Why Marvel Snap became a hit and for how long will it remain one?

Written by Javier Barnés. Make sure to listen to the podcast below to dive even deeper into Marvel Snap.

Executive Summary

What: MARVEL SNAP is a mobile CCG by Second Dinner, a new studio founded by veterans from Hearthstone. The company was originally funded by NetEase, but Snap is published by Nuverse (a subsidiary of ByteDance, of TikTok fame).

Key strength: Its biggest strength is the gameplay perfectly adapted for mobile. Snap presents a very accessible CCG with short intense matches of ~4 minutes which involve a high degree of poker-like mind games and deception. It’s extremely engaging.

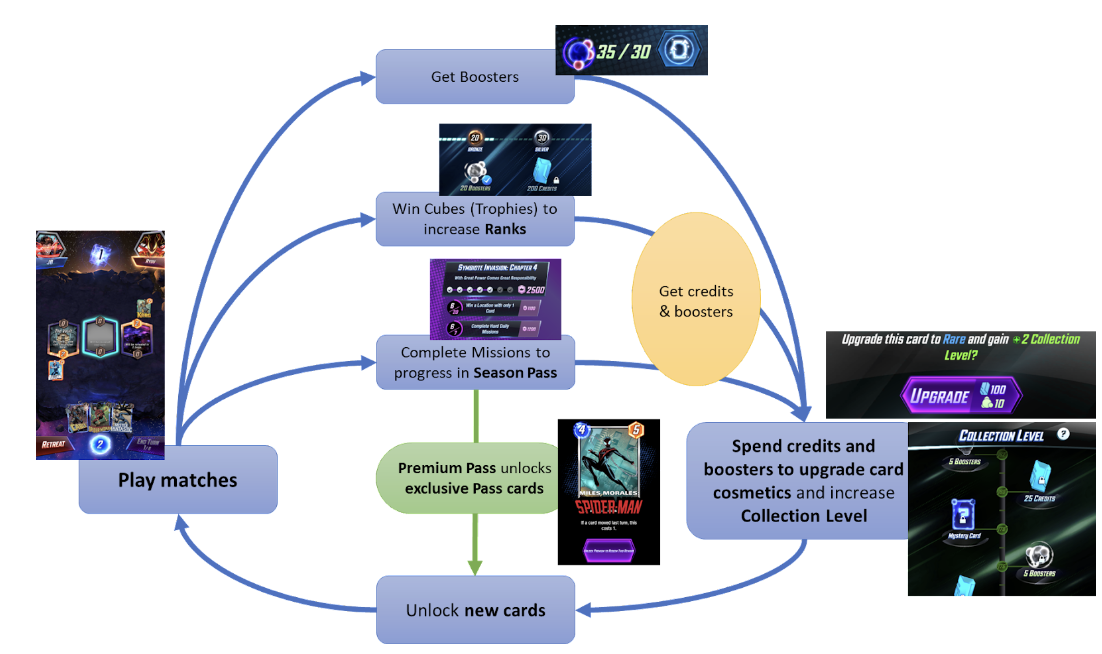

Progression: Cosmetics are essential to progression because upgrading Card Cosmetics is the main method to acquire new cards. This is a very interesting innovation that competitors should take note of.

Genre: CCG-Battle is a niche genre in both downloads and revenue. In the last 365d, the CCG-Battle sub-genre only made $376M and 59M downloads Worldwise. Additionally, about 46% of the total revenue of CCG-Battle games came from key Asian markets of China, Japan, and South Korea, which tend inaccessible by Western games.

