2021 Predictions #2 Will the Hypercasual Party Ever Stop???

Our 2021 predictions have been sponsored by Facebook Gaming.

Facebook Gaming helps developers and publishers to build, grow, and monetize their games. This is done through in-depth research, insights, and case studies as well as innovative marketing solutions and education materials.

Visit Facebook Gaming where you’ll find an incredible amount of insightful, actionable, and relevant information along with tips, tools, and solutions to help you grow your business.

Unless otherwise specified, all the data has been provided by the powerful Sensor Tower and analyzed by the author(s). All revenue numbers show net revenues. Data from China, Korea and Japan are excluded as this analysis focuses on Western markets only.

Finally, please take the numbers presented with a giant grain of salt. They are meant more for trend analysis based on estimations, rather than an exercise in accuracy.

Written by Michail Katkoff, games executive and founder of Deconstructor of Fun, and Niek Tuerlings, Senior Game Designer and author of popular game development blog Ludocious.com. Special thanks for the Hybridcasual design insights to Abhimanyu Kumar, founder of Naavik consulting.

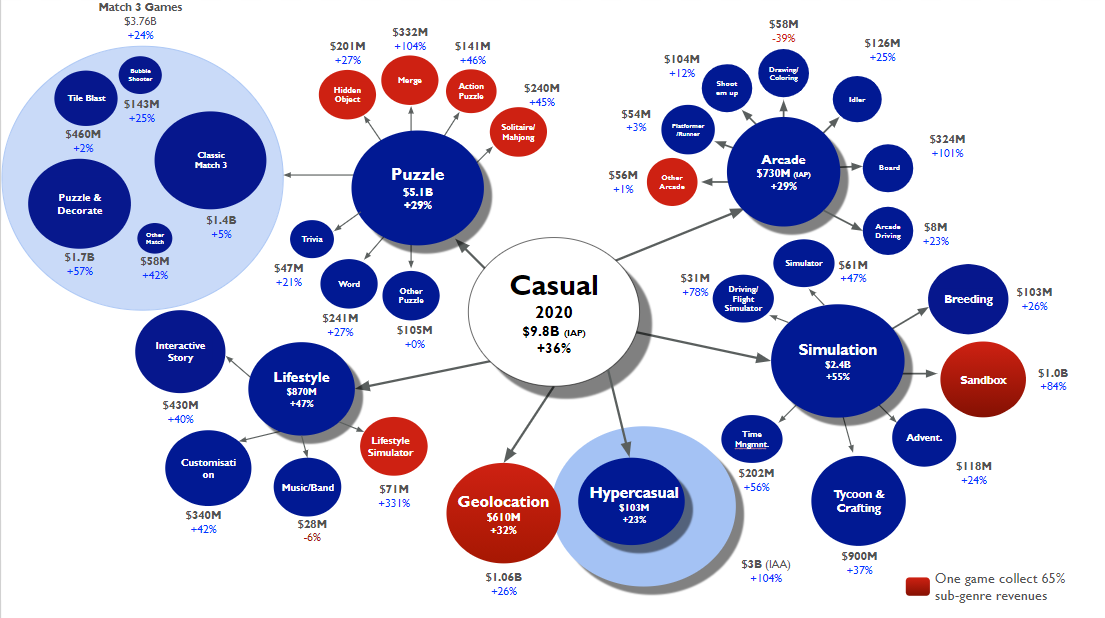

One of the most popular things during the past three years has been predicting the end of Hypercasual business model. And don’t get us wrong, we at Deconstructor of Fun have written multiple posts detailing why the end is near only to be proven wrong by a massive margin. So why are right this time around? Well, that will be up to you to decide. But one thing is for sure, we are giving credit where credit is due. And the Hypercasual publishers definitely deserve theirs after doubling the market size through unrivaled pace, innovation, and optimization.

While Hypercasual games account for less than 1% of the total IAP revenue of all Casual games, it drove well over half of all downloads for the category during 2019. In fact, Hypercasual games alone made up for ~45% of 2019’s total download volume across all mobile games.

Over 2020, YoY downloads for Hypercasual games went from 7.8B to a whopping 11.8B, continuing its double-digit growth rate from 2019 with +52% YoY. And let us not forget about the massive ad revenues, which according to our estimates crossed 3 billion. That’s double in comparison to 2019. With that in perspective, it is easy to realize the breadth of audience this genre serves worldwide and therefore its significance.

While Hypercasual games IAP is very modest, the estimated ad revenues are over 3B making this the fourth largest genre on mobile in line with Social Casino.

