2022 Predictions #1 The King is back, Merge overheats and Hypercasuals falter

This analysis is written by Laura Taranto, Niek Tuerlings, Ahmetcan Demirel, and Michail Katkoff. Opinions shared are personal and do not reflect those of their employers.

Summarizing an entire year of mobile gaming while providing predictions for what is going to happen next is a challenge that we at Deconstructor of Fun undertake every year. What we believe separates our market analysis from other great ones you have read is that the predictions are written by professionals working in gaming studios around the World and strengthened by feedback from our nearly thousand people-strong community of game industry veterans.

This report wouldn’t be possible without the help from our friends at Sensor Tower. An essential data platform for all mobile gaming studios.

Data from China, Korea, and Japan are excluded as this analysis focuses on Western markets only. This is because we don’t want to reduce the actionability of the data with games that succeed massively in what can be described as closed domestic markets. Finally, please take the numbers presented with a giant grain of salt. They are meant more for trend analysis based on estimations, rather than an exercise of accuracy.

From our sponsor:

With Luna elements, you can produce amazing creatives in minutes. And the more creatives you test, the higher your chances of success. So don’t let small things like not knowing how to code interactive creatives cap your UA output. Get control over your creative strategy by signing up at lunalabs.io, so you can start scaling up today.

The Macro-Level View

As we know, 2020 was a year of unprecedented growth for mobile games. Downloads grew by a whopping 36% and revenues followed suit with 31% growth. In 2021 Apple’s privacy-related actions made user acquisition significantly more difficult in H2. Despite that, the downloads stayed stable at an all-time height of 53B while revenues continued to break records with 17% growth.

We report gross revenue (including the cut for Apple or Google). Android estimates do not include third party stores.

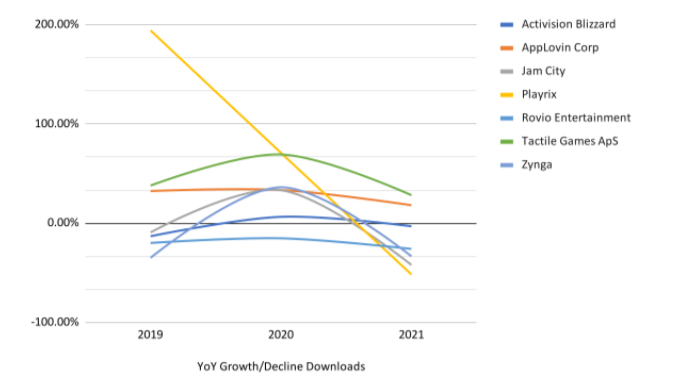

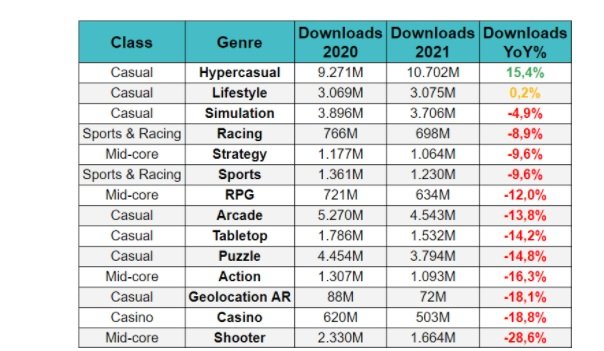

We predicted that it would be the game genres that rely on whale monetization that would suffer the most in the post-IDFA era. What happened is that all categories in the Western markets declined in terms of downloads while the revenue growth continued. Both Casino and Mid-core games saw a considerable drop in downloads that will likely reflect in the revenues of these categories during 2022. Sports games declined largely due to big IP racing games (ex. Mario Kart) failing to sustain the initial download numbers.

While the growth of IAP revenue continued strongly, all categories saw a decline in downloads. In fact, there are very few genres that experienced growth of installs in 2021. Hypercasual games were the only impactful one worth mentioning at 15% YoY growth.

We report gross revenue (including the cut for Apple or Google). Android estimates do not include third party stores.

What is notable is the number of games that entered the market in 2021 was the lowest in 10 years. Lockdowns for sure played a large role, since making new games with remote teams is simply harder than when working on-site. A big part of soft launch is figuring out the game’s scaling potential by improving marketability. The new limitations limited the speed of campaign iteration.

2021 saw the least amount of new games entereing the market.

Yet for games that launched and scaled it took only 6 months to reach the top 100 grossing list in 2021. That’s two months faster than a year before. Overall, over 30 new games were able to break the top 100 in 2021, which is a considerably lower amount than in 2020 when 42 games did the same feat.

The market became more top-heavy in 2021 with 65% of all in-app purchase revenue going to the games in the top 100. At the same time, last year's games that crossed $10M in net revenue continued to grow.

