Prediction for 2018: Casual Games

as always, huge thanks to Sensor Tower for providing us with analytics. We couldn't do these analyses without them.

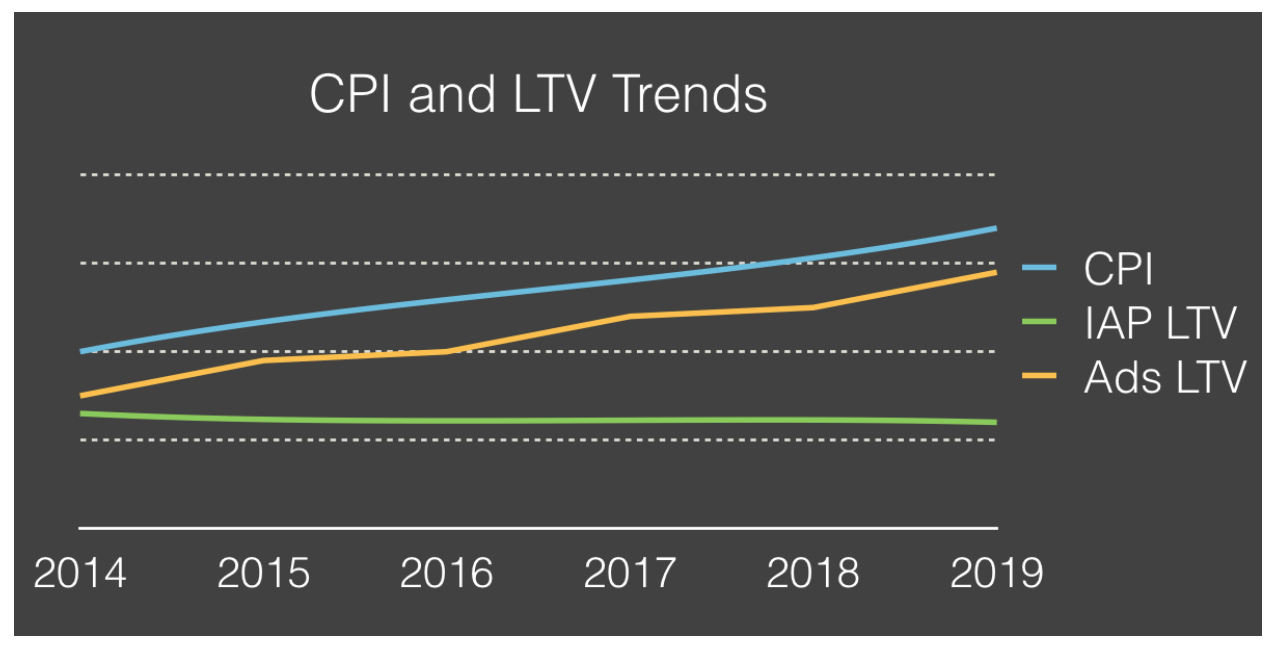

Casual Games have been in a year of constant and steady change. In short, the market has heated up to a point where the CPIs (cost per install) are so high that even a strong portfolio effect doesn't result in a positive LTV (lifetime value). This has driven developers to innovate with the goal of creating deeper, better retaining and thus better monetizing casual games.

Across all of casual games genres, there continues to be dominance by the big players. King continues to dominate puzzle category, with incumbent Playrix hot on their heels. EA, Supercell, and Playrix continue to fight for dominance in the simulation space. Wooga, Pretty Simple, and MyTona hold on to the Hidden Object genre, which is too small of a niche for the bigger publishers to move into. Roblox has taken on Minecraft's for the leadership in user-generated content driven games while Glu (Tencent), Pocket Gems (Tencent) and Pixelberry (Nexon) have enjoyed the growth of lifestyle games.

2017 was a year of revenue growth. As the market matured, we saw a decrease in downloads paired with a significant increase in revenues, which indicates that the battle has moved away from downloads and into improvements of the actual products.