The State of Hypercasual Publishers

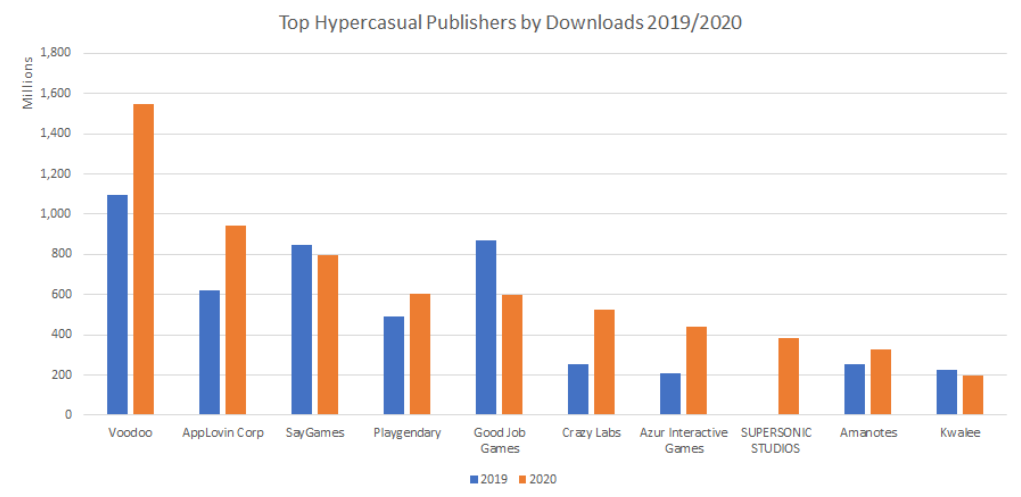

During the last year, nearly all of the top Hypercasual publishers grew at a double-digit pace. Noticeably Voodoo, which already generated close to a billion downloads in 2019 managed to grow its downloads by 52%. The biggest growth was seen by GameJam and Supersonic Studios, though both entered 2020 with very modest installs compared to the established players.

Voodoo’s growth in 2020 was incredibly impressive. Crazy Labs, Supersonic Studios and Game Jam were the other super stars of 2020. The rockets of 2019, Say Games and Good Job Games, ran out of steam last year.

Supersonic Studios’ success is straightforward to explain. To a large extent, ironSource seems to have taken a page out of AppLovin’s playbook by entering Hypercasual publishing after fueling the genre for years as an incredibly robust mediation and monetization platform. But what makes GameJam especially noteworthy is that this is a small studio out of Vietnam that not only publishes but also develops all of its titles - something that is less common among the top Hypercasual publishers. GameJam has also shown the ability to successfully integrate musical artists to its games, such as Marshmello and Tekashi 6ix9ine - taking(hyper)casually a page out of Fortnite.

GameJam is the second-fastest-growing Hypercasual publisher and developer in 2020. They’ve paved the way in many ways. Firstly by gaining success through internal development instead of publishing. Secondly by integrating popular IPs like Marshmello into Hypercasual games. And thirdly by running all of their operations out of the up-and-coming gaming ecosystem of Vietnam.

Good Job Games, which was the rising star of 2019 declined significantly as did Tastypill. Ubisoft’s Ketchapp, which was acquired in 2017, continued to decline. Ketchapp remains a warning example of an established developer purchasing a Hypercasual publisher. The question remains if Zynga’s acquisition of Rollic will counter or enforce the case.

Hypercasual Trend #1 The Rise of Feel-Good Mechanics

Ultracasual is the youngest subgenre within Hypercasual and it seems to have peaked in 2020. Starting mid-2019, the trend to make feel-good mechanics a thing of its own was introduced by the success of SayGames’ Perfect Slices. Lion Studios quickly jumped the bandwagon and released 3 highly successful UltraCasual games in 3 months. When a plethora of ASMR based games like Soap Cutting, Ice Cream Inc., and Woodturning released at the turn of 2020, all bets were off.

A plethora of ASMR based games like Soap Cutting, Ice Cream Inc. and Woodturning released at the turn of 2020. Folks clearly wanted to feel good in their lockdowns.

Throughout the first half of 2020, Woodturning, Perfect Cream, ASMR Slicing among others made huge splashes, contributing most to the 73% rise in total downloads in the subgenre this year. Reaching the second half of the year however, the genre has cooled down and lost its novelty effect. Only ~37% of 2020’s UltraCasual downloads occurred during the last 6 months. We don’t expect UltraCasual Games to come back with such furor in 2021, as we think that people can turn so much wood and slice so many cubes before ‘having seen it all’. An exciting exception could be a slick hybrid featuring an UltraCasual core game, connected to a meaningful metagame with actual power progression.

