Can Hay Day Pop Solve the Puzzle?

This post is written by Laura Taranto, Product Management Advisor. Previously at Wooga, King, and Mind Candy. Opinions are her own and do not reflect any of her past or current employers! Edited by Adam Telfer.

On March 16th, in the midst of a global pandemic, Supercell dropped a new game: Hay Day Pop (HDP). Turns out we all had some time to play it.

Every Supercell launch continues to shake the industry. The minute a supercell game is released, a thousand slack notifications go off. Mobile developers look up their fake AppStore accounts and download with excitement wondering what the new game could be. It’s like this because each new game has a history of defining a genre. This doesn’t happen every time, but even some of their stopped games have influenced design for years afterwards.

At first glance, it was clear what type of game they were emulating. The Match 3 + “Scapes” model which is dominated by King and Playrix. A bold move for Supercell, going against giants that continue to rule the casual puzzle space. A bolder move to try to use their oldest IP (Hay Day) and bring it to a modern audience. Can Supercell succeed in this space? Is it enough to compete with giants King and Playrix?

HDP is a well designed casual game. Supercell’s previous entry, Spooky Pop, had a lot of design mistakes that prevented it from competing with the Saga model. Hay Day Pop however shows that Supercell has learned their lessons and clearly understands how to build on the genre. It has a solid core game design, and a meta design that builds upon the successes we’ve seen in the market.

While Hay Day Pop is a solid, polished initial product, the road to success will be difficult.

For HDP to reach the top and compete with casual leaders King, Playrix and Peak, they have four main areas to reassess:

the choice of match 3 mechanic is limiting its potential

the lack of story is likely resulting in lower retention

the Hay Day Brand is not a competitive advantage

Supercell’s company culture is one of small teams: yet this genre requires a heavy content cadence to compete in the top grossing

None of these are easy changes to make, but Supercell will need to ask themselves whether they want to become the company necessary to own the match 3 space.

The Core Loop - “Match & Express”

Considering successes in the casual space, the pattern that yields these results tends to look the same. The match 3 success trifecta generally consists of:

a fun core match mechanic

a good metagame with a clean sense of progression

a new feature or innovation that brings something different to the space.

Exceptions to this do happen but they are rare.

An simplified view of casual metagame progression through the years could look something like:

Specifically, these games took proven match 3 core mechanics, represented progression in some form visually and added a twist to the genre. The exception is Bejeweled, which lacked any visual progression in its earliest form.

HDP looks to emulate the Fishdom model over the Saga model, especially when compared to Supercell’s previous attempt, Spooky Pop. Their attempt with Spooky Pop likely informed some of the good decisions that led to HDP: balancing known wins and innovation, testing a recognizable and previously loved IP and following best practices from top casual games.

Freeform Decoration vs Pre-Set Decoration

Hay Day Pop builds on elements from Fishdom by doubling down on a decoration metagame. Functionally closer to Fishdom than Gardenscapes, the decoration metagame has significantly more player choice and agency than a typical ‘scapes game.

Both models start with an empty space and the player completes levels to afford to build it up. Fishdom and HDP’s decoration is freeform, allowing for decorations to be placed anywhere within set boundaries. The land available is small and there are aspects that cannot be changed, such as the dirt path driveway or the river, but the player has free rein anywhere else. The decorative aspect is only that - visual increments of progress. There’s no meaningful narrative to lure the player forward.

Gardenscapes and Homescapes, on the other hand, allow players to choose one of a few styles of predefined decorative items. No matter what the player chooses, their garden or home will look nice. This restricted choice makes the game more casual, but also allows them to use the meta to drive the real carrot on the stick: narrative. The main goal is more around progressing the narrative than self-expression. The customization elements are just there to give you visual progression, but are not the major retention driver for the game.

HDP uses more Fishdom than Homescapes or Gardenscapes as inspiration. Curiously, market data shows that the simpler “Scapes” style games actually perform better than Fishdom. Fishdom has a significantly lower revenue share, and lower RPI overall. Based on what we've seen work, HDP should have dug its heels into both freeform decoration (with variety) and an epic story to boot. (And to be fair, we'd recommend the same for Playrix's latest game, Wildscapes. Their current release explores less story and more freeform decoration.)

So did Supercell take a step forward in the genre, or take a step back? The market data suggests that they adopted an outdated model rather than create a new one.

