2021 Predictions #1 Puzzle Games Becomes the Top Grossing Genre on Mobile

Our 2021 predictions have been sponsored by Facebook Gaming.

Facebook Gaming helps developers and publishers to build, grow and monetize their games. This is done through in-depth research, insights and case studies as well as innovative marketing solutions and education materials.

Visit Facebook Gaming where you’ll find an incredible amount of insightful, actionable and relevant information along with tips, tools and solutions to help you grow your business.

Unless otherwise specified, all the data has been provided by the powerful Sensor Tower and analyzed by the author(s). All revenue numbers show net revenues. Data from China, Korea and Japan are excluded as this analysis focuses on Western markets only.

Finally, please take the numbers presented with a giant grain of salt. They are meant more for trend analysis based on estimations, rather than an exercise in accuracy.

This article was written by Mat Baker and Laura Taranto. Mat Baker has been making mobile games for 15 years. Currently in charge of systems design at Trailmix. Previously at King and Glu. Laura Taranto has 12 years experience in casual games and is a product advisor and puzzle game aficionado. She was previously at King, Wooga and Mind Candy. Special thanks to Niek Tuerlings for the Merge Game insights. and Michail Katkoff for edits and data.

Please note that all opinions are their own and do not reflect any of their past or current employers.

Summarizing an entire year in the games industry against the ever-changing technological, political and economical backdrop of the average twelve months is a complex endeavor at the best of times. I think we can all agree however that 2020 has been somewhat of a humdinger.

2020 was a very good year for mobile games. The numbers above show net revenues (platform cut taken away) in the Western markets (China, Japan and Korea excluded).

In the year that most of us in the games industry could probably describe as ‘pants optional’ the intermingled effects of controversial elections, anti-trust lawsuits, potential extinction-level changes to ad attribution, a global pandemic and the ensuing global recession described as the worst seen since the Great Depression, might all be interpreted by an optimist as “interesting” but by someone less annoying as “absolutely insane”. Thankfully, your faithful crew at DoF are here to try and help you make sense of it, well, at least the very specific part of it related to puzzle games.

What follows is an overview of the performance of puzzle games over the last year, a retrospective of last year’s predictions for 2020 and some new predictions for the coming year of 2021. So settle down with a cup of hot cocoa, don your favorite hazmat suit and let's begin!

Casual games in the Western markets (China, Korea and Japan excluded) grew to nearly $10B. But the actual number is over 30% larger as the in-app-ad revenues in Casual games are very significant. Hypercasual games along peaked at $3B in ad revenue in 2020. More about this in the next post…

Puzzle Games in 2020

Puzzle, out of all of the genres and mobile, is the largest one when looking at IAPs only. It made $5.1 billion in 2020, growing 29% compared to 2019. In casual games overall, puzzle games account for just over 50% of all revenue for 2020.

Keep in mind that if in-app-add revenues are counted, Puzzle games would generate between 10 to 20 percent more. And Hypercasual games would be on par with Slots games. But more about that in following posts…

Within 2020, puzzle games experienced a 18% jump in revenue between Q1 and Q2, a jump larger than the Q1/Q2 increase of 2019 mostly due to more time playing games, not necessarily more players. The increase in time playing is presumably due to the pandemic’s effects on user behavior: various lockdowns cutting out other forms of entertainment along with an increase in down time (and honestly, the escapism games offer comes as respite from what was a bleak reality for most). This increase, sliced by subgenre, was driven mostly by Tile Blast and Puzzle & Decorate. Classic Match 3 games (think Sagas and games that don’t quite fit the bill elsewhere), did contribute to the genre’s overall growth.

Before we jump into an analysis of the coveted Match-3 and Merge games, let us highlight the growth in few other sub-genres:

Action Puzzle is known mainly for Angry Birds titles (Angry Birds 2 and Angry Birds Friends) that tend to dominate this relatively small sub-genre. Last year it grew significantly with the launch of Among Us that became to many the lockdown game of the year. Other than that, the genre remained largely unchanged.

Hidden Object leaderboard remained largely the same: Wooga’s (Playtika) June’s Journey takes nearly 50% of all sub-genre revenue. Seeker’s Note from Mytona is now a clear number two in the sub-genre taking nearly 20% of revenues. Hidden City from G5 was as big as Seeker’s Note in the beginning of the year but is now a clear second with a 10% market share. Rest of the titles have a fraction of the market space compared to the big three.