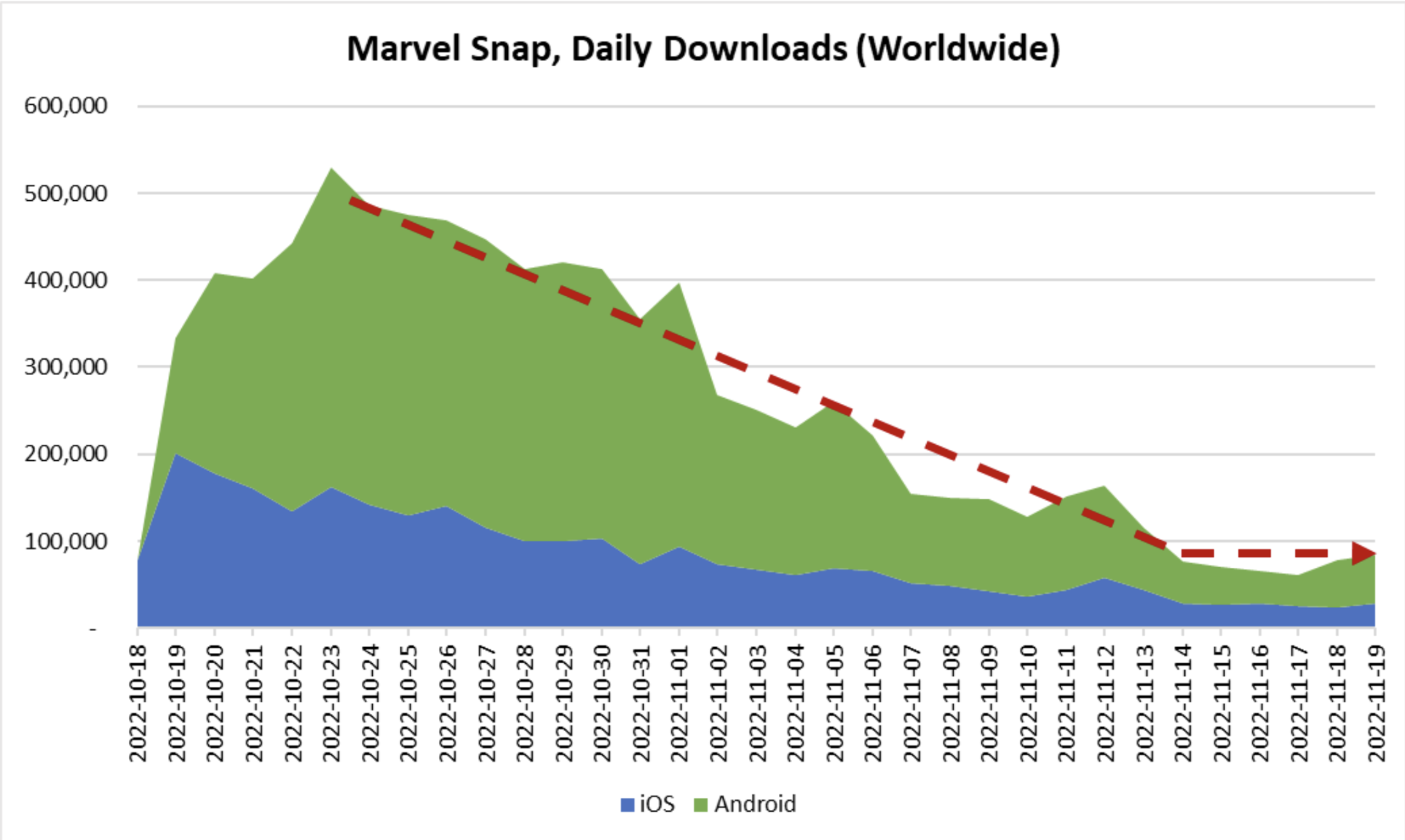

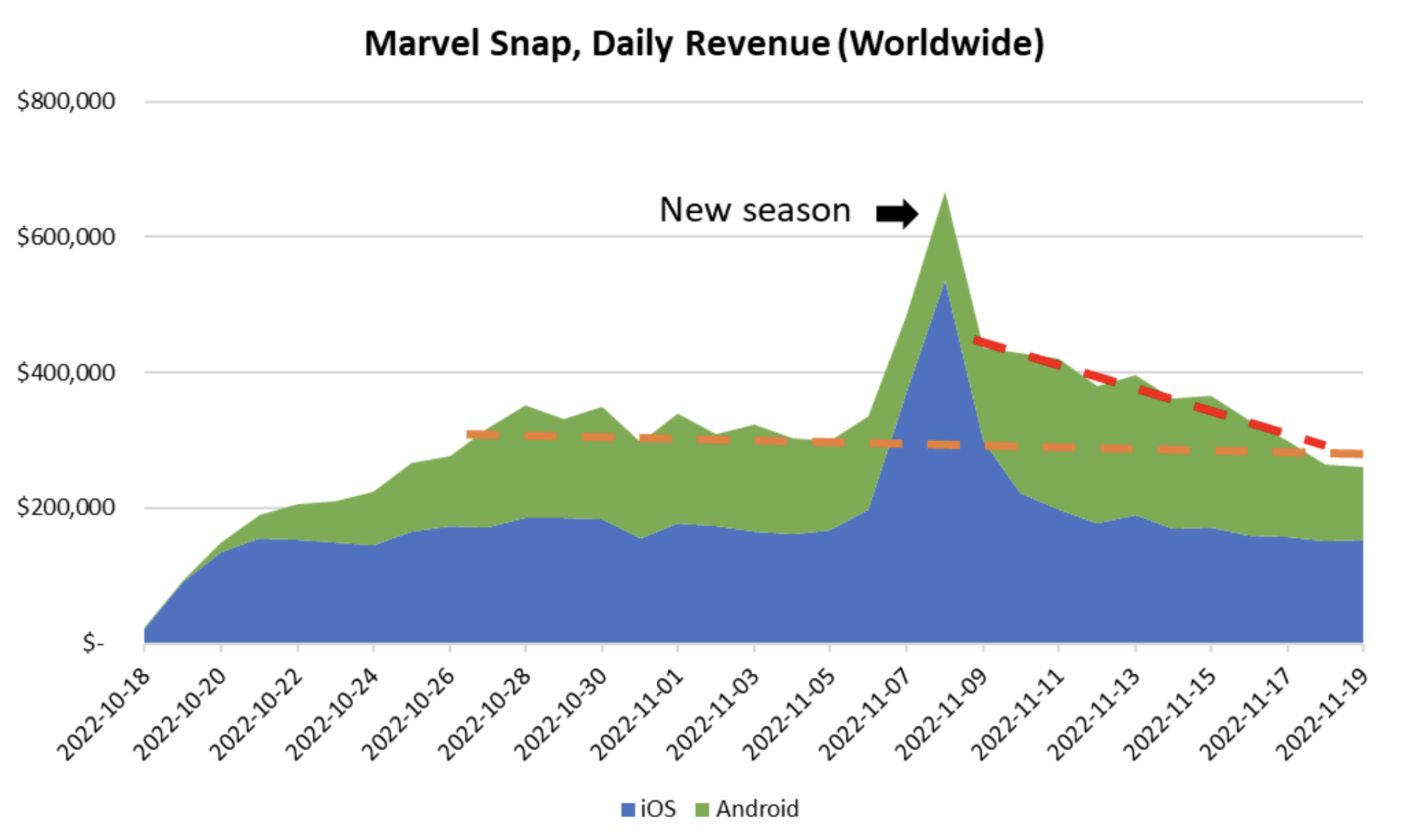

Launch: Snap had an aggressive launch, achieving +8.5M downloads and +$8M in revenue in the first month. A month after, the revenue still holds up strong despite a downward trend in downloads, likely because of excellent retention. But the decreasing downloads will eventually damage the daily revenue; and the revenue per download is still low versus its competitors, raising doubts about how profitable the title will be.

Business Potential: Monetization is weak, because of the low spending depth (small collection and deck size, no gacha) and very limited pressure and ways to spend. To maintain its current performance and grow, Snap needs a higher revenue per download, which likely requires reinforcing monetization. Employing an expensive IP and employing a publisher set immense pressure on monetization to reach profitability.

Recently, the Snap team has announced the introduction of the Collector Tokens, a new currency primarily obtained in the Collection Level that will allow players to directly purchase cards in a rotative shop. Simultaneously, they’ve announced the release of two new sets of rare cards. This big injection of new cards together with new means of monetizing them seems an attempt to increase RPD.

Live Services: At the moment, the game features no liveops, outside of the monthly seasons that introduce new cards and a Battle Pass.

Social: The most alarming element is the missing social systems. Plans to improve this have been announced in their roadmap but anyone involved in free-to-play games understands the imperative need for players to play together.

The Full Story

It’s been a few weeks already since Marvel Snap was released globally, after a brief soft launch of 3 months. It quickly became one of the most downloaded games in multiple countries including the US, which is no small feat for a collectible card game (CCG).

Although the company behind it (Second Dinner) is new, the Marvel Snap team ranks among the most experienced creators of digital CCGs. Many of its members are veterans of Blizzard’s Hearthstone.

Among them, it stands out Ben Brode, Second Dinner’s CEO and previous Game Director of Hearthstone. Brode is a very public personality (for game dev standards) who has leveraged his personal brand into this new game by appearing in ads.

The strong pedigree hasn’t hindered innovation, quite the contrary: Marvel Snap presents a gameplay more approachable than any other digital CCG on mobile. This facilitates adoption and generates fast and intense matches (~4 minutes). The loss of depth in gameplay mechanics is compensated with a higher weight of the poker-like mindgames.

The brief and high-intensity game loop makes it well attuned to mobile gaming tempo, and it’s one of the reasons why the game is so damn engaging. This has made core CCG fans passionately receive it as a refreshing experience, although retaining them for a long time may put a lot of pressure on the flow of new content.

Nevertheless, Snap's biggest opportunity is reaching broader audiences than just core CCG players. Its approachability could be a great advantage in the long run, as it may allow Snap to tap into a bit broader audiences like collectors or Marvel fans instead of competing exclusively for the galvanized audiences of MTGA, Hearthstone, or Yu-Gi-Oh.

That said, the future of Marvel Snap is not without challenges: Its current monetization approach has a very limited spending depth per user. This will put a lot of stress on its capacity to maintain a high volume of active users, which is challenging.

Additionally, in its current form Snap is severely lacking in terms of collection systems and liveops, and it isn’t very clear how effective the introduction of new content will be. These are all solvable problems but represent important factors of uncertainty regarding its ability to become a long-term success.

In terms of progression, Snap's biggest innovation is linking the acquisition of new cards to cosmetic upgrades. Thus, players are incentivized to acquire and upgrade their cosmetics beyond their visual appeal.

At DoF, we’ve been playing Marvel Snap since the closed beta in preparation for this article. And this is what we think…

The Launch and the Market

To properly contextualize Marvel Snap’s early success, it’s first important to understand the market space it’s in. For this, we used data.ai Game IQ, a pretty cool tool that makes analysis like this easier by classifying games across curated categories, as well as allowing categorization based on art styles and specific features.

Marvel Snaps falls into the Card Collecting Game Battle (CCG-Battle) sub-genre. A quick comparison with similar PVP sub-genres highlights how concentrated that market space is.

In the last 365d, the CCG-Battle sub-genre only made $376M and 59M downloads, which is a tiny fraction of what other hardcore PVP genres like Team Battle RPG or MOBAs, and puts it just slightly above a niche genre like autochess. So CCG-Battle is a niche genre in both downloads and revenue.

Additionally, about 46% of the total revenue of CCG-Battle games came from China, Japan, and South Korea. So when it comes to mobile, it’s another of these genres that do not work as well in the West.

