EA Mobile: Can the Giant Climb to the Top?

EA is a powerhouse on mobile with a broad portfolio of games in almost every possible category. Just like on the console, EA has built its presence on mobile via strong game IPs and their unrivaled competence in publishing new games. Till date, the company has enjoyed yearly growth in both installs and revenue driven by hit mobile titles like Sims FreePlay, SimCity: BuildIt, Real Racing and of course, Star Wars: Galaxy of Heroes.

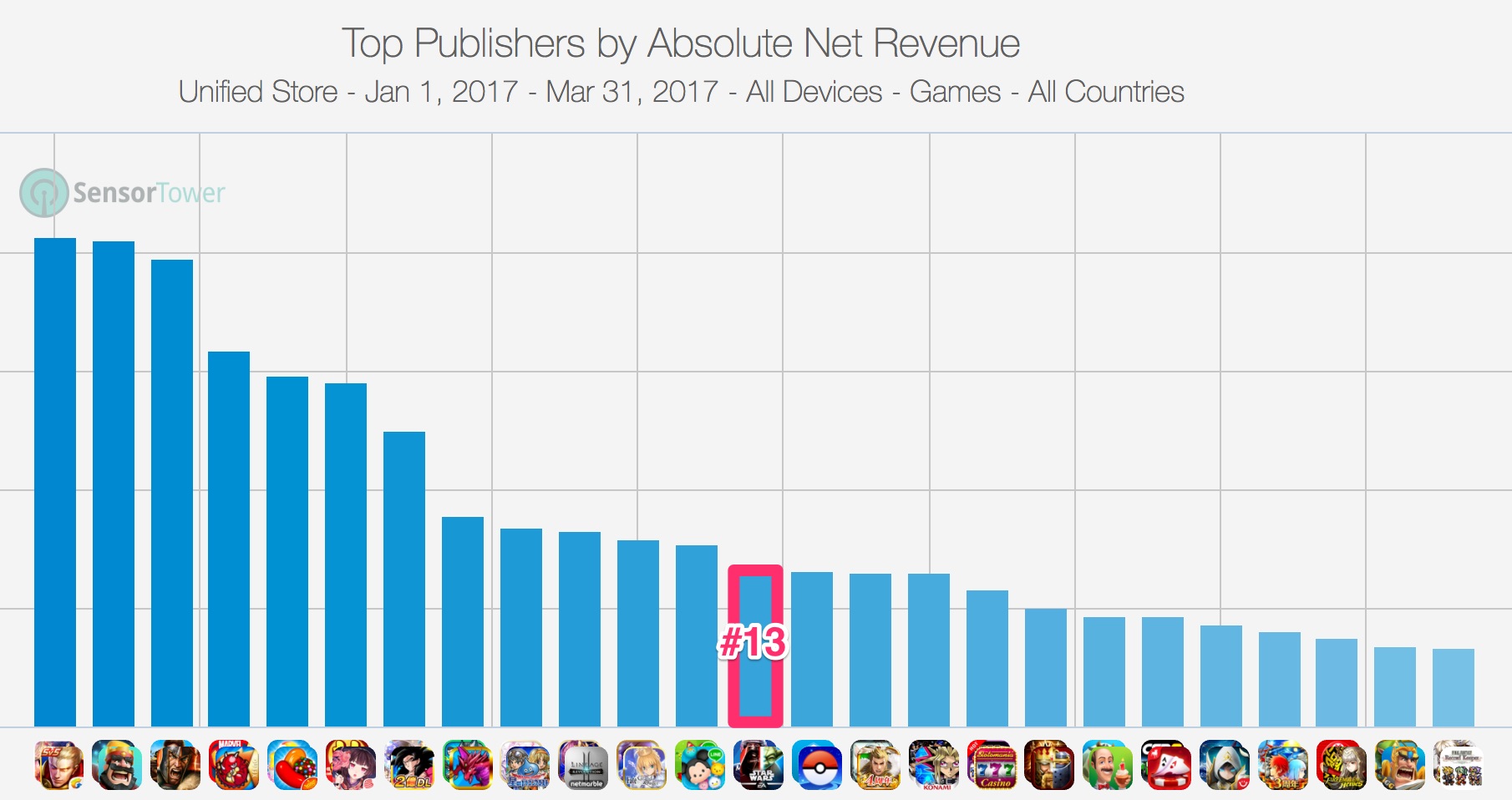

Despite all its resources, know-how, and IPs, EA hasn't broken into the top 10 of mobile game publishers. Even if we include only Western publishers, EA sits far off from the top three.

The key takeaway of this analysis is that even though EA Mobile is doing very well, it could, and frankly should be doing better. After all, we can all agree that Electronic Arts should be one of the top mobile publishers in the world. As the mobile market has matured, the chance of launching a new hit title has diminished and the role of well executed live operations has increased. Zynga is a perfect example of a company that switched from betting the bank on the next big hit to prioritizing its live operations. A shift that has paid off both in reduced costs and increased revenues. A shift, that EA could learn from.