Word games remained largely the same. Scopely’s Scrabble Go was the largest growing title due to the global launch early in the year. Wordscapes, which is by far the largest game in the sub-genre, was the biggest loser as its share dropped from nearly 30% to less than 25%.

Trivia Games is a small sub-genre in terms of IAPs. It grew largely due to the launch of Trivia Star and massive growth of Drink Roulette, which of course was the perfect fit for a World where both games and alcohol consumption grew exponentially.

The Solitaire sub-genre grew as we predicted last year. Solitaire Grand Harvest and Solitaire TriPeaks continued to dominate in the league of their own taking constantly 70% of all sub-genre revenues.

Other Puzzles grew significantly due to lots of games for kids such as Math Learner, World of Peppa Pig and Kiddopia being placed here in our taxonomy. It’s no wonder that kids games were among the biggest winners of lockdowns in terms of revenue and especially in terms of downloads. We’re working with Sensor Tower to update the taxonomy to now also include kids games as their own separate category.

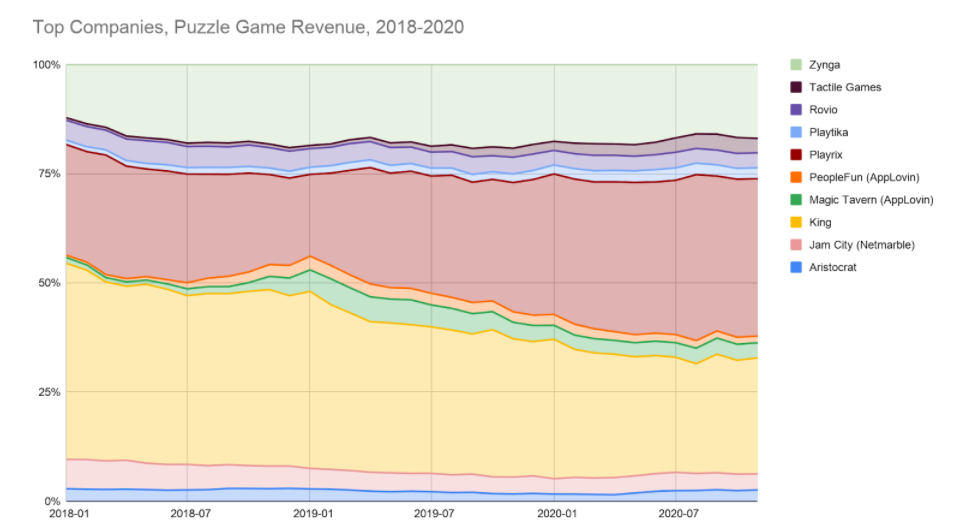

Puzzle Publishers in 2020

With this large sum of revenue, who is taking home the biggest share? While there is no specific formula to create a hit puzzle game, there is a growing baseline of what’s required to make a revenue generating puzzle machine. This past year, some companies seem to understand this better than others.

As predicted last year, Playrix unseated King from the throne in terms of volume of revenue for 2020. To be clear, Playrix key titles have been on an absolute tear. Gardenscapes made nearly a billion growing 65% in 2020. Fishdom doubled revenues making over 300M a year while Homescapes grew cool 20% and is now making 700M annually. That’s how the king of the puzzle games is doing.

Meanwhile King’s overall revenue trend nevertheless looks to be visibly declining while the rest of the market growing. This is clearly due to the publishers’ inability to not only innovate but keep up to the pace of the rest of its competitors.

Jam City’s Vineyard Valley failed to scale leading the publisher to fall behind in the competition.

Jam City, while showing stronger performance in 2018, has been slowly losing revenue share since. Their latest game, Vineyard Valley, launched in 2019, a Puzzle & Decorate (collapse core with narrative/decorate meta) did not generate any comparable revenue to their stronger titles (Harry Potter: Hogwarts Mysteries, Disney Emoji Blitz, Disney Frozen Free Fall). To see an improvement in revenue share in 2021, they need to either grow their top games or launch a clone that’s a noticeable improvement from what exists today. We’d argue that Vineyard Valley is not a noticeable improvement from the notable Puzzle & Decorate forerunners.

Tactile is following up Lily’s Garden with a Penny & Flo, which at least yet is not nearly in the same league as its predecessor.

In a first iteration of predictions, we toyed with the idea of suggesting that Tactile would be acquired in 2021. We decided it was unlikely that they would sell, but the rationale for the acquisition holds true: Tactile is the only top developer by revenue share without a parent company. That being said, this past year saw Lily’s Garden’s revenue grow to what seems like a peak in September 2020. After which, it appears to be in a slow decline. Their latest release, Penny & Flo does not appear to be making up for that revenue despite user acquisition. In 2021, they will need to find ways to further optimize both games if they hope to see growth.