Casual Games in 2022

In our taxonomy, built together with Sensor Tower, the casual games category is divided into seven genres: Puzzle, Hypercasual, Arcade, Tabletop, Simulation, Lifestyle, and Geolocation. These genres are then further divided into sub-genres allowing you to compare similar games (in terms of features and to some extent audience) to one another.

As a whole, Casual Games stand for 80% of all mobile game downloads and 35% of In-App Purchases. What is not visible in the graph below is the considerable ad monetization revenue. Hypercasual games alone are estimated to generate $3.4B in ad-monetization revenue. For example, in our conservative estimation Word- games generate at least double the revenue when ad monetization is counted in.

We report gross revenue (including the cut for Apple or Google). Android estimates do not include third party stores nor ad monetization revenue apart from Hypercasual games.

Chinese, Japanese and Korean revenue data is excluded to make the data more relevant for publishers operating outside those largely exclusive domestic markets.

As a whole, the growth of the Casual Games category in 2021 generated 17% more in in-app revenues (excluding China, Japan, and Korea), while the overall mobile games market revenues grew 14%. While the double-digit growth is impressive, it’s nothing compared to the year before 2020 when the category boomed by a whopping 36%.

When it comes to downloads, casual games were downloaded 33 Billion times, which despite the astonishing number is just a tad less than a year ago. The downloads for the mobile games market declined 5%. And to be even more accurate, Hypercasual games was the only genre that continued to grow in terms of downloads last year.

The fastest IAP revenue growth (+42%) occurred in the Tabletop Games genre. The growth was across the whole genre with honorable mentions going to Playtika’s Solitaire Grand Harvest ($53M, +56% YoY), Yalla Ludo from Yalla Technology ($49M, +187% YoY), Solitaire Cruise Tripeaks from Applovin ($34M, +504% YoY) and Dice Dreams from Superplay ($18M, +1446% YoY)

Hypercasual games increased in-app purchase revenue by a respectful 26% while Puzzle games, the second-largest genre on mobile after Strategy, continued to grow at a market rate of 15% year-over-year. Noteworthy in the Puzzle genre is the Other Match-3 sub-genre that grew 90% with games Match 3D (AppLovin) and Zen Match (Good Job Games). This is perhaps the most interesting puzzle genre as seemingly every year there’s a hit game that has some kind of a new twist to the puzzle gameplay.

The Simulation genre was propelled to 14% growth by the seemingly unstoppable success of Roblox as well as the rise of Family Island after the developer Melsoft was acquired by Moon Active.

Meanwhile, Interactive Story games went down (-22%) due to the decline of all three main franchises: Choices, Episode and, Chapters. Drawing and Coloring games also declined as platforms clamped down on the misleading subscription selling.

Puzzle Games

The King is Back

As we analyze all the various sub-genres of Puzzle, here’s a little cheat sheet with each sub-genre and a reference game in the sub-genre.

Just when we thought that looming lockdowns and hazmat suits were going to be a memory of 2020-2021, enter 2022. We’re starting the year strong with continued masks, work-from-home orders, and social distancing. If one thing can be predicted, it’s unpredictable.

The lifestyle changes of 2020 saw an increase in people becoming players and downloading games to likely pass the time at home. We saw a 30% increase in downloads from 2019 to 2020 and a similar increase in revenue over the same timeframe. This year, mostly due to the consequences of the changes to IDFA, but potentially to a lesser degree due to the small bouts of freedom from restrictions and a pent up desire to travel/adventure/leave the house from the year prior, we saw installs shrink by about 15% YoY. Revenue, on the other hand, still grew YoY, just not as much as the year prior (17% vs almost 30%). There are less new players but Puzzle is monetizing them better, some games and publishers more than others.

