Pixel Flow: The Publisher's Dream

Written by Aylin Yazıcı, Deconstructor of Fun’s new Editor Queen 👑 and a Mobile Game Consultant with a soft spot for hybrid casual and puzzle-heavy systems.

Pixel Flow: Why This Game Blew Up (and Why People Keep Talking About It)

Pixel Flow isn’t one of those games that accidentally wins the lottery. It’s more like a game that shows up at the exact right moment, does a lot of things right, and then just keeps scaling.

Built by Loom Games, a lean team of roughly 10 people, Pixel Flow launched on August 17 after what was likely less than ~3 months of development. Four months after launch, it was already doing $500K+ a day, which puts it somewhere around a $180M yearly run rate.

Half a million dollars a day within a quarter. That alone is impressive. But what really matters is how it got there.

Good mechanics. Tight monetization. Aggressive but smart UA. And a sort of sub-genre that was clearly ready for something new.

This Wasn’t an Overnight Thing

Pixel Flow scaled fast, but Loom Games didn’t magically appear.

The studio was founded in July 2025, but the founders had already spent five to six years building games before that. Before Loom, they ran Crescive Games, a small indie studio (around 7–10 people) best known for Twisted Tangle, made together with Rollic.

So while Pixel Flow looks like a breakout hit, it’s really the result of years of learning how to design, iterate, and ship efficiently. The speed is new. The experience isn’t.

All-time downloads & revenue of Twisted Tangle (likely pulled ~15M from ads alone, with Android carrying a disproportionately large share of IAA)

First Few Levels: You Notice the Difference

You feel it almost immediately. Pixel Flow looks casual, but it doesn’t play itself.

The game is actually hard. Not unfairly hard, but “you need to pay attention” hard. The overall feel is very close to HexaSort, which is about as strong a comparison as you can make in this space.

Everything responds instantly. The haptics hit. Every tap feels like it matters. You’re not just waiting for things to resolve. You're actively managing space, timing, and pressure the whole time.