The data in this analysis is provided, as always, by the powerful Sensor Tower.

Downloads

Massive portfolio of numerous IP games and several hit titles means that EA attracts around 40 million downloads during the quietest months of the year and up to double the amount during the peak months. While there is seasonality in downloads, the biggest download surges are related to new game launches. EA’s strong IPs almost guarantee featuring from Apple and Google as well as willingness for players to download these featured games. In addition, EA boosts their new launches with strong cross promotion from other titles and stellar marketing push. After all, publishing games is EA’s core competence.

The broadness of EA's portfolio is in full display when looking at the downloads. During the last 12 months FIFA Mobile was the biggest contributor of downloads as one of the biggest launches of 2016. What should be noted is how well the 'legacy' titles such as 7 year old Plants vs. Zombies, 6 year old Sims FreePlay and 5 year old Real Racing are still among the biggest contributors of downloads.

EA’s massive portfolio of strong IPs is not dependent on single title or specific franchise to drive the installs. What’s impressive is the fact that the number one generator of downloads during the past 18 months is the free version of original Plants vs. Zombies, a game that was launched mobile in the beginning of 2010! And the second most installs during the same period have been accumulated by perhaps the biggest flop of 2016, FIFA Mobile Soccer. Both titles have contributed little direct digital revenue but more than pulled their worth with around 100 million downloads each during the last 18 months.

Unlike with most publishers, the correlation between downloads and monetization is not that strong with EA. What this means is, even when EA releases a game with poor metrics, like FIFA Mobile Soccer or Plants vs. Zombies Heroes, the company will still rack up massive amounts of downloads, which can be cross promoted to better-performing titles in the portfolio or monetized via in-game ads.

EA’s downloads have been growing at single digit numbers for several years now but it looks like 2017 will be the first year that the downloads will decrease year-on-year. The reason for the decrease in installs is largely due to lack of new games launched in 2017. In fact, EA hasn’t globally released a single free-to-play game during the first half of 2017 compared to 6 games released during the first half of 2016.

Revenue

2016 was a great year for EA mobile as the revenues soared by over a third compared to the year before. This growth was largely driven by the mega hit Star War: Galaxy of Heroes and the stellar, though a cyclical performance of MADDEN Mobile.

In the first half of 2017 EA’s mobile revenues have continued to grow, though at a much slower pace. The reasons for the slower growth in revenues in 2017 is mainly due to the performance of EA’s three most anticipated games of 2016, NBA Live, Plants vs. Zombies Heroes and FIFA Mobile. All three of the games were launched with high expectations but thus far only NBA Live has been able to deliver some form of success while the other two can be considered disappointments.