What have we learned? Nothing new really. The more games base the cores of our games on hyper-satisfying mechanics, the more engagement we can expect from players simply interacting with the main game mechanic. This is in line with the current rise in popularity of games with the equally satisfying Merge mechanic in the puzzle genre.

Hypercasual Trend #2 Misleading Ads Turn into Actual Games

Instead of following the misleading advertising trends with a core game that looks nothing like the ad, Lion Games went full circle and launched not one but two games based on the most successful ad formats throughout 2020. ‘Save the Girl’ and ‘Pull Him Out’ have been Lion’s only two big successes last year but with ~140 and ~55 million downloads respectively these games have contributed to one-fourth of all of Lion Studios’ installs during last year.

Thanks Playrix for the idea! Now everyone, play the game (Pull Him Out) you watched the ad for.

XOXOX

AppLovin

The Future of Hypercasual

Hypercasual games continued their increasing popularity with its already tremendous installs soaring to new heights once again in 2020 peaking at 9.6B installs with over 50% growth YoY. Yet despite the yearly record-breaking numbers, Deconstructor of Fun has been very skeptical about Hypercasual games. The reasons for this are the underlying characteristics of the Hypercasual segment.

Surplus of games. Hypercasual games are relatively simple and fast to develop, compared to other games on mobile. This leads to a much higher influx of new games at incredibly rapid speed with publishers shipping fast and a lot.

Fast to follow. While we have seen more and more core game innovations over the years, the short development times lead to publishers jumping on game ideas that are trending, which in turn increases the CPIs as nearly identical games battle for installs. During 2020 we’ve seen this trend subdue to some extent as large publishers have engaged in legal battles for copycat titles.

Low LTVs. Hypercasual games are tasty, fun, and short-lived - just like bubble gum. They focus on straightforward gameplay (no need for tutorial), snackable sessions (low session start barrier), skill-based gameplay (engaging mechanic), watchable (performs well with video ads), and a sprinkle of innovation (to stand out from the crowd). The flipside of this is that they lose their sweet taste quickly, which means that individual publishers need a constant influx of new scalable games to stay at the top.

Low entry barriers. We’ve seen publishers like Good Job Games, SayGames, and Crazy Labs bursting seemingly out of nowhere to the top of the charts. This significantly increases the competition not only by raising CPIs but by also increasing competition for developers, whose games these publishers put out. The low entry barrier creates a race to the bottom where publishers will need to compete for developers on the basis of revenue share. On the other hand, this low entry barrier is what drove the growth of the genre as publishers advertise within each other's games to scale their titles.

Historical lack of staying power. With new publishers entering the market, the existing top players got squeezed out in a matter of quarters. We’ve seen Ketchapp and Cheetah Mobile pretty much disappearing despite having dominated the market earlier. Good Job Games was the success story of 2019 but had a heavy decline in 2020. On the other hand, more established publishers like Voodoo and Playgendary have shown resilience this year.

Mediation platforms such as AppLovin with its Lion Studios and ironSource with Supersonic have also entered the arena as a publisher as well as a partner for other Hypercasual publishers. With the growth being so incredibly reliant on creatives, these new players have a clear advantage over existing mid-tier players. Mediation platforms have access to a large scale of marketability data across many publishers. They can see what creatives work. This allows them to pinpoint their marketing efforts.

Hypercasual titles are known for being a source of cheap but often poorly performing traffic when pushed to non-Hypercasual titles. That is why a large portion of ads shown in Hypercasual games are showing other Hypercasual games instead of e.g. puzzle games. It is also the reason why many non-Hypercasual publishers choose to blacklist Hypercasual publishers as a source of traffic. Yet again, there are successful cases of non-Hypercasual titles benefitting from Hypercasual audiences, but without IDFA this is going to be infinitely more difficult.

What all of this ultimately means is that the continuous battle between publishers in terms of revenue share will get even more fierce, as developers can go out shopping for the best fit that allows them to get the most out of the partnership. It will become more important than ever for publishers to differentiate themselves also in terms other than revenue share, like for example the amount of coaching they provide to starting developers.

Hypercasual games focus on straightforward gameplay (no need for tutorial), snackable sessions (low session start barrier), skill-based gameplay (addicting mechanic), being watchable (performs well with video ads) and are sprinkled with some innovation (to stand out from the crowd).