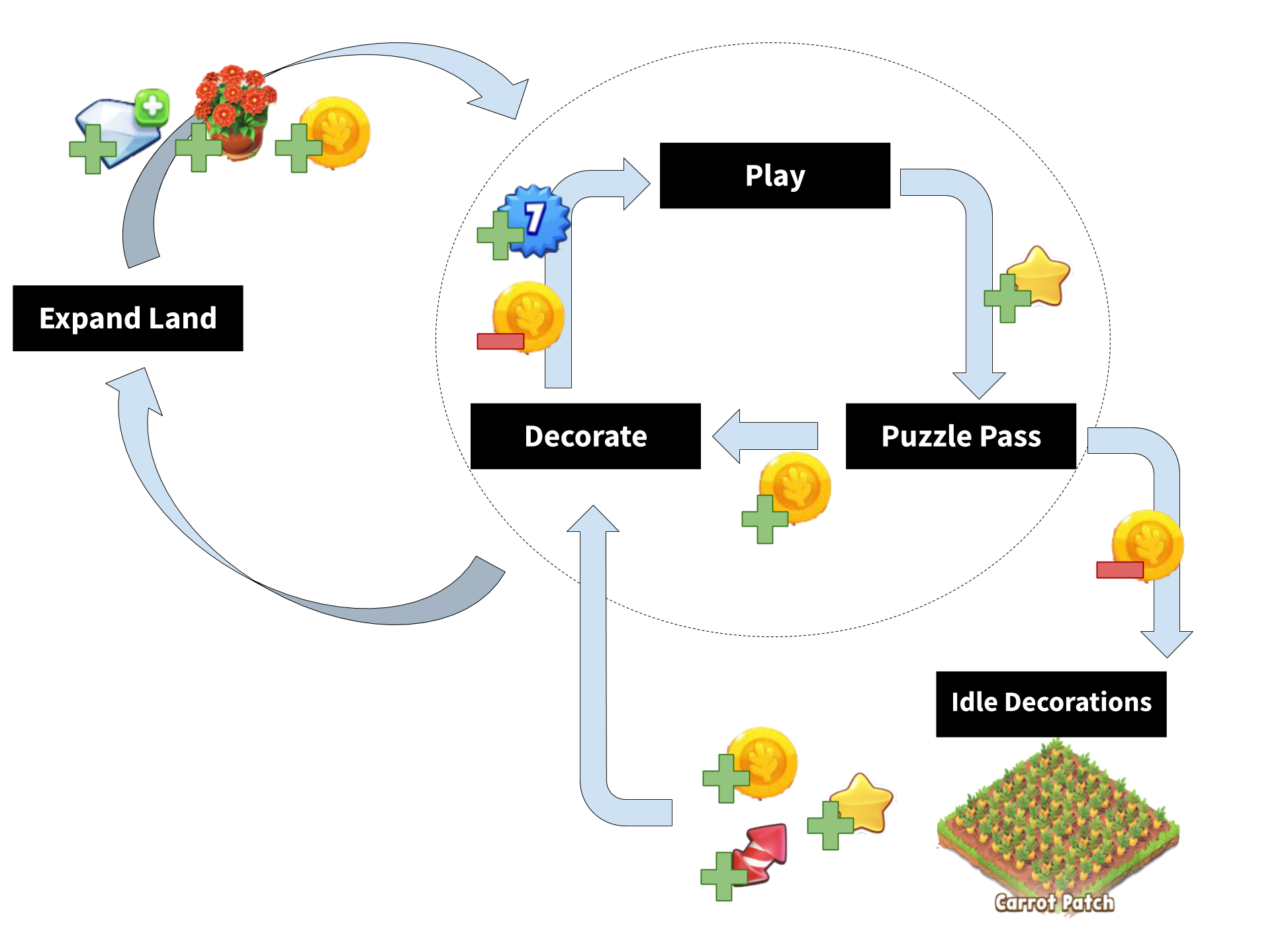

The Core Game Loop

Playing levels awards stars, which are used to earn coins in the Puzzle Pass.

Coins allow the player to buy decorations for his/her farm.

Decorations give decoration points, which accumulate to unlock more land and more decorations.

The cycle repeats with various features that allow players to speed up the progress.