On the consolidation side, there were some big moves: Zynga acquired both Harpan and Peak Games’ casino games. Big Fish changed hands from Churchill Downs to Aristocrat. Social Point was acquired by Take Two. Not to mention Rovio’s successful IPO (although soon after managing public investors hasn’t been easy for them) and Outfit 7’s acquisition by a Chinese Investor Consortium (United Luck Group Holdings).

Last year wasn’t shy about big new games either. Homescapes and Playrix as a whole earn the biggest success of the year - especially since it leapfrogged Gardenscapes’ already stellar performance and has accomplished where King has still struggled - to make a sequel that outperforms the original (King’s only more successful sequel till date has been Bubble Witch 2). Toon Blast by Peak was another notable entry this year, especially with experiments that bring it closer to mid-core with its guild design. Nintendo’s Animal Crossing was a big release in the fall but has yet to really prove that it has the same staying power as their DeNA-designed title, Fire Emblem Heroes.

Instead of doing one quick prediction for 2018, we decided to do a bit more than the others have done and broke our predictions based game categories and segments. Please let us know in the comments below or via Twitter if there's something we missed, got wrong or got right! (this post has been written by Adam Telfer & Michail Katkoff)

Sign up to our newsletter and be the first one to receive the next prediction

Prediction: From Puzzle to Advanced Puzzle

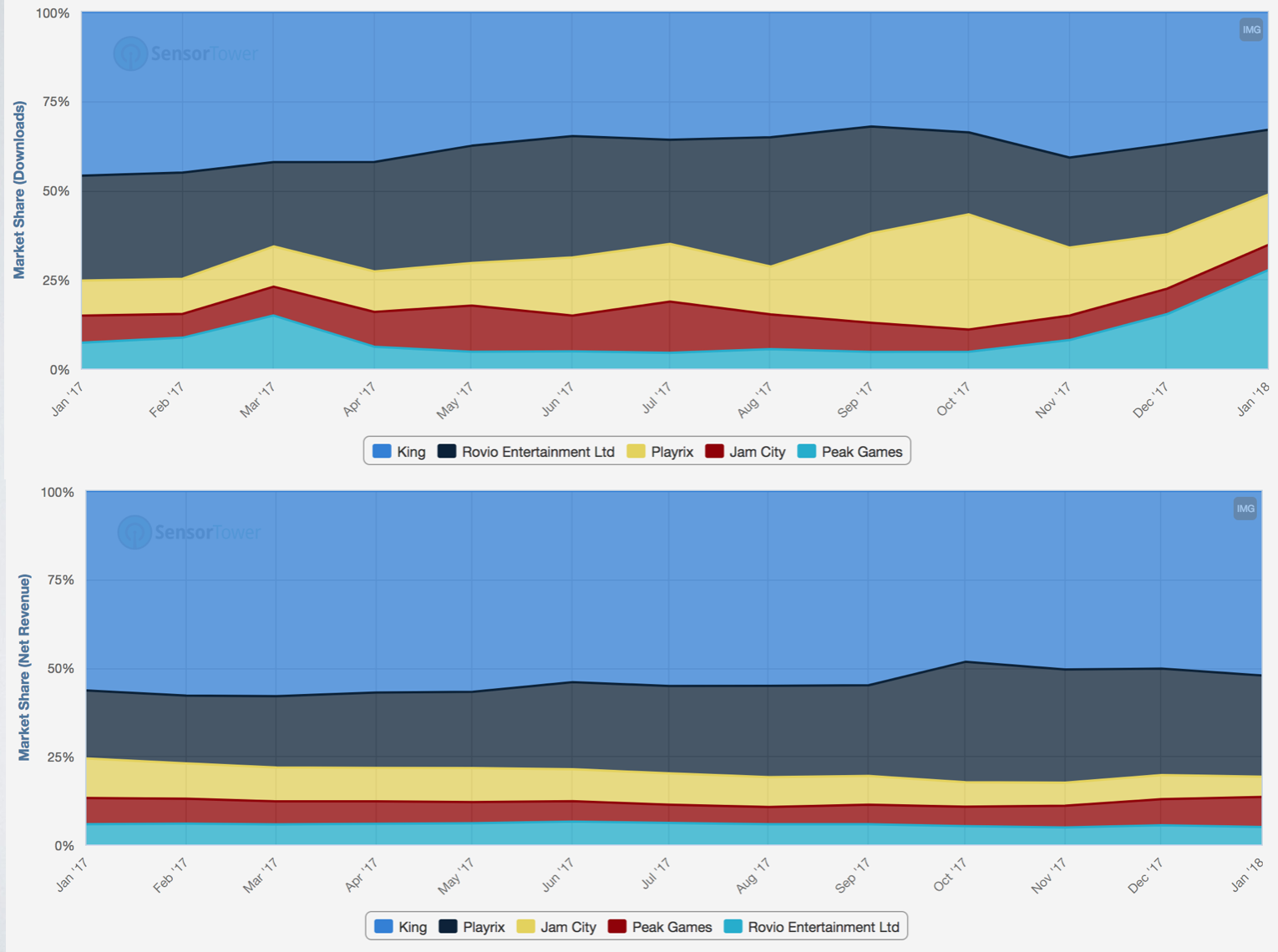

The puzzle games category is still growing with double digits almost 6 years since King’s Candy Crush Saga burst onto the iPhone screens. When analyzing the top five puzzle game publishers (King, Playrix, Peak, Jam City and Rovio) you come to a conclusion that the puzzle games are monetizing far better in 2017, as the combined monthly revenues for the top five publishers grew over 65% while the downloads stayed at the same level.

In the puzzle category, top five publishers have seen their downloads stall while the revenues have continued to increasing with double digit growth.

The reason behind the growth is largely initiated by one publisher. We had written off puzzle games as a mature market dominated by King and made hyper-competitive a long list of Saga clones from pretty much every other publisher - and then Playrix dived in. First, it was Fishdom in early 2016, which was followed up with a one-two combination of Gardenscapes (late 2016) and Homescapes (late 2017) to solidify Playrix as the second best in the category beating other runner-ups on its way to the top.

