12 Gaming Predictions for 2026

The gaming industry stands at an inflection point. The console is set for GTA 6 size of a booster, PC is steadily growing with Steam, Roblox reaches new heights by tapping into a totally new audience, all while mobile battles the declining installs with ever-increasing monetization.

At large, the balance of power continues to shift eastward, and venture capitalists have quietly retreated from content investing, almost entirely leaving the door open for publishers to swoop back in.

Here's what’s expected to unfold in 2026.

1. The AI Bubble Pops and Resets Everything

While AI hasn’t yet had a profound impact on gaming, the (risk of) the AI bubble bursting will have a significant impact both directly and indirectly on the game industry.

The main misconception is that calling something a “bubble” means the underlying technology or asset is worthless, when it actually means the current valuations and investment levels are disconnected from present reality. The technology can still be transformative long-term, even as short-term expectations and prices collapse.

Some of the most reputable sources are highlighting the lack of actual value delivered from AI investments:

Gartner found that more than half of consumers don’t trust AI searches

A McKinsey study found that 80% of companies using generative AI have seen “no significant bottom-line impact”, with 42% of them literally abandoning their AI projects.

An MIT study found that 95% of the AI pilot projects at the surveyed big companies “failed.”

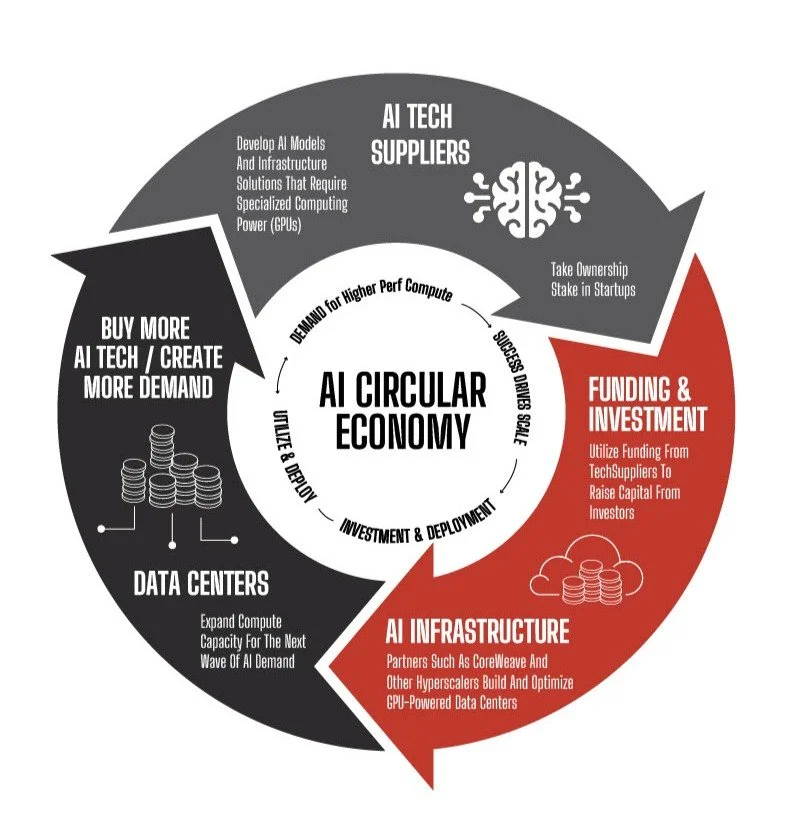

Furthermore, the “circular financing” is fueling the bubble. It’s a self-reinforcing strategy in which a company invests in its own customers to accelerate their growth. That growth then drives increased demand for the company’s products, boosting revenues and ultimately delivering a positive return on the original investment.

Circular financing is the engine of every bubble: infrastructure providers fund their own customers, who use that capital to buy more infrastructure, creating the illusion of organic demand. Sales growth attracts more investment, which funds more customers, which generates more sales—a self-reinforcing loop that looks like a thriving market until someone asks where the actual end users are.

When (if) the bubble pops and markets crash and money dries up instantly. The unprofitable AI contractors will face hard times. Most will evaporate as companies stop signing new projects and adopt a wait-and-see strategy. But a financial crash will also lead to a decrease in disposable income, which in turn will lead to a decrease in spending on games. This is what happened post-COVID, when inflation was decreasing, consumers’ indiscreet spending showed in a gaming revenue slowdown.