Worldwide Revenue and Downloads (last 365d). Source: Data.ai Game IQ

So just to set expectations: Even if Marvel Snap has had a great launch and outperform¢ed every other game of its sub-genre, we’re talking about a Top 100-200 grossing game at best, not a Top 10 candidate. There’s just not enough water in its pool, especially considering that it’s not available in China yet.

In fact, Snap being in the Top 100 grossing positions on worldwide revenue regularly is already an amazing achievement since games of this subgenre don’t inhabit the Top 100 grossing positions (for reference Hearthstone, MTGA, and the Yu-Gi-Oh titles regularly score in positions 200 to 300 daily)

Another important thing to take into account when comparing Snap to competitors such as MTGA, Hearthstone, or Legends of Runeterra, is that these games already had big user bases on PC before they launched on mobile. And when it comes to revenue, the bulk of their monetization likely happens outside of the iOS and Android stores.

So while it’s possible to gather insights about Snap in the mobile platform, we really can’t compare its revenue to say which games are bigger. We don’t know their true sizes.

With that clarified…

Snap's spectacular launch

When it comes to downloads, Snap has had a truly phenomenal launch amassing well over 8M downloads during its first 30 days. These would be impressive numbers in any category of the market, but compared to any other CCG-Battle, it’s another league.

Worldwide Downloads, 19th Oct to 15th Nov (Snap launched on the 18th Oct). Source: Data.ai Game IQ

Much of this success goes naturally to the powerful Marvel IP, the attraction capacity among core audiences of the team at Second Dinner, and the smart decision of bringing in content creators before the launch.

But let's not overlook that this game was published by Nuverse, a publisher brand owned by ByteDance, the same Chinese company that is known for a little app called TikTok.

Nevertheless, the negative trend points out that downloads will eventually normalize at a level likely higher than its close competitors, but not at a completely different magnitude as in the early days.

While still far superior to every other CCG-Battler, Marvel Snap downloads trend is declining fast. We predict that it will normalize at a higher baseline than its competitors. Source: Data.ai Game IQ

When it comes to revenue, Snap also outperformed other CCG-Battlers on mobile, but by a lesser margin. This points out that Snap is likely not that effective at generating high ARPPU across its players.

The daily revenue trend is quite interesting.

Snap has been able to generate a spike in revenue with the release of the new Season (Battle Pass…). This shouldn’t be surprising as it is a characteristic shared with other major CCGs that also get cyclical spikes whenever they release a new Pass or card set expansion.

What is impressive is that the baseline revenue is very strong. It has remained stable while the downloads were declining -- and it even grew temporarily after the release of the last season. This is promising, as it hints that the game has been able to grow its potential payer base. Meaning that the game has very good retention and conversion capacity.

The tradeoff between declining downloads and excellent retention may even make the baseline and next month’s spike grow even higher. Although it is likely that unless the monetization deepens somehow, a consistent decrease in downloads will eventually damage the daily revenue.

Ultimately, I think that Snap has had a good launch. It is an interesting case to study the key characteristics of the creation of a hit in the post-IDFA environment. Among them, we highlight: Presenting an extremely engaging gameplay fun (through an expert team in the genre, and focus on creating an easy-to-adopt product) and being able to put the game in the eyes of the audience (through a great IP, content creator involvement, and community building).

Cross-platform isn’t there yet

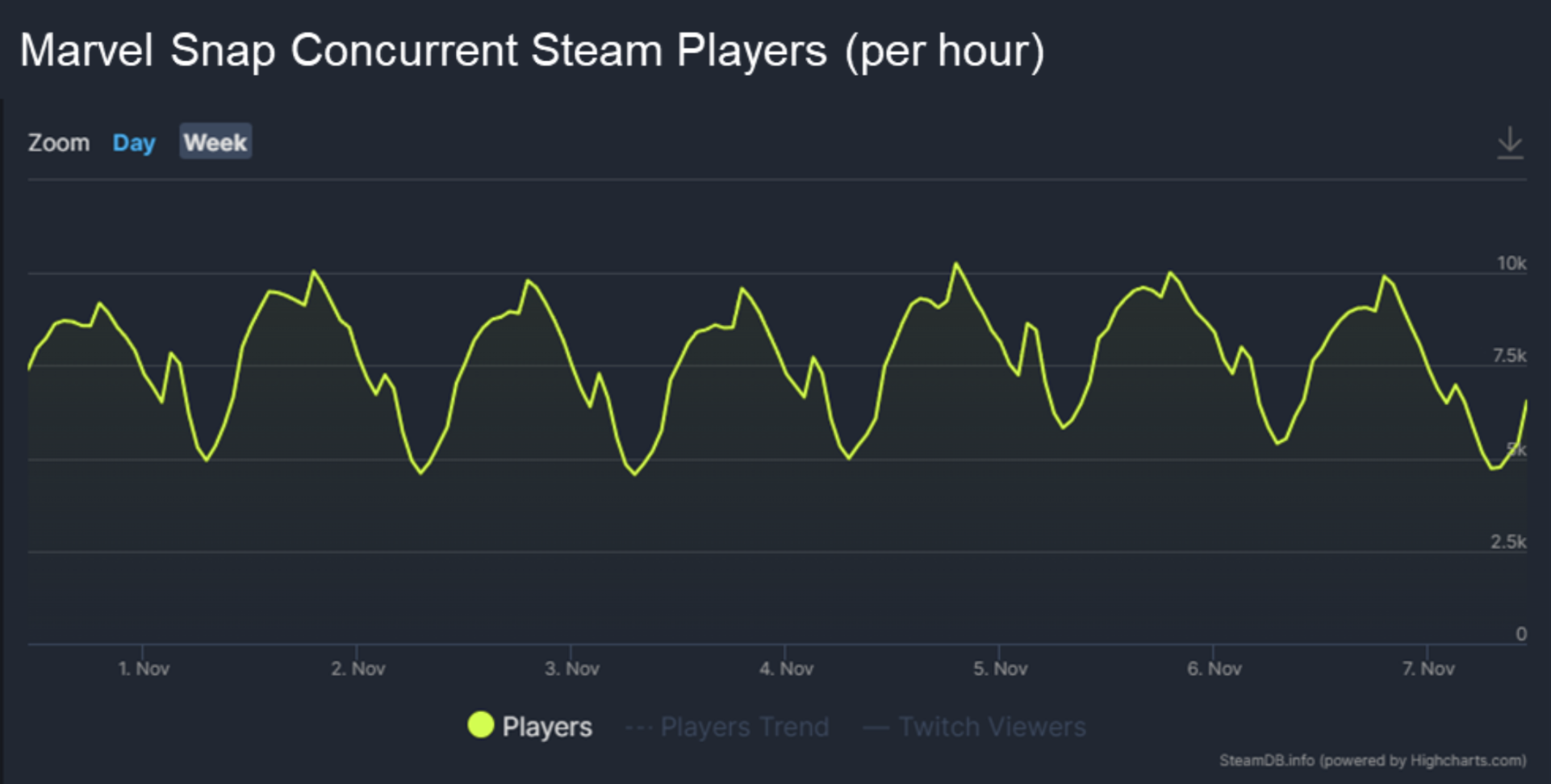

Despite its massive reach on mobile, Marvel Snap has had limited success on PC where the game has also been available since launch. To be fair, the game is still in early access status on Steam, which has triggered users to complain about the unpolished status.

Additionally, it’s likely that the CCG audiences are galvanized on PC, and favor the already existing slower and deeper games. The same speed and accessibility that makes it so engaging on mobile may also make it suboptimal for PC.

IMHO the lack of initial success on PC is not a big problem because Snap is a mobile-first game and being a mobile-first hit pays off. But the fact that the game is already cross-play lets us expect that Snap has a chance of growing on HD platforms in the future.