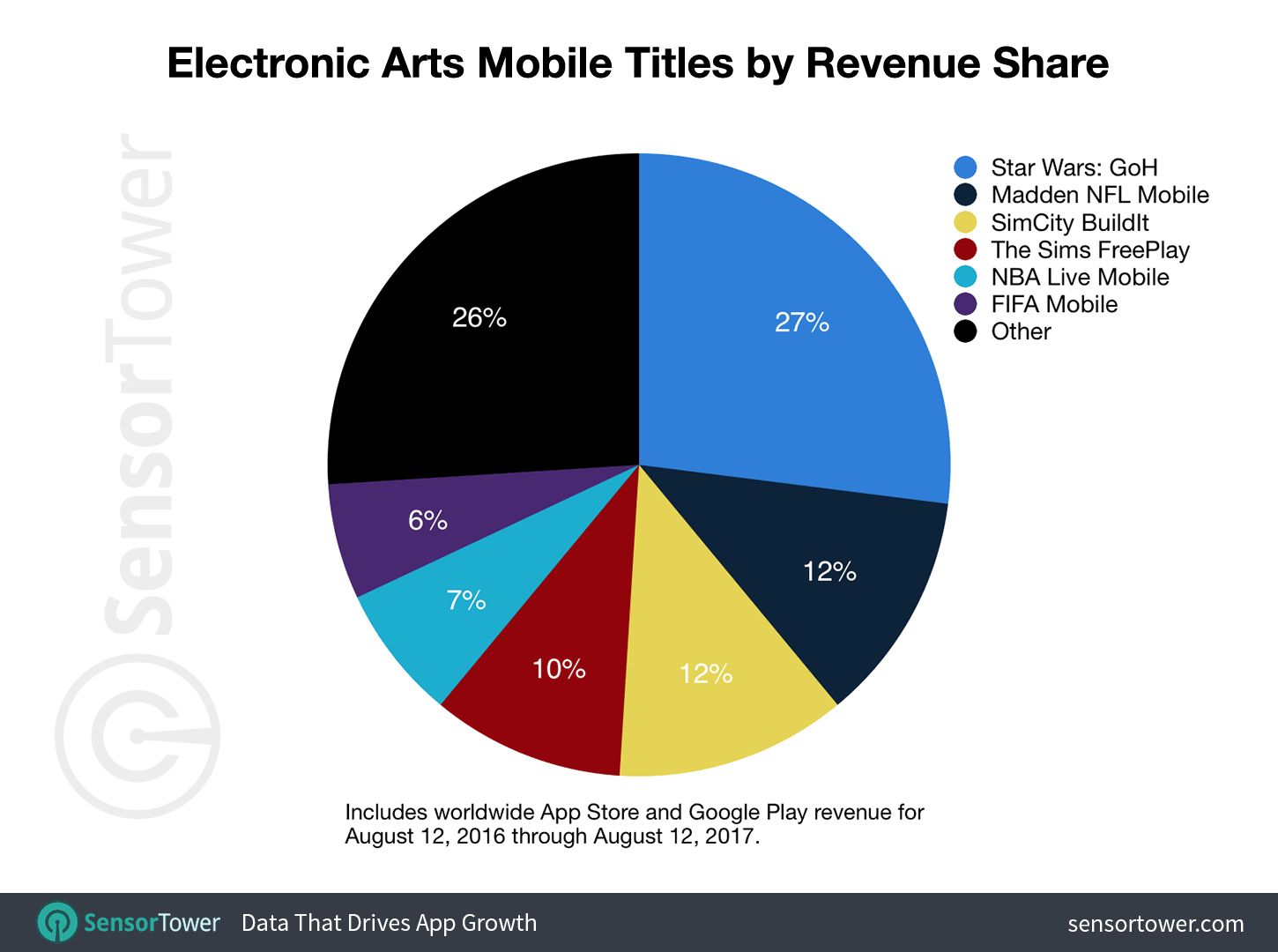

EA is not relying on a single franchise like its main competitors such as King and Supercell. While Star Wars is by far the biggest hit in EA's portfolio, it still brings only quarter of overall revenue. King's and Supercell's top titles account for over 40 percent of the company's early revenue.

Despite finding only one hit out of three releases last year, EA is not easily shaken. This is because EA’s portfolio does not rely on one dominant game or a franchise, unlike most of the other top publishers on mobile. In fact, EA’s current top grossing game, Star Wars: Galaxy of Heroes accounts for only around 20% of all mobile monthly revenue. In contrast, King’s Candy Crush Saga and Supercell’s Clash Royale are both contributing over 40% of their respective monthly revenues.

EA’s diversified portfolio is even clearer when you compare their top 6 grossing games with King’s top 6. While with King, the top 6 games account for 93% of the revenue, with over 70% of monthly revenues coming from three Candy Crush franchise games, EA’s top 6 generate only 64% of the company’s mobile revenues. Unlike King or Supercell, EA is also not reliant on a single category as their top 6 games represent simulation, racing, RPG and sports games.