Long-term, AI will transform industries. Short-term, we’re due for a painful reality check. 2026 will be remembered as the year reality caught up with the promises.

2. VCs Are Out, Publishers Are In

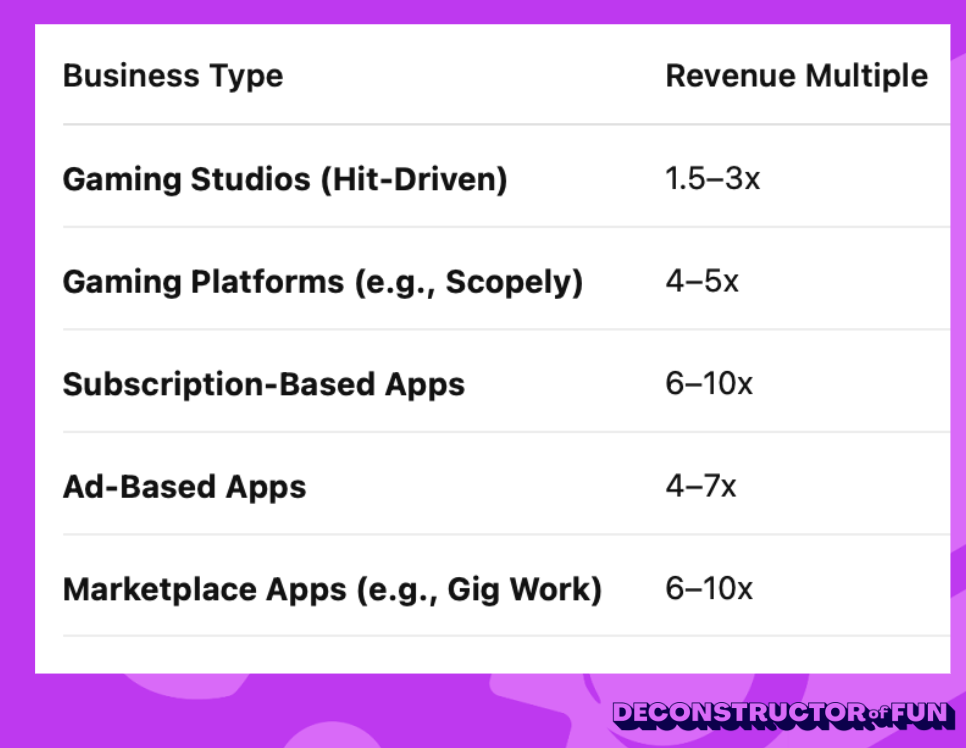

VCs haven’t fallen out of love with games. It’s the math that stopped working. As the lockdown ended, so did the gaming growth. And that’s when the acquisition multiples crashed from 10x revenue to 1.5-3x, making gaming content (game studios) a terrible risk-adjusted bet.

With most investments expected to go to zero, Venture Capital relies on backing individual companies that can return the entire fund upon exit. With multiples dropping to low single digits, investing in game studios no longer makes sense.