Playrix’ success in the category is driven by gameplay innovations that result in higher LTV than the competitors’ enjoy. The LTV for puzzle games is calculated by player’s value for the publisher’s portfolio of puzzle games because players tend to play several puzzle games at once and are also easily cross-promoted from one puzzle game to another. That’s why Playrix growth has escalated after the launch of the second and third title. With three well monetizing puzzle games, the publisher is able to purchase users at ever higher CPIs.

Peak Games has gone on the offense on the installs while on the revenue side Playrix has taken bigger market share with three consecutive hit puzzle titles. Jam City has seen its share melt during 2017.

While Playrix continues to be the biggest winner, the biggest loser of the category is Big Fish, which fell out of top five and Jami City that has seen its market share drop significantly in a year. The company made a wrong bet in investing into IPs as drivers for installs to their newest puzzle games and falling behind on gameplay innovations.

King, on the other hand, is making more and more money every month and seems unstoppable even though its downloads keep on declining. Peak, is acting extremely bullish powered by the massive $100M war chest it received from selling its casino games to Zynga. Rovio is fifth in the category, holding onto its share of the rapidly growing cake.

Predictions of 2018 in Puzzle:

- Value of the market increases additional 50% driven by Advanced Casual mechanics (read: Toon Blast and the Death of Saga)

- King will continue to dominate in revenues with added ad monetization while its player base slowly but surely continues to decline (read: Has King Peaked?)

- Playrix will catch on further to King in revenues (read: Gardenscapes Pivot to Success)

- Peak will become the clear third in the category with a launch of new games that have strong Advanced Casual design and its $100M war chest that will be spent on marketing

- Rovio will overtake Jam City as the fourth largest casual games company. Jam City will struggle to create new titles with Advanced Casual mechanics while being brought down with revenue share with IP holders.