AppLovin looks again to be ahead of the curve with Project Makeover.

AppLovin’s strategy seems to be casting a wide partnership/investment net. We are bullish on AppLovin’s partnership studios as Firecraft/Magic Tavern (Matchington Mansion, Project Makeover), Redemption Games (Sweet Escapes) and Belka (Clockmaster) demonstrate a desire to experiment with status quo for core/meta. That step is usually the first towards discovering a new crowd pleaser.

Rovio’s Small Town Murders focuses on hidden object style narrative. The game is growing but not at the pace of its competitors.

Rovio is also losing revenue share over time, despite launching new games. Before April 2020, their overall revenue was declining slowly, seemingly mitigated by a user acquisition push in Q3 2019. March/April 2020 bumped them back up to 2018 revenue numbers. Despite the new games in 2020, Angry Birds 2 and Dream Blast have not lost their footing as their top two titles. Small Town Murders, which launched around the start of 2020, was Rovio’s big gamble - New IP, new meta/core combination. It hasn’t yet lived up to the hype or, we imagine, it’s expectations yet, and will likely prompt others in the hidden object space to dabble with similar games.

There is a small pocket of games that lean into the interior design element of the decorate meta. Storm8 adventured early into this meta and owned the small space, alongside fun-gi’s House Flip with Chip and Jo. March bolstered FUN-GI’s title ahead of both of Storm8’s games by revenue and it continued to lose its place by Reworks (Redecor) and then dealt a final blow by Firecraft/Magic Tavern’s Project Makeover. While Home Design Makeover and Property Brothers are Storm8’s highest earning titles, they have just under 70 games live - so they are not lacking in either ideas or ability to produce. For Storm8 to see an improvement in 2021, they need to double down on their execution.

Supercell is a great game developer who has proven mastery of strategy and multiplayer genres. Having said this, puzzle is a different beast entirely and through the release of Hay Day Pop it seems they learned this lesson the hard way. HDP was cancelled in late 2020 and the project post mortem would undoubtedly make fascinating reading. Supercell is unlikely to throw in the puzzle towel just yet, but we don’t see them releasing another puzzle game in 2021. The earliest would be 2022 and until then they’ll most likely scratch the puzzle itch through investment in studios who specialize in puzzle.

Zynga started as the champion of simulations games, but has somehow become the puzzle underdog, growing by acquisitions to tackle even larger foes. However, every acquisition usually provokes a few to leave and while Zynga may be backfilling roles in Turkey, the magic that made Peak great might instead be found in Istanbul's burgeoning game startup scene (Dream Games’ Royal Match is one to watch in 2021). Zynga’s acquisition strategy suggests a desire for highly diversified revenue and a pipeline to ensure new games launch as old ones retire. It is unlikely they will unseat King or Playrix, next year or in years to come, but again, it doesn’t seem to be the goal.

Future Prospects for Puzzle

Dream Games’ Royal Match is one to watch in 2021. As is the whole Istanbul gaming ecosystem.

For many new studios, the idea of breaking into the puzzle market is a daunting one. Gone are the days where a reasonable attempt at a core mechanic and a saga map were all you needed for 6 figure revenue. Indeed, if your ambition is to compete with the incumbent lords of the genre then your work is cut out for you; you’ll need a top notch marketing strategy, an innovative product, perfect timing, an efficient content pipeline, meticulous live op planning, production quality through the roof and the resources to scale the game if everything else goes right.

This is most certainly not easy and it’s not hard to see why the average time to market with new puzzle games is increasing. Having said this, the genre is not barren in terms of creative opportunity - the recent trend for merge games shows that new ideas can take hold. Ultimately, all it takes is the right team to come along at the right time to upset the apple cart.

Effects of the Pandemic and IDFA Deprecation

As well as an effect on the market, the pandemic also had its effect on the companies developing these games. Puzzle games, that often look relatively simple to develop, require specialist knowledge and genre familiarity. These specialists are in short supply and hiring them can be tricky due to a variety of issues (relocation, visas, etc). The proliferation of remote working now presents new opportunities; studios that struggled to hire talent due to location can now import knowledge without requiring someone to move. This means that employees can be offered autonomy without the cost of a relocation package which in turn should see knowledge spread across a wider breadth of studios. While the future post-Covid is far from certain, even with widespread vaccinations, this momentary exile from a centralized office has taken us down a path to collectively ask the question of what it really means to be a part of a company at all. A question that could very well lead us to a place where specialists are increasingly more likely to become guns-for-hire than exist as a part of a digital tribe.