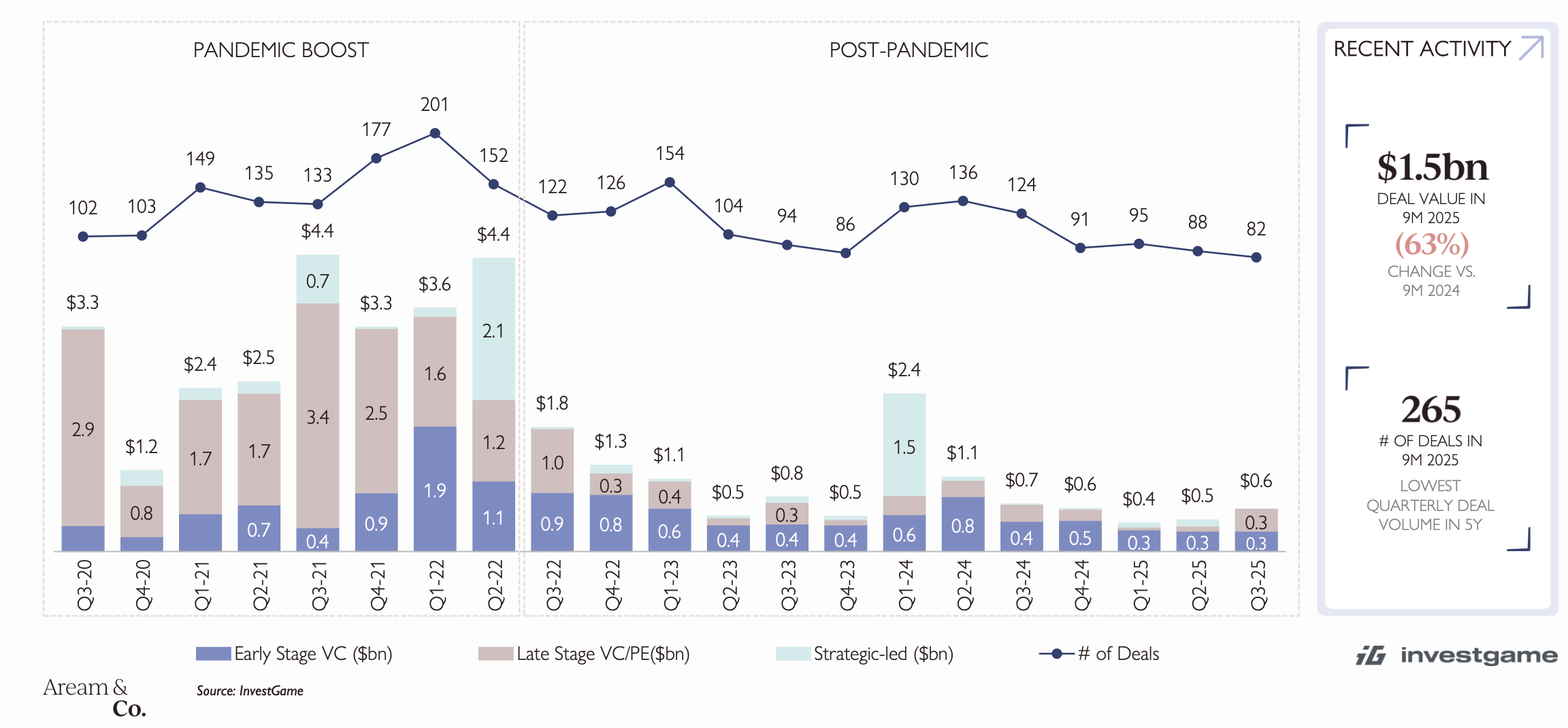

As the valuation have collapsed, so have the VC investments into gaming.

Gaming-focused VCs, who raised record funds during the COVID-infused gaming boom, have quietly pivoted away from content investment. Sure, there are some odd bets in selective geographies on super-selected teams early on. But at large, funds we used to know as “gaming VCs” are investing in interactive media, tech, tools, platforms, and apps.

VC investors exiting the playground have opened the door for other types of investors: Private Equity has been extremely active in larger late-stage investments (EA, Scopely, Dream…). While publishers have returned to funding early-stage teams. The change in investors will also push talent from mobile to Steam and apps…

3. PC Indie Accelerates as Mobile Funding Dries Up

More developers will move to Steam in 2026 as mobile becomes effectively unfundable. If you're starting a game studio and you hate C-suite, PMs, and UA (user acquisition), three cursed acronyms for many developers, you'll enjoy making a Steam game.

This shift reflects a fundamental reordering of where talent flows. Mobile used to be where you went to build a sustainable business; now it's where you go to compete with the giants for table scraps.