Prediction: Hyper Casual Is Where the Growth Is

While there is a clear trend of maturity in the casual gaming space, the more things stay the same, the more opportunity there is for something that breaks the status quo.

As the mainstream “AAA” casual games move towards complicated core loops and business models that require players to play for years in order to be profitable, this year has seen a resurgence in the opposite: Hyper Casual. Games that are instantly addictive like “2048”, “Snakes vs Blocks”, and “Color Switch”. Hyper Casual games have been the biggest area of growth for new companies on mobile -- growth and innovation that hasn’t been seen since the beginnings of the AppStore (2009-2012).

Hyper Casual games have been covered before, in our article on Gram Games - but essentially it breaks from the usual F2P model in which systems, economies, and content need to scale for years. Instead, it relies on short, accessible, widely appealing gameplay that is more about early day retention & driving engagement over strong long-term retention. While long-term retention can help, these games are usually developed in less than 2 months and can make back their development costs in far less time than a larger budget F2P game. This model of course was pioneered back with Ketchapp years ago, but this year has seen a resurgence with companies like Voodoo, Gram, BitMango, and Cheetah all seeing massive growth within the last year. Ad-based monetization has grown substantially over the past year, and games that take advantage of it are benefitting.

SOOM.LA’s prediction of the IAP vs Ads growth

3 Games, 3 Different Developers, all in the Top Downloaded Charts. There are only as many clones the market can handle

The more developers try to make a quick buck on this model, the more scope and novelty needs to happen. Many developers won’t be able to make this work - despite being able to test and validate games quickly, it still is difficult and hard to predict which titles will work. This is why companies like Gram focus on game jamming and soft launching many titles per week, yet only a small percent actually even make it to a production stage. This “hit rate” will lower in 2018 - publishers will need to innovate even more to stand out from the competition.

Besides the testing cycle, there is so much this model leans upon user acquisition for growth. These games need millions of players to be driving substantial revenue. As more competition enters this space, the harder it will be for UA teams to get the scale they need.

The dominant Hyper Casual publishers will try to suck up as many of the smaller developers with strong performing titles as they can. Developers that understand hyper casual games and can work smart on developing new hits. These publishers will innovate quickly. We’re already starting to see titles move away from just being a high score-focused game towards games focusing more on upgrades and “idle” style economies. Driving long-term retention is starting to become more important (and cheaper) for these developers than just acquiring new users. Regardless, 2018 will be a very fun year for Hyper Casual developers as they try to find the next hit.

Predictions of 2018 in Hyper Casual:

- Hyper casual games will start to become a bit deeper as the developers aim to increase LTVs through more engaging progression mechanics

- Consolidation as the biggest hyper casual publishers try to defend their advantages through acquisitions and further investment in UA