So far, this seems smart, but not all that innovative and not what we have come to expect from Supercell. Looking at the market, there have been plenty of combinations of Puzzle Core + Invest & Express hybrid games attempted.

Core Gameplay: Tap-2

Besides the meta design, HDP made an interesting choice with their core gameplay design.

HDP chose a “collapse” mechanic as their core (similar to Lily’s Garden, Toy Blast, or Toon Blast).

As a refresher:

Collapse (Hay Day Pop, Toon Blast) - Players tap on 3 or more blocks of the same color. there are no cascades or matches derived from the original tap.

Swiper (Candy Crush, Gardenscapes) - Players swap game pieces to create groups of 2 or more objects, from which multiple other matches can happen. There also tends to be more object movement horizontally with Swipe/Switch mechanic as compared with Collapse.

The Good: Meaningful Level Modifiers

Animation and advancement speed is snappy. The game responds quickly to input.

Blocks are easy to distinguish and special blocks are clearly differentiated.

There are a variety of obstacles as well as new ones. They didn’t simply clone other match 3 games.

The visual and function of the obstacles are generally sensible (e.g. honey looks like a liquid and spreads, toasters pop toast upwards).

Obstacles work together nicely and can be easily combined to create more diverse levels.

Obstacles are low complexity. There are none so far that are difficult to understand.

The Twist: The Puzzle Pass

Puzzle Pass

The Puzzle Pass is the biggest change to standard casual metagame. This concept is similar to a Battle Pass (Fortnite) or Gold Pass (Clash of Clans), and typically found in core and midcore games.

The idea of a Battle Pass is to drive strong conversion: players level up their pass as they play the game. If the player wants bigger, better rewards that help him/her progress faster, then s/he can purchase the premium track of the Battle Pass. A strong offer to get conversion, but due to limited spend depth, it is more of a retention feature than a monetization feature.

Some Battle Passes also have the option to purchase to progress the Battle Pass faster -- this game does not, most likely because the currencies offered are sold and earned elsewhere, so a tier skip would only serve to short circuit that loop (where they stand to make more money). The Puzzle Pass also has time pressure with its seasonal resets. Functioning as a seasonal engagement track that reinforces the core loop throughout that time.

Why the Puzzle Pass?

I believe this is Supercell’s attempt at improving revenue overall and diversifying from out of moves purchases, boosters and lives, as typical in most casual games. The gamble is that they can increase the overall conversion of players with a battle pass, and while they may take a hit on ARPPU, they will make more revenue overall.

This is actually a two-fold gamble: 1) changing what players are used to buying and 2) asking them to spend more in a single purchase than they are accustomed. Most in game items and conversion bundles are in the $0.99-$4.99 range in match 3 games. The Puzzle Pass, at least in my build, is a whopping AUD 13.00 ($7.13, £8.7), and will probably sit at the $9.99 tier when released to the US. And the purchase is only good for the current season, which is a defined number of days. Meaning, I have a set number of days (30-34 days) to beat enough levels to win all the extra tier rewards. After that, my Puzzle Pass/Season resets and I’m back to regular rewards.

Rewards from the Puzzle Pass typically are, from most to least: coins, boosters, lives, extra moves and decorations. Players receive 1 reward per tier normally and 3 in total if they purchase the Puzzle Pass.

I don’t think this will work in its current form for the casual player, and so far the RPI trend for HDP reinforces this - the value isn’t there yet and the rewards too fleeting. The coins are helpful, but not enough to earn more than 1 new plot of land. The boosters are also helpful, but having 6 boosters of a certain type instead of 3 doesn’t make that much of a difference. For this to be meaningful, I think the team needs to explore adding more valuable items as rewards - for example a unique decoration that can’t be purchased elsewhere. All of the decoration items I received could also be purchased at the store.

The Curious: Luck & Difficulty Curves

One of the most fun elements of playing a match-3 game is the cascades. Switchers (Bejeweled, Candy Crush, Homescapes), unlike collapse, allow cascades which can turn one move into multiple ongoing matches. This feels like a slot machine - lucky.

Yet collapse lacks cascades and requires players to plan ahead and plan how they are going to create special blocks to complete the level objective. For some players, this setup to create the right layout in itself is rewarding. However, the common problem with collapse is that players can quickly get into frustrating stale board situations. Pressing the wrong piece can result in pieces landing in a terrible “checkerboard” situation (where there are no possible matches in an area of the board). This quickly results in a stale board situation -- an area of your board becomes nearly impossible to remove pieces from. All because you didn’t plan ahead!