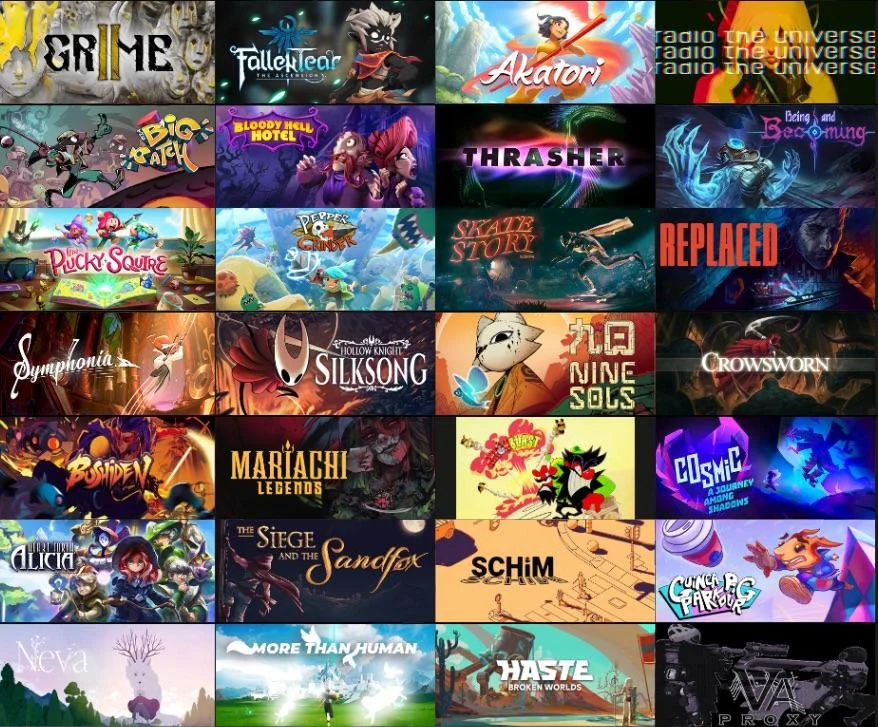

Steam offers a true low entry barrier for game developers. Indie teams of 1-5 developers are shipping great original games that dedicated pubilshers promote to ever growing player base.

Steam is far from easy, indie success rates remain brutal, but at least there's a path to breaking through based on making something genuinely special rather than optimizing match-3 meta for the thousandth time while running a brutal content treadmill that (hopefully) never stops.

4. Business-Minded Developers Flee to Apps

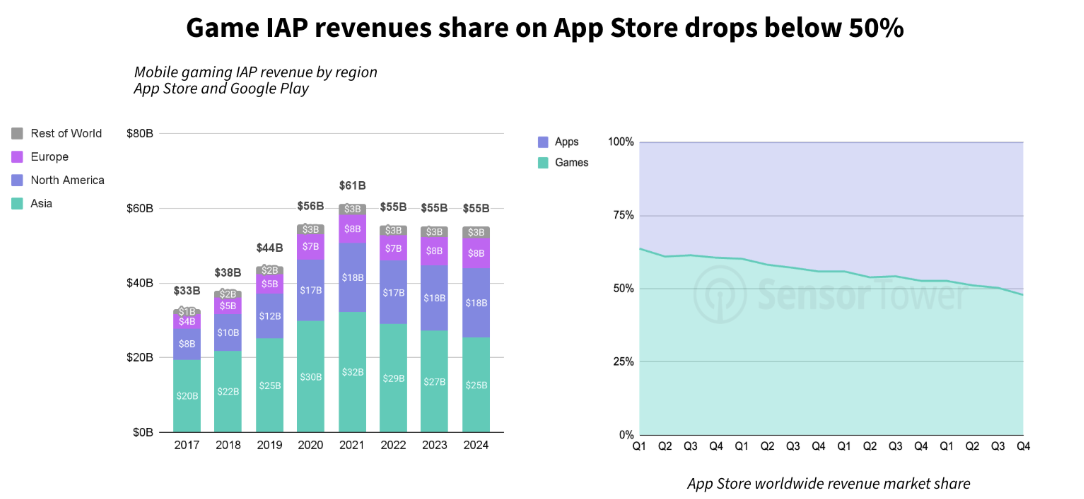

For the first time in a decade App Store is generating most of the revenue from apps, not games. And the trend is only accelerating.

Developers who actually like PMs, user acquisition, and execs will increasingly move from games to consumer apps in 2026.

The playbooks are similar, the teams operate the same way, but apps offer better funding environments and better exit multiples than gaming content. When venture capitalists tell you gaming isn't investable but will write checks for “Duolingo meets Tinder in an Uber while listening to Spotify”, smart operators follow the money.

Duolingo has had a rough year in the stock market. Despite the 45% drop in valuation, the company still boasts over 8 billion Dollar market cap. Valuations like these have shifted VCs interest from games to apps.