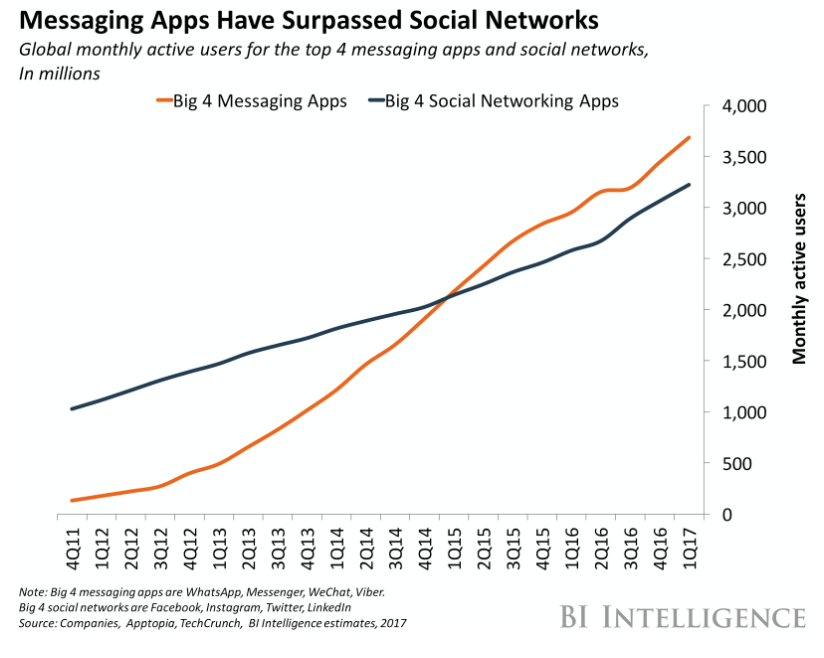

Prediction: The Year of Messenger Games

Similar to the hyper casual market, messenger games have been an interesting area of growth and opportunity in the casual space. Messenger games have had a great year. What started off as a risky market has looked more and more like a new frontier.

Early in 2017, there were two incumbent platforms in the space: iMessage and Facebook Instant. iMessage was built similar to the watchOS for Apple Watch: seen as an “extension” of a mobile game, and was showing some small signs of success. Games like “Game Pigeon” by a lone developer had been dominating the iMessage space for months. But as time went on, it became clear that Apple wasn’t making an effort to improve the user experience. There still is no clear way for someone to install a new game for iMessage while staying within the chat. It was clear by WWDC 2017 that Apple’s priorities have moved beyond iMessage games.

Facebook Instant on the other hand has reached a tipping point. In early 2017, the platform had just been announced and there was plenty of speculation if the platform would move beyond the gimmick of playing Pac-Man and Space Invaders against your close friends.

While instant games fixed the issues that iMessage had by having no installs required (all games are built using HTML5), they still had plenty of drawbacks. No App Icon on your home screen meant that players could easily forget about your game. No Notifications meant retention had to come from your friends actively playing and nudging you back. Lastly, and more importantly, there was no way to monetize.

By the end of 2017, all these issues have been fixed. Facebook has actively worked to bring games to the forefront of the messenger UI, built bots for games to send notifications, started rolling out Video Ads, and promises In-App Purchases early in the new year. With the platform working, the proof of a business case has come quickly: Everwing, the top game on the platform, has stabilized 20M monthly active users since the summer. New games launched on the platform have reached multiple million MAUs within weeks of launching (Adventure Capitalist is currently just under 3M MAU). This platform can scale.

Predictions of 2018 in Instant Games:

- Facebook Instant will become a more widely adopted platform by players and developers

- further platforms will enter the fray soon (WeChat just began their own HTML5 Instant platform)

- We’ll see more 5M+ MAU games on the instant games platform

Prediction: Simulation Games Stay the Same

Before puzzle games ruled the casual market, it were the simulations games that got us farming, building, gifting, and training. The market is far from its hay days (pun intended) and has been in a stable cash cow mode with top 9 simulation games generating consistently around 35 million Dollars of post-platform cost revenue a month. The stability of the revenues indicates that the top games are populated by extremely well retaining ‘old users’ because the downloads have decreased by a quarter year-to-year.

While the combined downloads for the top 9 simulation games are going down, the revenue stays the same month to month.

The two biggest winners of the category are the two evergreen titles: Supercell’s Hay Day and Playrix’ Township, which is even older title than the soon 6-year-old Hay Day. These two old ladies are followed by EA’s Sims and SimCity. In fact, the over three-year-old SimCity is the youngest top grossing simulation game. This indicates how difficult it is for new games to break into this highly mature category. Or in other words, how unappealing it is for new games to try to enter the category, where LTVs are comparably low and gameplay innovations and graphics are trumped by a vast amount of playable content that takes years to produce.

For last three years, the market share has been pretty much the same with Hay Day, Township, Sims, and SimCity

The biggest loser of the category has to be Jam City and it’s TinyCo studio. Family Guy Quest for Stuff used to be the crown jewel of TinyCo. Today is has fallen to the bottom of the top list and the last two TinyCo games Avengers Academy and Futurama Worlds of Tomorrow perform far worse the first title.