Top 20 in 2020 vs 2021 and Notable New Games

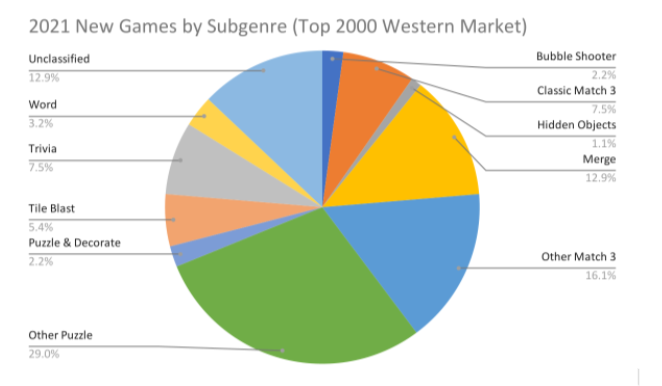

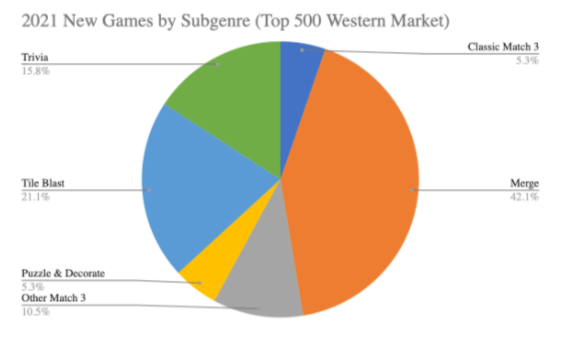

Outside of Merge, 2021 felt a bit empty with respect to new puzzle games. Looking at the top 2000 Puzzle games, about 140 were new (or did not have a ranking the year previous).

While there were a few notable 2021 releases including Good Job Game’s Zen Match, Rovio’s Angry Birds Journey and Supernatural City, Wooga’s Switchcraft, Fusebox’s Matchmaker: Puzzle and Stories and Qiiwi’s MasterChef: Match and Win - Puzzle and Cook, none of these are big enough (yet) to break into the top 40. This is a difficult feat, to be fair.

Only 2 games have broken into the top 10 puzzle games in the last 4 years: Royal Match (full deconstruction here) and Project Makeover. Aside from these unicorns, the games in the top 10 remained relatively static. This is expected behavior, however: once a game breaks into the top 40, it will generally stay within 10 rankings.

The range of movement increases the lower the rank, so if a puzzle game can put in the work (live events, feature updates, and UA) they are likely to stay pretty much where they are. Of the new games mentioned above, Zen Match’s revenue growth is impressive, especially within the Other Match 3 subgenre, but it still needs to grow 10x to break into the top 10.

Puzzle Subgenre’s Movers and Shakers

Puzzle & Decorate is still the dominating subgenre with 36% market share and revenues are up by $328M (+15%) to $2.46B. Nearly 60% of P&D revenue is attributed to Playrix and their top 3 games, Homescapes, Gardenscapes, and Fishdom. However, their growth YoY was not the reason for the subgenre’s gain, in fact, Homescapes and Fishdom had modest growth YoY, while Gardenscapes shrunk. The true award for YoY growth goes to AppLovin’s Project Makeover (+$241M) and Dream Game’s Royal Match (+$164M).

Classic Match 3 follows as second with a 29% market share, reaching $1.9B from $1.6B. King’s portfolio is leading the subgenre with a 70% market share and the majority of the growth is driven by Candy Crush Saga and Candy Crush Soda Saga. Candy Crush Saga launched in 2012 (turning 10 this year), and has grown almost 50% in the last 3 years. While AB’s new casual game pipeline has been less than stellar, its ability to optimize games is impressive. Zynga’s Harry Potter: Puzzle and Spells, while just under 5% of the 2021 revenue share, also deserves a call out due to its 280% growth YoY.

Smaller but still mighty, both the Merge (+17%) and Other Match 3 (+11%) subgenres had double-digit growth in 2021. In Merge, Evermerge and Merge Mansion grew the market while Merge Dragons and Merge Magic took a big hit. In Other Match 3, Rovio’s Angry Birds Dream Blast was coasting ahead nicely since 2019 as top-ranked by revenue, without anyone tailgating. It seems they got too comfortable as their 2020 50% revenue share has dropped in 2021 to under 30% due to entrant’s Match 3D (AppLovin) and Zen Match (Good Job Games). I wouldn’t be surprised if we saw more changes next year dethroning ABDB from the top.