This brain drain from gaming to adjacent tech categories will accelerate the West's decline in mobile gaming specifically. The people who made Western mobile successful in the 2010s are discovering they can apply the same skills to better-capitalized, higher-multiple opportunities elsewhere.

Gaming will increasingly be left to true believers while the mercenaries find easier ways to make money.

5. Chinese Developers Eat Turkish Puzzle's Lunch

Turkish teams have not felt the investment crunch like the rest of the market, having received record-breaking Series A investment throughout 2025. The problem is that they've used it to create operational sameness: many of the latest games look and feel similar, the teams behind those games operate identically, and as a result, most face the same brutal $25+ CPIs to compete with Dream.

Over the past couple of years, most puzzle games from Türkiye look and feel like iterations of Royal Match. This presents a risk. Lack of differentiation means they battle for the same players and bid for the same super high CPIs.

The Turkish developers are excellent operators, undoubtedly among the best in the world. But unless Turkish studios start genuinely innovating beyond their current formula of "like Dream but slightly different," they'll find themselves steadily losing ground to incoming Chinese studios with bigger teams (hundreds vs. dozens), bigger budgets, aggressive meta innovation, and battle-tested UA playbooks.

6. Mobile Growth Stalls at 2-4% as Maturity Sets In

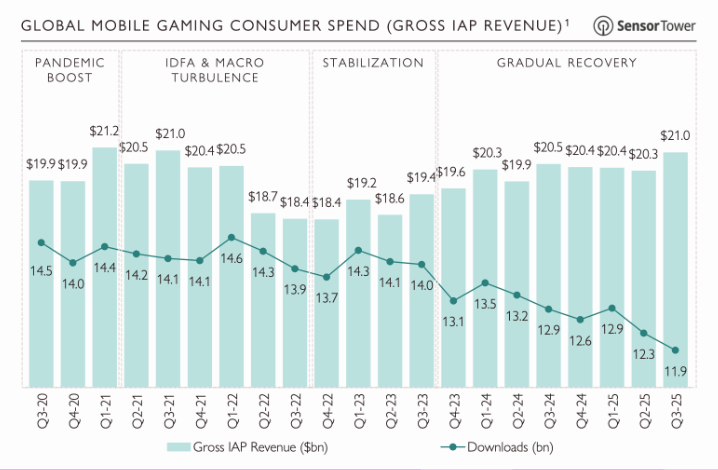

As a backdrop to the previous predictions, mobile gaming will eke out a meager 2-4% growth in 2026, with no major releases coming from Western publishers. Downloads will decline another 8% year-over-year as CPIs continue rising, forcing games to monetize ever more aggressively.

Mobile IAP revenues are near an all-time high. Yet downloads keep sliding at an accelerated speed in Q1 2023. This indicates saturation of the market. And creates a barrier to new entrants (high CPIs due to high LTVs).

But it’s not all bad across the board. Chinese and Turkish developers will continue their dominance, Vietnamese developers will emerge as the new frontier, all while Western mobile has mostly conceded the new release pipeline.

The mobile gold rush that lasted from 2012 to 2022 is definitely over.

We're in a mature market where only the largest players with sophisticated LiveOps and massive UA budgets can compete profitably. Web shops will continue shifting revenue away from app stores, making the actual growth picture even murkier. For Western developers, especially, mobile has become a defensive position rather than a growth opportunity.

7. UA Finance Gets Commoditized: Winners Emerge

Talking about massive UA budgets…

User acquisition financing will become commoditized in 2026, driving interest rates down and making capital accessible to a much wider set of studios. What sounds like democratization will actually concentrate power even further.

The winners won’t be those with the most capital, but those who can underwrite at the lowest rates while maintaining profitability. These winners will have a three-level moat:

Cheaper access to capital than competitors

Highly sophisticated data platform for underwriting decisions with extreme confidence

Access to game performance and MMP data at scale across a vast range of studios.

The companies that crack this formula will effectively become the new kingmakers of mobile gaming. They’ll be able to cherry-pick the best opportunities, offer terms that marginal competitors can’t match, and build proprietary datasets that create compounding advantages in underwriting accuracy. Everyone else will either get squeezed on margins or forced to take increasingly risky bets to generate returns.