Unrelated to the pandemic, Apple proposed a change to IDFA (Identifier for Advertisers), which was also a hot topic across mobile gaming. Advertisers use IDFA for more granular targeting (user characteristics) and campaign feedback while maintaining users’ privacy.

DoF’s back of the napkin summary of IDFA depreciation.

This entire process was once opt-out; the fundamental change being that in early 2021 iOS 14 will make this opt-in (with predicted opt-in rates of as low as 10%). As discussed at length on this blog and in TWIG, games need effective marketing to reach the highest echelons of prolonged success. Once upon a time game developers could deploy highly optimized puzzle creatives and campaigns based on seemingly surreal or misleading premises, all in the search of lower CPIs and higher CTRs, even if the optimum campaigns misrepresented games and engendered distrust. Post IDFA, game creatives will have to take a more scattershot approach, with only a vague sense of how various campaigns are performing.

While the ramifications are still hotly debated, here are some effects we foresee:

Marketing for F2P games turns back the clock and relies more on the playbook of traditional advertising. This should lead to more of a focus on product USPs, theme and mechanic differentiation rather than the wild fever dreams that have been propagated during 2019/2020.

Puzzle is less likely to be harmed by the lack of ability to target VIP players compared to more hardcore games (4x/casino/RPG etc.) because of the lack of reliance on a very small percentage of extremely high spenders. Puzzle games also generally have a broader appeal which is easier to advertise in a traditional sense (see previous point)

While a good IP historically won’t save an underperforming game (especially in mobile F2P) the boosting effect it can have on UA for a high performing game will increase going forward.

Any developers that belong to a larger publishing network with broad portfolios and large captive audiences have the best shot of mitigating some of the sting from IDFA deprecation by using IDFV (Identifier for vendors) to leverage data from players within their network or by using traditional CRM outreach methods.

In the short term, puzzle publishers will all double down on advertising in the trusted sources of traffic, such as Word games. This will lead to increasing CPIs and acquisition of developers that have stable organic DAU that can be successfully promoted to puzzle games.

Last Year’s Predictions - Scorecard

2021 Predictions

IDFA will throw a big ol’ monkey wrench at the top mobile puzzle publishers. We expect that Playrix’ growth will slow down significantly as the era of misleading ads comes to an end. At the same time, King having focused on building franchises instead of perfecting the latest trends of performance marketing, may just have its decline halted. Overall, games with large stable DAUs will be the winners as they know where to draw the traffic from and they can focus on CRM to boost already high retention rates. New titles and titles grown by misleading advertising are the ones that will be taking a hit.

2021 will be the year of acquisitions’ soft launches specifically from Zynga (Peak) and Playrix (Zagrava, Plexonic) in H2 2021. By the end of 2021, companies that were acquired in 2019, and early 2020, will have had roughly 2 years of runway to release a game. We think there will be at least 1 new puzzle game from either Playrix or Zynga that’s a product of their acquisitions.

Applovin and new smaller splinter studios will continue to push the boundaries of the casual metagame. Expect the ‘aspirational lifestyle mine’ to be plundered mercilessly in 2021 - we can already see hints of this in Applovin’s Project Makeover - a game that takes the Puzzle & Decorate formula and adds elements of personal styling, fashion and opt-in narrative ‘drama’. Other themes we expect to see be popular in 2021 would be exotic insta-style influencer travel and leisure pursuits which should be especially popular for an audience whose own freedom of movement continues to be restricted. The relative success of Belka Games’ Clockmaker demonstrates an appetite for different kinds of meta concepts, choosing to focus on resource management combined with a mystery narrative.

Merge games will represent the majority of new entrants to the puzzle market in 2021. From the moment Gram Games modernized and popularized the genre in 2017 with Merge Dragons, they have dominated it. 2021 is the year when this will really change. The Merge mechanic has been unmasked to be a valid alternative to classic puzzle cores like the popular switchers & collapse, which are too big an investment to break into for smaller studios due to King, Playrix and Tactile’s monopolization.

The merge sub-genre is quickly filling up with new entrants rushing in. At the moment there’s only evolution of game systems between the nearly identically looking games. Soon, we’ll see evolution in themes as the marketability will become the name of the game. Just like it occurred in match-games.