This level of frustration is likely the reason why games like Toon Blast and Toy Blast have a very easy onboarding level difficulty curve. The game’s first 100 levels are considerably easier than Homescapes and Gardenscapes. This results in lower overall booster sinks and monetization, but they counteract this by going more aggressive on things like Events and Social systems. Yet overall this translates into a base mechanic that can’t monetize as effectively, that has to be cautious about difficult levels, and can’t retain as well as the luckier swipe mechanic.

data from the powerful GameRefinery

Market data backs this up, where the majority of top grossing matching games use the swapping mechanic. Although, when looking at new entrants, there have been more collapse style games than switchers, the reality is that switchers have always been the strongest retaining and monetizing core mechanic. Collapse may be trending, but it's unlikely to beat Switchers.

Continuing from the base mechanic issues, the choices of their level difficulty curve don’t match the limitations of their core mechanic. The first Puzzle Pass season was quick so as to have a player experience the full cycle. Afterwards, I found my progression to be too quickly throttled - I faced multiple difficult levels in a row. The number of attempts to pass the level jumped from 1-2 to beyond 5-6, and most were not close wins. Having a variety of levels with respect to difficulty is important; games that are too easy can be boring and players want to feel like they are close to a win, especially when they lose. However, blocks of difficult levels and a lack of progress are not fun. Florian Steinhoff has a great GDC talk about the balance of levels here.

Florian Steinhoff’s optimal level difficulty curves

Potential reasons for increasing the difficulty curve are:

Supercell is still testing the ideal difficulty curve in the game for their main audience. Certain players respond well to difficult games; other players prefer easier levels. Finding the right balance is important to meta progression which in turn is important for long term retention and LTV. That said, I could easily be in an A/B test comparing different level attempts per successful attempt to see which performs the best.

Supercell wants to stretch each decorative area as long as possible with respect to levels. They likely don’t have enough content yet in the game and want to avoid the situation where a player plays through the game too fast. The fastest way to earn large sums of coins is through the Puzzle Pass. Progressing through Puzzle Pass requires completing levels. Throttle one and you slow down the other.

Encouraging spend on boosters to ease through difficult levels. Repeat booster usage ensures that players become accustomed to using them and buying more. However, that only works if boosters are hard to earn for free...

The New: Grow Items

Another new, albeit smaller, addition in HDP is the Idle Reward Generators. Each time the player expands his or her land, s/he unlocks new decoration items. This includes special farm items that reward bread, milk, and other farm things that immediately convert to coins, boosters, or stars every number of hours.

It’s not much of a reward: not enough to progress a Puzzle Pass tier or buy a meaningful amount of decoration points but a small boost to the player’s session. While I like the idea of the mechanic, in its current implementation it is not critical to progression nor does it make a meaningful impact.

As they do not yet reward logins, this appointment mechanic seems to fill the gap. The only difference is as it scales, it will require a content pipeline whereas simply awarding the items via a login bonus would not.

This Idle reward generator can give the player too much currency and make the Puzzle Pass (and direct purchases) less appealing to buy. It does lend itself to expand gameplay if they choose to keep the reward items as items (bread as bread) and add trading elements. To be seen.