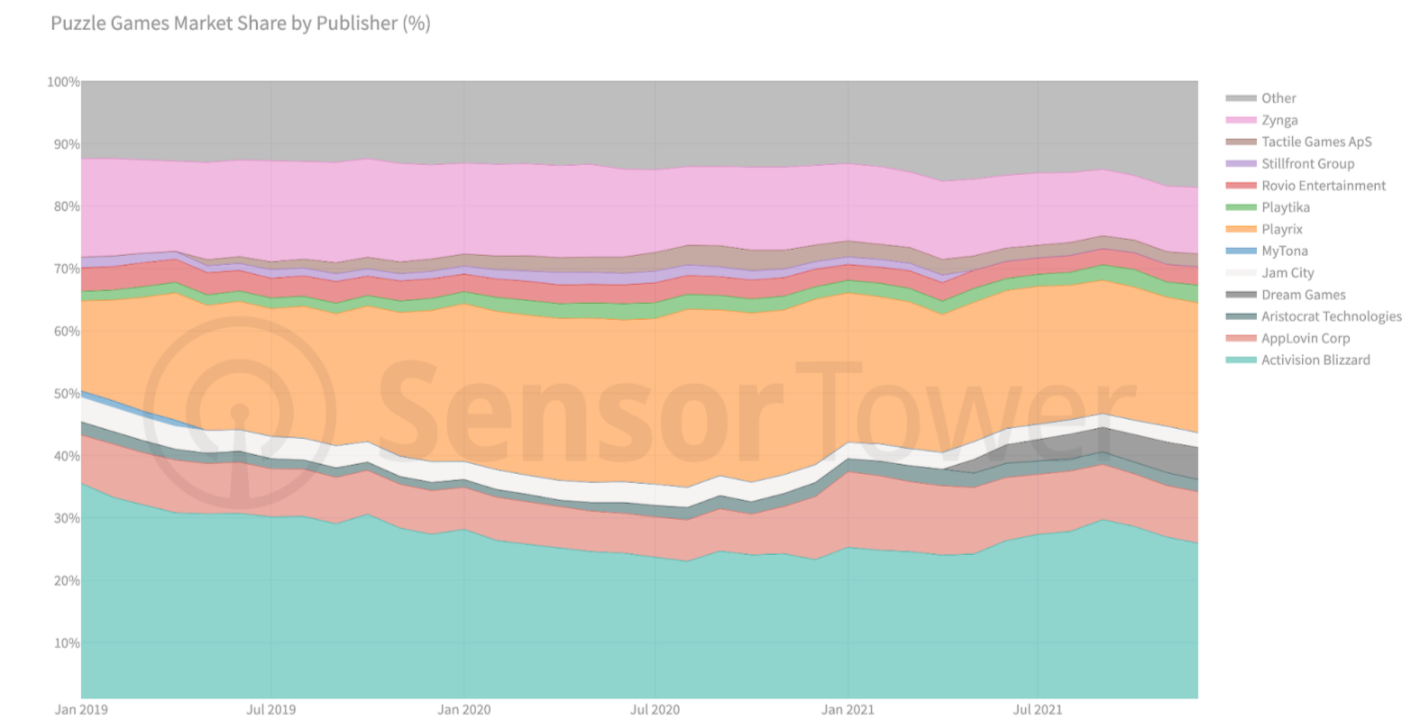

King vs. Playrix - The Two-Horse Race

Every year, Playrix and ABKing are neck and neck in the race to be a top Puzzle publisher. In 2020, Playrix ousted ABKing as top publisher by Western revenue only to be outdone in 2021, returning to second place. The pressure is high as a poorly performing feature or change in privacy legislation can be enough to turn the tide. In 2020, Candy original shrunk by 2% YoY, while Soda and Farm grew about 15% and 18%, respectively.

This past year, all 3 of ABKing’s top titles grew, with Candy growing almost 40% YoY. Playrix, on the other hand, did not see as much growth from its top titles, but from its smaller games, namely Manor Matters (Hidden Object) and Farmscapes, which wasn’t enough to topple King again. Even though Zynga’s Harry Potter: Puzzle and Spells saw massive growth, it wasn’t enough to counteract the rest of Zynga’s portfolio’s decline.

AppLovin’s game collection is large, especially compared to AB, Playrix, and Zynga, so it’s natural to expect to see a bit more growth. Matchington Mansion, their highest-earning title in 2019, has been in decline but Project Makeover, which launched in 2020, has more than been making up for it. While Match 3D grew 5x in the past year, it is still not big enough to compete with its top 2 games. Let’s see whether AppLovin doubles down in Match 3D or uses it to spin off an inspired game with a more immersive meta.

IDFA. We all knew it was coming. There was debate about how much it would affect specific publishers or genres, as to how companies did their targeting was obfuscated. Indeed, in a post-IDFA-change world, the lucky still had growth, just not as big as the year before; the less fortunate had a modest decline (aka no growth).

Playrix, was seemingly an outlier, as their installs dramatically fell off a cliff - a 50% cliff. In their top scapes titles, the number of creatives used in advertising decreased significantly starting from May. Looking across installs by platform, Android installs took a bigger hit than iOS. YoY, Android installs dropped by 56% from 482m to 215m meanwhile iOS installs suffered by 23% (108m to 84m). Android prices soared with every publisher shifting their UA onto that platform, likely driving out some developers, and we assume there was a bit of inactivity, post-change while figuring out how to proceed.

Hypercasual Games

IDFA led to consolidation and extension to new genres

On a high level, Hypercasual seems to be chugging along despite the deprecation of IDFA. In 2021 the genre reached 13 Billion downloads and $3.4B in total estimated revenue (IAP + IAA). This is a 15% increase compared to 2020. At the same time, the IAPs in the genre increased over 50% indicating the trend of hybrid-monetization we’ve been talking about for the past years.