In a way, hypercasual games are like bubble gum as they lose their sweet taste quickly. This means that individual publishers need a constant influx of new games to stay at the top. That’s the sweet science.

Yet despite the challenges stated above, the Hypercasual genre has been on a tear. And despite it continuing to prove us wrong with its impressive year-over-year growth, we can’t promise the genre won’t be facing some trouble in 2021. Here’s why:

It is possible that IDFA deprecation will lead to the collapse of CPMs in the ballpark of 30 to 50 percent. Hypercasual’s CPMs are generally based on their ability to target players. And with that dissipating, the business will suffer as the drop will be seen directly in games monetized primarily using ads. While one could make the case that if CPMs drop, the cost of user acquisition will drop too (Cost Per Install = Cost Per Mille / Installs Per Mille) they might overlook how Hypercasual games have been monetizing; by selling their high-quality players to other games through the ads they show. Even if acquisition costs would drop and Hypercasual games could be scaled more cheaply, the ability to monetize efficiently by selling high-value users to IAP monetized games is gone because the lack of IDFA will make it near-impossible to track the quality of the traffic.

On the other hand, Hypercasual game UA is targeting very broadly already. Logically, the step from 'target broadly' to 'acquire anyone' is easier to make for Hypercasual than it is for e.g. casual puzzle games, where much more specific targeting is crucial. It might be that Hypercasual games can form an even more walled garden where they sell even more traffic exclusively to each other.

Cross-promotion has been seen as a life vest for the genre due to the IDFV, which allows publishers to access information of all their apps on one player’s device. In theory, the IDFV allows a publisher to build user profiles. But in practice, effective cross-promotion is not easy to pull off. It requires lots of testing, segmentation, and constant monitoring across titles to avoid the risk of losing players altogether while they are moved around within a publisher’s portfolio. If that portfolio consists of games within different genres, the work is even more demanding due to increased differences in player behavior. Given Hypercasual players don’t tend to perform very well when pushed to other genres the IDFV is not likely to contribute to the growth of the genre but it will continue to have significant value for Hypercasual publishers as it helps to promote within their own portfolio of Hypercasual games.

To mitigate the lack of effective targeting, publishers will try to offset declining ROIs by:

Increasing efforts on cross-promotion tooling

Double down on personalization to make their games fit to more players, as it will be less clear who will be installing their games

Attempting to uproot platforms similar to e.g. Hago where players can browse all of the publisher’s games in a dedicated ecosystem

Will IDFA depreciation kill the Hypercasual market? No, it won’t. Hypercasual will keep existing. Not in its current state of massive YoY growth but as a sizable segment of the overall mobile market. Hypercasual games will increasingly become the breeding ground that keeps teaching us the importance of addictive core games, quick market testing, low-cost production, and creative optimization. While the segment’s growth might recede one thing is certain; the role of established Hypercasual publishers will become more important than ever before.

The Rise of ‘Hybridcasual’

Only about a year ago, as a prelude to our 2020 predictions and months after Archero entered the scene and took the world by storm, we wrote what we thought was going to happen when the Hypercasual market matured and its players started looking for alternatives. We called it Hybridcasual, after the tendency of games in this segment to monetize on both IAP and IAA.

It cannot be understated that the ripples Archero has created have fundamentally changed the way the industry approaches Hypercasual from Design, Production and Marketing profitability perspectives.

The Design Evolution

Today, as competition heats up and the market matures, generating unique Hypercasual designs that can crack the top 100 download charts is becoming increasingly complex. But what Archero’s design has shown us is that Hypercasual core design can coexist beautifully with traditional metagame design principles. Armed with that insight, one can imagine what the big publishers of yesteryear will use & reuse their massive traditional Hypercasual portfolios for.

The Production Evolution

What Archero also signals is a massive upcoming change to the production process of Hypercasual. While the Hypercasual process is a wonderful machine for discovering new core mechanics, the real big money in Hypercasual is going to come from organizations that can turn Hypercasual into a cog in the bigger machine. Eventually, the best companies will be able to validate myriads of core mechanics using the traditional Hypercasual process; take many games to market and identify the ones in there that have the potential to be grown into a bigger product. This elongated production process obviously has increased project cost ramifications, which only reinforces the above-mentioned design evolution.