Portfolio Analysis

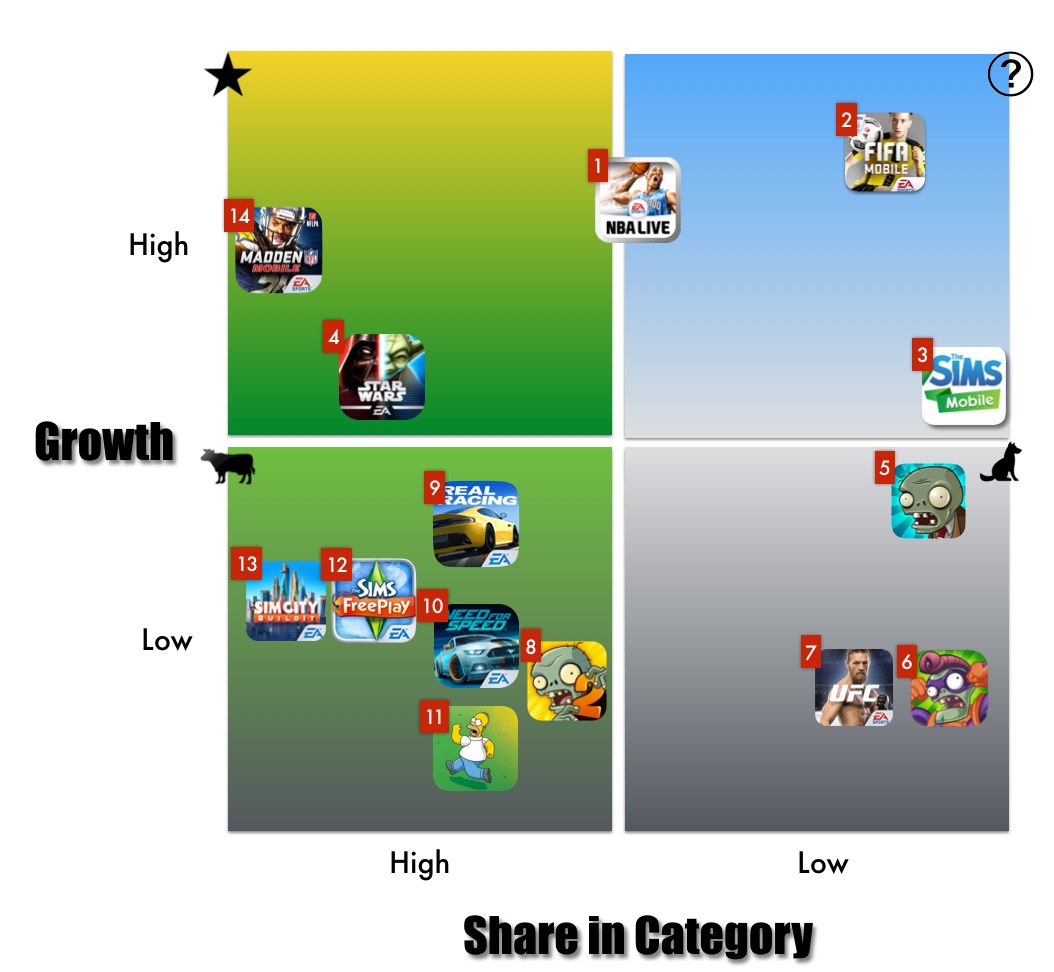

In this analysis, I use a self-modified Boston Consulting Group’s Growth Share Matrix, which is designed to help companies decide which products and categories to invest in on the basis of two factors—company competitiveness and market attractiveness—with the underlying drivers for these factors being relative market share and growth rate, respectively.

Putting these drivers in a matrix revealed four quadrants, each with a specific strategic imperative. Low-growth, high-share “Cash Cows” should be milked for cash to reinvest in high-growth, high-share “Stars” with high future potential. High-growth, low-share “Question Marks” should be invested in or discarded, depending on their chances of becoming Stars. Low-share, low-growth “Dogs” should be taken off live operations given that their current positioning is unlikely to ever generate cash.

This modified growth share matrix is populated with EA's top 14 titles in terms of revenue and downloads from the last 12 months. The Growth axel represents a combination of downloads and growth in revenue. Share in Category is a combination of ranking in category grossing list as well as the contribution to EA Mobile's revenues.

High-growth, low-share Question Marks should be invested in or moved off from live operations, depending on their chances of becoming Stars or Cash Cows.

NBA Live has the most potential out of the current Question Marks to become a Star. The game was the fourth most downloaded EA title during the last 12 months and also the fifth most grossing title in the same period.

Despite impressive numbers, it is not a Star just yet as a number of downloads compared to the revenue is proportionally low. This indicates that the game has still some issues with its design that are not allowing it to reap its full potential. Once the design is improved, the game could be a perennial top hit during the long basketball season. For closer analysis, please read Why EA Can’t Replicate Madden’s Success.

FIFA Mobile was by far EA’s most downloaded title during the last 12 months but only the 6th most grossing title during the same period.

This game has the strongest sports IP in the world and it should trump Madden Mobile on every other month except during the Super Bowl. The struggles of this game are due to a design that doesn’t please FIFA fans. Fans who made FIFA 17 the most sold console game in 2016. Fans who spend hundreds of millions in buying digital card packs on consoles.

Given a number of installs and the amount of digital revenue FIFA 17 generated on the console, a full revisit of the design should be in order to transform this game into a Star it should be. For closer analysis, please read Why FIFA Hasn’t Landed a Touchdown.

Sims Mobile is the most recent EA game in soft launch. It is too early to say whether the game will be a Star or whether it will even launch. Most important thing to watch out here is not cannibalizing the perennial top hit, Sims FreePlay.

High-growth, high-share Stars are titles that are successful but which have even more future potential.

EA's most consistent Star in the portfolio, Star Wars: Galaxy of Heroes. The company has done a phenomenal job in growing the game’s revenues and they should do all in their power to continue investing in this title instead of letting it wither down into a Cash Cow. To fully understand the game and why it is such a massive success, please read the full deconstruction of EA’s Death Star.

Madden Mobile has been an amazing success story for EA and is at the moment of writing EA's top grossing game in US. Since the game launched in late 2014, it has been a top grossing mainstay during the NFL season. In fact, the only weakness the game has it’s the extreme seasonality. When NFL season is on the break, the game drops out of the charts only to be resurrected with a massive update at the start of a new football season.

Madden’s last year’s peak revenues were considerably lower than the year before. Since there’s no competition in this particular genre, the reason for the drop is likely due to the decline in popularity of NFL that can be seen in both the TV ratings and substantially lower year-on-year downloads of Madden Mobile during the peak season. You can find a thorough deconstruction of Madden Mobile here.

Low-share, low-growth Dogs should be taken off live operations given that their current positioning is unlikely to ever generate cash. Seizing live operations releases a considerable amount of resources that can be used to strengthen other titles in live operations or to kick off new games.