On Steam, Marvel Snap has obtained a decent reach, outranking the Witcher card game GWENT's all-time peak. At the same time, Snap seems to not be growing. As the downloads subside, we will likely see a downward trend. Source: SteamDB

Unrivaled Gameplay

Frankly, Marvel Snap is a masterpiece if judged exclusively from the gameplay design POV.

In one of the Snap ads, Brode says that the game is the culmination of everything they’ve learned about [mobile] CCGs. He is not bluffing. What seems to be the most important lesson is how to create gameplay that’s well-suited for mobile devices.

Hearthstone, which set the template of modern digital CCGs, did a great job at porting to a videogame the “physical CCG experience” while benefiting from the unique capacities of digital format (randomness, action counting…).

But it wasn’t as effective at porting the experience to smartphones.

This is because mobile is inherently more arcade than other gaming platforms:

The screen is small, so information is harder to display.

The standard and most comfortable usage of a smartphone is in Portrait mode (horizontal), which decreases the usable screen space even more.

Sessions tend to be shorter and get less player attention since many happen while they are doing something else and can’t focus entirely on the game. So it’s harder to manage complexity and retain information.

For those reasons, most digital CCGs that are perfectly enjoyable on PC are harder to play on a smartphone and are limited to a niche audience. They are not well adapted to the player’s natural relationship with the device.

Classic digital CCGs have a significantly higher % of players and spending on iPad, which has more in common with non-portable devices (bigger screen, you don’t carry it out in your pocket…). But Marvel Snap device usage has more in common with mobile-first games like Clash Royale. Source: SensorTower.

Snap’s design mixes components from games like AIR, LAND & SEA, GWENT (score-based victory condition, multiple lanes, mindgames), Marvel Smash Up (unit design), Texas Hold’em (progressive reveal of key shared components, betting), and Hearthstone (usage of digital-only mechanics).

While none of these elements is - by itself - revolutionary, the combination creates something extremely fun.

What makes Snap gameplay truly unique is that it can compress the CCG experience to present a game that’s easy to learn and manageable on a smartphone, and that provides the full intensity of a match (the slow build-up of strategies, identification of opponent strategy and countering, surprising twists and reveals…) but in just ~4 minutes.

Ultimately, this means that Snap is accessible enough to engage broader audiences that would be unreachable by regular CCGs. While also innovative and fun enough to engage a significant share of the existing mobile CCG audiences and PC digital CCG players that do not play them on mobile.

How does Snap adapt CCGs to mobile?

Simpler victory condition (based on highest Score)

Limited match length (6 turns, ~4 minutes)

Less amount and simpler gameplay components (Small deck of 12 cards, only 1 card type, only 1 class of interaction)

Big weight of mindgames and unpredictability to maintain gameplay depth (due to the Locations)

The standard gameplay paradigm on most digital CCGs (like MTGA or Hearthstone..) is summoning units that have to protect their owner while they inflict damage on the opponent.

This means that players may have to give multiple orders per turn to their units, which often have complex abilities and stats. This takes a lot of time and mental effort per turn. And ultimately, it means that the match can last an undetermined long amount of time while players engage in successive clashes of attack and defense.

Contrary to that, the victory condition in Snap is to have the highest score on most of the 3 locations (lanes) when the match ends in Turn 6. So matches have a predetermined length, enforcing the ~4-minute span.

This short span creates a “c´mon, one match more” loop on sessions, and increases the number of opportunities that players have to open the game during a day: Players may not have many windows of 20 minutes required for an MTGA match, but they can afford a quick Snap match. And maybe a couple more.

Players perform only a single type of action per turn, which is to summon heroes on any of the locations (until they deplete their mana). Once on the board, players can’t interact with the units anymore, and they don’t attack each other like in other games.

Instead, the focus is entirely on the “card reveal” moments which open the possibility for unexpected counters and twists that are fun and memorable.

This greatly decreases the number and complexity of the decisions that players need to take during a match, which generates a very fast pace. One repeated criticism is that waiting for the opponent's turn to finish takes too long, which is a sign that players choose their next move quickly, and would enjoy an even faster experience.

Another key factor that contributes to Snap's fantastic dynamism is the lower number of core components and their simplicity:

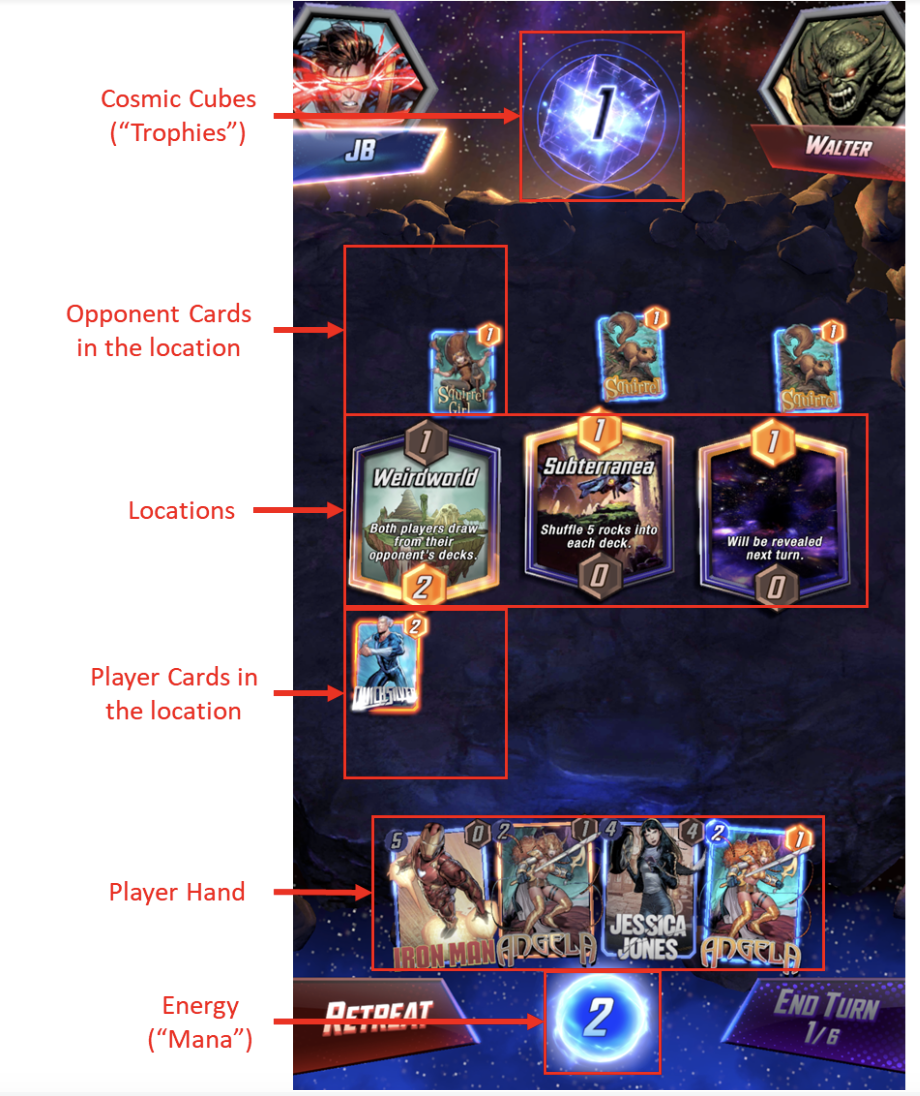

Marvel Snap gameplay screen breakdown: It features fewer components than what’s usual in CCGs, and is one of the few that can be played with one hand in portrait mode.