Think of it as the difference between a local bank and a modern credit scoring system, except the local bank is competing against an AI that’s seen the complete financial history of thousands of similar borrowers.

The irony is that as UA finance becomes more accessible, the actual power dynamics become more concentrated than ever.

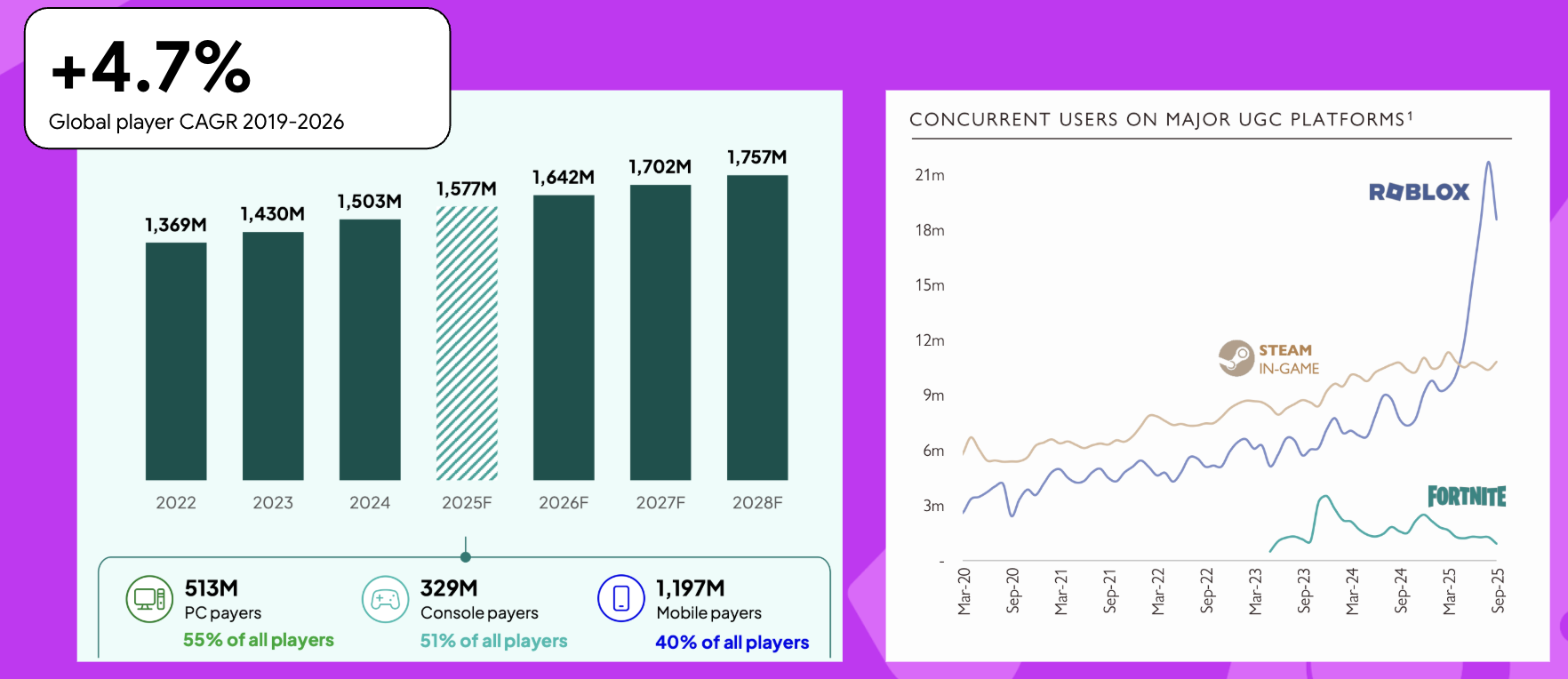

8. First $100M+ Roblox Studio Acquisition

The logic is simple: Roblox captures hearts, minds, and wallets of the next generation of gamers. Getting access to this audience is vital for major IP holders. And even though the games on the platform look extremely simple, it's functionally impossible to make a successful Roblox game if you're not Roblox-native.

This prediction will seem absurd until it happens. And you might assume that work-for-hire will continue to prevail as the operation model, but consider this…

Roblox published a brand portal, making it easier for companies to work with brands. Top Roblox games generate massive revenue, and premium developers are scarce. When a major IP holder gets real traction with a top studio and realizes they need to lock in that capability, not lease it project by project. The acquisition math suddenly makes sense.