An exemption to stopping live operations on a game that has fallen into the Dog category is if the title attracts a significant amount of organics installs. In this case, the company should consider whether to invest into reviving this title and/or monetizing it via in-game ads.

Plants vs. Zombies FREE is an interesting Dog in EA’s portfolio. It’s a legacy title that generated second most downloads during the past year but only very small amount of revenues. This title is mainly used as a gateway to funnel players into other titles. The company should investigate the opportunity to monetize the game via in-game ads.

Plants vs. Zombies Heroes was PopCap’s attempt of casual Hearthstone. While the game received positive feedback, it came around the same time with Clash Royale and had no chance in holding its ground in the synchronous multiplayer category.

Based on the installs and the lack of success, this title should be sunset and the resources made available elsewhere in the company.

UFC Mobile is another title, which has gathered an impressive amount of installs due to its IP but has failed to convert these downloads into meaningful revenue. Fighting genre is quite popular on mobile with titles such as Marvel: Contest of Champions and Injustice leading the way.

EA chose to take a much more simulation based approach in building UFC fighting game instead of borrowing the more arcade approach from the category leaders. This design hasn’t paid off. Given the global popularity of UFC, EA should revisit the design with an attempt to push the game into the Question Mark category as the game still seems to generate a considerable amount of organic downloads. If the design changes won’t move the needle, a discussion of sunsetting the title should occur.

Low-growth, high-share Cash Cows should be led by top teams with the challenging goal of both milking the titles while at the same time growing, or at least maintaining the user base.

In the traditional BCG Growth Matrix, Cash Cows are simply milked in the most efficient way till the end of their lifecycle. Nevertheless mobile games business differs from other industries because our games are services, not products. What this means is that the longer a top title can hold on to its position, the more difficult it will be for a competitor to beat them with a similar title. Clash of Clans, Candy Crush Saga, Game of War and Star Wars: Galaxy of Heroes are but few of the examples of games that have reached the top and held to that position with a steady stream of top notch updates.

Plants vs Zombies 2 is the smallest Cash Cow in EA’s portfolio. Nevertheless what makes this game a Cash Cow, in addition to a steady stream of good revenue, is the impressive amounts of downloads it generates every year. After all, this is EA’s second most downloaded mobile game of all time.

The game has the potential to be a much larger contributor to revenue with better integration of free-to-play design in its impeccable core gameplay. Read a more thorough analysis Why Plants vs. Zombies 2 Can’t Make it to the Top.

Real Racing 3 is EA’s most downloaded game of all time with well over 200M downloads and counting. Large user base almost automatically leads to a steady stream of revenues and Real Racing has been a solid Cash Cow since February of 2013.

Given the fantastic amounts of downloads the game still generates every year, there should be more room to grow its revenue contribution.

Need for Speed: No Limits is the younger, more famous, edgier and slightly prettier cousin of Real Racing 3. Despite fairly impressive metrics and being “the new game from the makers of Real Racing”, Need for Speed still receives fewer downloads and generates fewer revenues than its predecessor.

Part of the problem with Need for Speed is the game’s free-to-play design, which just doesn’t feel quite right for a racing game, much in the same way FIFA Mobile’s free-to-play design feels off for a soccer game. Read more about Need for Speed: Why Racing Game’s aren’t Winning on Mobile.

In several key markets, Zynga’s CSR2 and Glu’s Racing Rivals and Gameloft’s Asphalt 8 and Oh BiBi’s SUP are beating EA’s racing games despite EA having the head start and arguably bigger IP. While it would be easy to say that the competitors’ games are better, the real reason may be that the Fire Monkey studio in Melbourne just doesn’t have the sufficient resources to effectively run and grow three worldwide hits in Racing Rivals, Need for Speed and Sims FreePlay.

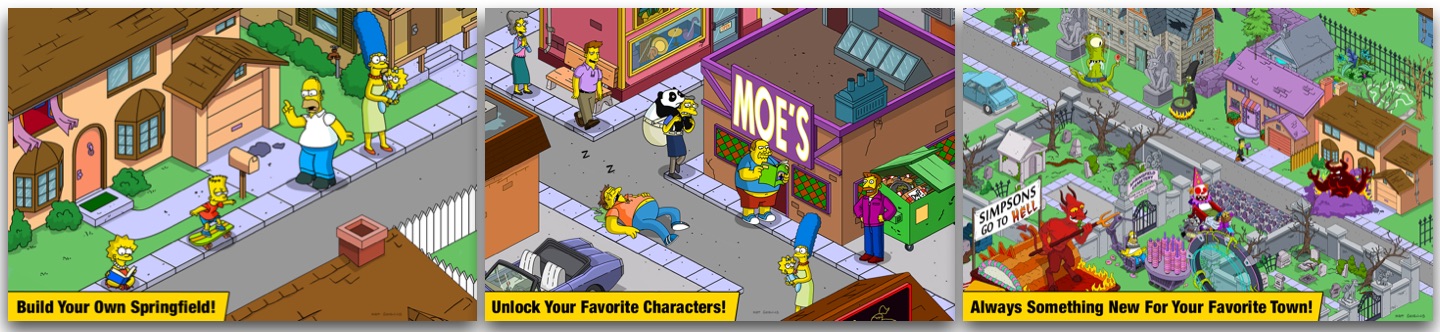

Simpsons: Tapped Out has generated the most revenue out of all EA mobile games. It’s a game that has single handily created the genre which combines entertainment IP with city building and storytelling.