It’s been a while since Hypercasual became a genre that was big enough for the mobile gaming business to talk about. Although this was the case, most people looked at Hypercasual games and the whole Hypercasual ecosystem like a “phase” that was going to collapse at one point. The reason, of course, is that the look and feel of those games were inferior to other games on the market according to the general expectations from mobile games. So, when COVID-19 fueled the entire gaming business throughout 2020, Hypercasual was expected to be affected the most by the world returning back to normal in 2021 because of having games that mostly rely on the number of downloads with ridiculously low LTVs.

However, having a ridiculously low LTV also means having an equally, or even more, ridiculously low CPI which brings a lot of downloads along with it! At the end of the year 2021, the year that followed one of the biggest surges in mobile gaming, Hypecasual was the only genre that grew in downloads with a 15.4% YoY growth.

The only other genre that didn’t show a trend of decline was Lifestyle (games like Toca Boca, Design Home, and Beatstars) which increased its total number of downloads by 6 million.

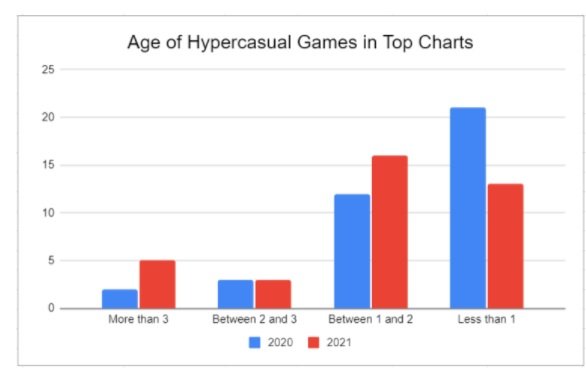

However, there is a “dark side” behind this increase which we actually predicted in our 2021 predictions that would happen: The number of new games that became successful in 2021 decreased compared to that number in 2020 while older games continued scaling and acquiring users.

The Hyper Consolidation

One of the most prominent aspects of the Hypercasual genre is the fact that it has a lower entry barrier. It is used almost as a selling point by publishers and developers to attract talent in order to continue their growth. This is true that a lot of game studios around the world owe their start in mobile gaming to Hypercasual games: They started with only a few people by prototyping fast which turned into games that gained hundreds of millions of downloads (although published by someone else).

Nevertheless, when we look at how the market shaped up during the last year, it seems that those publishers and developers who were in the party early started dominating others who joined it relatively late. Out of the 100 games that were downloaded the most throughout the year, 38 games fell under the classification of Hypercasual in 2020 while this number stayed almost the same with 37 in 2021. Although this might tell us that nothing really changed, the age of those games tells the story of Hyper Consolidation of Hypercasual.

Hypercasual games lanched in 2021 didn’t have the same impact as those in 2020. The impact would be even more radical had IDFA depreciation been instituted and enforced earlier in the year.

The most downloaded Hypercasual games in 2020 were mostly games that were published in that year: 21 of the 38 were less than a year old while 12 were between one and two years old. When we look at the same classification for those games in 2021, only 13 of the 37 were less than a year old while 16 were between one and two years old. What this means is that older games are now able to rescale and continue having lots of downloads more efficiently. This is not surprising or a new thing for people who follow the download charts closely. Especially for the second half of 2021, fewer and fewer new games saw the light of top 100 download charts while older games reached and stayed there comfortably. New games and new developers who are supposed to have a low entry barrier are actually faced with the wall of IDFA deprecation. The lack of targeting caused the increase of CPIs which is a certain killer for a new game.

Finding the Players

The IDFA deprecation hung over the whole mobile gaming business like the sword of Damocles. Everyone knew something terrible was happening, but nobody knew what that exactly was and how to react. Ultimately, this was a certain limitation on targeted advertising which would affect every person not just in mobile gaming, but mobile apps in general. The implications of this in Hypercasual resulted in developers and publishers playing the kids’ game “Where’s Waldo?” when trying to acquire users to their new games.

Before the IDFA deprecation, the players, who would be willing to download a certain game, were highlighted and shown with huge billboards. It was obvious where the player was and new games were able to find their target audience with competitive CPIs in no time. Of course, this helped those games to be profitable in the short term and continue scaling in the long term in order to acquire more and more users.

After the IDFA deprecation, on the other hand, new games had no idea where their player was. They had to make random guesses and hope that they were right the first, second, or third time. Otherwise, the CPIs would already be way more than their upper limits which cause the certain death of yet another Hypercasual prototype.

Before IDFA depreciation, games were able to find their target players from the crowd. Apple’s privacy-related changes made this much more difficult. Given that hypercasual games monetize via ads that promote other games, the IDFA depreciation is a significant risk for the whole genre.