The mana system is the same as Hearthstone. A predictable amount increases by one per turn, removing any randomness from the mana curve of the match. In Hearthstone, this removed the classic problem of MTG of not drawing any mana (or drawing too many); but still had the issue that players may not have any card with the right cost to play.

Snap has iterated on this concept by introducing cards with the ability to appear in specific turns (“Starts in your opening hand”, “You always draw it in turn 2”), thus removing the need for a mulligan (reroll) mechanic for the opening hand.

The game only features a single type of card (units) that feature very few stats (Cost and Power),and cards overall have less complex effects than other games in the genre (briefer descriptions, few keywords…).

Hearthstone simplified Magic’s cards to better adapt them to broader audiences. Snap goes even further.

Instead of relying on shared keywords, most cards have very unique effects specific to them, which contributes to giving a very distinctive and recognizable usage. This uniqueness means that many combos rely on specific cards that can’t be replaced easily -- you need that specific card to make a combo work.

On top of the unique abilities, another factor that makes every card on a deck critical is its small size: Decks only have 12 cards. As a consequence, each card has a lot of chances to appear during a match, which decreases the need to take probability into account when building a deck. And forces that each deck only has space to be structured around a specific combo. Ultimately, this means that deckbuilding is way easier in Snap than in other CCGs.

Regarding cards, one big thing missing is card tags or types (like Avenger, Symbiote…) which would be great to create gameplay synergies (“+2 to all Avengers”) and link them to out-of-gameplay systems (“Play with a Symbiote”). IMHO, this will appear sooner or later, and I’m a bit confused why the devs chose to not introduce it from the beginning.

Having a small combo deck could risk making the game feel repetitive and grow boring. But Marvel Snap avoids the lack of depth by placing more weight on uncertainty (randomness, mind games…).

This is what avoids that Snap falls into the trap where many games try to adapt hardcore experiences to mobile tend to fall (to make a shallow game where nobody drowns, but nobody is able to swim).

A key mechanic that empowers mind games is the Locations: In a manner that resembles the shared cards in Texas Hold’Em poker rules, on every turn a new one reveals its unique gameplay effect.

Some have game-breaking effects that can completely alter the logic of the match and completely change the strategy like altering card costs, only admitting a single card, granting additional turns, or granting buffs for specific actions.

Locations make every match feel very different, forcing players to readapt their strategies on the fly, and keeping the mind games fresh. They are a dynamizing mechanic that boosts gameplay emergence and compensates for the limited mastery depth and repetitiveness of the decks themselves.

Additionally, the featured locations (which have a greater chance of appearing) are an interesting live op that in some cases can make the player tweak their decks to make them better suited to exploit them.

Some examples of locations with game-changer effects. Source: Snap.fan

The final component of the gameplay worth mentioning is the Snap mechanic: At any point during the match, players can “snap” to increase the Cosmic Cubes (rank trophies) that they will win or lose in the match. Without Snap, in a match a player can win/lose 2 Cubes, with the Snap it can be up to 8 depending on if both players snapped and how early they did.

Players also need to know when to leave the match to minimize their losses.

The Snap is an interesting mechanic which is likely to be replicated by competitors: It can be used to bluff, it’s a useful way for competitive newcomers to significantly accelerate their progression, and creates big stakes in high-ranked matches.

We think there are no red flags in Snap's gameplay, but some of the challenges that we detect in its current shape are:

Limited mechanics to foster horizontal content exploration. There are no good reasons to build and play more than a single top-performing deck at a time. To improve this, we expect Snap to eventually add game modes with requirements, missions targeting the usage of specific cards and strategies, and a very active meta-content rotation strategy.

Players may exhaust the fun of the content faster than in other games, potentially requiring a faster flow of new content to remain interesting. The reason is that Snap decks have limited mastery depth and it’s easy to acquire them, and there are a few reasons that foster horizontal content exploration. (That said, on the available data there are no signs of such content exhaustion, but the game hasn’t been running for long yet…)

Because of the high degree of randomness, it is unlikely to foster a truly competitive or eSports scene. To achieve it would perhaps have to present a poker-like format where the focus is on the betting of Cubes. Nevertheless, we think this is not a big deal because Snap’s main target is not hypercompetitive players, and eSports is not a big factor in mobile.

Systems & Monetization: The Weakest Point

Contrary to the gameplay, which has been almost universally well received, Snap’s monetization systems have raised the eyebrows of many product specialists in the mobile devsphere.

The main reasons are that Snap’s approach to monetization has limited spending depth (no loot boxes, weak upgrade systems, no sharding system for acquisition, small card collection, and deck). And the pressure to spend is quite low (quite indirect means to pay to expand the collection fast, lack of payment-gated activities…).

An important clarification is that Snap's monetization concerns have nothing to do with cosmetics. Some specialized media wrongly reported that the game doesn’t sell shortcuts to power and relies almost solely on cosmetics. This is incorrect.

So let’s be crystal clear to dispel any remaining confusion:

Snap monetization is mainly based on accelerating the acquisition of new cards (power).

The game indeed puts a lot of focus on cosmetics, but this is deceiving because - contrary to most games where cosmetics are separated from power progression -, in Snap cosmetics are the core of the acquisition process of new cards.

Let’s explain this more in detail:

Playing matches grants resources that allow upgrading card cosmetics. That increases the Collection Level, unlocking more powerful cards. The Pass contributes to this loop by granting more resources, additional card skins to upgrade, and access to exclusive cards in the premium option.

When it comes to progression, Snap players pursue two objectives: Competition (win matches to collect Cubes and progress in the ranks) and Collection (to get all the cards). Regardless of what each player cares more about, they don’t have a choice because both objectives progress in parallel:

To keep winning matches as they progress in the ranks, players need to build more competitive decks which require more powerful cards.

To get powerful cards, players need to increase their Collection Level, which is the main source of cards in the game.

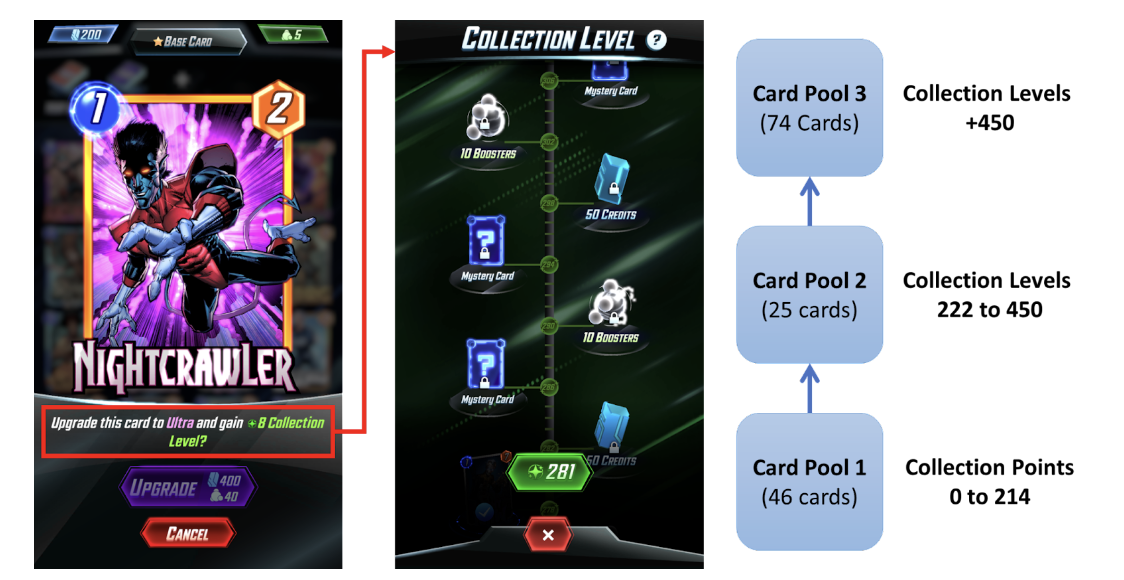

Increasing this Level grants regularly grants random cards within the available pools, and reaching specific milestones unlocks higher “pools” of cards (a bit similar to Clash Royale's concept of unlocking new cards as you progress in the Arenas). These card pools are incremental in terms of power and scarcity (in particular, the final Pool 3 requires grinding a lot).