While being the most successful EA Mobile game to date, it is also a prime example of EA’s focus on publishing new hits instead of building upon the hits they’ve released. After two and a half years of being a consistent top 20 grossing games, Simpsons: Tapped Out started quickly fading out to a point where it peaks well outside top 100.

Given the Simpsons IP and the amount of content the game has to offer the player, this is simply unacceptable. This game still has all the potential in being at least a top 100 game if not top 50 but it requires a top talent to run. Based on the steady stream of unsuccessful updates since January 2016, it seems like the game has been used as a training ground for relatively unseasoned developers to make mistakes and learn from them. It’s like learning to drive with your father’s Bentley.

Unlike Simpsons: Tapped Out, Sims FreePlay has only improved its revenues every year despite being an older title of the two. In fact, Sims FreePlay stands to surpass Simpsons as the all-time top grossing EA mobile game.

The biggest threat in Sims FreePlay horizon is the puzzling soft-launch of Sims Mobile. When you have a game, that sits firmly in the top grossing charts, you should invest more into it rather than cannibalizing it. Using cannibalization as a growth strategy is not the case here since Sims FreePlay doesn’t have a string of direct competitors it needs trying to take the market from it.

SimCity: BuildIt is another example of a game that has kept its stride of more than impressive revenues ever since the launch in late 2014. There’s really no competition for this city building masterpiece, which stands as the fifth most grossing EA mobile game of all time. It also seems like the departure half of the core team, who established the rival Zynga Helsinki studio, hasn’t significantly affected the game’s solid stream of updates.

Strengths and Weaknesses

- Intellectual Properties

- Live Operations

- Publishing

- Studios

- Pipeline

IPs and Publishing

EA’s key strength is their portfolio of strong IPs. This strength coexists with the company’s core competence in publishing new games and getting them into hands of tens of millions of players every single month. Up until 2017, EA’s mobile division had been taking full advantage of the company’s strengths and core competence, racking up around one billion of downloads and roughly the same amount of revenue over an 18 month period.

Because publishing big IP titles is one of their core competencies and growth strategies, it’s quite worrisome that EA hasn’t released any new mobile titles in 2017. This introduces a risk of overall decline in downloads and thus will likely be seen as a decline in user base as well. To mitigate this risk, the company needs to invest into its live operations.

On the flip-side, it can be argued, that EA has been too aggressive with publishing big IP games every year, resulting in them having to maintain arguably an oversized catalog. While most of the games are no longer in live operations, there’s still a pretty hefty portfolio of legacy titles, which tax EA's resources to various extent. Unlike King, EA doesn’t use cannibalization as a growth strategy, since games with the same IP can exist in different categories instead of oversaturating and controlling a single category.

Live Operations

EA’s core competence is the company’s ability to publish games and just like with many other companies, EA's core competence is also the company's main weakness on mobile. While publishing bigger and better iterations of your key franchises every year or every second year is the de facto model on the console, it is not the best way to operate on mobile. What works on mobile is launching a game with a solid core loop, good retention and successful monetization and continuing to grow that game incrementally one update after another. Star Wars: Galaxy of Heroes, Sims FreePlay, Madden Mobile and SimCity: BuildIt have all shown what a steady stream of well-executed updates can do to a hit game. All of these previously mentioned hit titles are generating the same or larger amount of monthly revenue years after they were launched.

Keeping your hit games manned with the best people possible team is crucial for success on mobile. While this is a pretty simple rule to follow in theory, it's more difficult in practice. Firstly, a successful launch team always wants to create their next big hit despite the fact that the odds will always be stacked against them. Secondly, if your core competence is publishing, you always want to put the best people to work on the Next Big Hit. The best way to solve this problem is to create a bulletproof bonus model to the core team running a live service in addition to having a clear hand-over process when the core team finally moves to start their new game.

Global Network Of Talent

EA has an extraordinary ability to manage their worldwide network of high-performing studios. Capital Games in Sacramento run Star Wars: Galaxy of Heroes, Track Twenty in Helsinki is responsible for SimCity: BuildIt, Fire Monkey in Melbourne has excelled with Real Racing, Need for Speed: No Limits and Sims FreePlay while Red Crow in Charlottetown delivered Simpsons: Tapped Out and NBA Live.