When it comes to games with a pre-existent user base, they would have already found their channels to acquire players at competitive CPIs. This doesn’t mean older games weren’t affected by the IDFA deprecation, but their loss was smaller compared to more recent games which led to them having a stronger position after the change. That’s why it got harder to make new games as profitable and popular as older ones.

So, when we look at the download increase in Hypercasual and the number of Hypercasual games that were downloaded the most, we would only see the tip of the iceberg. That growth in downloads might be affected by the increase in the number of Hypercasual games in total, but the well-known Pareto Principle can be seen here, too. The most downloaded Hypercasual games (i.e., the most profitable ones) were games that have already been there for more than a year.

The “Squid Games Effect”

If you are no longer able to target your players, but still have to find low CPIs; what else is left for you to do? The best thing to do in such a scenario is to increase the breadth of the audience so that the chances of finding preferable players increase. So, that is what the Hypercasual world has been doing especially for the last 6 months. Previously, we mentioned the rise of trend-based Hypercasual games in the Deconstructor of Fun Newsletter when games that were, to say the least, inspired by Squid Games took over the top download charts.

Following certain trends has always been the Hypercasual way of game developing, but what has been happening for the last 6 months is something a little more than that. Trends in Hypercasual used to mean certain mechanics and themes that were proven to be successful such as ASMR mechanics or fashion themes etc. However, after the IDFA deprecation, these trends didn’t suffice for Hypercasual developers to speak to larger audiences. What they needed was short term trends that were easily recognized by everyone which would lead to higher IPM (installs per 1000 impressions), hence, low CPIs.

This inspired Hypercasual developers and publishers to go after games that depended on the popularity of challenges and TV shows. Games that were based on the “Pop it Challenge” or the “Milk Crate Challenge” easily reached number one in the download charts. Of course, the Squid Game-inspired games had a massive impact the same way Huggy Wuggy themed games are having now.

Challenges and TV show/pop culture trends helped Hypercasual’s post IDFA struggles.

This trend of following short-term trends, in turn, created very short-lived games even for the Hypercasual genre. Most of the successful games in the space could see hopeful retention metrics for D14 if they played their cards right and produced enough content.

When you have a game that can keep some of its players even after the first two weeks, it gets easier to spend a little bit more to rescale it so that new users can join your large user base. However, when the game in discussion is a trend-based game that depends solely on the popularity of its theme, it is really hard to find a meaningful retention number even after the third day. Of course, when a game cannot survive without the popularity of a TikTok challenge or a pop-culture element, it is impossible to completely rely on it even when it first gets published. The developers of the Squid Game-inspired games will say the opposite by claiming they can rescale their game when the second season gets released; but it still relies on the popularity of the show, not the attractiveness of the game itself…

Gotta Spend That Money

For the last couple of years, Hypercasual publishers started acting as consolidators who acquire game studios. Voodoo had already acquired or invested in a couple of studios in 2020 which then was followed by Rollic’s series of acquisitions of Turkish Hypercasual developers.

Lately, Homa Games joined the party by making an acquisition shortly after announcing their $50 million Series A investment. What all this indicates is that Hypercasual publishers no longer want to serve only as mediators who are responsible for publishing, but as parent companies who own every part of the games they publish.

It seems like an efficient way of growing their business because building an internal developer team while also continuing their publisher duties is hard for any publisher. Therefore, when they see a team that is capable of producing hits continuously, spending a little bit of money upfront for continuing their growth in the long term doesn’t really feel like a risk. Besides, any publisher working with a developer already gets only a certain percentage of the profit of the games published, so it makes more sense to acquire those teams that are going to produce games that will make a profit in the future.

Hypercasual publishers seem to like investing in developers.

What this acquisition spree brings with it is another selling point for Hypercasual publishers: If you be a nice developer, one day you can be acquired. The fact that small studios can still produce games which with a considerable amount of profit increases the competition of the market. It is no longer enough for a publisher to offer a bulky contract and assure the cooperation of a studio. We’re living in a world of M&A and everyone wants a piece of it! So, Hypercasual publishers try to utilize this opportunity to convince developers to work with them and have a competitive advantage in this red ocean of post IDFA.

While we see the acquisition of Hypercasual developers, those publishers didn’t stop there and diversified their portfolio more than ever! 2021 saw the rise of casual puzzle games produced by Hypercasual publishers who wanted to have variety under their store accounts.

The three publishers mentioned above all took steps in this direction as Voodoo invested in casual puzzle game developers, Rollic already has a couple of merge games published, and Homa announced that they would go beyond Hypercasual. In addition to all this, Lion Studios published their merge game in 2021 as a part of the Merge-Mania.