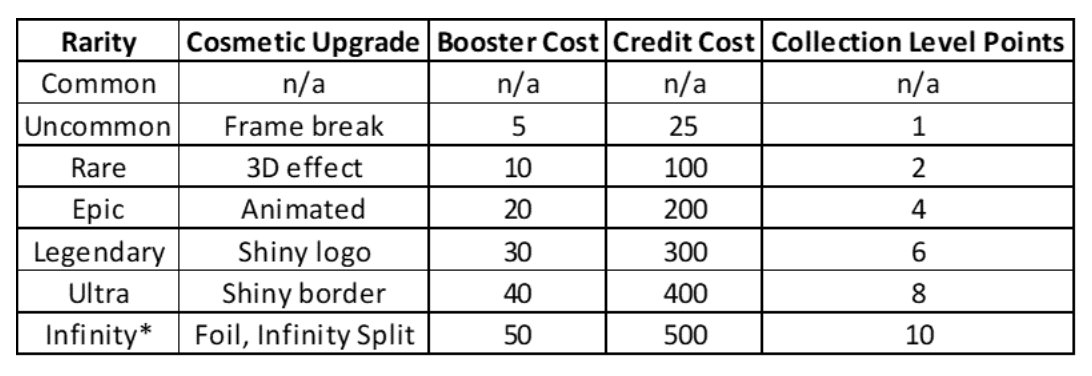

Increasing the Collection Level is achieved by upgrading cards. This requires boosters (shards that are unique to each character) and credits (soft currency).

Other than the Collection Level increment, the card upgrades only provide small cosmetic improvements (frame break, picture 3D effect, animated logo…).

Increasing the Collection Level, by upgrading more cards and Variants (card skins) grants cards and unlocks more powerful pools of cards. So if you want all the cards, you want all the card skins and cosmetic upgrades!

After every match, players get a small number of boosters for one random card in the deck that was used. In theory, this should incentivize players to use multiple decks with different cards, but in reality that doesn’t make a lot of sense as it endangers the Cubes (trophies), and credit-wise it’s more efficient to upgrade a single card more, rather than upgrade many. Thus, this doesn’t really incentivize horizontal exploration.

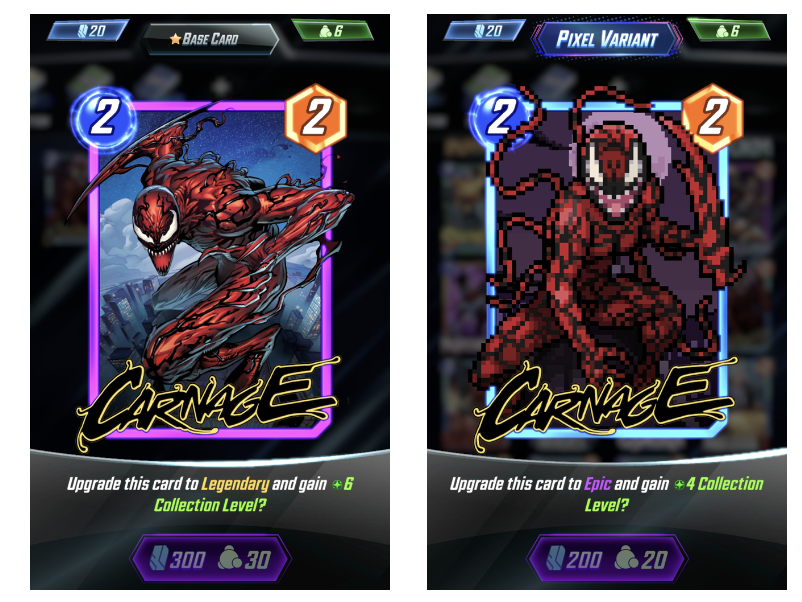

What’s interesting about this system is that each Variant (card skins) has its own line of upgrades, thus increasing the opportunities to spend boosters and credits for Collection Points:

For example, my base Carnage is Epic level, but the Pixel Variant (a card skin) is only Rare.

Finally, once a card is maxed out to Infinity level, they generate an “Infinity Split” version (at Common level) that includes an exclusive Background and Particle effect. Players can upgrade this Split version to generate additional Splits. This serves as a very high-end upgrade system.

To summarize: Even if players don’t care about cosmetics and only want better cards for their decks, they still need to upgrade as many cards and skins (Variants) as they can, just to increase their Collection Level and get more powerful cards.

This relationship between collection, power progression, and cosmetics gets the job done when it comes to players caring about cosmetics beyond their individual appeal and diminishes the risks of cosmetics saturation.

And it seems it has been well received by the players, in part because the alternative in other games is more P2W systems (like Clash Royale upgrades) or booster packs (loot boxes) that demand much more spending to get the desired content.

So it’s likely that devs from other cosmetic-driven games are taking note.

Another key system worth analyzing is the Battle Pass and Missions.

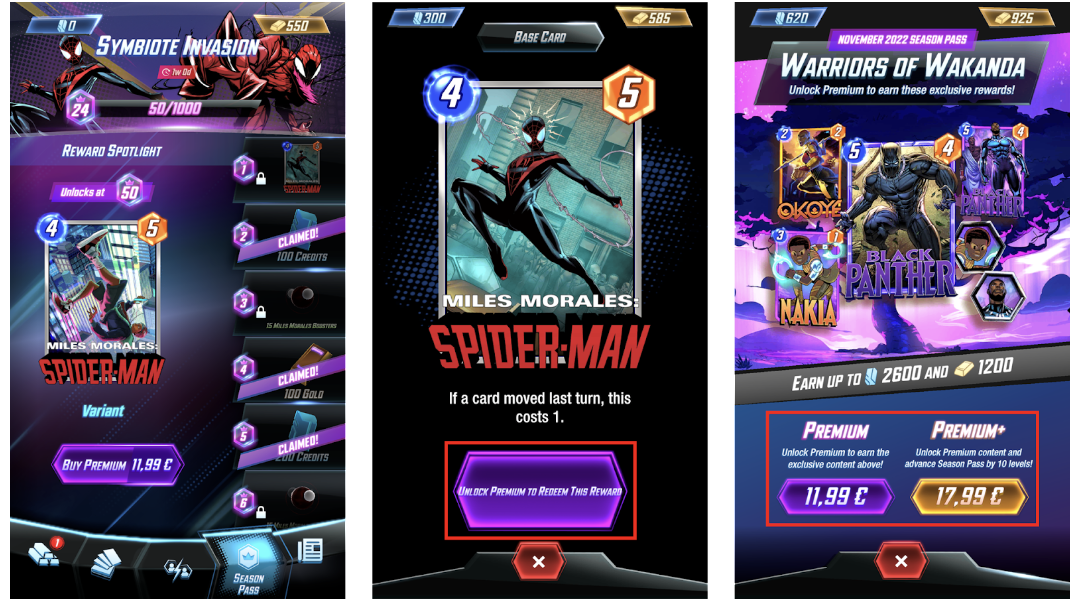

Snap features a Battle Pass that lasts for a month (Season). Every season is uniquely themed (Symbiotes, Wakanda…) and adds 1 new card to the game, multiple new locations, a bunch of Variants, and a variety of minor cosmetics (card backs, avatars…).