What the Game Actually Is

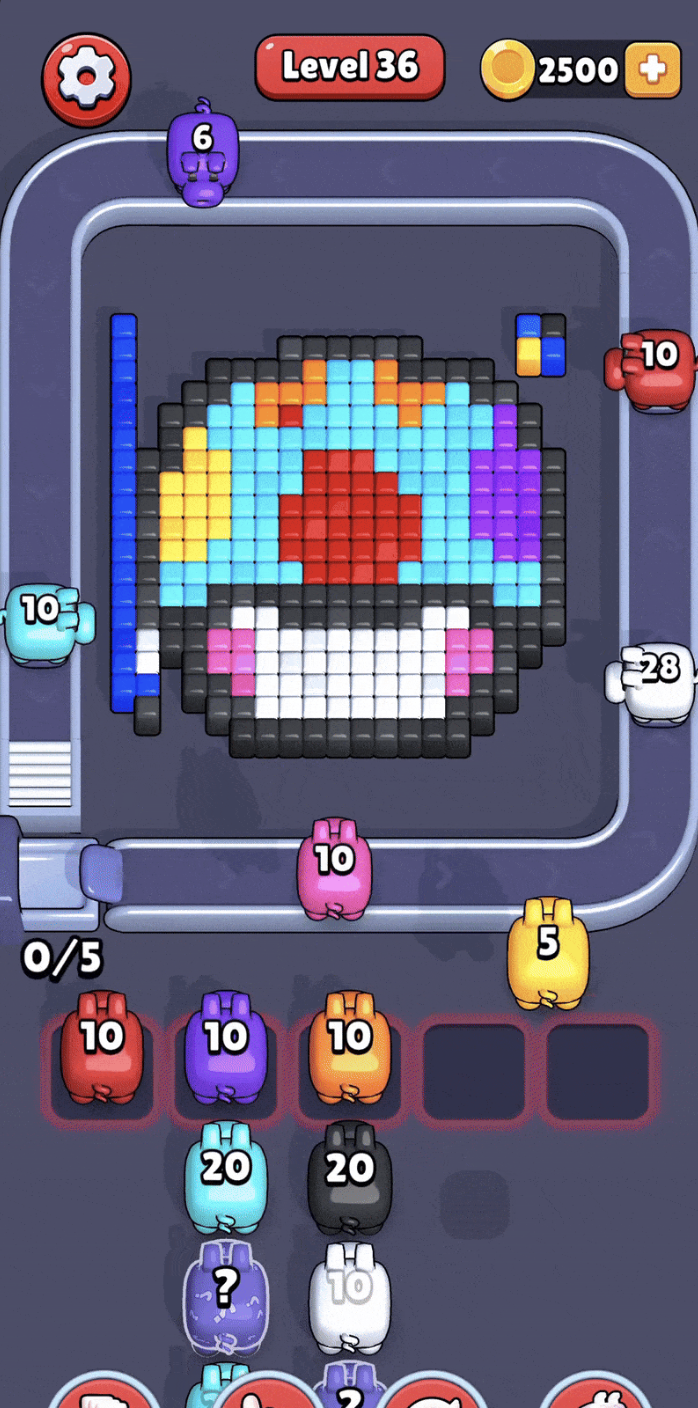

Pixel Flow sits inside the Sort genre, but more specifically in the Color Shooter / Sorting Shooter niche.

At a basic level:

You have shooters with a limited number of bullets

Each shooter only clears blocks of its own color

The goal is to clear pixel blocks and finish the picture

What makes it work is the structure around it:

A conveyor belt and a rotating tray

A bench system where shooters come back after firing

Strict slot limits, which define when you lose

Interaction is limited to the front row

Without those limits, there’s barely a game. Space pressure is what turns this into a puzzle.