However, the most important step into the casual puzzle world was taken by a long-lost Hypercasual publisher: Good Job Games. The Turkish Hypercasual publisher, who took the top download charts by storm in 2019 but fell short of such significance in 2020, proved that those who adapt eventually win. Zen Match which was first published on Android was taken live on IOS in the July of 2021 and quickly took its place among the top-grossing games. Good Job Games, which were among the few publishers that didn’t grow in 2020, certainly made amends with their casual puzzle game which seems to stay as a top-grossing game for the months to come. Meanwhile, Voodoo and Homa already started working towards making blockchain games, which is quite the leap from their current portfolio.

Merge Games

Arguably the hottest subgenre after the evergreen and perpetually growing Match-3 segment are Merge games. With a 19% YoY growth in 2021 from $271M to $322M, these games have been doing very well for themselves. The top 10 of all merge games in 2021 looks like this:

Given that in 2021 seemingly everyone and their mother were starting projects to develop a Merge game, unsurprisingly only a select few newcomers managed to reach the top 10.

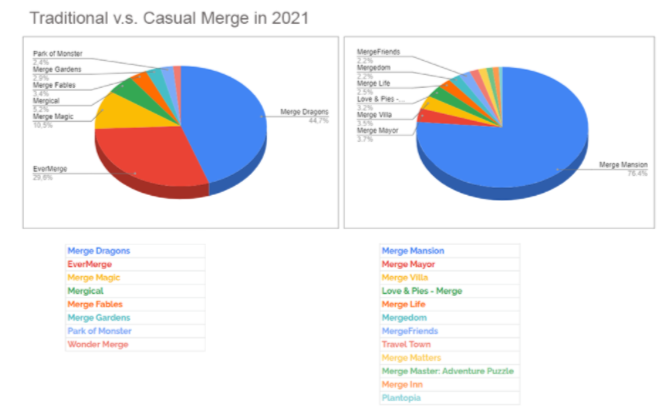

Nine games in the top 10 have the well-known, traditional Merge-3 mechanic we know from undisputed king ‘Merge Dragons’. Total revenue for games with this loop has increased slightly by ~10% YoY in 2021, even though the number of downloads has steeply decreased. This growth is mainly thanks to EverMerge (247% YoY), Mergical and newcomer Merge Fables saving the day while Gram’s isometric kingdoms of Magic and Dragons declined. Regardless, Merge Dragons still leads the race with almost 45% market share on its own.

The marginal growth in this segment can mainly be attributed to one game in the top 10, now sitting in 3rd position. It is the only game that uses the new, more casual Merge-2 mechanic; Merge Mansion. After the huge hype Metacore created all throughout 2020, many developers followed suit, trying to replicate or innovate on this loop’s success, with mixed results.

As seen in the above comparison graphs, the Casual Merge segment is still very much Traditional Merge’s little sister with roughly 20% of its revenue (and 60% of its downloads). The sizeable difference in revenue can partially be attributed to a lower Revenue Per Download for its titles, as the Merge Dragons loop attracts a more hardcore audience because of its intrinsically less accessible gameplay with higher cognitive load. Additionally, the Traditional Merge market is fairly saturated while the Casual Merge market just seems to be getting started. This suggests that lots of monetisation potential within the latter market is still untapped.

While the Merge-2 segment seems to be a source for lots of potential growth, who (if anyone) will become the ‘Evermerge of Casual Merge’ has yet to be determined. None of the new competitors this year have been able to make anything but a dent in initial innovator and Merge Mansion’s market share. Backed by Supercell, the game managed to reach 1900%(!) YoY growth in revenue from $2.2M in 2020 to $43M last year! Looking back at 2017’s Merge Dragons, it seems merge history repeats itself where being the first to market shows to be the major factor of success, guaranteeing at least a couple of years of growth and a shot at that $100M league.

2021 Predictions Scorecard

2 x Correct / 2 x Semi-correct / 2 x False

#1 We expect that Playrix’ growth will slow down significantly as the era of misleading ads comes to an end. At the same time, King has focused on building franchises instead of perfecting the latest trends of performance marketing, which may just have its decline halted.

True - Judging by the YoY installs (see above), all of the top puzzle publishers saw a decline in downloads - with Playrix seeing the worst of it.

#2 There will be at least 1 new puzzle game from either Playrix or Zynga that’s a product of their acquisitions. By the end of 2021, companies that were acquired in 2019, and early 2020, will have had roughly 2 years of runway to release a game.

False - Zynga’s last puzzle game release was Harry Potter: Puzzle and Spells, which launched around September 2020. Playrix’s last games were Manor Matters, Farmscapes, and Farm Slam, all of which were also soft-launched in 2020. Manor Matters did see a lot of growth, jumping in revenue entering the top 20 from 50+ in rankings.