Competence in building and managing a network of studios around the world means that EA is not hampered held back by the lack of talent. It is also important to notice, that the most successful studios are located outside the headquarters in Redwood Shores. This is smart on EA’s part. It is commonly known that building new games near to most of the company’s powerful executives is seldom the fastest or the most cost efficient way to operate. There's a certain amount of peace and quiet that a separate location gives a studio.

The strong network of studios has allowed EA to have a strong pipeline of new titles. Though when closely examining the current network of mobile studios, it is evident that most of them are likely having their hands full in operating a live game. Essentially EA has three options to beef up their pipeline:

1. Move top talent from live operations to start new games

Moving your best talent from a top grossing hit game to start developing a new game is always risky. The development of a new hit title takes give or take two years and the likelihood of success are relatively slim, despite the strong IP and publishing power of EA. Not to mention the skill-set required to build a new hit game is much different from the one needed to run an existing hit game.

The cost of taking this route is that your top developers are working on a new game instead of running live operations on a hit game they’ve launched. Taking this route is actionable only if you can ensure strong backfill.

2. Open up / acquire new studios

This is possibly the best option for EA, who has been successful in opening up new studios through strategic acquisitions of companies and/or top teams. As the mobile market is rapidly becoming more saturated, EA has the resources to snatch studios or hire the top teams from other gaming studios to beef up their pipeline. This strategy allows EA to start new projects without sacrificing the ongoing ones. As we know, EA is no stranger to closing down studios either, which allows them to keep a network of top performing studios only.

3. Third Party Publishing

The last but not the least option to beef up the product pipeline is to use third party publishing, which EA has been doing for years in form of Chillingo. Most of the titles Chillingo has published till date don’t carry EA’s IPs and are games from developers around the world. Given the current state of the market, there’s a powerful opportunity for EA to employ some of their preferred Chillingo partners to build games with EA IPs.

This option would also allow EA to compete with other big name mobile publishers such as Scopely, Nexon, Flare Games, and NC Soft. And EA has a clear advantage compared to the competition as they could offer 3rd party developer the opportunity to work on one of the company’s amazing IPs.

To learn more about mobile publishing, please listen to our podcast “The Good, the Bad and the Ugly of Mobile Publishing.”

Opportunities and Threats

- Live Operations

- New Games

- Publishing Business

- PopCap

- Copy-Paste Design

- Consolidate Catalog

Live Operations

EA’s biggest short and mid-term opportunity lies in the live operations of its existing Cash Cows and Stars. Unlike in console business, where every franchise needs to be updated with yearly or bi-yearly titles, in mobile, a hit game can stay on top for years. In fact, it is more likely for a hit game to keep its top position than for a new game to surpass it. King is a great example, as all but one franchise sequel the company has released during past five years have done worse than their predecessors (for more details on King, please read “Has King Peaked?”)

While Zynga, led by the former EA Mobile chief Frank Gibeau, is rebounding with the “EA playbook” there’s an argument to be made, that EA should take a closer look at (Gibeau's) Zynga’s playbook. Zynga has been able to finally rebound with a hawkish focus on its top live games instead of placing all the bets on future hits. While EA Mobile is by no means in a state where Zynga was just a couple of years ago, they still should take note of the benefits of prioritization of live operations.

While EA has done a solid job with running live operations for Star Wars: Galaxy of Heroes and Sims FreePlay, both top 50 grossing mainstays, the company could have done a far better job with its half-a-dozen other top hits, such as, Real Racing 3 and Simpsons: Tapped Out. It is clear, that these titles could be top 50 grossing mainstays, but it feels like the studios behind them are more focused on their new games instead of growing the existing hits.

New Games

Building and launching new games is a long and risky process that ties up top talent and resources for years. Strong IPs decrease the development risk by creating a target market for the developers to aim at and by lowering the marketing cost for growing the game. EA is full of strong gaming IPs that they have successfully used to build out their massive mobile portfolio.

While launching a new game with a strong IP is a great opportunity for a company, it can also be a major risk. For example, after conquering the number one spot in racing category with Real Racing from Natural Motion’s CSR Racing, EA decided to put the same studio to work on Need for Speed: No Limits. Fast forward a couple of years and both Real Racing and Need for Speed have ceded the top spot to CSR 2, and are barely hanging in top five of the racing category with Real Racing performing better than the follow-up, Need for Speed. While the both racing games' combined revenue over time is more than Real Racing would have made alone so are the costs of building, running and marketing two games. And a case can be made that if the resources of building Need for Speed would have been invested into Real Racing 3 instead, it would still have its top grossing spot in the category in every key market.

In addition to the threat of spreading resources too thin by starting to build a follow-up title, EA risks cannibalizing their existing hits with follow up titles. For example, the newly soft-launched Sims Mobile threatens perennial top 50 grossing hit Sims FreePlay. I personally don’t think that mobile users are cramming to have the same game with better graphics like console users. By releasing an updated title, EA risks losing part of its user base as it attempts to cross-promote them from the old title to the new one. As a result, the company may end up with two struggling Sims games in top 200 grossing instead of one hit Sim game in top 50. But then again, I may be wrong if the Sims Mobile is one of the biggest games of 2017.

