are seeing ad CPMs drop by up to 40%, but remaining IDFA users claim higher CPMs and all Android users also claim higher CPMs due to increased competition. Depending on your game’s audience mix, genre, and how well you are optimizing your UA/ad monetization in reaction to these changes, you could actually be making slightly more money than before! For most studios, at the end of the day cash flow is pretty much the same.

There are also a variety of reasons why less performant ads served to LAT users could push CPM up. The CPIs you pay is influenced by both ad competition over acquired users and how well your creative performs (your conversion rate). If your ads are less performant due to loss of targeting, then you will need to show more ads to get the same amount of users, thus increasing your CPI.

If it's more expensive to acquire players, this means marketers are also paying the publishers they advertise to more as well. Lower conversion rates on creatives and difficulty tracking impressions per device all mean that CPM would go up, mitigating some of the downward pressure on iOS contextual ad revenue. Altogether, this doesn’t amount to much of a topline impact at the end of the day. Any shortfall could be mitigated by your ad ops team retooling the iOS ads stack to be more contextual friendly and altering your Android stack to drive more competition among the highest bids (which are higher post v14.6).

If this seems hard to understand, it’s because ad delivery is very similar to high-frequency trading on the stock market. There is no “real” value to an ad impression, we are just bidding based on our predictions and adjust based on previous performance. When you add more competition, the bid will increase because it appears the impression is more valuable- regardless of an IDFA being present. As long as there are marketers spending to acquire users, and recognize that value back on some time horizon, there will continue to be a robust UA and ad monetization market. If some spend shifts between platforms, then you simply increase competition and thus revenue yield on the more attractive platform, which would mitigate the shortfall from the other platform.

“At the very high end, the companies that are amassing a walled garden of IDFVs are on a path to do better.”

This is absolutely true- if these companies do it right. Publishers need to curate a portfolio with a strategy in mind, and build a tech backbone to serve cross-promotional ads to the right players at the right time to the right portfolio game. Even then, IDFV through cross-promotion could only make up about 15% of your new installs in the rest of your portfolio, concentrated in your less successful games rather than more successful ones. This is because your most successful game will either be your largest and highest monetising game, in which case it will mostly give away players to your smaller portfolio games that could monetise better on a per user basis but have lower retention or K factor.

Or your most successful game is small but highly monetizing, in which case feeding its players from a larger casual game is unlikely to be a fit in terms of genre. That being said, typically there is no downside to cross-promoting. When done the right way, the donor game doesn’t “lose” that player. They will keep playing the donor game and likely play the new one with lower engagement. The exception is hardcore games, which are challenging for cross-promotion. The whale hunting is intense enough that players choose just one game to invest in, so xpromo may actually make them start investing in your lower monetising game instead.

This is why a strategy is key, instead of simply acquiring a bunch of games and thinking that running xpromo video ads in your normal ad placements will be effective. You can start with a genre-targeted approach, which works very well for arcade, casual, and casino portfolios (see King’s giant puzzle portfolio). This is because there is high affinity between different subgenres and players easily play multiple games at once. You can try this in other genre portfolios as well (like midcore or hardcore), but advised to investigate a propensity to churn model to only xpromo players who are already on their way out the door. Because games in the same genre will monetise similarly on a per user basis, your target KPI is to increase portfolio retention and overall DAU in the portfolio.

You can also start with a more diverse portfolio with games in many genres, likely the result of many acquisitions that were primarily done for EBITDA mining (see Zynga or Stillfront’s diverse portfolio). Your goal here is to cross-promotion players from your larger more casual games that have a low ARPDAU to successively higher monetizing games, thus increasing overall LTV. The difficulty is the low affinity between genres, so you will have lower install conversion rates. In these cases you will need solid tech that can segment your players and understand which portfolio game is the best to move them to (see VooDoos acquisition of Bidshake). In some cases you will need to target new acquisitions to serve as stepping stones between two dissimilar portfolio games to execute a successful and diverse cross-promotion strategy.

What about when these gaming “content fortresses'' buy an ad tech company instead, like Zynga with Chartboost?

No, this doesn't mean Zynga has access to all the IDFAs passing through Chartboost’s 90 billion monthly advertising auctions, as that would still be “third party data”. But it does mean that Zynga doesn't need to pay any of the costs associated with mediating and serving ads with Chartboost through their games, so they get a better CPM. They also get lower costs on the buy-side sending their ads through Chartboost to other apps, which means their CPIs are lower. This of course becomes a virtuous circle that enables them to claim more market share.

There are also the synergies of Zynga’s first-party information about their players that they can use to influence the CPM of ads served out of their placements through Chartboost. So while they are building the walled garden just like EA and Activision Blizzard, they are also bringing Chartboost into the garden and giving it diverse data the platform couldn't access before.

Let’s not forget the value of talent at Chartboost building other foundations of an ads ecosystem, although Zynga likely has more ad tech acquisitions ahead to fully realize their aspirations. In most of the gaming ad tech acquisitions, it's not the revenue that is material. Gaming companies simply cannot afford to acquire ad tech firms who are raking in the dough.

These ad tech companies have a much wider swathe of the market interested in purchasing them and higher revenue multiples pushing up their valuation, so realistically game companies can only acquire small ad tech firms for “synergies” before gaming is outpriced. Typically an ad tech firm that makes ¼ the revenue of a game company would have a similar valuation! Purchasing an early or discounted ads startup to complement or build into a gaming business’s ecosystem is the only way gaming companies can access this market (and the revenue multiples it gives their stock on Wallstreet as well!).

Many of us in gaming are angry at the overblown ad campaigns Apple has been leveraging against advertising to scare users into rejecting the ATT prompt. There is no reason for us to use the same rhetoric about its impact on our business.

Mobile game makers had to work hard over the past year to respond to platform privacy changes and regulations, but that’s no reason for us to make doomsday predictions about its impact on our business. While there are headwinds now, as long as players are spending money in our games there will be a market to acquire more users. At the end of the day, we are creating amazingly context-rich worlds that our players adore, and that gives us all the signals we need to build a viable business.

Our sponsor ironSource builds technologies that help game developers take their games to the next level. They boast industry’s largest in-app video ad network, a robust mobile ad mediation platform, and a data-driven user acquisition platform. In other words, everything you need for game growth.

Make sure to follow their Level Up blog for unmissable insights.