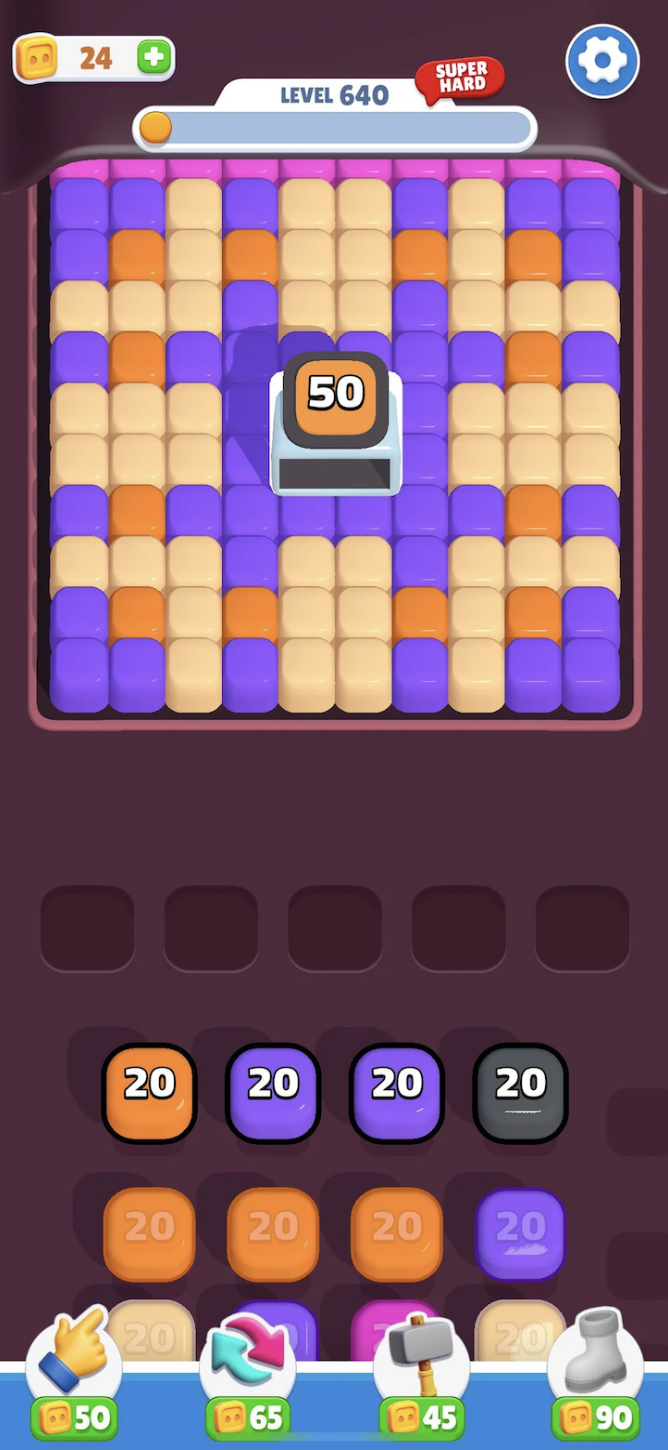

Slinging Is Where Skill Shows Up

One of the smartest parts of Pixel Flow is something players don’t immediately notice: It’s not just puzzle solving- it’s dexterity under pressure, closer to Bejeweled Blitz than to a traditional slow-burn puzzle. Pixel Flow deliberately reintroduces speed and execution into a genre that has spent years removing them.

If you’re fast enough, you can chain actions to stack up to 10 units, temporarily push past the tray limit, and recover situations that initially look completely doomed. Miss the timing, and the entire board collapses. As progression advances and double blocks that consume two slots are introduced, this mechanic stops being optional. Execution begins to matter just as much as planning.

That shift is important. Pixel Flow moves away from the traditional “Netflix puzzle” model - games designed to be played passively, half-attentive, in the background. Slinging requires focus, timing, and deliberate action. The game actively rewards players who engage with it as a skill-based experience rather than a low-friction time filler.

This design choice subtly reshapes the audience. It likely narrows the top of the funnel compared to more passive sort games, but it also increases engagement depth. Instead of optimizing for the widest possible audience, Pixel Flow appears to target higher-intent players willing to invest attention and mastery. In a crowded hybrid casual market, that tradeoff looks intentional and potentially smart.

It’s also the foundation for everything that follows.