Following the Formula

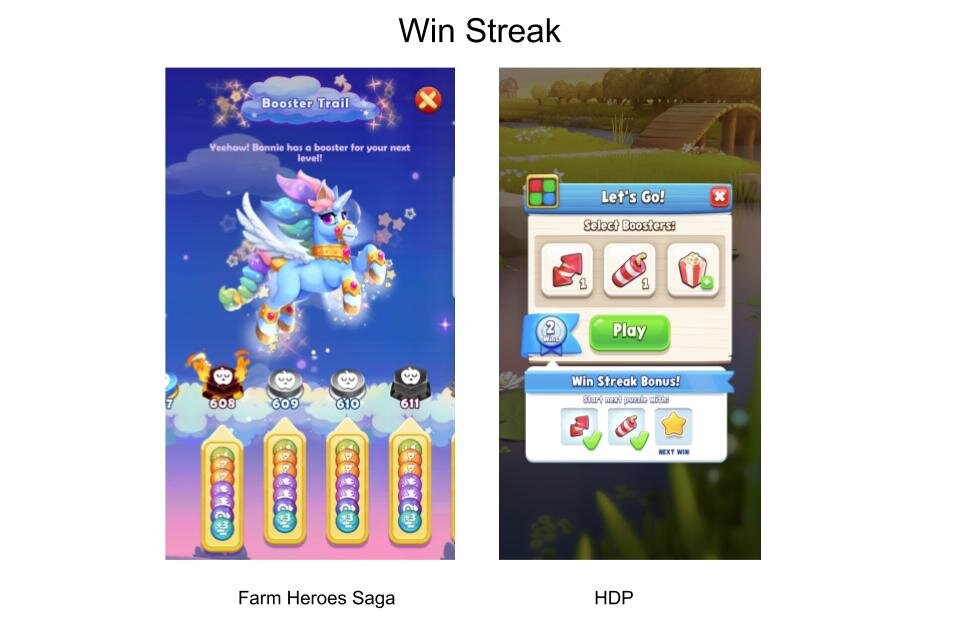

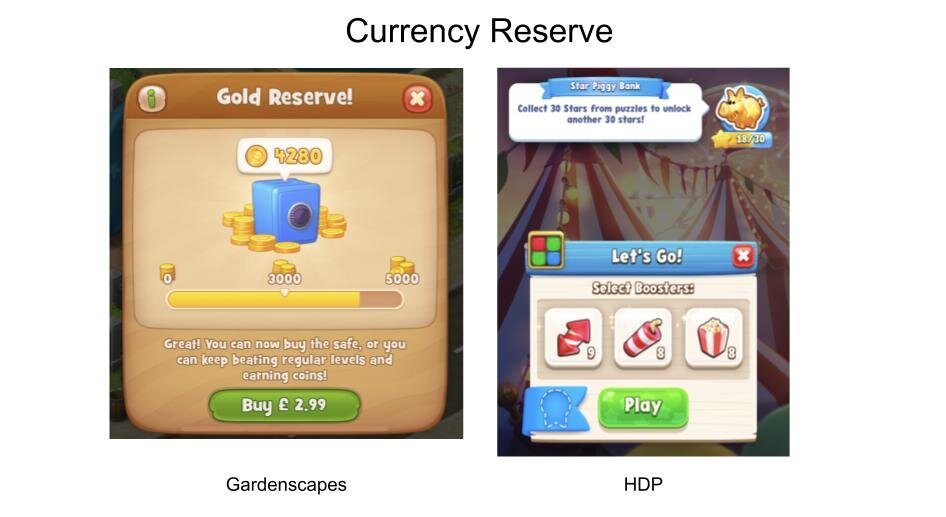

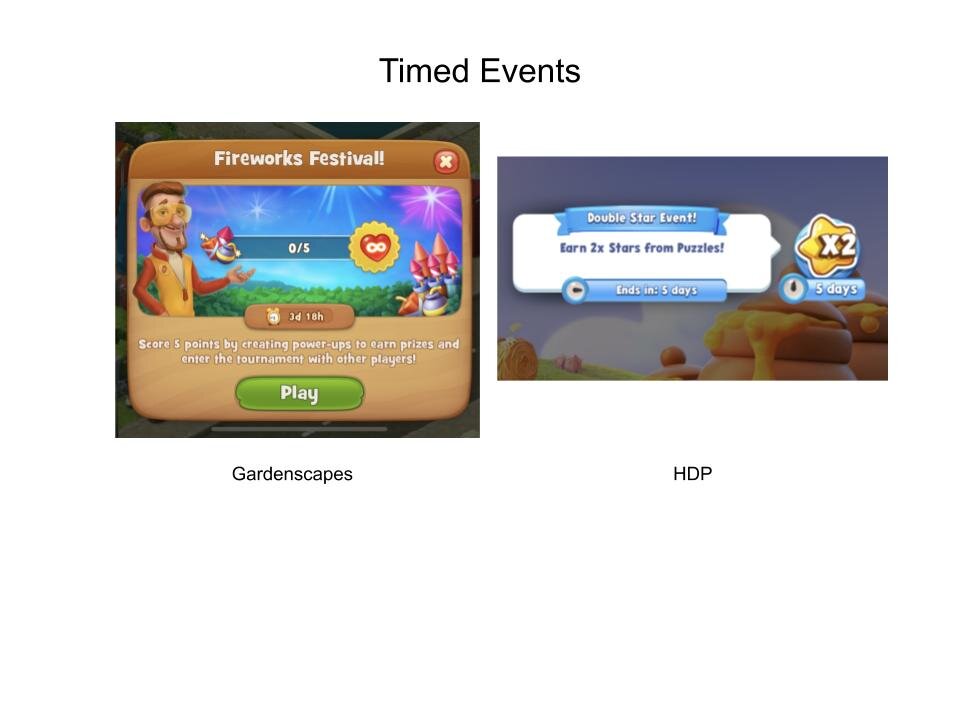

In terms of wider feature set, so far, HDP takes cues from the modern match 3 playbook: hard level designations, currency reserve, timed events and win streaks. (They are releasing new features as we write this, so this will likely be out of date).

Win streak rewards the player for passing levels and not losing a life. The rewards tend to be boosters, or in HDP’s case even another star. The boosters are helpful in easing the difficulty of the subsequent level. One change they made to mitigate the decreasing difficulty was a cooldown timer for non-Puzzle Pass players - if you are going to win levels faster than usual, at least you’re paying for it!

But can HDP Compete?

Overall the design is solid, and they’ve implemented the full gambit of features needed to compete in match 3.

If this were built by any match 3 developer, I would say they have a strong foundation. But this isn’t built by Jam City, King, Playrix, or Peak… this is built by Supercell. For Supercell to compete given its culture is the real fundamental question.

Supercell’s culture is known to be focused on small teams that make a big impact and autonomous choices. Yet in this case, they’ve walked into a heavy content treadmill genre with just the basics right.

We see 3 big flags right now with the project:

#1 No Story

The biggest glaring difference between this game and competitors is Story. HDP has none.

Looking at what trends are the most effective in matching games, Story is one indicator that has been proven time and time again. Since the mid-2000s (Real Arcade and PC Downloadable Casual Games) core matching game players have always loved having a compelling storyline alongside their game.

Left: Mid-2000s Match 3, Right: 2020 Match 3 -- Story is consistent!

Recently, the biggest success story has to be Lily’s Garden, while using the same core mechanic as HDP, they’ve managed to more than double HDP’s RPI out of the gates. There’s likely a lot of factors that determined that, but we believe Story is a key reason. It is very likely that having a story means that players are more likely to play through difficult levels and use boosters -- just to see what happens.