This acquisition will kickstart a mini gold rush of investors funding Roblox-native studios. And that’s awesome for the industry, and for Roblox.

9. (First) Steam Machine Launches with a Thud

Valve dominates the distribution of PC games. Their expansion into hardware can be described as incremental. Over a decade, they will capture a significant portion of the hardware market. But these first devices don’t pose a risk for the incumbents.

Valve’s Steam is the face of PC gaming. And it makes all the sense for them to continue to expand their hardware offering as they already largely dominate distribution.

The company has previously released a handheld console, the Steam Deck, which has sold around 4 million units since 2022. This converts to around $4 billion in nearly 4 years. That is considerable revenue, albeit it pales in comparison to Valve’s annual platform revenue estimated at $16 billion, and with considerably higher profitability.

It is expected that the Steam Machine will arrive to fanfare from Reddit and disappointment everywhere else. The fundamental problem: it can only play about 15% of the games, generating meaningful revenue on Steam. With RAM costs rising sharply, the price point will be even less competitive than before. Expect sales under 2 million units, which is a rounding error in the console market.

The first version of Steam Machine will be a fun miss and warning shot for established hardware manufacturers of the next version that is much more likely to hit…

10. Xbox Announces Another Major Restructuring

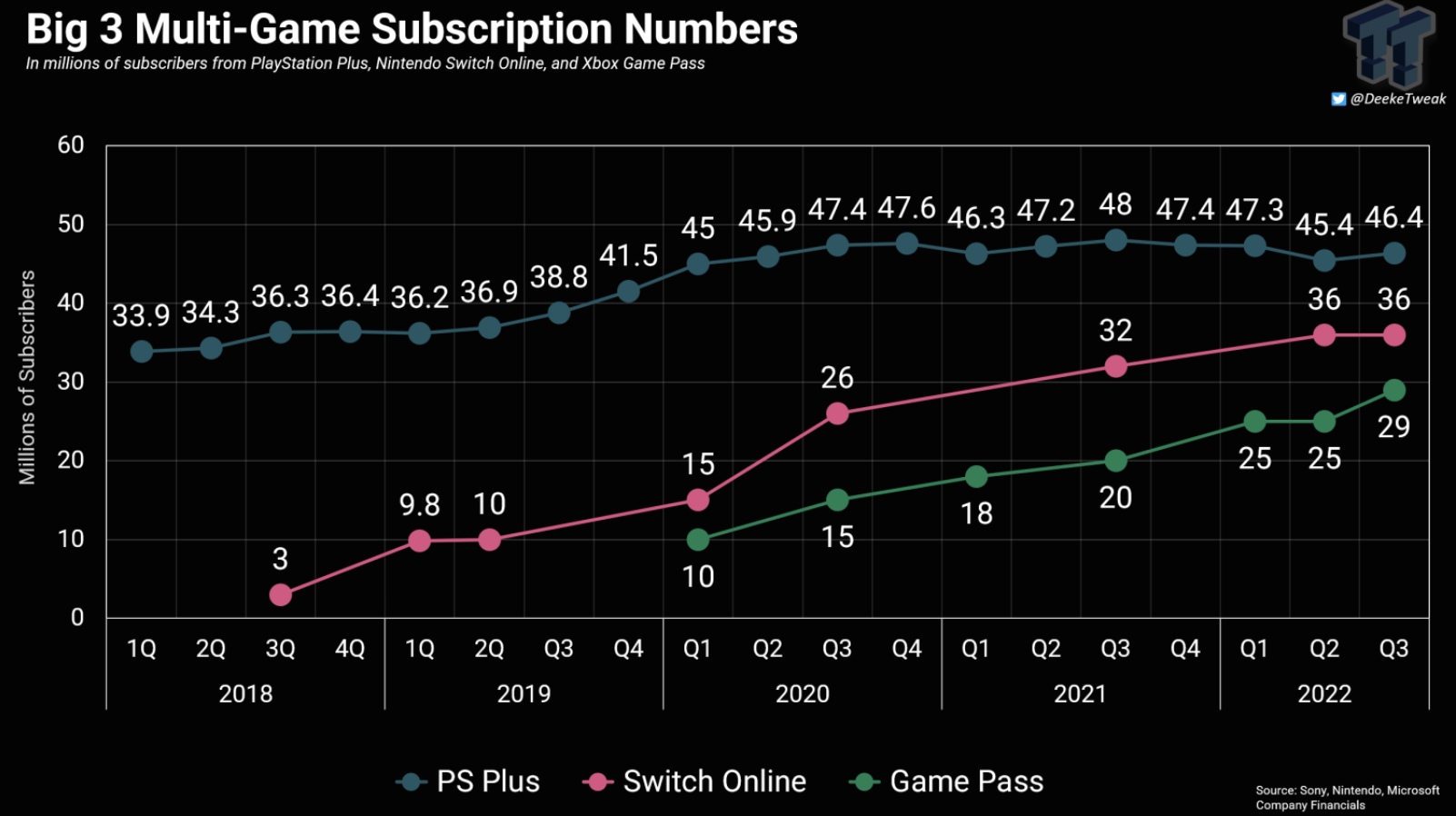

Microsoft will continue to announce significant layoffs and at least one round of restructuring as it continues digesting its massive Activision-Blizzard acquisition while looking at the Xbox Game Pass subscriber growth that significantly lags projections.

Xbox Game Pass subscribers may have broken 35 million (according to a LinkedIn post of an Xbox Program Manager).

This number included the transition of Xbox LIVE Gold members being recognized as Xbox Game Pass Core subscribers. The number, if true, is not only lower than what rivals Nintendo and Sony have but also significantly lower than the goal of 100M subscribers that greenlit the project at Microsoft.

image: tweaktown.com

The post-acquisition integration hasn't delivered the expected synergies, holiday hardware sales were weak, and third-party software sales continue their downward spiral. Profitability is becoming a serious problem.