Predictions of 2018 in Simulation Games:

- JamCity’s TinyCo will be restructured due to high costs and poor performance

- Playrix’ Township will take over the category due to better live operations than Hay Day

- EA will sunset its follow-up title for the original and the ever so well performing Sims FreePlay

- Zynga will come back swinging to take their piece of the category they used to control. The snatch of EA’s SimCity Helsinki team is a strong indication of this.

Prediction: Competition in Lifestyle Category Turns Red Hot

Since Facebook fully embraced free-to-play, many developers have strove to get to grips with what’s perhaps rather crudely been referred to as “female first” gaming - to make their name as a company that truly understands and delivers on an underserved demographic in the market.

In practice, what this translated to was - at least initially - a series of “cute” style games; taking care of sweet animals, managing a farm packed full of farm animals with massive eyes, or dressing up games with way too much glitter and pink everywhere. It ended up with studios creating games for a stereotype: a fictitious and overly simplistic view of what might interest women, with very little understanding of the nuances the chosen demographic actually wanted. Worst still, not all too many developers successfully went much deeper than that, believing that focusing a title on cute animals with big eyes was how you made a games ‘female friendly’.

The winner of the lifestyle category is none other than Glu following the extremely successful Crowdstar acquisition in early 2017. Covet Fashion and Design Home are one of the firsts of their kind to truly create a social network-game hybrid that recreates the feeling of being a professional in fashion design and interior decoration. They’re also one of the few games to really deliver on the actual professions of interior design or fashion without feeling cutesy or too complicated. Not only that, these two games have managed to deliver a strong core loop built around equally strong principles of great F2P design - a core loop that, dare I say it, has never before been seen on the App Store.

Covet Fashion and Design Home built and grew a niche into a lucrative segment. This is an extremely admirable long-term approach that Glu is now reaping benefits off.

Covet Fashion was launched in 2013 and has remained within the Top 200 grossing since launch, although it has been in a slow and steady decline since Fall 2016. Design Home launched during this period and has remained within the Top 100 grossing since launch, despite having a smaller feature set compared to Covet Fashion. Delivering on these games, Crowdstar cemented itself as a top developer, catching the eyes of the bigger players on the App Store.

Both Design Home and Covet Fashion are games that have no direct competition on the market at this moment. When there’s no direct competition, and the KPIs of both of the games are solid, all what Glu needs to do is grow the market and reap the benefits. And that’s exactly what the company has been doing with heavy investments into marketing of Design Home.

Where there’s profit to be made, competition will emerge. The prediction for 2018 is that new competitors will enter the lifestyle market popularized by Glu. While the first competitors may enter with inferior products, in a year or two Glu will have its hands full in owning the overwhelming market share of the highly lucrative and growing lifestyle market.

Just a year after Pocket Gems broke through with Episodes it was followed by Pixelberry's Choices. The two games are in intense competition and there are more similar titles creeping from behind making the market less attractive for new entries.

Pocket Gems’ Episodes and Nexon’s Choices offer almost a perfect example what the future holds for Glu. As you can see from the charts below, Choices was launched only a year after Episodes became a breakaway hit. While the combination of the two top performing games have grown the overall market, they’ve also increased the costs through their battle for downloads and rising production costs. Not to mention that Episodes is already seeking growth with IP partners like Pitch Perfect, which tend to further decrease the bottomline by taking a percentage of net revenue.

Predictions of 2018 in Lifestyle Games:

- Glu will keep its spot as the number one lifestyle game developer in terms of net revenues due to the growth of Design Home and lack of competition.

- The competition in story-based games like Choices and Episodes will intensify. This leads to falling net revenues as the companies will focus on adding expensive IPs instead of building out the feature sets to increase LTV.

- New titles will enter the lifestyle category to take market share from Glu, Pocket Gems and, Pixelberry (Nexon).