Adding to this, Story also helps with marketing. The obvious example being Lily’s Garden’s amazing marketing campaigns. Without Story, HDP is restricted to just advertising about their farming mechanics, which just won’t drive a lower IPM.

#2 Live Content & Events

The business model of match 3 relies on one thing: content. Just like most mobile free to play games, the majority of revenue for the game comes from your top tier players. They are usually eagerly awaiting new content at the end of the game as they consume the game much faster. The reality is that the only way to continually get more revenue is to quickly produce new levels and content for your rabid fanbase. As discussed at GDC, the requirements to maintain a match 3 level pipeline are very high:

From GDC: Producing each level can take 5-8h on average, but top players can easily consume more than 40 levels in a single day.

Each update will need new levels, special blocks, time-limited events, customization content and Puzzle Pass seasons to keep players in the game.

I have no doubt that Supercell is able to do it - they are known in the industry for the best tooling, tech, and talent. It’s likely that Supercell can create a procedural generator tool for levels that can dramatically reduce the content cost.

However, players in this genre don’t want auto-generated or recycled levels… They want novelty and excitement. They want interesting level designs that challenge them. While some levels can be generated, they need a pipeline of unique level designs that introduce novelty if they want to retain their best players.

[edit 5/25/2020:] After playing longer we’ve discovered that Supercell recycles levels each season. It’s unclear the amount that they are recycling (we’ve heard more than 50% of levels in a season are repeated from the previous season) but it is unclear how this trend will continue. Unclear whether they recycle with minor changes (like the number of moves, or spawn rates, etc) or how they keep the content interesting. Even if they have a great recycling solutions, there is a case that players that love levels, want fresh content. And if they want to make a hit games, they need to redeliver fresh content to meet those needs.