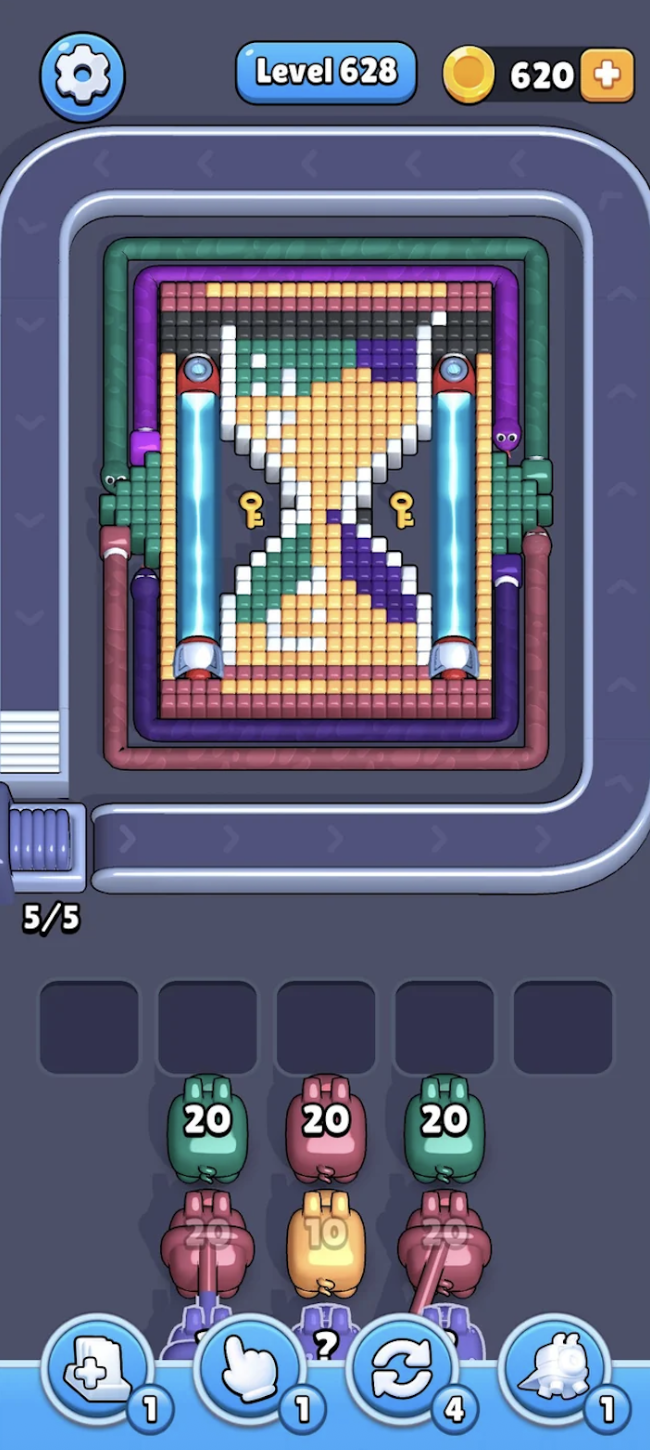

Deterministic, on Purpose

Pixel Flow is fully deterministic.

Boards don’t change. There’s no randomness saving you. If you fail, it’s because the sequence was wrong or the timing was off.

That puts it closer to a “real” puzzle game like Royal Match. You’re solving problems, not rolling dice. The downside is obvious: deterministic games don’t always scale as wide as random ones. But they usually get much stronger engagement.

The reason is funnel shape. Randomized puzzle games tolerate mistakes. They reshuffle, bail the player out, and let lower-skill or distracted users continue progressing. That makes them easier to onboard and better at capturing very large, low-intent audiences.

Deterministic games don’t do that. They demand learning, attention, and improvement. More players churn early but the ones who stay understand the system, replay levels, and invest more time. That tradeoff sacrifices reach, but it concentrates engagement.

Engagement Explains the Money

Engagement explains the money.

At scale, Pixel Flow players are spending close to one hour per day in the game across roughly ten sessions. That’s extremely high for a puzzle title. It explains why the ad layer performs so well and why players are willing to convert on IAP despite relatively limited monetization shortcuts. The game isn’t just being opened frequently - it’s being actively played.

Why It Pulled Ahead of Similar Games

A good comparison here is This Is Blast from Voodoo. It operates in the same general category, but the depth difference becomes obvious very quickly.

Pixel Flow:

Keeps players shooting longer: Longer uninterrupted play stretches increase session length and reduce early exits.

Gives you more space to work with: Players feel challenged without feeling trapped, reducing rage quits while preserving difficulty.

Has slinging and rotation as actual mechanics: These mechanics convert time pressure and dexterity into mastery

Forces constant decisions: High decision density keeps players cognitively engaged. That increases active playtime.

Those differences matter. This Is Blast took a long time to climb and eventually plateaued around $40K per day. Pixel Flow moved past $500K per day in a much shorter window. That gap isn’t explained by marketing alone. It’s the result of higher decision density, stronger retention, and players spending more active time in the core loop. In other words, the performance delta is rooted in design.