The Marketing Evolution

Archero has accomplished two things with its extremely effective marketing strategy. It leveraged its Hypercasual core game design to center its marketing videos around, while also showcasing its RPG elements in a light and fun way. This has allowed the game to capture not only the wide Hypercasual audience but also the well-monetizing and notoriously expensive RPG audience, all without breaking the bank! This is why the marketing future we see is one where IAP or hybrid-monetisation-focused games learn to profit on both Hypercasual and IAP inventory.

The Hybridcasual gold rush is here; its games are produced using 5 key tenets:

Built with a Hypercasual inspired production process

Contain a simplified metagame with roots taken from Casual or Midcore

Make the most of hybrid monetization tactics

Implement ‘lean live ops’ techniques that focus on strengthening medium/long-term retention with elegant execution

Apply user acquisition strategies that allow profit from both traditional Hypercasual and IAP accustomed players

Hybridcasual’s limitations

It was to be expected; a lot of Archero iterations have flooded the market last year, with mostly questionable results. None of them have come even close to the success Archero has seen. The most successful of the six games shown below has made only 0.6% of Archero’s revenue.

Dashero: Sword & Magic, Butchero, Lunch Hero, Hunter: Master of Arrows, Tales Rush, Hit And Run - Archer's Adventure Tales

What makes Archero’s execution so challenging to replicate? To start off, Habby had experienced marketeers from Cheetah Mobile and a very solid core gameplay experience. Next to that, they were first to market and have invested huge sums of their funds into Archero’s UA allowing them to establish and solidify their position early on before their competitors were even able to release. Most videos of the newer games pictured on YouTube above have comments below them mentioning Archero. Additionally, there is a more design-related reason why the other games haven’t been able to scale, but let’s first have a look at some of the Hybridcasual games that did manage to make a difference this year.

And the winner is...

So is that it? Are all games we call Hybridcasual simply less successful Archero clones? The answer is no. In fact, throughout 2020, some companies making games using different core mechanics have slowly started becoming successful (>$0.5M lifetime revenue) following the Hybridcasual opportunity. Mr. Autofire - a bullet hell platformer, Mow Zombies - a top-down survival shooter, Combat of Hero - a side-scrolling ninja slasher and Ancient Battle - a Medieval themed iteration on .io-style Hypercasual gameplay as featured in Crowd City or agar.io have all done fine or more than fine this year.

Where Archero seemed untouchable without any real competition at the beginning of 2020, the game has been slowly declining to the point where in december, Mr. Autofire made 20% of Archero’s revenue on a good day. Extending their respective trajectories paints a picture where Archero would be dethroned by July 2021. The industry shows slow signs of progress into Hybridcasual, but if there is anything that 2020 has proven is that it’s not the instant goldmine of success many developers focusing on western markets have hoped for, but something is visibly stirring.

Expanding our view to non-western markets, indicators of the Hybridcasual contingency have been much clearer. It’s visible there as well that the depth of the metagame is key. We strongly recommend taking a look at the example of Ninja Must Die 3, a beautifully styled endless runner with double the worldwide lifetime revenue of Archero, all while having been released exclusively in China!

It’s important to mention that even though the title of the ‘Hybridcasual’ segment suggests its titles are casual, other big successes that are hybrids of various systems used in the Casual category most certainly deserve acknowledgement. Games like Empires & Puzzles, Match 3D, and even Gardenscapes are fitting examples of these. But, the specific model of symbiosis that Archero has started, however, is what we’ve been calling Hybridcasual and it deserves to be looked at more thoroughly. In principle because these games bank on the ‘Marketing Evolution’ we have illustrated above.

When looking from a design perspective, the two factors these games have always in common are:

An arcade-style, motoric skill core game

Power progression within a linear metagame

It seems logical that the most prevailing option is to pick an Arcade core for your game to make it fit the bill, given the advertising strategy that’s required to market the game. After all, how can games that don’t immediately look interesting or are too difficult to grasp coerce enough players into trying them out? The next question would be, what exactly counts as being Arcade?

The core needs simple controls, a flow-inducing interaction that holds the player’s attention, some degree of skill, and last but not least it should allow meaningful integration of the metagame’s increasing power progression. After all, power progression is the foundation for long-term engagement which in turn is the means to an attractive IAP monetization model.

As of late, several startup studios have set their eyes on “a Hybridcasual game” but neglected the formula above choosing to simplify Battle Royale or MOBAs. We would argue that this is not the smartest move forward. The sweet spot for Hybridcasual is within genres that offer skill-based gameplay, limited session length and clear power progression.

The interplay between a Hybridcasual game’s core and meta is the most important aspect of their design.