Yet this content requirement counters their culture of small teams. Eventually Supercell will need to generate a lot more levels, special block types and decorations bi-weekly. To accomplish that, Supercell must make some hard choices about how they generate these levels and modifiers if they want to retain their culture and make this game a success.

Will they be able to keep up content before players leave the game or will they need to adjust their usual approach and scale up their teams, internally or externally, to meet demand?

Are they willing to become closer to King and Playrix in terms of company size than they are right now?

#3 Marketability

Lastly, the Hay Day IP is just not going to give them a strategic advantage. They will be on level playing field with other match 3 games, and will need to execute at the same level as their competitors. There will be no sustainable base organics for this game like they’ve had for games like Brawl Stars and Clash Royale. And different audiences mean a lack of cross promotion as well.

We don’t have data on IPM or CPI, so this is all really just assumption. However, from our point of view, it’s unclear whether the Hay Day IP will give them a lasting advantage on CPI to be able to scale to the same level as King or Playrix. Hay Day launched in 2012 and in 2020, it’s not as big of a name as it used to be.

Google Trends: “Hay Day” (Game) from 2012 to today

Looking at their gameplay choice, the Toon Blast and Gardenscapes audiences do not have a high affinity to the Hay Day IP. This likely means that Hay Day IP won’t give them a sizable reduction in CPI. Farming works as a theme (Farmville’s Matching Games, Farm Heroes Saga), but it is not going to make or break this game.

On top of this, stronger brands (Frozen, Toy Story) with high affinity to this audience have attempted to create games that still did not perform on the same levels as games from King, Playrix and Peak. The three latter all created their success using new IP.

One thing to consider also is that Hay Day Pop is very different from player motivation perspective than all the Puzzle & Decorate games. This raises a question whether the IP fits with the different audience personas.We know that Zynga’s FarmVille Harvest Swap couldn’t connect with the IP’s core audience.

This player motivation data is from the powerful GameRefinery platform.

Zynga attempted this with Farmville Match and did not see success in the match 3 space even though it used a widely known IP. These previous attempts suggest that the Hay Day IP is likely not going to be a major competitive advantage -- it really comes down to their ability to execute on the core business model of match 3.

Finally, it’s the UA resources. When it comes to money, Supercell has thousand time more than it needs. When it comes to people, Supercell can hire them. When it comes to the influencers, Supercell has been investing into this since 2012. And when it comes to organics, everyone loves Supercell and will install their game. Nevertheless, Supercell’s capabilities on the performance marketing side might be limited. It’s been a while since Supercell has been recognized for performance marketing excellence, as the company has switched its focus to top-of-the-funnel channels (TV, events, billboards) and influencers.

Will this possible marketing limitation hurt Supercell with Hay Day Pop? We don’t think so. In fact, it can actually help to boost the game on top of the charts and keep it there. And focus on top-of-the funnels doesn’t mean it’s not quantifiable or less strategic than traditional performance marketing. Just check out the case study below done by AppsFlyer on the growth of Contest of Champions via out-of-home campaigns.

Top-of-the funnel campaigns are just as strategic and measurable as traditional performance marketing campaigns. >> Case Study <<. source: AppsFlyer

Nevertheless, it is a Super Solid Game

Overall, this is a noteworthy match 3 game. The new additions to the metagame are well crafted and the core mechanic plays very smoothly. They didn’t just build a clone, they built a Fishdom-like game with a farming style meta and introduced the Puzzle Pass. They innovated in blocker design to make the core feel different.

However, given that their core gameplay won’t have industry-leading retention (because of the blast gameplay), the lack of story, and the low impact of the Hay Day IP, to compete it will come down to Supercell’s ability to generate the Live Content needed for this to be competitive. Then there is the fundamental issue of culture vs what it will take to make this game into the lasting hit to match Supercell’s ambitions. Keeping up requires large teams.

Most companies would and should be proud to launch a game with the polish and innovation that HDP showcases. However, Supercell isn’t most companies.

My belief is that Supercell wants to aim for the top and not settle for a middle-tier match 3 game underneath Peak, Playrix, and King. To achieve this goal, not only would they need to address the points we’ve made throughout this piece, but they’d also need to revisit how they are structured as a team and the values they cherish as a company.

Their ambitions have always been to create lasting games with small talented teams. So what is more important: keeping their culture, or doing what it takes to make this game successful?