Monetization Is Intentionally Boring

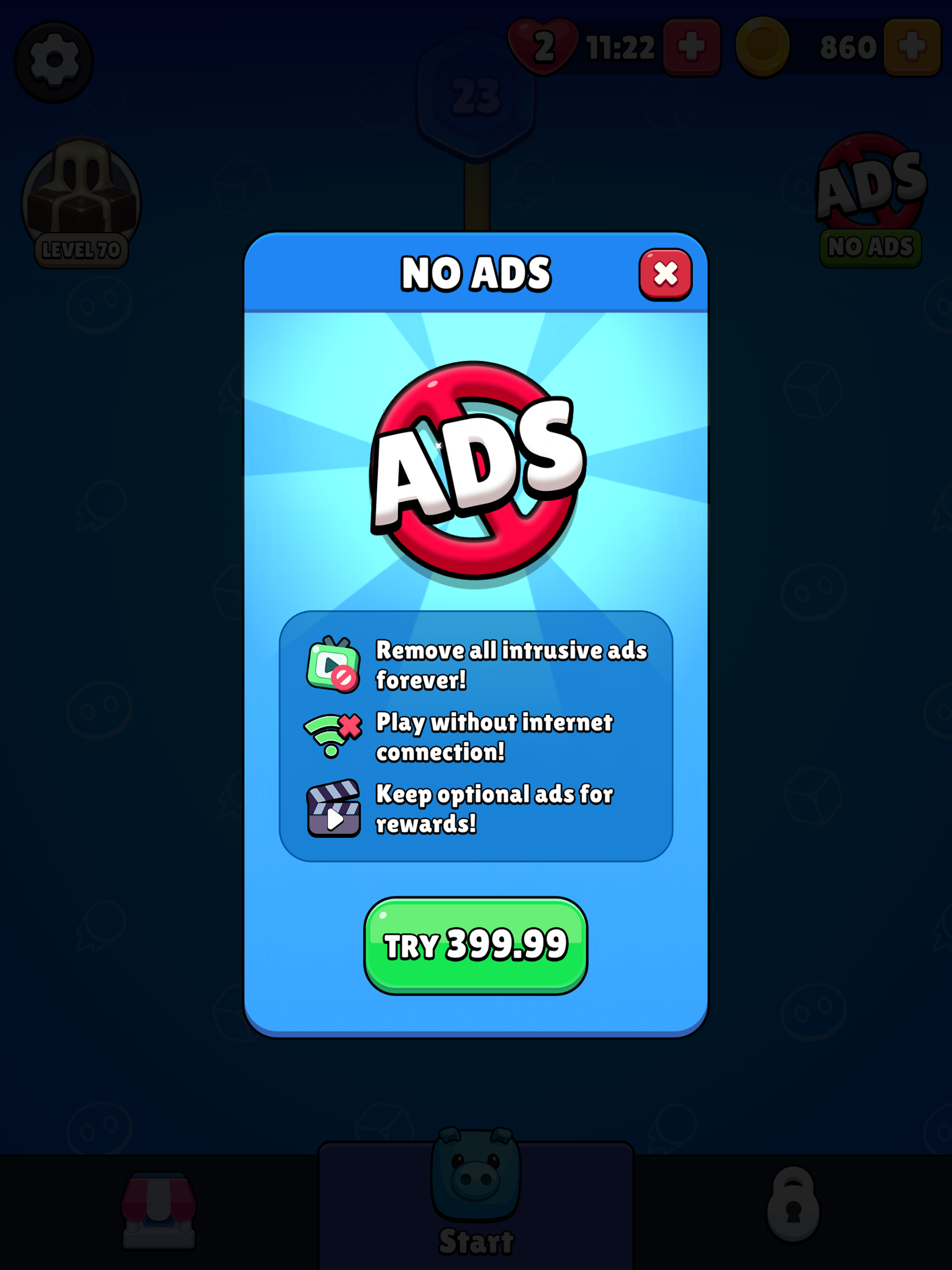

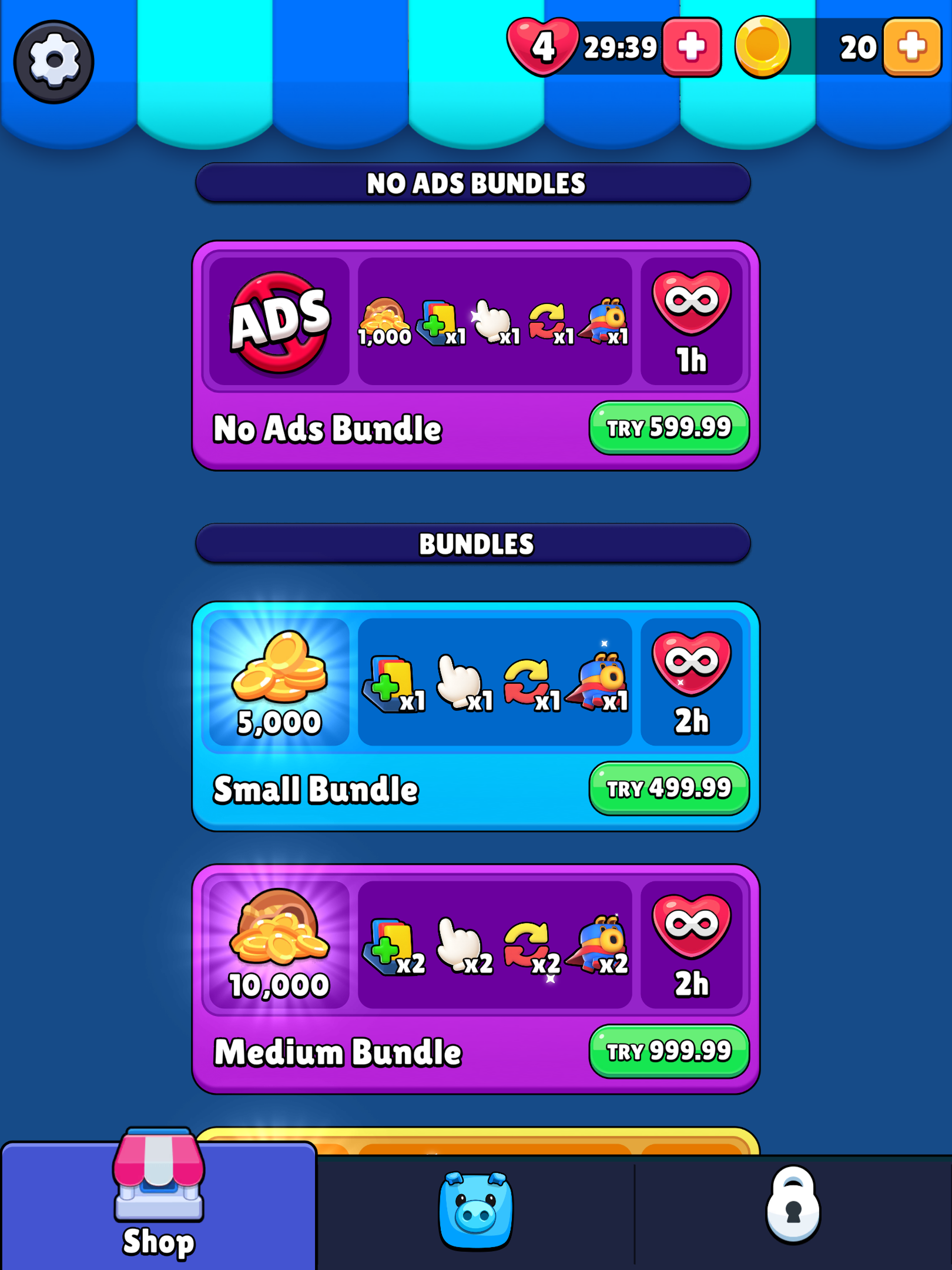

Monetization in Pixel Flow is intentionally boring and that’s a good thing. Ads are also deliberately aggressive once players are invested (roughly after level 20). There’s no easy “airplane mode” escape hatch, unlike in some competitors. That pressure is intentional: the intrusiveness of interstitials, combined with strong core engagement, makes the Remove Ads IAP convert extremely well. In this setup, ads don’t just monetize - they actively reinforce IAP demand.

The game sticks to a very straightforward setup:

Interstitials on failure

Optional interstitials after wins

Rewarded ads are limited to extra lives in the menu

There are no rewarded shortcuts that let players bypass difficulty. That’s deliberate. In a deterministic system like this, difficulty is what drives IAP. Undermine it, and both engagement and monetization fall apart. Pixel Flow protects its challenge curve and monetizes around it, rather than against it.

The Scale Came Fast

Pixel Flow launched on August 17. By December:

$300K+ per day from IAP

30–40% of revenue from ads

Around $550K total per day

Roughly 200K downloads per day

Close to 1M DAU

Those numbers matter in context. Pixel Flow even surpassed Magic Sort from Grand Games in downloads - not a small milestone if you’re familiar with the Turkish sort ecosystem and how competitive it is at the top.

Geographically, the mix is healthy. The US accounts for roughly 9% of revenue, the UK around 5%, with solid Tier-1 presence overall. That balance helps explain both the game’s monetization performance and its ability to sustain aggressive UA without collapsing margins immediately. Being less Tier-1 West heavy reduces CPI pressure. US and UK traffic is the most expensive in the market. If the revenue mix were 40–50% US-heavy, sustaining aggressive UA would require extremely high LTV to clear acquisition costs. A more geographically diversified mix allows the game to scale volume in lower-CPI regions while still capturing high-value Tier-1 revenue.