Xbox has lost the hardware war to Sony, failed to build a compelling first-party lineup despite an impressive string of massive acquisitions, and hasn't been able to keep the Game Pass subscriber numbers growing. Another restructuring won't fix the fundamental issues. Unfortunately, there’s no quick fix in sight.

It wouldn’t be surprising if Microsoft decided to divest from gaming altogether. Though that won’t likely happen in 2026.

11. Sony Unveils a Handheld and Continues Dominating

Sony will announce a proper handheld device to complement the PlayStation 5, and they'll continue their dominance in North America and Europe throughout 2026. With GTA 6 launching exclusively on current-gen consoles, Sony is positioned to capture approximately 75% of that windfall, translating into sustained hardware momentum through the year.

Eleven months on from its U.S. launch, an estimated minimum of 420,000 units of PlayStation Portal had been sold in the country making it the best-selling accessory in dollar sales for 2024 in the US market.

Sony has learned from both their own PSP/Vita experiments and Nintendo's Switch success. A handheld that seamlessly integrates with the PS5 ecosystem, plays actual PlayStation games, and arrives at the right moment could finally give them the portable presence they've always wanted. Meanwhile, Xbox's continued decline only strengthens Sony's position as the default choice for core gamers.

12. GTA 6 Drives Console Double-Digit Growth

And finally, the most likely prediction of them all: GTA 6 will be the biggest launch in gaming history, driving double-digit console growth in North America and Europe.

GTA 6 is rumored to have one of the highest development budgets ever, with estimates ranging from over $1 billion to potentially $2 billion, making it the most expensive game produced, surpassing even GTA V's ~$265 million and RDR2's ~$540 million budgets. Add hundreds of millions in marketing, a live service model in form of GTA Online and you’re still looking at one of the most successful investments ever.

The game will sell consoles, boost software attach rates across the industry, and set records for sick days taken, divorces filed, and DoorDash deliveries ordered. More importantly, it will juice the entire console ecosystem just when hardware sales had cratered to unprecedented lows.

The only downside is timing. Launching late in 2026 means most of the benefit won't flow until 2027. If Rockstar had shipped in May, it would have carried the entire year. But even launching in Q4, GTA 6 represents a generational tide that lifts all boats. Sony will capture 75% of that wave, cementing their console dominance. Microsoft will get a temporary reprieve from its Xbox death spiral. And the industry will remember what a true blockbuster can do.