Most of the rewards in the Pass are premium-locked, with only a few freebies. These free rewards only grant small amounts of currencies and boosters (and a couple of Variants). In short, it’s a Pass where almost all of the value is on the Premium version, strongly pushing players to convert.

Snap Battle Pass grants an exclusive new card right after purchasing it. This is an excellent reason to buy it!

The most exclusive rewards of the Battle Pass are the new card and its Variants, which are gated under the premium paywall during the season month.

To get the new card, players need to buy any of the Premium versions of the Pass: The new card is obtained right away after the payment, and the Variants require progressing in the Pass. After the Season expires, the new card is added to the regular card pools of the Collection Level.

Because of the extra resources, Variants, and exclusive content, the Pass is the single best progression accelerator sold in Snap, and definitely a must-buy.

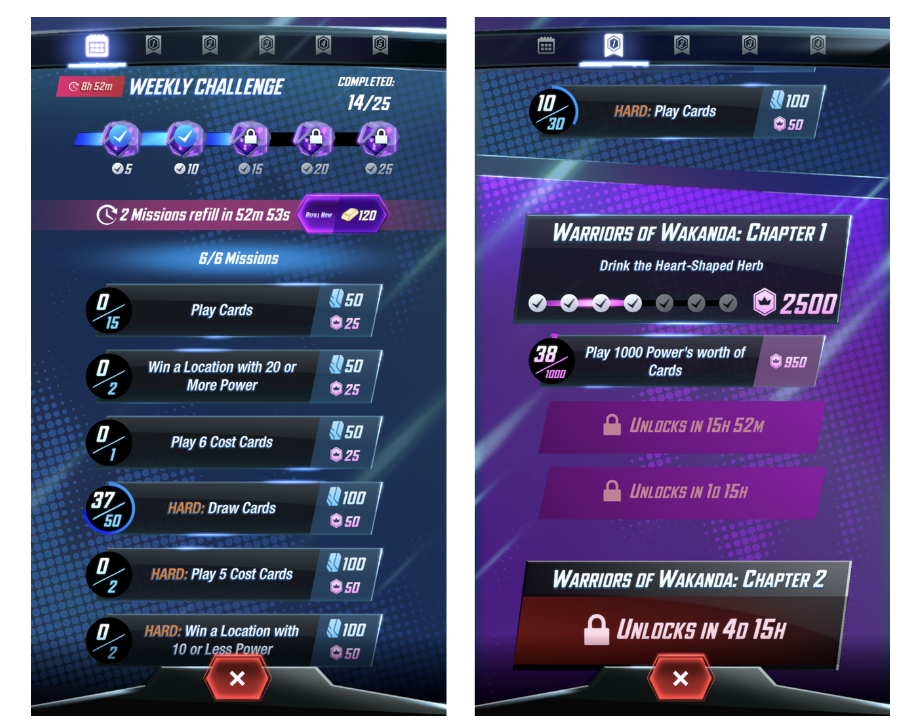

The method to acquire progression in the Pass is by completing Missions (which also grants credits). The different types of missions and their refresh timings enforce that players come back on a daily, weekly, and monthly basis:

Snap has Regular Missions (3 refreshes per day, 2 new missions on each refresh) + A weekly challenge (that requires completing up to 25 fast missions, and refreshes weekly) + Seasonal Missions which are unlocked in Chapters progressively during the whole month.

Regular Missions incentivize to come back multiple times during a day; the weekly challenge incentivizes coming back multiple days in a given week, and the Season Missions make players come back every week of the month.

We’re not sure if Second Dinner devs read our article analyzing Battle Passes, but they have taken several decisions that we highlighted as good practices, among them:

Pass progression is based on completing missions, which fosters players to slightly tweak their gameplay and decks to achieve them -- although Snap is soft on this point at the moment, providing no missions that target specific cards or skills.

Missions are unlocked progressively, fostering that players come back often. The timings provide reasons for players to come back multiple times during a day, multiple days during a week, and every week of a Season. It avoids that passionate players can devour the whole Pass too fast. And it incentivizes being early while also allowing latecomers to progress faster (as they’ll find more released Seasonal Missions).

The Pass value is immediate, granting a big valuable thing (the new card) upon purchase. This makes the Pass worth buying even if the player is not going to have a lot of time to grind, avoiding possible regrets.

Premium Pass is priced in IAP, avoiding the issue that players can farm enough gold inside to get it endlessly for free. This is interesting because during the closed beta the Pass was priced in hard currency, not IAP.

They uplift the Battle Pass revenue through a Premium+ price which already skips the first 10 levels. Interestingly, they also add other uplift mechanics like allowing tier skips and allowing to pay to refresh regular missions (a limited amount of times) to grind the Pass faster.

The list of rewards is endless, since after players claim the 50th level, there’s an endlessly repeatable “Season Cache” reward that contains credits and boosters. This means that super-engaged players always have value to grind from the Pass.

It incorporates an onboarding pass (Recruit Season Pass). This onboarding pass doesn’t have a timer, allowing newcomers to get familiarized with the basic mechanics and build a starter set of cards in a linear funnel, unaffected by seasonal content, before moving into the main game. On the negative side, the onboarding pass doesn’t have a Premium version and it’s a bit long, which means that Snap delays quite a bit the first chance to convert its users.

Monetization toolset

Summarizing, the main weapons in the arsenal of Snap are all based on accelerating the acquisition of new cards:

1 - Premium Battle Pass: The single biggest contributor to the revenue, we think. The Pass is a must-buy because it grants exclusive content and its resources and Variants are a huge progression speed accelerator.

Notice the revenue spike when the new Pass was released (the first since global launch).

2 - Credits scarcity: The upgrade process requires both credits and boosters. Snap constantly provides a lot of boosters (the biggest source is that every single match played grants boosters). But there are very limited and heavily gated sources of credit. This means that the most common situation for the player is to have more than enough boosters to upgrade cards and progress in the Collection level, but severely lack credits, which can be bought in IAP packs. Interestingly, the total amount of credits that a player can buy per day is gated, likely to avoid players spending too much in a short period of time. This is an interesting decision, which is likely harming ARPPU.

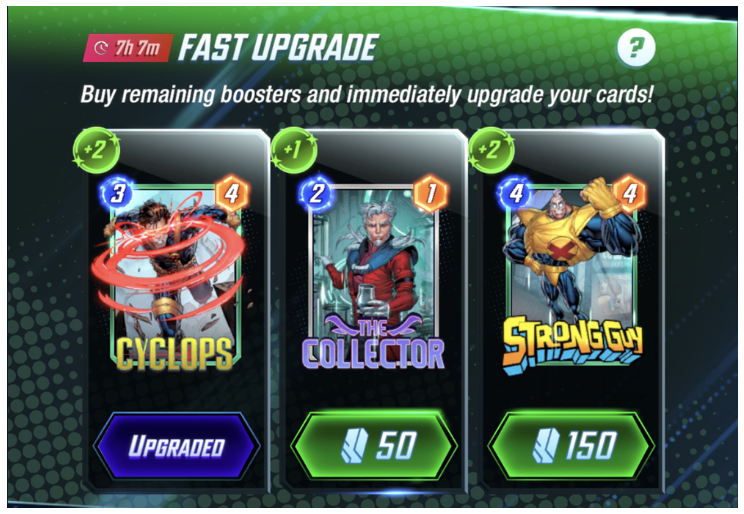

Snap accelerates the credit scarcity even more through the Fast Upgrade: A random set of three cards (refreshed every day) that can be upgraded only using credits (i.e. even if you lack the boosters).