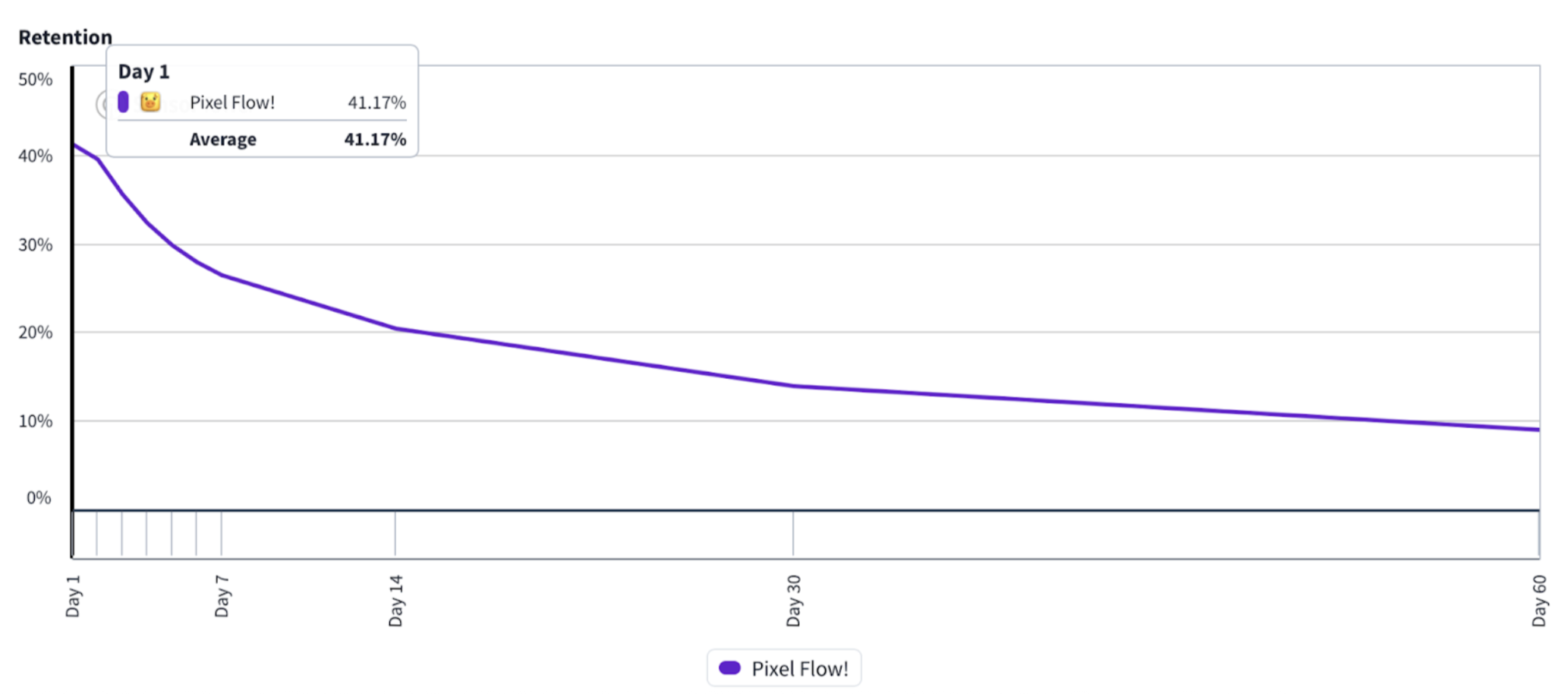

Early retention isn’t spectacular. It’s relatively modest for the category. But what matters more is the shape of the curve over time. As Supercell reflected in their Squad Busters article, the starting point matters less than the long-term trajectory. Strong games are defined by how they hold, not how they launch.

Generic Still Works

The generic still works.

Recognizable visuals convert, and Pixel Flow leans into that reality without overthinking it:

Superhero-adjacent characters

Familiar cartoon proportions

Cute animals, especially cats

None of this is new. It’s the standard gray zone approach - not direct IP, but close enough to feel familiar and lower CPI. Pixel Flow doesn’t try to reinvent visual language. It uses what’s already proven to work and focuses its differentiation on gameplay and systems instead.