Publishing

EA’s publishing arm, Chillingo has been suffering for several years as developers have chosen to self-publish rather than share the spoils with a publisher. But the market has finally matured and is now at a point, where developers need both significant resources and a hefty dab of good luck to break through to the top. This change of market has allowed mobile publishing companies like Scopely to flourish as they can finally pick and choose from a list of solid developers instead of working with the less successful ones. The maturity of the mobile market opens up an opportunity for EA to get back to the top of mobile publishing, where Chillingo ruled in the beginning of the decade.

PopCap

EA acquired PopCap in 2011 for as much as 1.3 billion dollars and I think it’s fair to say that PopCap's performance never came close to the high expectations set by the purchase price. PopCap’s Plants vs Zombies was one of the biggest mobile hits when top games were paid. The much-anticipated sequel showed, that while there is a strong demand for the game, PopCap had no expertise nor drive to learn how to build and run free-to-play games. Since then, PopCap has showcased further struggles with Plants vs Zombies Heroes and various Bejeweled iterations, which have all performed significantly worse than their predecessors.

While it is easy to write off PopCap as a company that wasn’t able to translate their success to free-to-play and case can be made, that a company with its roots in casual paid games can become a powerhouse in freemium games as well. Rovio is a prime example of this transformation. The maker of Angry Birds struggled for years after initial success with paid games but after finally embracing free-to-play games, they’ve been soaring with impressive double digit growth in year-to-year revenues. With the right leadership and organization structure, PopCap has the full potential to bounce back onto the top of the charts where they used to be. At this point, it’s up to EA to put them in a position to deliver on their considerable potential.

Copy-Paste Design

Need for Speed, NBA Live and especially FIFA Mobile have all suffered from a copy-paste design practices. In the case of both FIFA and NBA, it often seems like you’re playing Madden but in soccer or basketball theme. Because these sports games are in real-life inherently very different from each other, it doesn’t make sense that they share the same gameplay design.

For example, in FIFA every player on your roster can play only one position. While this makes all the sense for American football where for example the quarterback plays only that specific position, it is simply not true for soccer, where for example a midfielder can play various positions from attacking to defending and from sweeper to full-back. This practice of copying the metagame of a benchmark title has arguably cost EA the success of its biggest sports game on mobile, as FIFA continues to suffer from Madden driven design instead of giving the player the beloved Ultimate Team experience. A design that has generated hundreds of millions in digital revenues (in-game purchases) on the console.

Sharing learnings between studios is the key to overall success of the company. But there’s a difference in sharing knowledge and simply copying and pasting game design from one different title to another. While copying designs may be the quickest way to build a new game it is far from being the most sustainable way to do so. Games are entertainment services and in that sense, they need to offer authentic, new and familiar experiences to succeed. Just think how likely a TV show with a dozen of fantasy kingdoms and dragons would fair against Game of Thrones if launched today?

Consolidate Catalog

Finally, a case could be made to further clean up EA’s massive mobile catalog by cross-promoting the players from various legacy titles into games in live operation. This would likely result in a slight growth of the live titles but also as reduced upkeep costs and improved organic traffic to main titles as the players would find only one Need for Speed game when searching for it in the app store.

Prioritize and Execute

Managing a successful portfolio of mobile games is extremely difficult. On one hand, a company has to explore new products and frequently renew their advantage through disciplined experimentation. On the other hand, the company should keep its top talent on existing hits, because there’s a bigger risk in creating a new successful game as a service rather than operating an existing one.

The balancing of the precious resources has to be done systematically to avoid wasting them. This approach requires companies to invest in more promising game projects, experiment with them in a quicker and more economical way than competitors, and systematically select most successful of them to be grown into hits. At the same time, companies need to be prepared to respond to changes in the marketplace, by keeping the top 50 grossing mainstay titles manned by the top teams while maximizing the information value gained from the failed projects.

After the booming 2015, EA Mobile is running a slowly growing billion dollar business. While the company’s mobile division has been busy in building and shipping ever more impressive games, it has sometimes forgotten what the success in mobile business actually looks like. It’s not the new games with high-production values and the most known IPs that control the top of the charts and bring in hundreds of millions of dollars in revenue each year. It’s the two to five-year-old games, with a bit outdated graphics but fast loading times and nearly infinite content that keep reaping the success on mobile. Games that players have been playing for so long that they’ve become part of their lives. Games, which they will not switch for another one with better graphics.

EA has a strong portfolio of top grossing hits, which they can all grow into top 25 mainstays with relatively limited yet focused effort. This requires the company to reevaluate its approach on mobile and instead of focusing on the next big hit they should be focusing on growing the existing hits into ‘everlasting’ games. Much like what Zynga has done during the last year or so.