3 - Variants Daily Offer: Likely a smaller contributor than the previous. Daily, the player is presented with a random set of 6 Variants to buy (only of base cards that are owned). On top of the cosmetic value, this is a good accelerator of progression since Variants can be upgraded independently from the base cards, for additional Collection Level points.

Variant gold prices in the Daily Offer range from 700 (~$12) to 1200 (~$20).

So what are the problems?

#1. Low Spending Depth

To put it simply, there’s not that much money that a player can spend in the game:

Small collection: Snap only features ~250 cards and grows very slowly. It also doesn’t feature a shard system that could extend the depth of the collection (by making players have to collect several shards before actually getting access to the card). For comparison, it is a fraction of the ~1.200 available at any given point in Hearthstone’s Standard format. So even if the cost-per-card in both games was the same, in Snap a player would get it all for way less money.

No gacha (no acquisition rarity): The cost-per-card is not the same between Snap and other CCGs, it's way less. The reason is that in every other CCG some cards are harder to acquire than others. For example, to get a mythic rarity card on MTGA, the player will have to open many booster packs that often grant things of lesser value and duplicates that transform into dust. So the cost of a mythic is high. Contrary to that, in Snap the cards are obtained in a linear way and players can only pay to accelerate the process. So no card is expensive, it just comes later. Without loot boxes, Snap simply can’t generate the same depth of spending to acquire specific rare items as other games. But introducing loot boxes is very complicated due to the small size of the collection and deck, since most times you’d get worthless stuff, and if there was a dust system you’d get what you wanted too fast.

Soft, linear upgrade system & weak shard system: In an attempt to maximize the spending depth, Snap forces the players to max upgrade all their cards, putting a strain on credits. This is a problematic approach:

1) Because the progression system is completely linear, Snap can’t afford big costs without stopping progression entirely or making credit rewards feel worthless.

2) It doesn’t generate a rarity system that could extend spending depth beyond soft currency costs: All shards have the same value. This is opposite to most examples of upgrade systems, which often put the pressure on the acquisition of rare shards, not on the currency

Ultra-cheap new cards: The elements that increase the spending depth the most at the moment are the new cards (1 new card per month). But since currently these new cards are acquired upfront in the Battle Pass, the price to get them is ridiculously small (~$12). And past attempts to monetize new content more aggressively (like the Nexus Event) failed. To solve this, Snap would have to achieve the hard feat of ramping up significatively the amount and release pace of new cards and increase the pressure on players to get them faster.

During the soft launch, Snap tested a Nexus event where players would buy boxes to get new cards. This caused the new cards to be extremely expensive. Players massively disliked this, forcing the devs to roll back the feature.

#2. Low Spending Pressure

There’s not that much money that players can spend in total in the game.

But also, there are actually not that many reasons to spend at all:

Limited need for new cards & no need to run: Because cards are so irreplaceable for the combos, and there’s an escalation of usefulness through the cards in the Collection Level, players do need new cards to build new decks. But it’s not like they constantly need new cards to build new decks. In reality, this may happen two or three times over the progression through the ranks. On top of that, Seasons so far do not change that much the meta, since they add very little new content and don’t rebalance the old. And the game features no liveops that could incentivize spending pressure to acquire content available for a limited time. As a consequence, the pressure to progress is fairly low, and players can afford to go a bit slower and just grind it.

Indirect and limited means to pay for progress: But even if they got desperate and wanted the best cards now, Snap doesn’t provide direct means to access them. Other than the Pass, the purchases that players can do are just accelerators that often don’t even provide noticeable value (credits for an upgrade that doesn’t even grant a new card, refreshes for a mission for a few pass progression points…). On top of that, these points to spend are fairly limited (the total amount of purchasable credits is gated, the number of available boosters caps the total usable credits, and players can buy only a limited amount of variants, fast upgrades, and mission refreshes per day).

Overall, we’ve doubts about how effective Snap monetization will be in the long run.

It seems to us that revenue holds at the moment due to a combination of excellent retention and big flows of downloads, achieved through high UA spending and novelty. Two factors cannot be taken for granted forever.

The root of why monetization is that soft seems dual:

First, a deliberate attempt to avoid non-user-friendly monetization mechanisms like loot boxes, consumable or sharded content, or liveops that generate pressure to acquire content available for a limited time or require hard currency to participate (like MTGA’s drafts or the Hearthstone Arena).

Being very user-friendly it’s great for the adoption stage. But in the long term, it is a dangerous gamble on if Snap can keep enough players engaged for years to keep performing at the current level. This has shown to be viable in mass-adoption genres like MOBA, Battle Royale, or FPS, but isn’t that clear in a niche genre like CCG where CPIs are higher.

Second, constraints caused by the gameplay itself: Such as small deck size, strong gameplay orthogonality of the cards which makes the creation of new content difficult, and lack of an upgrade system based on power.

These characteristics may make a more standard approach to monetization not suitable.

IMHO, these problems are far from a death sentence for Snap.

After all, when a game has engaging gameplay and excellent retention, it does have less pressure on monetization to make it work as a successful product.

Nevertheless, we think that Snap may have to eventually reinforce its monetization strategy to compensate for the normalization of the flow of downloads. Otherwise, it has limited chances to maintain its current revenue performance, let alone be able to grow profitably.

This doesn’t necessarily mean adding gacha systems (players would react very negatively to it, given the negative soft launch experience). Instead, expanding the methods of introduction of new content, adding time-limited events and other liveops, and game modes that would better incentivize horizontal exploration seem fairly obvious opportunities.

*Last Minute Addendum: Just a few days before publication, the devs announced the introduction of a new rotatory shop that will allow the direct purchase of cards through a new currency (Collector Tokens), that will be primarily obtained in the Collection Level and 2 new sets of cards (~22 cards).

This at least partially solves some of the issues presented above, in an attempt to improve RPD, because:

The injection of so many cards should boost monetization for a while, and seems to hint that they’re ramping up the production of new content.

The new currency partially solves the topic of sharding. It’s not shards per card, but at least allows to give partial acquisition of a new card in the Collection Level, granting this currency instead of a whole new card.

It’s more or less of a gacha, because the Tokens will be spent on a rotatory shop, so it’s not like players can go directly for the top stuff, as it may not be available. But it provides a higher degree of agency among players, therefore being better received.

It also allows devs to sell this new currency in some direct but controlled way, boosting monetization.

While this may not be a definitive solution to these issues, it points out that the team is aware of them and is moving to solve them, double time.

Conclusions

We can discuss how easy it will be for them to keep it, but the undebatable fact is that so far they’ve made it. They have an IP that can bring in many potential players, and a game that keeps them hooked to their mobile screens.

That’s a big battle they just won. But what about the war?

The real challenge going forward is if they can maintain the game at its current performance (already a challenge given the downward trend of downloads, and low RPD to be able to sustain UA for the long term). Scaling it to an even higher level seems a bit unlikely at the moment, given the low RPD.

The future of Snap will depend on if Snap can manage well their content strategy to keep current players engaged, and create and leverage enough high LTV players, by deepening the monetization, to afford to replace the ones that leave, and acquire even more.

Same as in a Snap match, the end result could go either way, and we won’t know the answer until time reveals all the cards.

Suggested Side Lectures

Marvel Snap Has Secured Success, but Has It Also Sowed Its Demise? (great analysis by @econosopher)

Is Marvel Snap’s Laid Back Monetization Working? (by Ethan Levy)

Marvel Snap global launch case study: UA, GD, Admon view (Two & A Half Gamers)

Understanding Marvel Snap’s Meteoric Rise (Naavik Newsletter)

Special thanks to the many members of the DoF community and colleagues that helped to review this and provided tons of feedback. You’re the best. In particular, I’d like to thank the great Devin Becker for helping massively in the preparation of this piece and the recollection of all the points that I explained in the article.