Finnish start-up Metacore (backed by Supercell) seems to have found a solution that works with Merge Mansion, which is currently in Soft Launch and has been for the majority of 2020. Combining the ‘Puzzle & Decorate’ meta game we all know too well with the puzzle-like game board and its accessible merge-2 (instead of 3 or 5) seems to hit a lot of the right notes.

A big advantage of this strategy is its scalability. There is no need for a seemingly endless chain of hyper-optimized puzzle levels but instead features a carefully balanced ecosystem of interwoven merge chains. This offsets the missed monetization on e.g. extra moves, given the lack of a loss condition.

While the game is showing to have some challenges to expand its board in the long term, numerous other studios are quickly catching up with their own version of this highly engaging loop. 2021 will show who will come out victorious.

While Evermerge has been absolutely killing it by proving Gram Games’ is not the sole wielder of their traditional ‘Merge Dragons’ loop anymore, players are craving to merge more than ever and will continue to be until we are all allowed back outside. The industry will undoubtedly deliver by exploring combinations of the merge core and different metas in search of that golden combination.

Merge Game developers will be the targets for M&A. At the moment the merge sub-genre is filled with merge titles that have nearly identical themes and that are aimed at exactly the same audience. This has led to a situation where only Zynga and Big Fish have been able to scale their titles due to their massive war chests that allow extended payback times and high CPIs. We see lots of smaller Western developers, such as Futureplay (Merge Gardens) and StarBerry Games (Merge Mayor) being picked up and scaled by companies like Playtika, SciPlay, Voodoo and Huuuge Games. Chinese merge developers like Betta Games (Mergical) will remain out of reach of Western publishers.

Pro Tip: Merge Games with more masculine themes will break the bank. Remember Merge Planes? They got 120M installs. How about Top War? It’s a strategy game with a merge core that has crossed $100M in life-time revenues. First three developers to ship these titles are the lucky ones.

There will be a trend in puzzle games in 2021 to evolve “elder game” features.

Every year in puzzle the following things happen:

The audience matures and their expectations in terms of depth in the feature set increases

More and more puzzle games enter the market to vie for their attention, making it one of the most crowded spaces in F2P

Puzzle games have been adding features that drive competition. The goal is to engage most valuable players without overly straining the content treadmill. Homescapes implemented ‘Tournament of Champions’ which is mechanically similar to Toon Blast’s implementation.

source: Liquid & Grit

Due to this, it is a necessity for game designers to find ways to engage their most valuable players. The problem in any game that relies on a content treadmill is that the players who are engaging and spending the most will always end up at ‘the end of content’ counting down the days/weeks until the next content drop. What is supposed to occupy these players in this limbo period? There is a clear opportunity here to find a system to plug the gap, lest those players move on from your game. Presently, we’ve seen certain live op events work (as long as they introduce new content) but many of them essentially piggyback off of the primary level progression… So what else can be done?

Toon Blast attempted to solve this challenge with a system called ‘Champions League’ - a kind of conditional event whereby players automatically get entered into a competition consisting of 20 other end of content players. Levels are recycled for the duration of the event and players compete for position on a leaderboard, the top players earning the best rewards. The league ends once new content drops and the entry point shifts up to the new end of content point - setting the cycle up afresh. This implementation is sound but there’s still a huge amount of room here to evolve features like this within puzzle games - ones that can tap even more effectively into highly engaged players’ motivations.

While Supercell’s Hay Day Pop never made it into global launch. It introduced Puzzle Pass, which will be adapted by several publishers in 2021 - as long as they solve the challenge of finding the reward layer that will really motivate the player base.

At least one breakthrough puzzle game in 2021 will feature Puzzle Pass at its core. Puzzle Pass reared its head during 2020 with Homescapes’s ‘Season of Wonders’ and Hay Day Pop’s ‘Star River’. Whilst this has been relatively successful for Playrix, the system was still introduced on top of a 3 year old game. What’s really interesting is the opportunity for future games to have a Puzzle Pass forming an integral part of the core loop. Even though Hay Day Pop was cancelled, the amount of innovation has to be admired - the ‘Star River’ and season concept being arguably one of the most interesting ideas they brought to the puzzle table. While Battle Pass systems are great conversion points, they are typically seen as more of an engagement system than a monetisation system in hardcore games. With generally lower payer buckets in casual - we believe Puzzle Pass could soon become a playbook system for new companies in the space as long as they solve the challenge of finding the reward layer that will really motivate the player base.