#3 Applovin and new smaller splinter studios will continue to push the boundaries of the casual metagame. Expect the ‘aspirational lifestyle mine’ to be plundered mercilessly in 2021.

Semi-True - Smaller studios are definitely pushing the boundaries of casual metagame mashups. If it can be dreamt, it can be merged with a match-3 board. While we, unfortunately, did not see any more personal styling + puzzle standalone games like Project Makeover, we are seeing studios experienced with storytelling looking to take a slice of the personal styling pie like Homescapes launching a makeover inspired Puzzle Pass.

#4 At least one breakthrough puzzle game in 2021 will feature Puzzle Pass at its core.

False - 2021 did not have many new puzzle games and we saw even less risk-taking or experimentation with a new monetization model (ala Hay Day Pop). Puzzle Pass did make its way through the circuit of chart-toppers, with the seeming exception of Candy Crush. Homescapes, Farm Heroes Saga, Lily’s Garden, Royal Match, and Candy Crush Soda all implemented a version at some point, the latter of the bunch integrating it with their PvP feature Bear Brawl.

#5 Merge Game developers will be the targets for M&A.

Semi-True - Merge Gardens was acquired by Plarium as we predicted. Surprisingly enough many smaller merge games that started scaling last year weren’t picked up by larger players. Perhaps Zynga’s merge portfolio went to Take-Two, though we doubt that it really was the driver for acquisition.

#6 Merge games will represent the majority of new entrants to the puzzle market in 2021.

True - This is true depending on how you slice it. Of the top 2000 games, about 140 were new; if we narrow that to the top 500 games, then merge is roughly half of the new games. A list of the 2021 new merge game can be found here: https://ludocious.com/index.php?p=blog&u=merge2021

Four out of 10 puzzle games launched in 2021 were Merge Games. Just wow…

2022 Predictions

Merge Predictions

The lion’s share of merge games that failed to scale up before IDFA depreciation will either stay small, get acquired, or perish due to Supercell-backed Merge Mansion driving up CPIs as it competes with narrative-driven puzzle publishers such as Playrix. One of those to get hurt will be another Supercell-backed game, Love&Pies.

Overall, we predict a Ragnarok of Merge games. There’s always room for innovative takes on the strong merge core-mechanic, but the time of copycats is long-gone. With the privacy changes it is simply impossible to outmaneuver existing players with more agile user acquisition strategies. You actually have to have a game that resonates with a target audience. So don’t get fooled by early retention metrics. Scale or die is what Merge genre is about.

Puzzle Predictions

We will witness the transition to audience focus instead of genre focus. Ishai Smajda gave a brilliant talk on audience mapping and this has been a theme for 2021 and will continue through 2022. Wooga expanded tangentially to capture an audience with a similar affinity to their core business, Hidden Object. Playrix, on the other hand, did the reverse, aiming to capture Hidden Object using their perfected decoration meta. This is the beginning and the experimentation will continue through 2022.

This prediction is wider than only a puzzle: we will see a new way to pay for IAPs. Between cryptocurrency’s rising popularity and the battle of payment methods, namely Epic vs Apple and South Korea’s new rule as of August 2021 that forces Apple and Google to accept alternative payment systems, we are likely to see payment options start changing next year. This is not to say that Candy Crush will accept Bitcoin as payment for 100 Gold Bars, but I wouldn’t be surprised if we did see an option to pay directly, potentially skirting the 30% platform fee. The payments revolution is still unfolding and changes will also depend on how difficult Google and Apple make adoption for developers. But companies like Xsolla are already offering a platform to make alternative payment options as smooth as possible.

As for crypto, some games may allow cryptocurrency payments, my hunch says smaller studios would hop on the bandwagon first, but larger publishers would be slower to test the waters, given it’s not recognized as legal tender worldwide. There is less urgency as I assume the older majority of casual puzzle games audiences are likely not trading crypto, but it would be silly to ignore entirely.

Hypercasual Predictions

The consolidation of downloads and the tyranny of older games will continue: As the user acquisition costs don’t seem to go down in any way possible, successful Hypercasual games with an already formed user base will continue rescaling and grabbing most of the downloads throughout the 2022.

Short term games which follow pop culture trends will be seen more frequently: An increasing portion of the new Hypercasual games that reach a certain level of success will owe their success to following social media and TV show trends, not to original mechanics or innovation in gameplay.

The M&A spree will increase its speed: As more publishers join the developer acquisition trend, the ones that have yet to make a move will participate in this and we will see more Hypercasual developers being part of publishers that once was their partner.

Portfolio diversification will be an important part of the strategy going forward and more casual puzzle games will be published: The Zen Match case is a good example for the rest of the Hypercasual publishers which will show its effect with more games in 2022.