The skill- and power progression complement each other throughout the player journey as they both increase. The more often the result of both progressions competes with the game’s balancing, the more engaging a game will feel. It’s also important that the power progression takes over when the player’s skill doesn’t progress as linearly as expected. Players exhaust Hypercasual games as the only way to progress is having more skills. Hybridcasual games allow players to progress by state-based power progression. And as we know, stats increase by playing the game for an increased amount of time, or by making an in-app purchase or two.

When the player has been properly hooked on the collaboration between these two progressions, their tolerance of incentivized in-app advertising is safeguarded as well. After enough meaningful progress has been achieved, only then will the player be susceptible to ‘easy ways out’ when the product of both progressions doesn’t sufficiently seem to progress them anymore. This is when a dollar-fed boost in power can potentially come into play.

So what happened with the Archero look-alikes?

While other developers (half of which were newly founded studios) were trying to get to market to grab a slice of the Archero pie, Habby was working on features to keep their game fresh in the long term. They successfully made sure that even when the competitors entered the market, their feature set felt basic compared to Archero’s time-limited events and battle pass implementations. Most studios initially failed to factor in the time investment required after their game’s initial launch or simply didn’t have the experience to properly expand their games using Live Ops. Additionally, the ~$5-10 CPIs they encountered during UA might not have helped either.

While Archero is currently still the best example in terms of meta progression that is currently available within Hybridcasual, we think there is a vast uncharted territory to be explored by introducing even more depth, albeit only in highly progressed stages of the game. Archero still only has limited depth as it doesn’t include traditional RPG mechanics like sharding or hero ascension. Given the audience’s relative inexperience with these mechanics, caution is advised as this undermines the initial graceful simplicity the game used to hook the players in the first place.

All in all, when looking at the games that did manage to catch some attention throughout 2020, the Hybridcasual segment has seen hardly any new games featuring elaborate, meaningful live-ops up until this point, while this clearly is the last piece of the puzzle to provide games with that long and profitable tail. The last hurdle for many Hybridcasual games is finding ways (and budget) to integrate light but meaningful seasonal events, tournaments, and social layers into their metagames. It’s all a matter of time before the newer games will start featuring these game modes, which will then mark the moment when the segment will really lift off.

Three Common Pitfalls when making a Hybridcasual Game

As time has passed we’ve seen several titles going after the path set by Archero without finding nearly as impressive results. We’ve identified the three most common pitfalls.

Overproduction. As developers with no experience in hypercasual games rush the market, they will focus on making their game compete with higher quality visuals. This prolongs the development times and hinders the ability to acquire from hypercasual games.

Cloning. The most common pitfall is simply to make Archero but just change the visuals by offering another set. By making a game just like the biggest game in the genre will lead to failure to acquire players. They are already playing or have played the game.

Unscalable. Developers who lack understanding of marketing will simply focus on making a game without testing how well it resonates with the target audience during the concept validation phase. This leads to the game being ‘dead-on-arrival’ when it launches.

Last Year’s Predictions - Scorecard

To follow up on last year’s article, here’s the scorecard. It’s definitely not the most accurate thing we have ever done but as we’ve all been excusing ourselves all year long “it’s been a strange one”, it’s only fitting to continue that trend here as well. The good news is that this means the result has ended up much more positive than the initial prediction.

Deconstructor of Fun’s 2021 Predictions for Hypercasual Games

The entire segment’s growth will stagnate, being crippled by the highest-as-ever CPIs rise and people’s increasing ability to go outside, with the summer months to even show declining numbers before picking up again at the end of the year. A big part of 2020’s growth can be attributed to the COVID-19 pandemic, which will not be without repercussions.

#1: A decline in CPMs caused by IDFA depreciation will undermine the monetization structure that relies on selling well-monetizing players to other games. The market will see major consolidation with the top publishers growing while the small ones decline.

#2: Large Hypercasual publishers, in addition to Voodoo, will seek growth outside the genre with the acquisition or creation of small development studios.

#3: The Hybridcasual model will breakthrough in 2021 as Hypercasual developers will be forced to increase monetization by implementing features that drive in-app purchases. This evolution will decrease the number of games entering the market and increase the lifetime of successful games from weeks to months.

#4: Zynga’s acquisition of Rollic will be seen as a misfire leading other top players in the market to become more careful when exploring M&A with Hypercasual publishers. This will fuel the trends above as Hypercasual publishers will seek to become consolidators and push their new games towards the hybrid monetization model.