Where the Category Goes From Here

Of Course, Copycats Showed Up

It didn’t take long for copycats to appear.

A Vietnamese studio released Color Pixel Shooter, a close structural clone, which quickly scaled to around $140K per day. Roughly 67% of its revenue comes from the US, and downloads are still trending strongly. That kind of performance, especially so soon after launch, is hard to ignore.

It highlights two things very clearly. First, the category works. Second, it’s easy to copy. As more studios pile in, competition will intensify, UA costs will rise, and demand will fragment. From this point on, Pixel Flow’s success will depend less on novelty and more on execution speed and operational discipline. Things are going to get crowded.

This means Pixel Flow can’t stand still. To sustain, the team needs to ship new levels and mechanics faster than copycats, continuously tune difficulty to protect engagement, and adjust monetization and UA before competitors drive CPI up. The advantage isn’t having the best idea - it’s moving faster and operating tighter than everyone else chasing the same one.

Where the category goes from here is fairly clear.

In hybrid casual, genuinely good ideas don’t stay undiscovered for long. If a mechanic works, it’s already out there and if it scales, it will be copied quickly. At this point, the real barrier isn’t creativity. It’s operation.

There’s still room in Color Shooter and sort hybrids, but survival will come down to execution: content cadence, art quality, feature depth, and, most importantly, keeping UA economics under control as competition intensifies. The winners won’t be the teams with the best idea. They’ll be the ones that can sustain it.

So What’s the Ceiling?

The more relevant question isn’t how big Pixel Flow can get on a revenue chart. Revenue is a vanity metric. The real question is what kind of margins this game can sustain.

Pixel Flow’s engagement profile - close to an hour per user per day across many sessions, creates strong monetization leverage. High session density supports aggressive IAA without collapsing retention, and deterministic difficulty supports IAP without relying on heavy pay-to-skip mechanics. That combination is rare, and it’s what makes the business interesting.

At the same time, the constraints are clear. Deterministic gameplay narrows the audience. Copycats quickly increase CPI pressure. And as the category crowds, UA efficiency becomes harder to maintain. This isn’t a game that can endlessly buy growth at any cost.

What that suggests is a business optimized for efficiency, not infinite scale. If LTV continues to clear CPI comfortably - especially in Tier-1 markets - Pixel Flow can be a highly profitable operation even without chasing maximal reach. If CPI inflation outruns engagement gains, margins compress quickly.

The ceiling here isn’t defined by how much revenue the game can print at peak. It’s defined by how long it can hold its unit economics together in a competitive market. By that standard, Pixel Flow already looks like a well-built, disciplined business - not just a hit.

Philosophical Musing

A small Turkish team, without a publisher, took a known mechanic, layered in real executional depth, protected its difficulty, and scaled to meaningful heights in a matter of months. That’s not just a hit story. It’s an ecosystem signal that the mobile is still alive and kicking! And that the Turkish puzzle teams are the best in the world.

For years, the Turkish market has been associated with strong hybrid casual production, often in partnership with large publishers. Pixel Flow shows something slightly different: experienced teams don’t necessarily need external validation anymore. They can design, monetize, scale, and operate independently - provided their fundamentals are strong enough. The bar is no longer “can you prototype fast?” It’s “can you run a disciplined business at scale?”

More broadly, Pixel Flow pushes back against the idea that hybrid casual must always optimize for the widest possible funnel. Instead of chasing low-friction, second-screen consumption, it leans into focus, skill, and engagement depth. That narrows the audience but it strengthens unit economics. In a market where CPI inflation and cloning are inevitable, depth becomes a form of operational leverage.

This doesn’t mean every hybrid casual game should become harder. It means the edge is moving. The advantage no longer comes from discovering untouched ideas. It comes from executing known ideas better, tuning them faster, and sustaining them longer than competitors can.

Pixel Flow may or may not become a long-term giant. That’s almost secondary.

What it has already proven is more important: small, experienced teams can still outmaneuver larger structures by stacking correct decisions in design, monetization, and UA and moving decisively when the window opens.

Nothing here is magic.

It’s experience, applied with discipline, at the right moment.

And in hybrid casual today, that’s clearly enough.